Is Cisco Stock a Buy, Sell, or Fairly Valued After Earnings?

With strong Q1 sales but a short-term slowdown in order growth, here’s what we think of Cisco’s stock.

Cisco Systems CSCO released its fiscal third-quarter earnings report on May 17, 2023. Here’s Morningstar’s take on what to think of Cisco’s earnings and stock.

Cisco Stock at a Glance

- Fair Value Estimate: $56

- Morningstar Rating: 4 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Wide

What We Thought of Cisco Q1 Earnings

- Cisco’s fiscal third-quarter results came in ahead of expectations, driven by its core sales of networking equipment, but were tempered by poor order growth.

- Cisco remains highly profitable, driven by its pricing power, competitive leadership in networking equipment, and wide economic moat.

- Cisco stock continues to be weighed down by worries about demand in the short term. We aren’t overly concerned, as we believe delayed orders from the past two years can make up for weak short-term demand, and the firm’s long-term fundamentals look healthy.

- When we consider our long-term view of strong networking equipment demand, Cisco stock looks undervalued. We believe investors who buy in now can see strong upside.

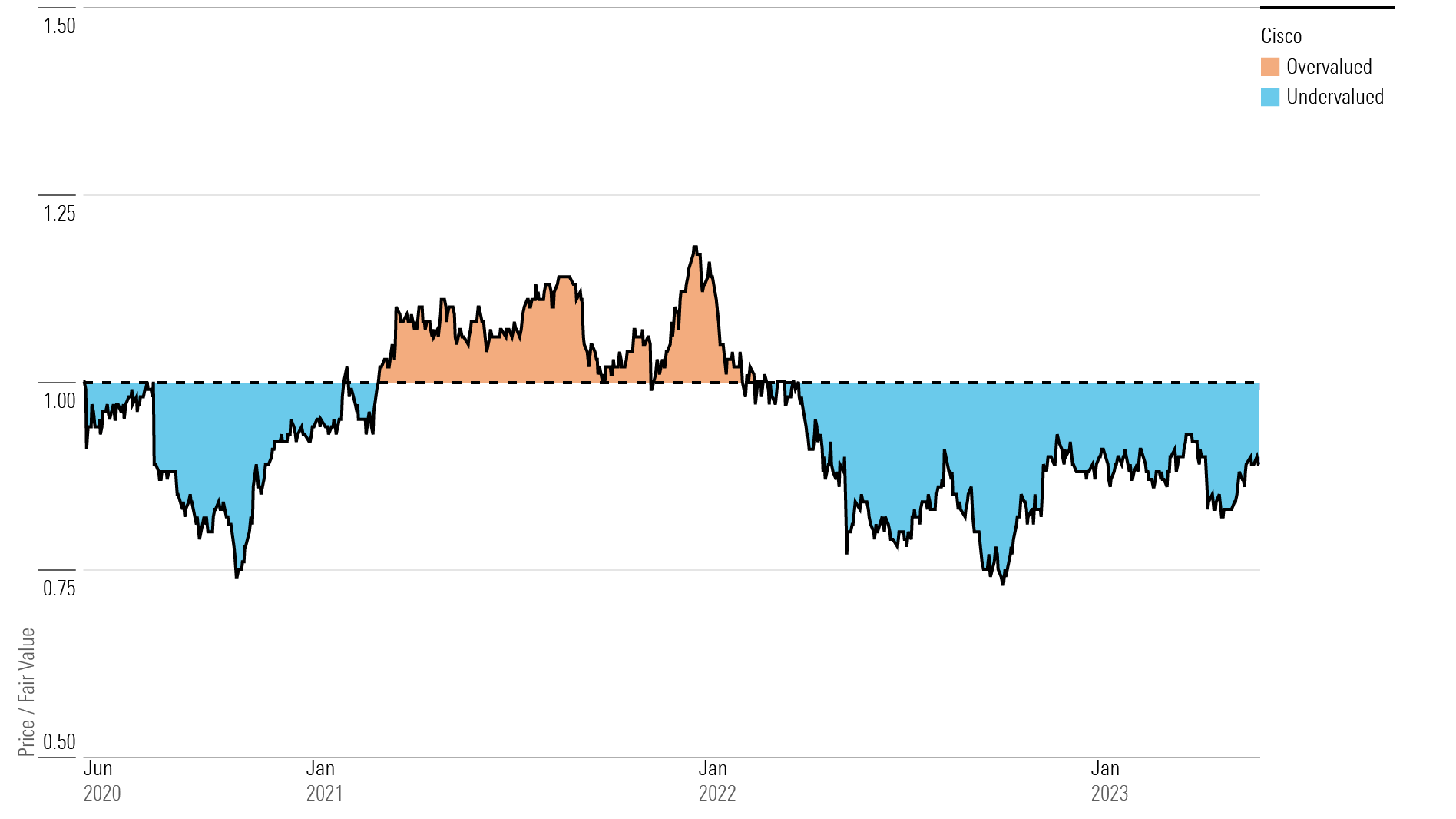

Cisco Price Chart

Fair Value Estimate for Cisco Stock

With its 4-star rating, we believe Cisco stock is undervalued. Our fair value estimate is $56 per share. Our valuation implies adjusted price/earnings of 15 times for the fiscal year 2023, fiscal 2023 enterprise value/sales of 4 times, a free cash flow yield of 7%, and a next-12-month dividend yield of 3%. Our biggest drivers to Cisco’s valuation are the growth of its core networking business and its ability to maintain and improve both gross and operating margins.

We forecast 5% compound annual growth for Cisco through fiscal 2027, including an exceptional fiscal 2023 with 10% growth and 3%-4% midcycle growth thereafter. We think its largest core networking business, including services, will expand roughly 3% at midcycle, largely in line with the underlying market. We assume Cisco can stem its market share losses in networking, and expect strength from its newer product families with more software and subscription-based consumption models like the Catalyst 9000, Nexus 9000, and Cisco 8000.

We expect more rapid growth from Cisco’s security, collaboration, and observability businesses. Though security has lagged peers of late, we think it can begin to slow market share losses with a more streamlined, feature-rich, cloud-based platform and more observability integration.

Cisco Price/Fair Value Ratios

Read more about Cisco’s fair value estimate.

Economic Moat Rating

We assign Cisco an economic moat rating of wide, stemming from customer switching costs. We think Cisco’s offerings for networking and cybersecurity are comprehensive and intertwined, with integrated software, hardware, and services creating a sticky overall solution and leading to pricing power. These competitive advantages give us confidence in Cisco’s profits over the next 20 years.

Cisco is the dominant force in enterprise networking. It’s the only provider we see with a complete end-to-end portfolio for both on-premises and the cloud. Cisco’s switches, wireless access points, routers, and networking software allow enterprises to create local networks and give those networks access to private clouds, public clouds, and the internet. Cisco holds the top market share position in nearly every subsection of the enterprise networking market, including campus and data center switching, networking software, routing, software-defined wide-area networking, or SD-WAN, and wireless access.

Cisco also offers a comprehensive platform for cybersecurity. It’s a strong incumbent vendor for network firewalls but has a rounded portfolio that includes identity access management, cloud security, endpoint security, zero trust, and threat intelligence. We see cybersecurity software as eliciting switching costs due to how deeply it’s embedded in enterprise networks. To change a cybersecurity vendor, a customer incurs the time and expense of getting up to speed on a new system, along with the expense of running both systems concurrently during the transition. Finally, the customer risks breaches during the vulnerable transition.

We believe that security and networking are converging, especially as multicloud and hybrid cloud environments become the norm. Every network and connection needs to be secure. As a preeminent provider of both setups, Cisco is in an advantageous position to both win new customers and cross-sell within its existing customer base.

Cisco’s sticky products embed themselves with customers and give the firm pricing power that leads to strong margins and returns on invested capital. Even against robust competition and a rapidly evolving technological landscape, Cisco has done well to gently expand its margins with software. We believe the push toward subscription-based offerings will solidify the firm’s stickiness. Even as competitive threats persist, we are confident in Cisco’s ability to generate excess returns above its cost of capital over the next 20 years.

Read more about Cisco’s moat rating.

Risk and Uncertainty

We assign Cisco a Medium Uncertainty Rating. The firm can experience some mild cyclicality in customer IT spending, and it’s under constant competitive threat across its broad portfolio. We’ve seen high, concentrated investments from more-focused competitors like Arista Networks ANET, Palo Alto Networks PANW, and Fortinet FTNT lead to market share gains at Cisco’s expense.

We believe Cisco can face risk from its outsourced manufacturing model, which can augment supply constraints, as the firm saw in fiscal 2021 and 2022.

Finally, we foresee modest environmental, social, and governance risks for Cisco, primarily owing to the possibility of cyber breaches to its security equipment and software, which could cause serious customer harm and tarnish the firm’s reputation. We also see high human capital demand making it difficult for Cisco to attract and retain top engineers.

Read more about Cisco’s risk and uncertainty.

CSCO Stock Bulls Say

- Cisco holds dominant market shares across networking, and its leading shares in areas like SD-WAN bode well for its position in the next era.

- We view Cisco’s shift toward a higher mix of software- and subscription-based consumption models as positive.

- Cisco’s balance sheet is strong and generates impressive free cash flow, and it sends most of that cash back to shareholders.

CSCO Stock Bears Say

- Cisco‘s core networking markets don’t offer robust growth opportunities, and it has to seek top-line upside from nascent corners or other markets, where it is less competitively advantaged

- Cisco has been losing market share across networking and security over the past decade, and it will need to redouble its efforts against the likes of Arista and cybersecurity platform providers.

- In high-speed public cloud applications, Cisco trails behind Arista in market share, which could hamper its growth as these applications increase their market mix.

This article was compiled by Muskaan Hemrajani.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)