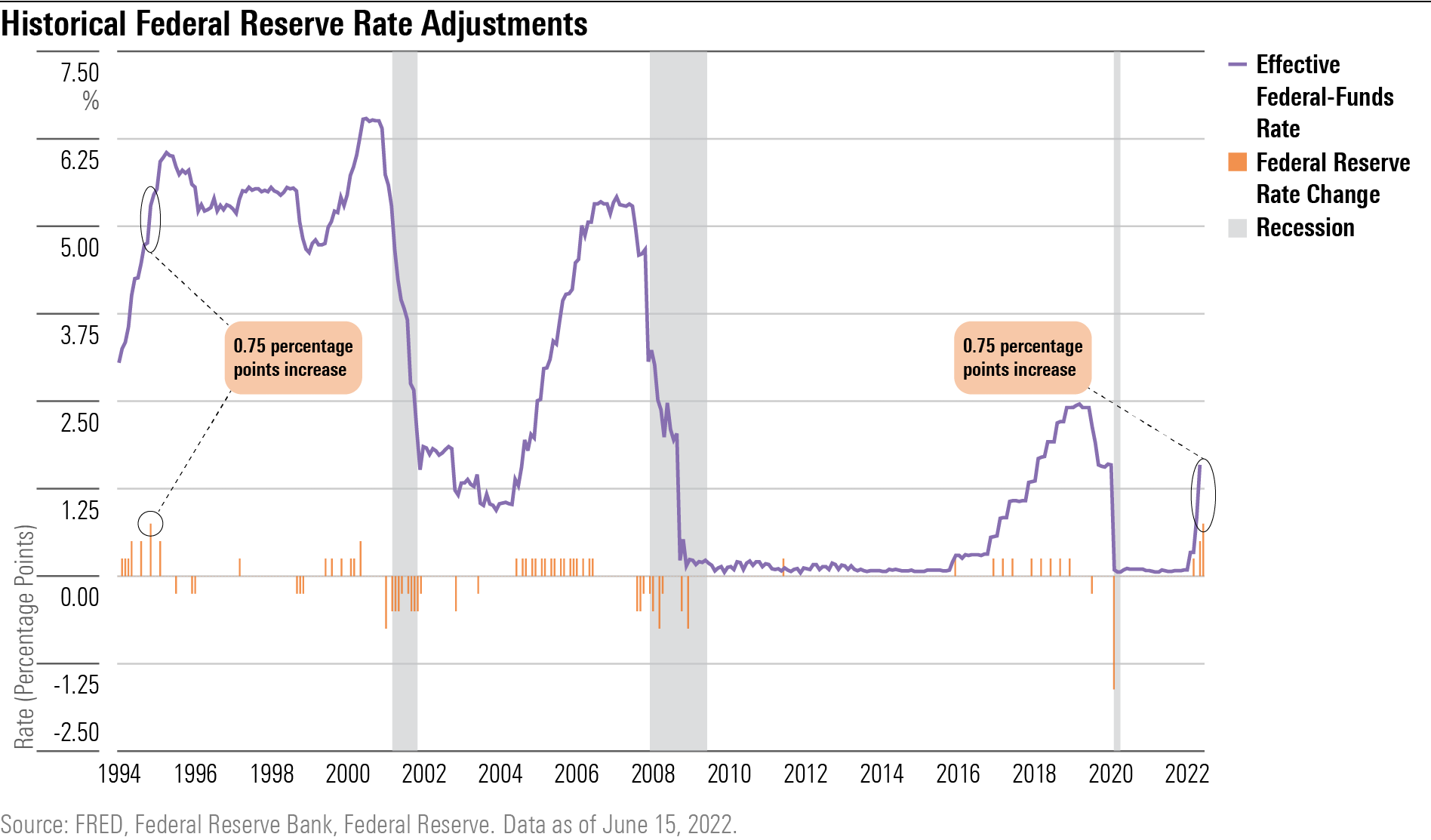

Federal Reserve Hikes Interest Rates by Biggest Amount Since 1994

Says another 0.75% move is possible in July.

Vowing to rein in rampant inflation and restore price stability, the U.S. Federal Reserve boosted a key short-term interest rate by three fourths of a percentage point Wednesday and said it could consider hiking between 0.50 and 0.75 at the next meeting.

“We have to have price stability,” said Fed chair Jerome Powell, explaining the Fed’s position at a press conference following the meeting of its policy-setting committee. “It’s the bedrock of the economy.”

After starting the year at near zero, the federal-funds rate is now 1.50%. The Fed raised rates in March for the first time since 2018 by a quarter-percentage point, followed by a half-percentage move in May, the highest since 2000.

Investors, initially buoyed by the Fed’s more-aggressive stance, drove equity markets higher following the news.

“It is smart and prudent to frontload the rate increases and that’s what they’ve done,” said Olga Bitel, global strategist at Chicago-based William Blair, a boutique investment banking and investment management company. “I don’t think the U.S. economy is headed to recession. We should be able to manage.”

“The nice thing about a 0.75-percentage-point hike that didn’t rattle markets is that they could do it again if needed,” noted Eddy Vataru, manager of the Osterweis Total Return Fund OSTRX. “If price pressures abate, they can slow hikes as well.”

Yet, benchmark indexes Thursday gave up the previous days’ gains. Investors resumed selling at the open as European countries announced rate-tightening actions, triggering worries about a global slowdown, and heightened concerns that it will be hard to avoid a recession.

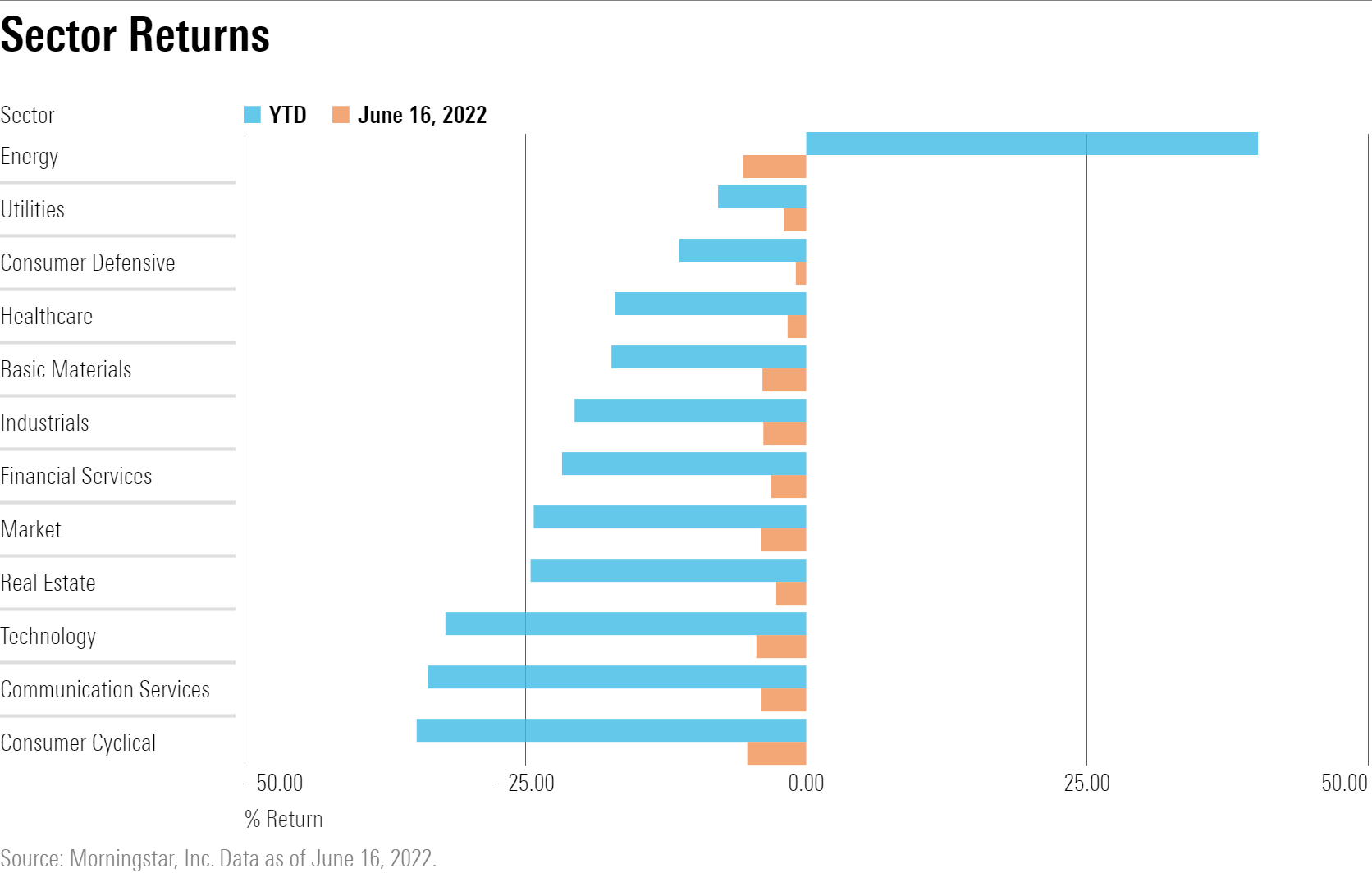

The Bank of England raised rates by a quarter-percentage point for the fifth consecutive time and said it sees inflation rising to 11% by the end of the year. Switzerland’s central bank raised rates by a half-percentage point, marking its first hike in 15 years. On Thursday, the Morningstar US Market index lost 3.49% to 8,977.87 and the S&P 500 dropped 3.25% to 3666.77. The tech-heavy Nasdaq Composite index fell over 4%. The bear market deepened with the S&P 500 now down nearly 24% from its high and the Nasdaq off 34%.

Richard Bernstein, chief executive and chief investment officer of Richard Bernstein Advisors, said the Fed’s more-aggressive rate hike “was needed” but “even with a 75 increase and a forthcoming 75 increase …we still think inflation remains higher for longer than investors and the Fed currently expect.” Bernstein considered investors’ initial reaction to the Fed move “a knee-jerk reaction” and Wednesday’s bounce in beaten-down growth stocks “misguided.”

At this late stage of the economic cycle, he recommends energy and commodity stocks as well as consumer staples, utilities, and Japanese stocks for the protection they provide against inflation and in a slowing economy.

Bernstein considers what he calls “long-duration securities” to be “most at risk” from rising rates. These include growth stocks that sport high price/earnings ratios, typically those in the technology, communication, and consumer discretionary sectors, as well as assets considered to be innovative and disruptive, such as cryptocurrencies, and fixed-income assets.

In this environment of decelerating economic growth, which she puts at 2% to 2.5%, Bitel of William Blair recommends focusing on “those companies that can maintain a high level of earnings or demonstrate accelerating earnings growth.”

“In ordinary expansions, market leadership is driven by earnings growth,” she said. “By this time next year, we will be in an expansion.”

In explaining the Fed’s rate-hike’s decision, Fed chair Powell said economic conditions in the United States continue to be healthy. He noted “there is no sign of a slowdown in the broader economy,” “consumer spending remains strong,” and “there’s no wage price spiral.” Unemployment continues at historically low levels.

Said Powell, “The U.S economy is strong and the U.S. economy is well-positioned to deal with higher rates.” He added that three-quarter-point moves should be considered “uncommon.”

It was the central bank’s most aggressive move since 1994 and it comes days after inflation readings hit a 40-year high. May’s consumer price index showed prices rising 8.6% from the prior year, higher than the 8.3% economists forecast. Core CPI, excluding food and energy prices, rose 6% compared with an anticipated 5.9%. Since the CPI numbers were released Friday odds had risen that the Federal Reserve would take a more-aggressive stance at its coming meetings.

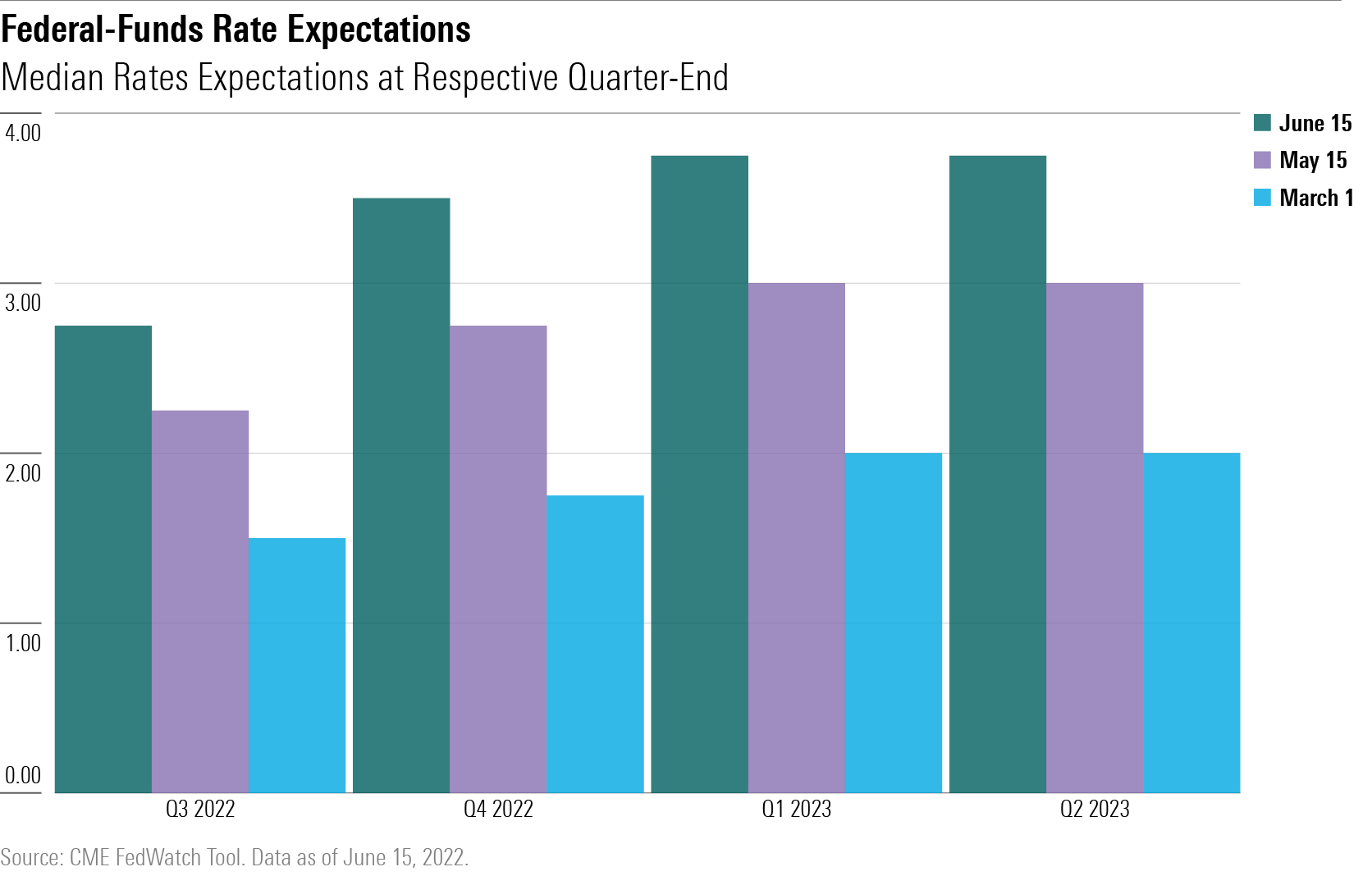

Fed officials now put the benchmark federal-funds rate at 3.25% to 3.5% by year-end 2022 and close to 4% next year as it aims to bring underlying inflation down to 2%. Earlier this year, the Fed had targeted a fed-funds rate of 1.9% by year's end.

“Their forecasts for the fed-funds rate seem much more reasonable now, but I am afraid long-term expectations of inflation coming back to 2% are a pipe dream,” says Vataru of Osterweis. “That’s something to be sorted out if and when inflation falls and perhaps appears stubborn in the descent.”

Powell signaled in a series of interviews in May that the Fed would be flexible in its position and was prepared to be more aggressive if conditions and data warranted.

Outside the Federal Reserve’s control are two main drivers of inflation: energy and geopolitical factors, including the Russian invasion of Ukraine and China’s coronavirus lockdowns, which have disrupted supply chains for critical commodities and materials.

Blair’s Bitel argues the U.S.’s self-sufficiency in energy and food production will enable it to better cope with continued pressures and is what separates it from Europe, which, she says is facing a period of stagflation as high inflation persists and economic growth slows.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)