Jobs Data Points to More Big Fed Rate Hikes, for Now

Moderating wage growth may be a positive sign for the inflation fight ahead.

The jobs market remains hot, fueled by gains in some of the sectors that had been hardest hit by the pandemic, and leaving the Federal Reserve on course to keep raising rates at a quick pace in the months to come.

However, there is one possible piece of good news for investors and consumers rattled by high inflation: Wage gains appear to be slowing, suggesting less potential for an out-of-control wage-price spiral that fuels continued high levels of inflation and makes the Fed’s job even tougher.

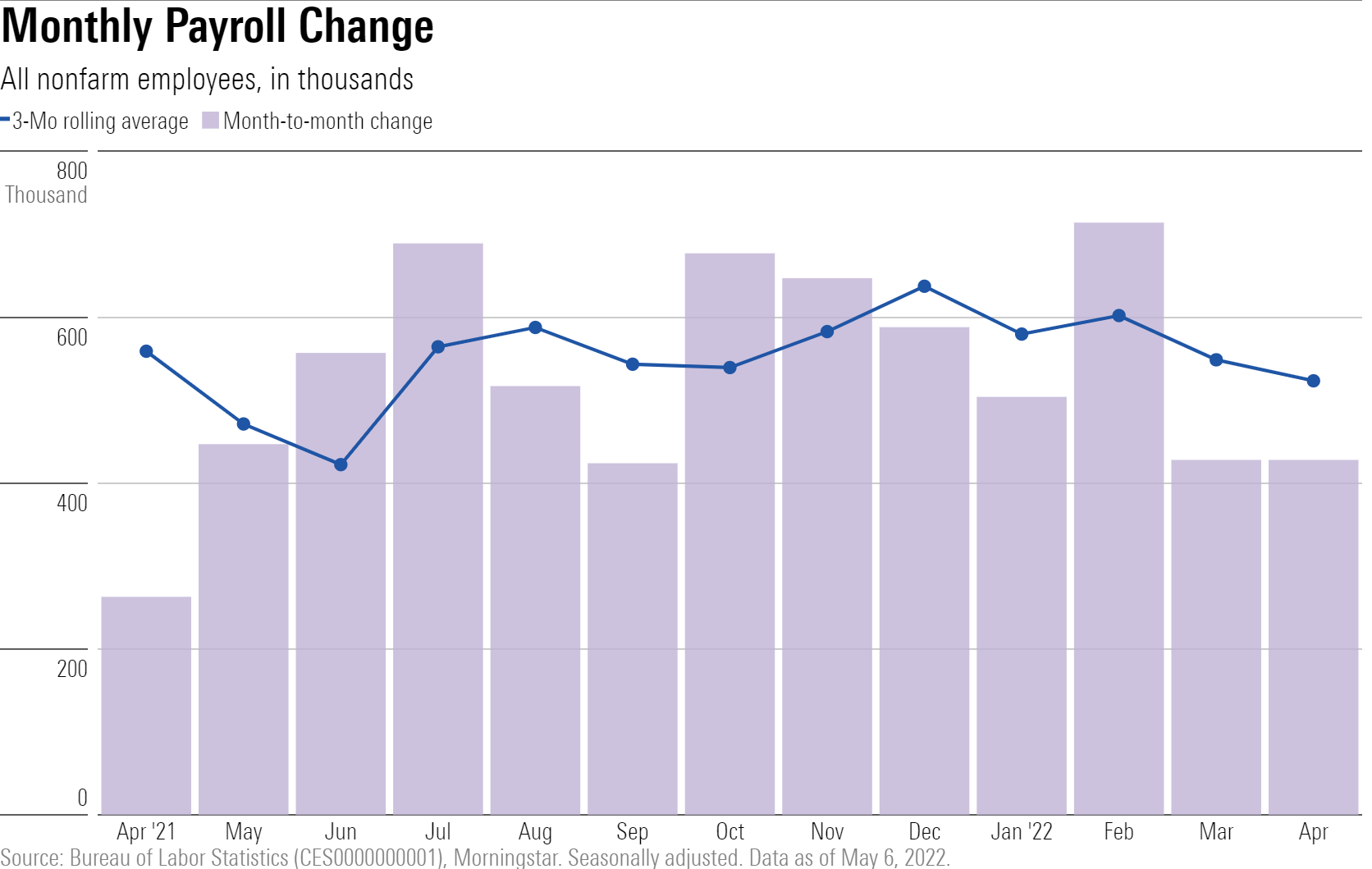

The Bureau of Labor Statistics reported Friday that the U.S. economy added 428,000 jobs in April thanks to widespread gains in hiring across the economy. That followed increases in nonfarm payroll employment of 714,000 in March and 428,000 in February.

"Today's jobs report confirms that economic activity is still trending up briskly, which supports the Fed's plan of aggressive rate hikes," says Preston Caldwell, chief U.S. economist at Morningstar.

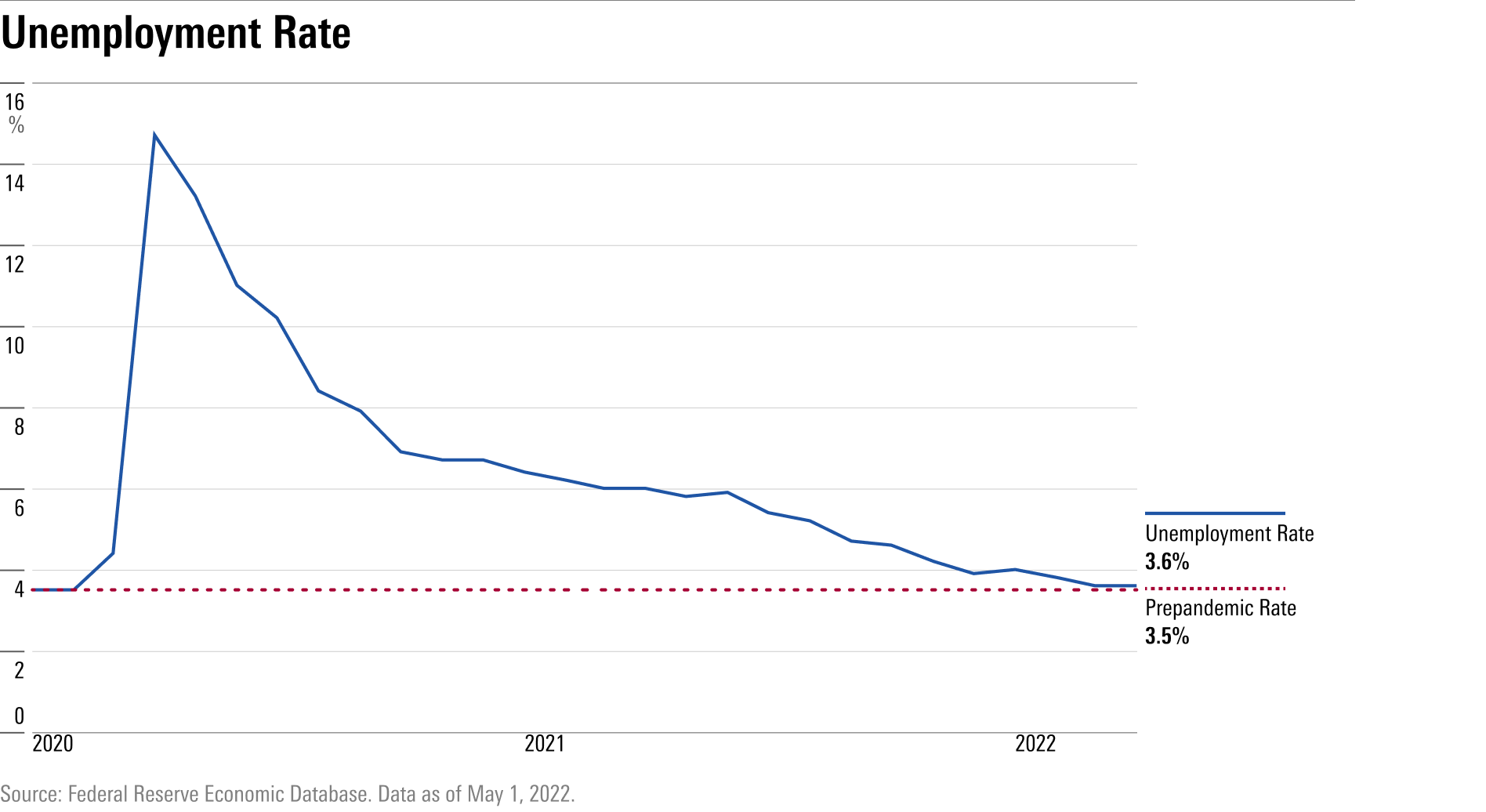

The unemployment rate held steady in April from the prior month at 3.6%. That is just one-tenth of a percent higher than it was before the onset of the pandemic recession in 2020.

That the unemployment rate was flat in a month that also saw strong gains in payroll employment "reflects the inner workings of the jobs report, more than a trend in the job market,” Caldwell says. The unemployment rate is sourced to what BLS calls the household survey, and the headline hiring number comes from a separate survey.

“The household survey reflected a 400k decline in employment in April, contributing to the unemployment rate holding steady for the month despite the jump in hiring reported in the payrolls side of the report,” Caldwell says. “We don't think this is a red flag, as both measures of employment continue to trend upward—the household survey posted much stronger gains in prior months.”

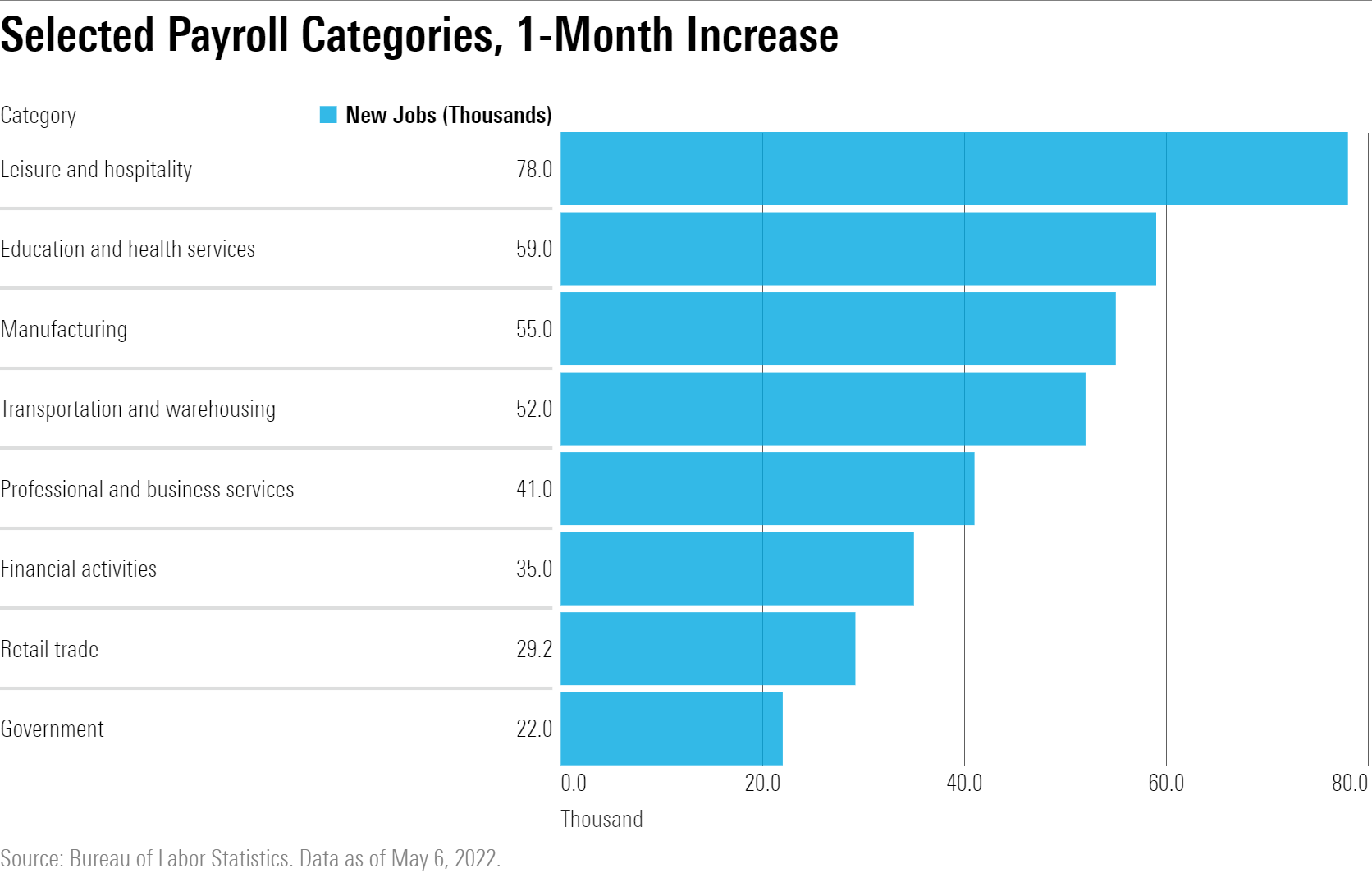

When it came to gains in hiring during April increases were widespread, BLS said. Employment in leisure and hospitality increased by 78,000, in restaurants by 44,000, and hotels by 22,000. The manufacturing sector added 55,000.

Employment in leisure and hospitality is down by 1.4 million jobs, or 8.5%, since February 2020, BLS says. But that category, among the hardest hit by the pandemic lockdowns, is coming back to life.

"By industry, job gains have been broad-based, but the largest gains in industries like leisure and hospitality are benefiting from the normalization of consumer behavior,” Caldwell says. "Growth has also been solid in manufacturing, which is expanding capacity to meet the surge in goods demand, as well as mining and oil, which is racing to close the shortfall in global oil supply. These industry-level drivers are likely to play out through the remainder of the year.''

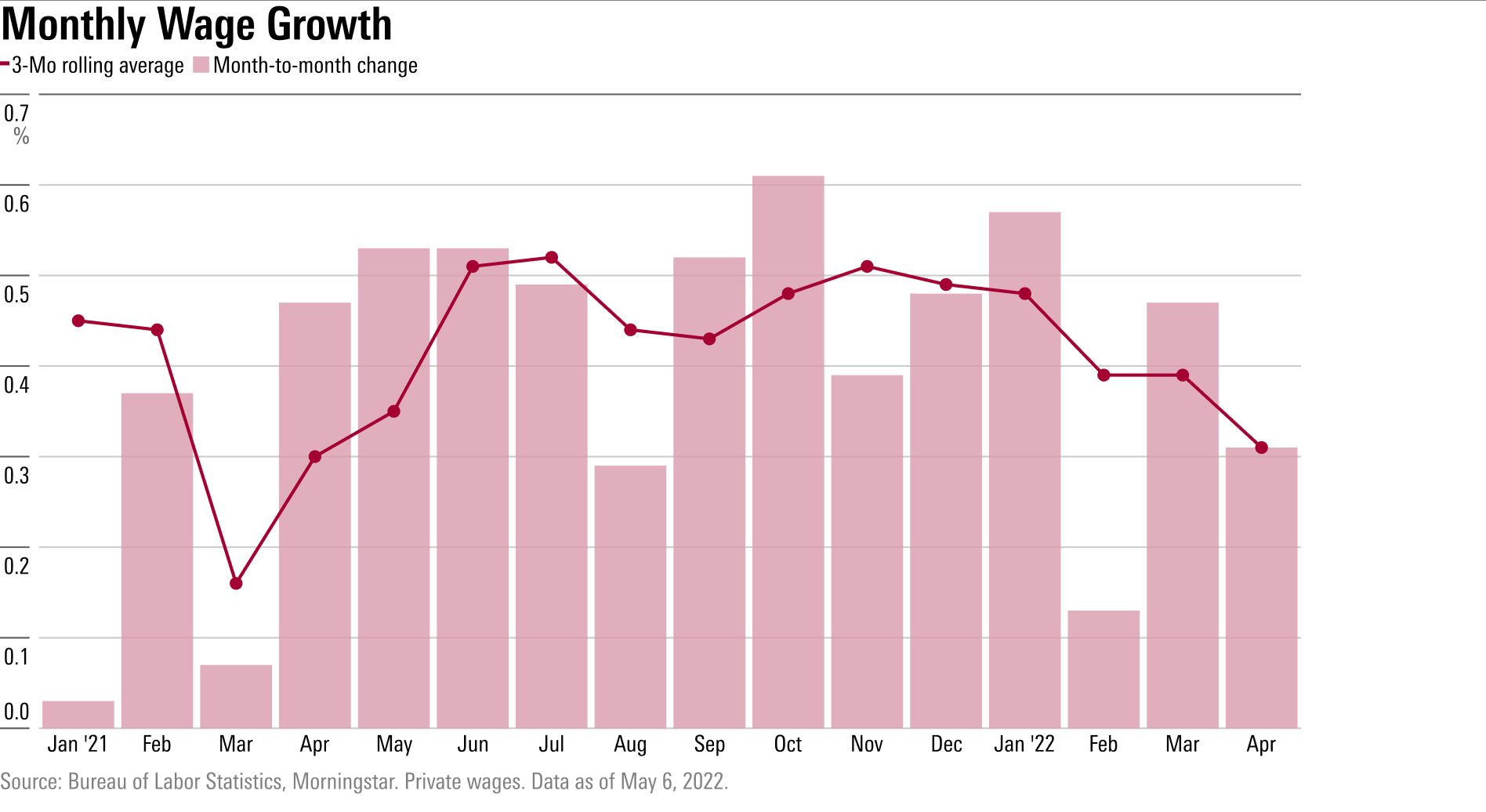

On the wages front, there was good news for inflation. Average hourly pay rose by 10 cents, or 0.3%, to $31.85 in April. The BLS notes that over the past 12 months, average hourly earnings have risen 5.5%. In recent months, the trend has been toward slower wage increases.

“Wage growth appears to be moderating to a more sustainable pace, with private wages averaging just a 0.3% monthly increase in the three months ending in April, or a 3.7% annual pace,” Caldwell says. “If this keeps up—and other supply side headaches offer relief—the Fed will have room to ease off the brakes in the second half of 2022."

When it comes to the near-term course for Fed policy, the strong jobs market sets the stage for continued rate increases in the months to come, Caldwell says.

“Job growth has remained quite robust so far in 2022,” Caldwell notes. “This supports our argument that economic activity is still trending upwards, despite the 1.4% dip in Q1 2022 GDP. In light of this and ongoing worries over inflation, the Fed has every reason to continue the course of aggressive rate hikes for now.”

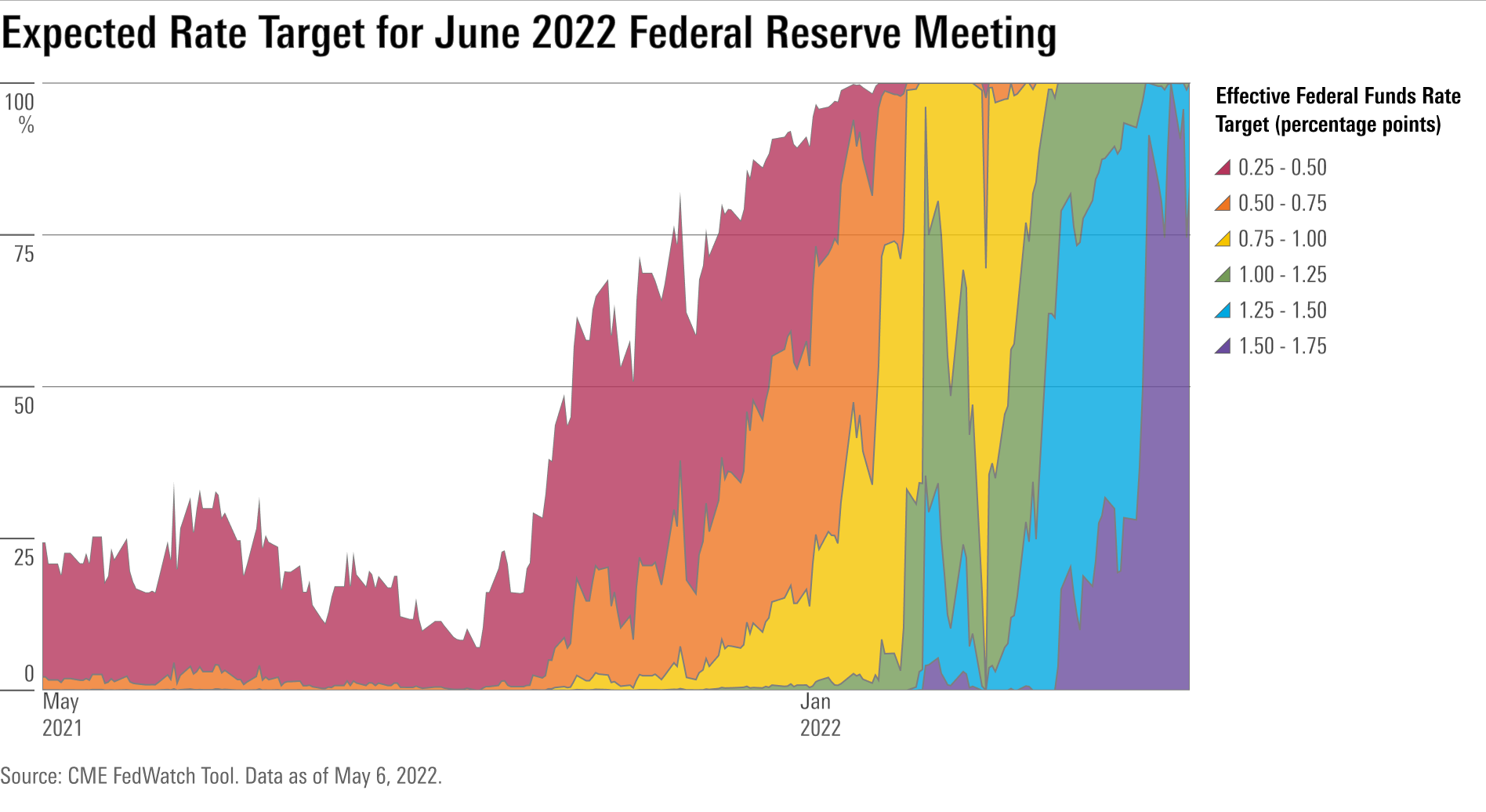

On Wednesday, the Fed announced a 0.5-percentage-point increase in the federal-funds rate, the first increase of that size in 22 years. The funds rate target now stands at 0.75%, up from zero before the rate hikes began in March with a quarter-point increase. Federal Reserve chair Jerome Powell has told the public to expect additional half-point increases in the federal-funds rate following the central bank's June and July policy-setting meetings.

However, financial markets are signaling the Fed may become even more aggressive and lift the rate in June by three fourths of a percent. The Fed hasn’t raised rates by that amount since 1994.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)