Fed’s Powell Signals a Possible Rate Hike ‘Skip,’ Not a Pause

But with inflation likely to ease as the economy slows, we see the Fed cutting rates around the year end.

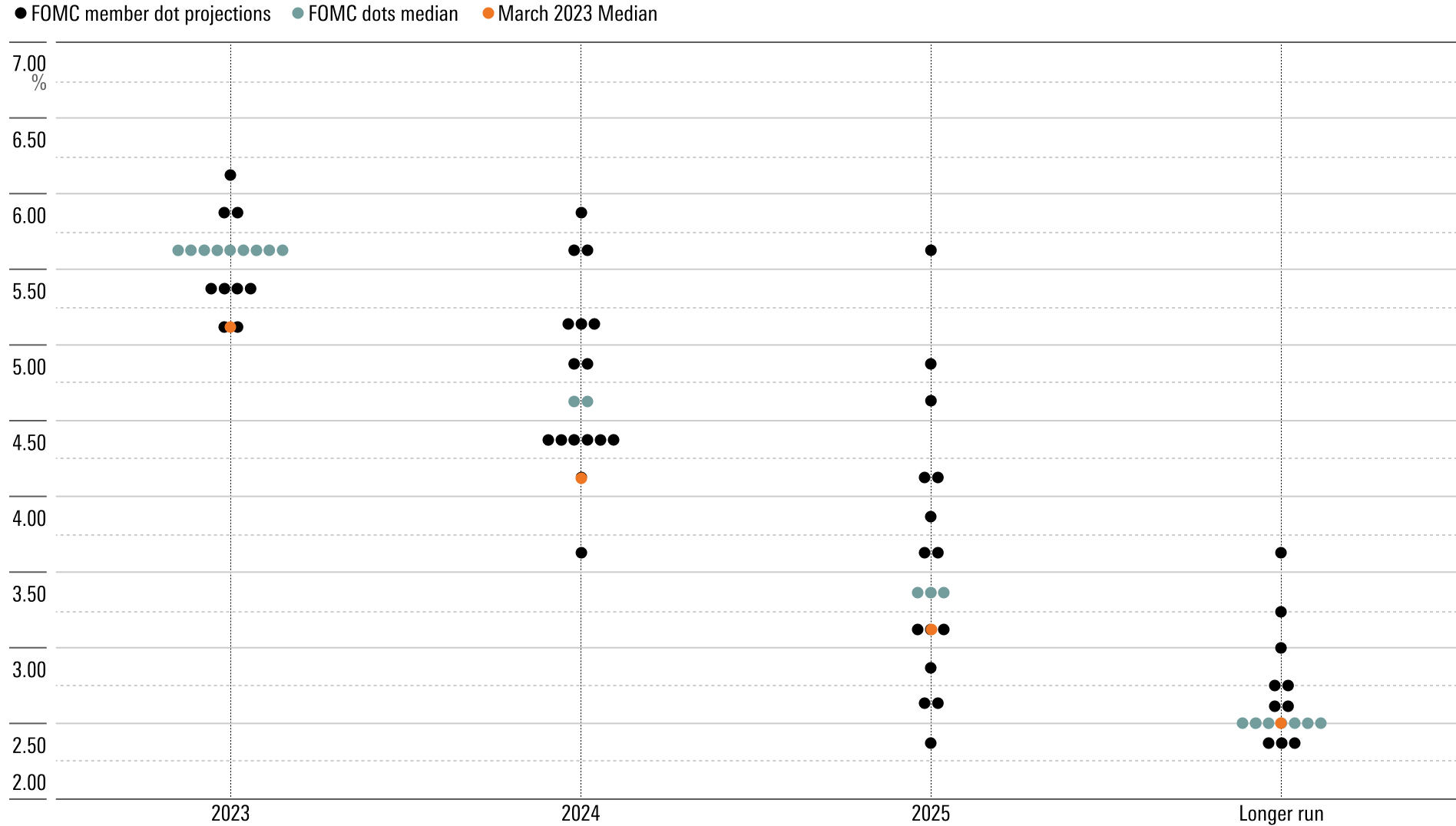

While Federal Reserve Chair Jerome Powell is reluctant to say whether the agency is winning its war against inflation, we’re optimistic. And we continue to project that interest rates in 2024 and 2025 will fall much lower than what the Fed is projecting.

In line with expectations, the Fed decided to keep the federal-funds rate unchanged after its two-day meeting, which concluded Wednesday. According to its official statement, this will provide the Fed with time to “assess additional information” and determine whether current rates are high enough to bring inflation to normal or if further increases will be needed.

This is the first meeting at which the Fed hasn’t hiked interest rates since January 2022. Over the course of its meetings from March 2022 through May 2023, the Fed brought the federal-funds rate up 5 percentage points to its current target of 5%-5.25%. That’s the fastest rate of increase since the early 1980s. Just as it did during that period, today’s Fed has sought to aggressively tighten monetary policy to crush high inflation.

The question is whether the Fed has tightened enough. Officials have raised the possibility that today’s meeting could be a “skip” rather than a permanent end to the rate-hike campaign. Powell asserted that whether the Fed will raise the rate again at its next meeting in July was “not the focus” at this most recent meeting. However, he also said that the July meeting was “live” when it came to the possibility of a rate hike.

Treasury Yields and Federal-Funds Rate

Inflation has yet to fully return to normal, with the latest Consumer Price Index report showing a 4.1% year-over-year increase for May. But inflation has fallen dramatically from its peak of 8.9% in mid-2022, and Powell suggested current rates are within a range sufficiently restrictive to tame inflation.

Projections from Fed officials call for two more rate hikes of 0.25%, the first of which would likely come in July.

The Dot Plot: Federal-Funds Rate Target Level

A year ago, it was clear the Fed was way off-target on interest rates, with inflation reaching a 40-year high and spiraling ever higher. That called for the Fed to move very fast. Now it’s clear the Fed is within range of the appropriate rate level. That calls for a slower, more deliberate approach to achieve the precise level that’s high enough to bring down inflation but not so high as to cause unnecessary economic pain.

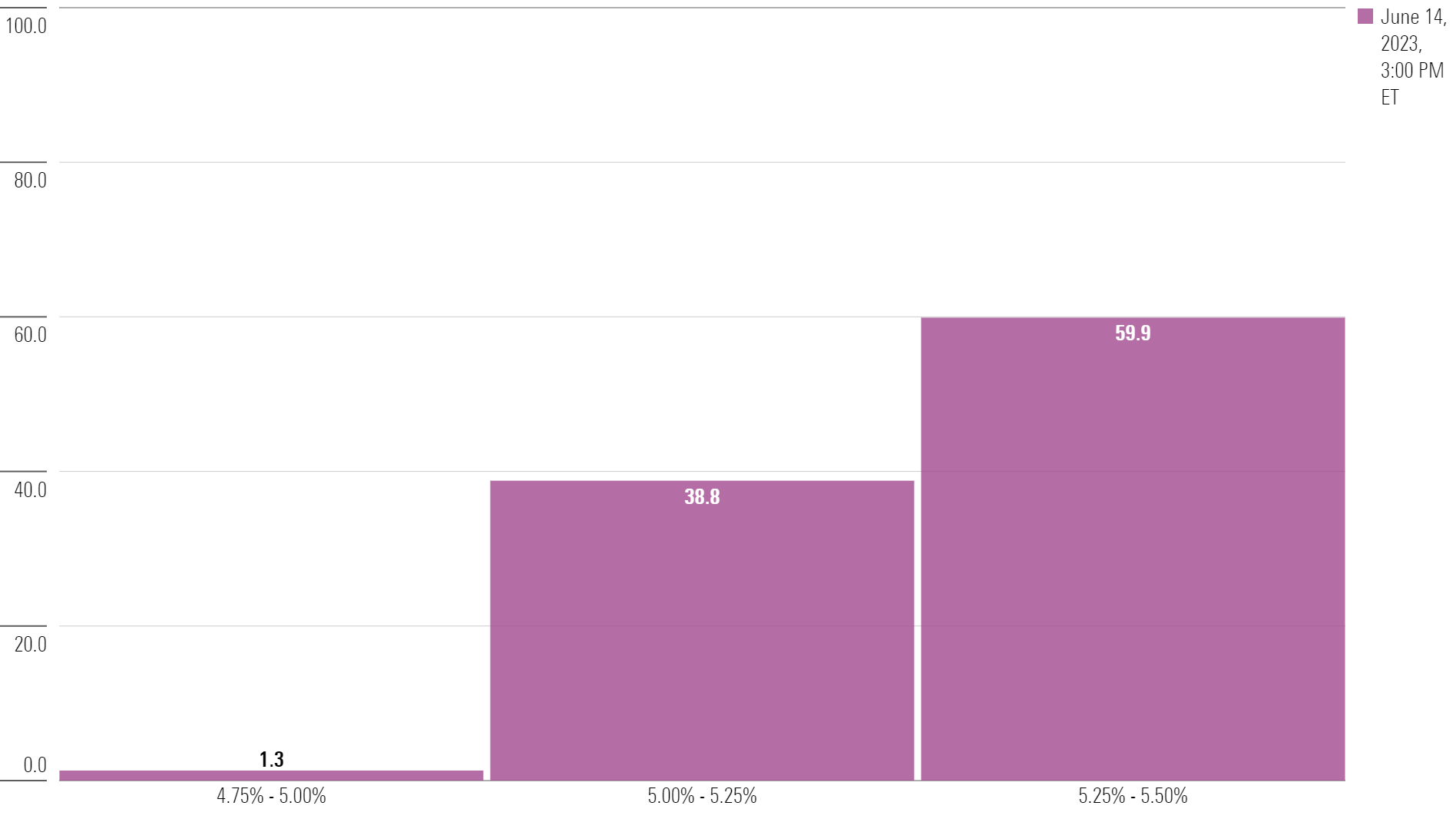

Markets are split on whether the Fed will return to hiking rates in July. We think the coming month’s data will probably be favorable enough to refrain from hiking again, but it’s unclear exactly what officials will be looking for. Market expectations incorporate a decent probability of one or two rate cuts before the end of 2023.

Expectations for July 26, 2023 Federal Reserve Meeting

Regardless of the fine-tuning to rates over the next several months, we think weak economic growth and falling inflation will call for the Fed to pivot to cutting rates around the end of this year. We expect cuts to then continue aggressively in 2024 and 2025.

So far the economy has seemed very resilient to the impact of rate hikes. But we think the lagged impact of the Fed’s prior hikes will weigh greatly over the next year via contracting bank credit as well as the knock-on impact of housing sector weakness on other parts of the economy. Additionally, the depletion of excess savings will lead to more conservative consumers. And businesses have been slow to curtail hiring in the face of slowing economic growth, but that’s likely to change over the next year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)