Markets Brief: Why Have Bonds Been So Volatile? And Will That Continue?

Uncertainty over inflation, a recession, and the Fed could mean continued wide swings in the bond market.

Investors were able to breathe a sigh of relief in 2023 not just thanks to big gains in stocks, but also because the bond market broke a two-year losing streak. However, bonds’ road to positive returns last year was a white-knuckle ride. By one measure, the bond market was more volatile than it was in any other year for at least the last decade.

Now, with the Federal Reserve seemingly on course to cut interest rates in 2024, observers expect some of that volatility to fade. But there’s enough uncertainty that investors most likely shouldn’t expect a return to the kinds of relatively placid conditions seen in bonds during the period from the 2008 financial crisis through the beginning of 2022.

That post-crisis time “was the abnormal period,” according to Stephen Bartolini, who manages the U.S. Core Bond Strategy at T. Rowe Price. With a return to generally higher levels of interest rates comes a higher level of price swings, he says. “We’ve returned to a more normal volatility regime.”

How Volatile Have Bonds Been?

Wide price swings are not what most investors associate with bonds, especially government bonds. Bonds are regarded as safer than stocks, and most investors think of them as ballasts, providing stability in their portfolios against swings in riskier investments like stocks.

In 2022 and 2023, that was far from the case. The extreme volatility in bonds can be seen through standard deviation, which measures the variability of returns. The lower the standard deviation, the smaller the range of returns. From 2014 through the end of 2021, the quarterly standard deviation on the Morningstar US Core Bond Index averaged 0.2. In contrast, the stock market, as measured by the Morningstar US Market Index registered an average quarterly standard deviation of 0.94. For 2022-23, the average standard deviation on bonds more than doubled to 0.45. Stock market volatility rose as well, but by a smaller amount, to 1.2.

Bond Market Volatility

Why Have Bonds Been So Volatile?

For the most part, the blame goes to inflation, the economy, and the outlook for Fed policy.

Bartolini focuses first on a return to swings in inflation. “Inflation volatility was dormant for the post-[2008 financial crisis] period,” he says. “Obviously that has some back quite strong.”

From 2010 through 2020, for example, inflation as measured by the Consumer Price Index largely held at an annual rate between 1% and 3%. That trend goes back even further. From 1984 through 2020 (except for a short-lived spell around 1990), inflation stayed in a band of roughly 1.50%-4.25%. (From 1970 through 1980, inflation ranged from 3.3% to 13.5%.)

In 2022, as inflation surged to a four-decade high, the Fed raised the federal-funds rate at an unprecedented pace, and bond volatility leaped higher. Those wild price swings continued in 2023, as investor expectations for Fed rate hikes and cuts swung back and forth.

The important context for bond investors is that for much of the time after the financial crisis—those years when inflation was low and stable—the Fed kept interest rates extremely low. That included two rounds of so-called quantitative easing, wherein the central bank pumps money into the banking system through purchases of bonds. The result of that was that the Fed kept a lid on bond yields, and thus on bond market volatility.

“Most investors at this stage have experienced a large part of their careers from basically 2008 through 2020, when there were artificially suppressed yields on the back of super-accommodative policy through the fund rate and quantitative easing, and that certainly suppressed volatility [on long-term bonds],” says Ricky Williamson, head of investments for Morningstar Mutual Funds within Morningstar Investment Management.

2023′s Big Swings In Fed Rate Expectations

The Fed’s move away from capping interest rates began in 2022, but 2023 saw extreme shifts in expectations around the outlook for the central bank’s policy, which flowed through the bond market.

In 2023, “we lived four years in one,” when it came to Fed expectations, says Lindsay Rosner, head of fixed-income multi-sector investing at Goldman Sachs Asset Management. “There were four different regimes, and I think that led to the volatility you’ve been seeing.”

At the start of the year, investors were braced for continued big rate hikes. Then came the collapse of Silicon Valley Bank and fears of the economy falling into recession, which turned expectations to Fed easing. Then came summer, and the economy not only avoided recession but accelerated, with the Fed pressing on with rate hikes and signaling more through the end of the year. That summer selloff saw bond yields spike to their highest level in 17 years, with the yield on the U.S. Treasury 10-year note reaching 5%.

That all changed again in the fourth quarter, as evidence of continued moderation in inflation, coupled with cooling in the red-hot jobs market, swinging expectations back to Fed easing. That was confirmed in December when the Fed signaled that it expected to lower rates in 2024.

What’s Next For Bond Volatility

Bartolini expects bonds to remain relatively volatile, but for a different reason. “There’s potential in 2024 for a transition from inflation volatility to volatility of growth,” he explains. “Inflation has come down quite a bit in the last three to six months, and the expectation is that it’s going to stay relatively tame from here.” Instead, he thinks there is more room for investors to be wrong about their expectations for the pace of economic growth.

Currently, the consensus is that the economy will have a soft landing, meaning the Fed succeeds in pushing down inflation without a recession. To Bartolini, that has already happened: “This is what a soft landing looks like. We’re living it.”

He continues: “If we’re thinking about how to structure portfolios for the next three, six, or 12 months, we need to think about the tail risks.” In other words, we should think about what investors are not generally expecting.

The risk, then, is what happens from here. Will the economy tip into recession thanks to the delayed impact of the Fed’s rate hikes or some renewed issues in the banking sector that aren’t apparent today? “The alternative is that we’ve had a substantial easing of financial conditions which in the right environment could lead to a growth acceleration, which would be pretty far outside the consensus,” says Bartolini

Rosner thinks bond market volatility should fade somewhat from 2023′s extremes, but she also reminds investors to consider what might not go right in terms of expectations. She notes that investors seem to be banking on things going just right with the economy, an “immaculate soft landing.”

She says: “The ability for central banks to do this pivot and start to cut is predicated on growth being at or a little bit below trend. It doesn’t work if growth rates begin to accelerate, because then they can’t feel confident in cutting rates. On the other hand, the policy path that has been laid out doesn’t make sense either if there is a growth shock and we go into recession.”

Opportunities for Bond Investors

Against this backdrop, Rosner says that one piece of good news is that even with wider swings in prices, it makes sense for investors to consider moving out of cash where they took advantage of higher yields and safety from the storm of rate hikes.

“It’s impossible to pick the exact point when you are supposed to extend, but we think it generally makes sense to extend ... in the short-to-medium part of the bond market,” Rosner explains. Moving into bonds in the two-to-four-year maturity spectrum will provide attractive additional yield, she adds.

Bartolini doesn’t have a strong bias about the likely outcome for the economy. He is instead looking for ways to build a portfolio with a mix of elements—some that could benefit from a weaker economy, and some that would perform well should growth turn out to be stronger.

He feels that Treasury inflation-protected securities, or TIPS, are attractively priced, should the economy reaccelerate. “Particularly when the Fed has a dovish bias, generally TIPS do well when we have an acceleration,” he says.

On the other side of the equation, he looks for bets that the slope of the yield curve will steep from its current inverted position, wherein short-term yields are higher than long-term yields. Were the economy to slide into recession, or if the Fed opts to cut rates more than is currently expected, that would push down yields on short-term bonds relative to long-term bonds.

For the Trading Week Ended Jan. 12

- The Morningstar US Market Index rose 1.77%.

- The best-performing sectors were technology, up 4.76%, and communication services, up 2.61%.

- The worst-performing sector was energy, down 2.29%.

- Yields on 10-year U.S. Treasury notes fell to 3.95% from 4.05%.

- West Texas Intermediate crude prices fell 1.72% to $72.74 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 431, or 51%, were up, four were unchanged, and 409, or 48%, were down.

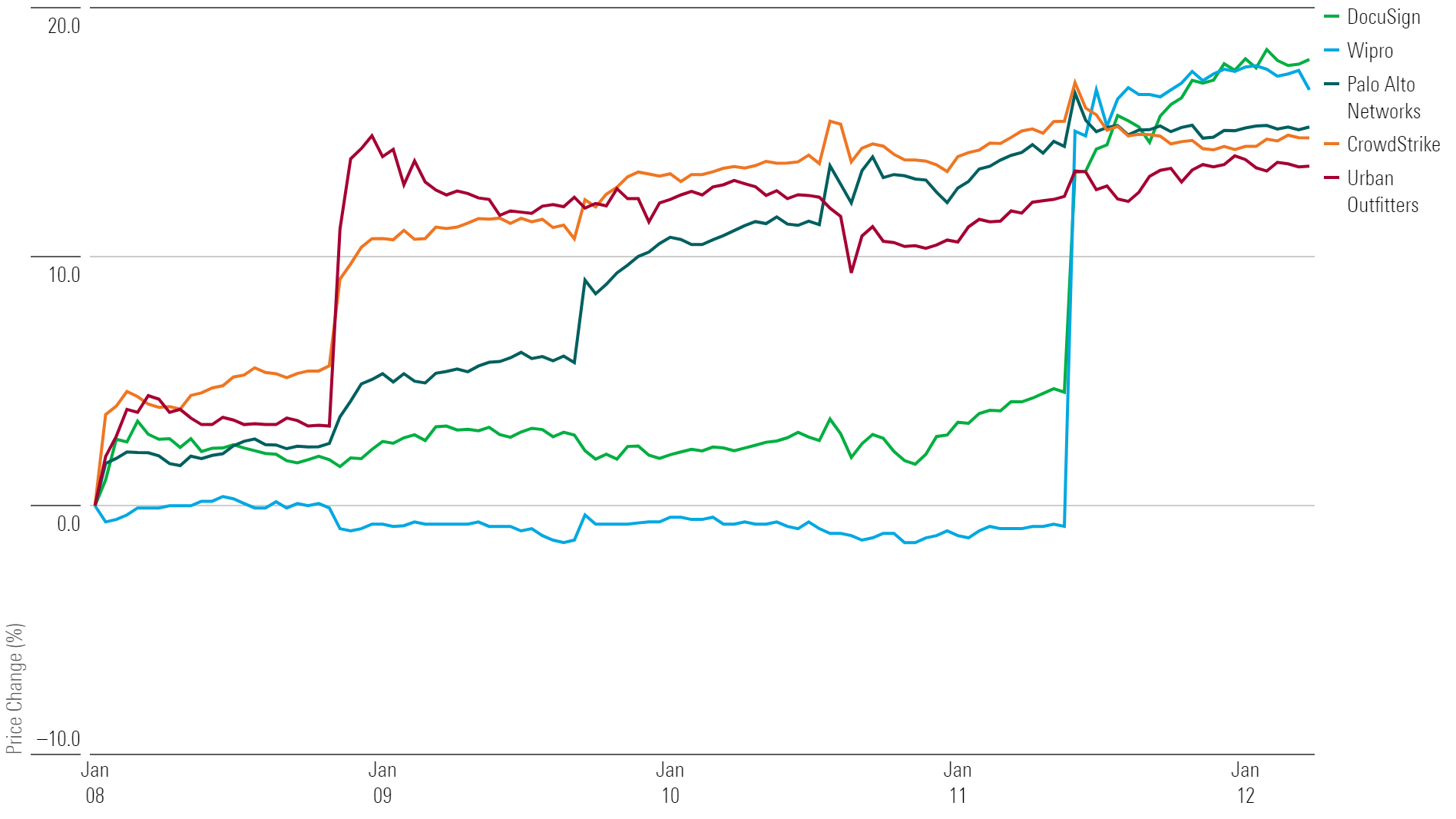

What Stocks Are Up?

Docusign DOCU, Wipro WIT, Palo Alto Networks PANW, CrowdStrike CRWD, and Urban Outfitters URBN.

Week's Top Winners

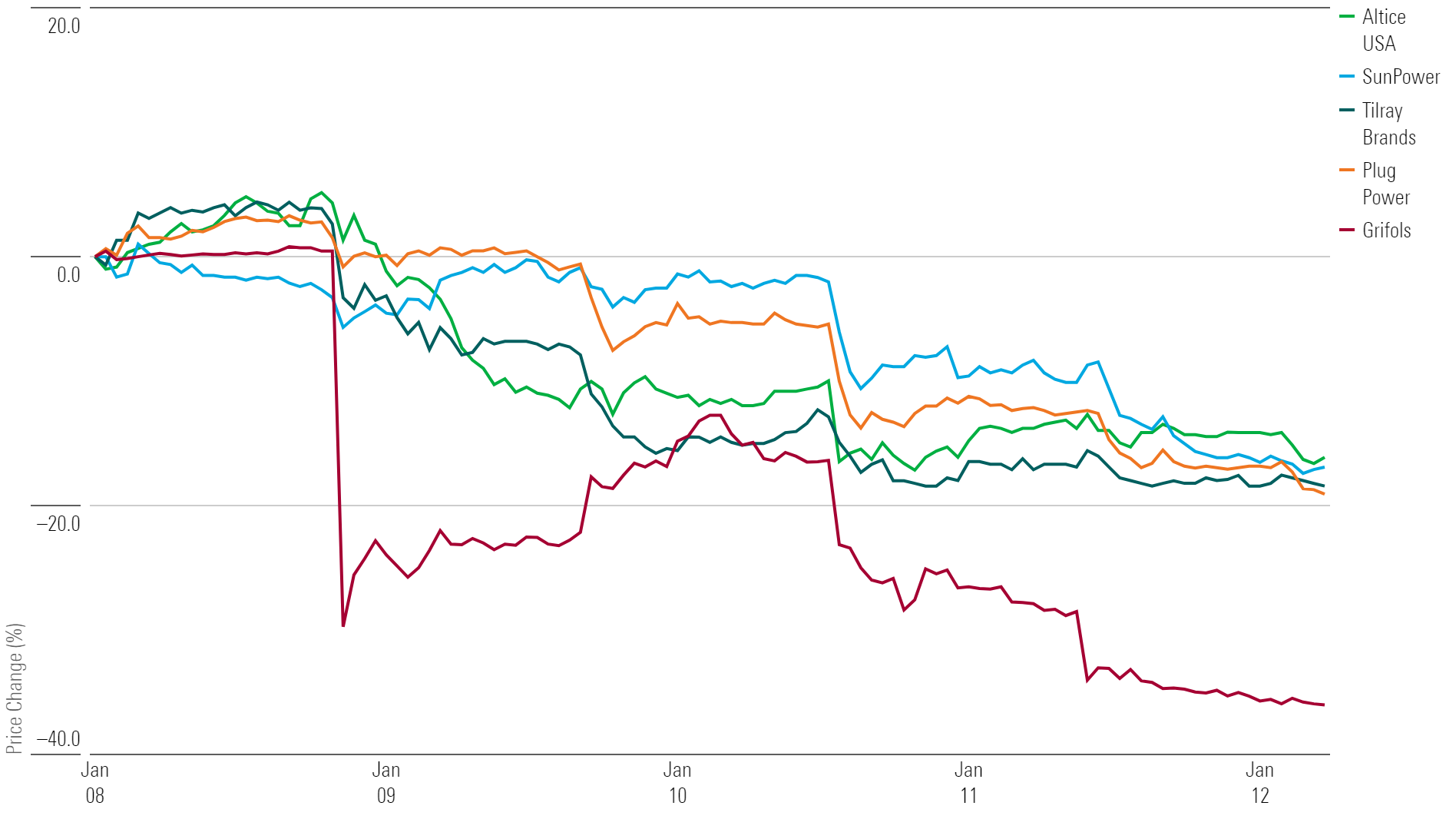

What Stocks Are Down?

Grifols GRFS, Plug Power PLUG, Tilray Brands TLRY, SunPower SPWR, and Altice USA ATUS.

Week's Top Losers

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)