WeWork’s Wild Valuation Ride

The problems of pricing private placements in open-end funds.

At this point, it’s not clear if WeWork, the troubled office-leasing firm, will ever go public. But even if it doesn’t, the notoriety surrounding the firm’s delayed initial public offering could have a long-term impact on open-end mutual funds through fostering greater scrutiny of their private placement valuations. That’s not the only lesson to draw from WeWork’s precipitous decline as concerns about its business model have multiplied, but it is an important one.[1]

Indeed, open-end funds’ pricing of WeWork shares varied not just between asset managers but in one case among funds using the same subadvisor team. The discrepancies illustrate the problem of pricing private placements in investment vehicles that require daily liquidity. In the absence of the market setting a closing price, big valuation gaps sometimes appear. As a result, much lower valuations hurt sellers and help buyers of open-end mutual funds, while much higher ones do the reverse.

Infrequent pricing can also mask risk. Even though private companies like WeWork tend to be early stage companies with uncertain prospects and a wide range of potential outcomes, their shares can go a year or more without changing in price. Were their shares public, their prices would probably fluctuate like emerging growth stocks and heighten the volatility of portfolios that own them. The lack of regular public pricing, however, damps volatility.

These pricing issues won’t have a big impact on funds with modest, diversified private stakes. They can get complicated, though, for funds with concentrated private helpings that push against the SEC’s 15% cap on such holdings. One fund, for instance, stashed 8.6% of its assets in China’s Didi Chuxing ride-sharing service, and owned another private company, as of September 2019.

It’s questionable whether the SEC should let vehicles that require daily liquidity to put so much of their money in illiquid shares of private companies, especially when they can be valued so differently. Revisiting the SEC’s guidelines on pricing practices and 15% limit could be an enduring legacy of WeWork’s wild valuation ride.

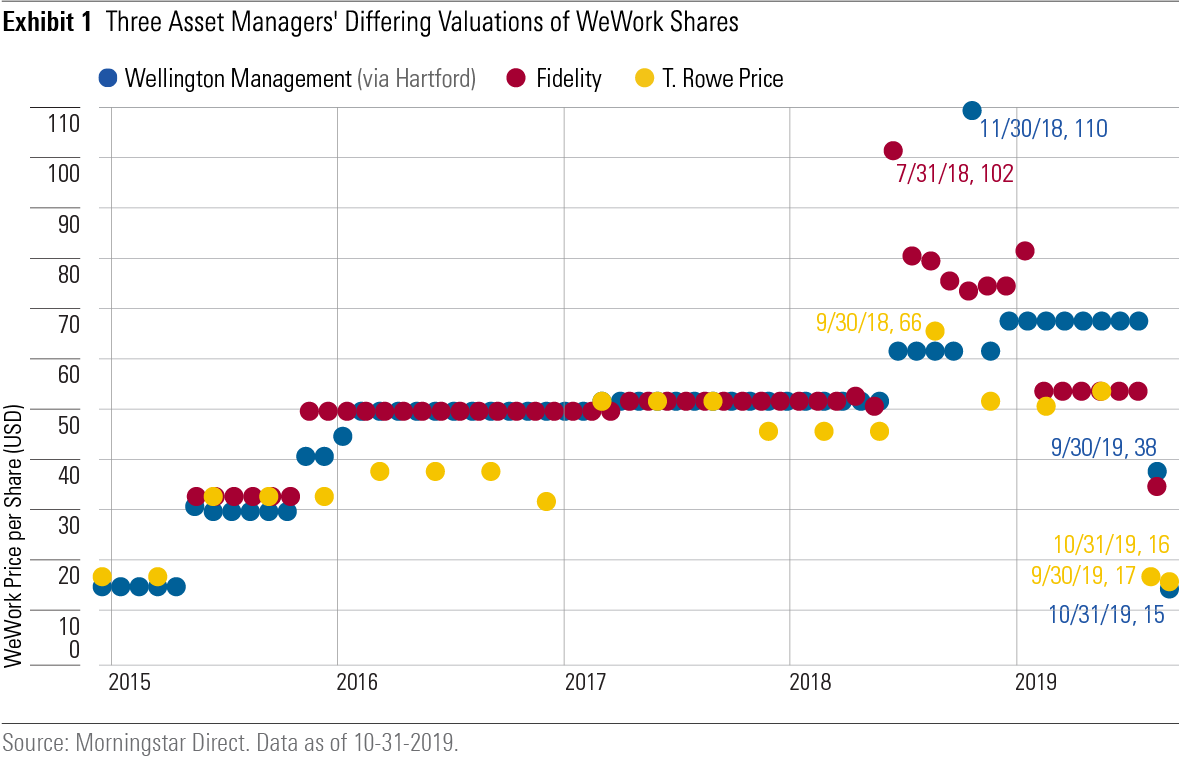

Timing and Path of the Descent The plunge in WeWork's market value to around $8 billion in October 2019 from $47 billion in January 2019 caused quite a stir, but its slide began in 2018, judging from the way three prominent U.S. asset managers priced the workspace-sharing company.

WeWork shares first appeared in stock funds run by T. Rowe Price and Wellington Management as a subadvisor to Hartford in December 2014 and then in Fidelity equity portfolios in June 2015. As Exhibit 1 shows, Wellington and Fidelity priced WeWork at $50.19 between February 2016 and February 2017. By May 2017, all three firms had increased their valuations--at different times--to $51.81. Their prices largely agreed until July 2018, when Fidelity’s $102.48 peak was almost two thirds more than Wellington’s price on the same day. Fidelity’s dropped to $73.94 on Nov. 30, 2018, while Wellington’s valuation then hit $110 a share. Pitchbook estimates that was the same price, adjusted for subsequent growth in the number of shares outstanding, implied by WeWork’s $47 billion firm valuation in January 2019. T. Rowe Price’s appraisal of WeWork shares in disclosed portfolios never reached such heights, peaking at $65.74 on Sept. 30, 2018. Even if T. Rowe Price merits some credit for its restraint, the broader and more important issue is not whose valuation was better or worse, but that valuations differed so much.

The three asset managers also disagree on trough pricing. The WeWork valuations in their Sept. 30, 2019, portfolios vary so widely that Wellington’s $37.80 price tag was then more than twice that of T. Rowe Price’s $17.03.

The Oct. 31, 2019, portfolios show a further decline, if not confusion. A variable annuity fund that T. Rowe Price subadvises priced WeWork shares at $15.64, less than the $19 per share that Pitchbook estimates was implied by WeWork’s most recent $8 billion firm valuation. Meanwhile, two Wellington-subadvised Hartford funds valued their WeWork shares at $14.55, on average, which included pricing newly appearing WeWork tenders at $19.19, WeWork convertible D shares at $12.60, and WeWork A shares at $7.50. Significantly, that is the first time since the convertible D and A shares appeared in Hartford funds’ December 2014 portfolios that the firm introduced a pricing difference between these two share classes. In every other portfolio, they had the same price.

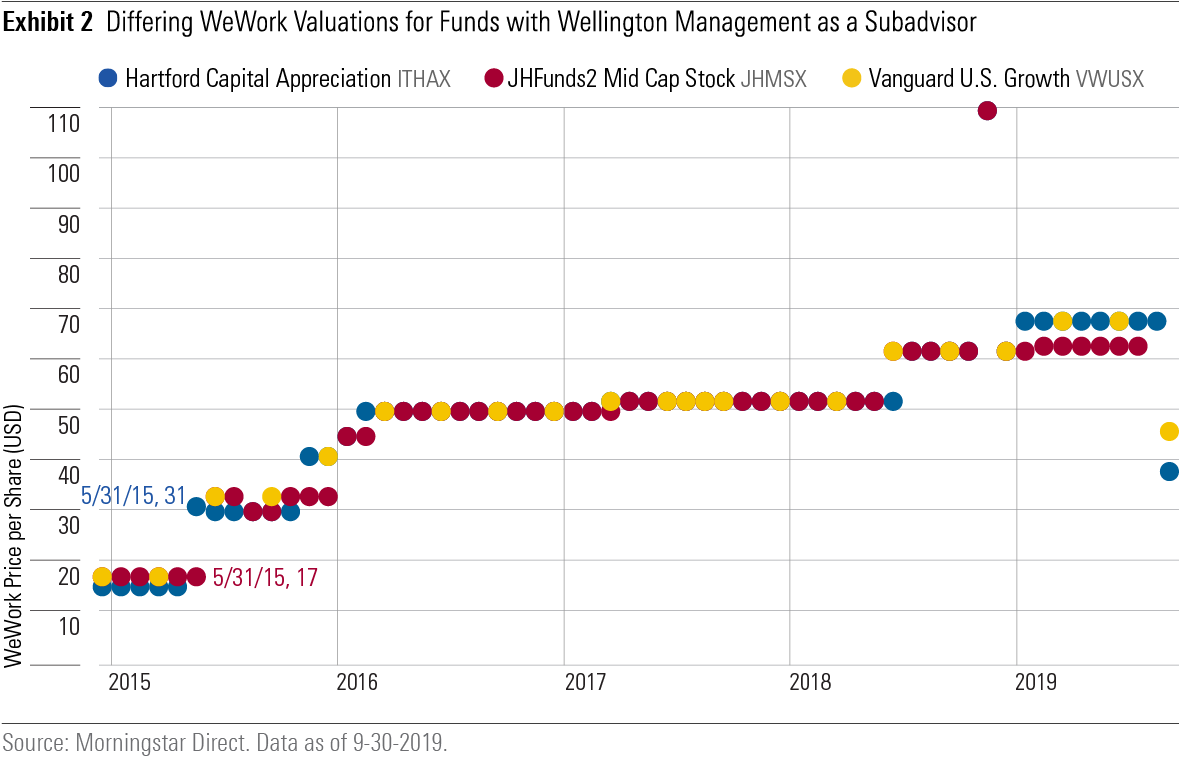

Discrepancies Within Wide WeWork valuation discrepancies don't just appear between firms, but within them because of differing subadvisor relationships. Exhibit 2 shows the WeWork price per share history of Hartford Capital Appreciation ITHAX, JHFunds2 Mid Cap Stock JHMSX, and Vanguard U.S. Growth VWUSX, each subadvised, at least in part, by Wellington Management.[2]

According to industry sources, Wellington as a subadvisor would have had input on WeWork’s pricing at each of the funds, yet those prices still differ, sometimes by a lot.[3] That’s because ultimately the advisor is responsible for valuing the fund’s portfolio holdings, including private placements. And advisors’ influence can be significant. On May 31, 2015, Hartford Capital Appreciation’s $31.32 WeWork price was 88% more than JHFunds2 Mid Cap Stock’s $16.65 price for the same shares, even though the same Wellington team ran both funds.

Precedents of Kind, Not Degree There is some precedent for pricing the same security differently in open-end mutual funds. Fair value pricing prevents profiting from stale prices of securities that trade on closed markets in other time zones and requires estimates that can lead to different prices of the same security. But those differences resolve once the relevant international market reopens and establishes a public price.[4] Morningstar fixed-income strategy analysts also report that firms often assign different prices to the same bond if it is illiquid and rarely trades.

Yet, it’s unlikely those cases exhibit the degree of pricing differences seen in private placements. WeWork may be an extreme example, but it isn’t the only one. In June 2016, Morningstar data showed a wide range of valuations for Airbnb series D and E shares: $88.44 per share on the low end (Delaware) to $130.39 on the high end (Wellington via Hartford and Vanguard funds).[5]

The Need for a Standard This survey has important implications for open-end funds that invest in private placements. First, even if Exhibits 1 and 2 reveal that pricing discrepancies can be within a tight range or nonexistent, the sizable gaps that appear show the need for some standard in the absence of a daily closing market price.

Independent assessments of a private early stage growth company like WeWork should vary greatly when that company reaches an inflection point. It is surprising, however, that in the highly regulated world of mutual funds such divergent valuations can become incorporated into funds’ net asset values for purchase or sale by retail investors.

Someone's Getting a Deal Big pricing discrepancies mean someone is getting a deal. The question is whether it is a good one or a bad one. Much lower valuations hurt sellers and help buyers while much higher ones do the reverse.

Consider the 88% premium Hartford Capital Appreciation’s investors paid for WeWork shares on May 31, 2015. Had those WeWork shares been priced at $16.65, as in JHFunds2 Mid Cap Stock’s portfolio on the same date, then Hartford Capital Appreciation’s WeWork stake would have fallen to 22 basis points from 41 basis points. That one pricing discrepancy, in other words, amounted to 19 basis points.

If an outlier valuation fuels growth in a fund’s private stake, so, too, does the opportunity for someone to profit at another’s expense. When Hartford Capital Appreciation priced WeWork shares at their $110 peak on Nov. 30, 2018, the fund’s WeWork stake was its top holding at about 2.1% of assets. Had those WeWork shares been priced at $73.94, as in Fidelity Contrafund’s FCNTX portfolio on the same date, then Hartford Capital Appreciation’s WeWork stake would have fallen to 1.4%, a drop of more than 65 basis points.

Distorted Risk-Adjusted Returns Daily pricing of publicly traded early stage growth companies' shares allow the market to reflect the uncertainty of their business prospects, especially when changes occur, but infrequent pricing of private placements can create problems in open-end funds. WeWork's share price was static for a long time before its risks became starkly apparent. Between Feb. 29, 2016, and Feb. 28, 2017, its $50.19 price in Hartford Capital Appreciation didn't budge. It then rose 3.2% to $51.81 and stayed there through June 2018. Hartford Capital Appreciation's WeWork price during the period had an annualized standard deviation of 2.1%, versus 7.7% and 2.8% for the S&P 500 and Bloomberg Barclays U.S. Aggregate Bond Index, respectively.[6] In other words, WeWork's shares then seemed less volatile than the broad U.S. investment-grade bond market.

Standard deviation is not a perfect proxy for risk, but it’s a component of risk-adjusted return calculations, such as the Sharpe ratio. A large WeWork stake between early 2016 and mid-2018, for example, could have inflated an open-end fund’s Sharpe ratio by muting its standard deviation.

Pushing the Limits The WeWork stake in the multimanager Hartford Capital Appreciation never reached double digits, but it did in one sleeve of that fund. When Wellington (via Hartford) valued WeWork shares at $110 on Nov. 30, 2018, Hartford Capital Appreciation's 2.1% WeWork stake translated into a double-digit weighting in manager Michael Carmen's sleeve, as that sleeve then accounted for about a fifth of the fund's assets, according to information provided to Morningstar.

Davis Advisors manager Danton Goei’s private placement investment in Didi Chuxing has been similarly aggressive, but at the portfolio rather than subportfolio level. As of Sept. 30, 2019, his Selected International SLSDX had 8.6% of its assets in Didi and 2.1% in another private ride-hailing service, Grab, which is based in Singapore and counts Didi among its investors. Selected International’s combined 10.7% isn’t the biggest stake that one of Goei’s funds has had in private companies: Davis Opportunity’s RPEAX total exposure to Didi, Grab, and the Chinese e-commerce startup Miss Fresh on July 31, 2019, reached 12.2%--approaching the SEC’s 15% limit.

Challenges Remain There's a case for investing in private placements in open-end mutual funds. Fewer companies are going public today than in the past, and when companies do file for an initial public offering, some do so later in their life cycle. Thus, much of their exponential growth and outsize returns occur when they're still private. Amazon.com AMZN went public in 1997, three years after its founding, at a market capitalization of less than $900 million in today's dollars. By contrast, Facebook FB stayed private for eight years and debuted in 2012 with a market cap now worth about $91 billion.[7]

Active investors with the will and the wit to find the giants of tomorrow, while they’re still private, can add significant value or even hit the jackpot, so the argument goes. But the challenges of open-end funds investing in private placements shouldn’t go unnoticed.

The SEC has an opportunity to address those challenges before another open-end fund’s private investments cause it to stumble badly, as happened in Britain when Woodford Equity Income Fund, laden with private placements, closed its gates in June 2019 to stop redemptions from its increasingly illiquid portfolio.[8] If WeWork’s rise and fall helps prevent the need for such measures again, then the $15.64 billion of capital that investors, according to Pitchbook, have poured into a company now worth much less won’t be for naught.

----------------------------------

[1] On WeWork's business model, see especially Nori Gerardo Lietz and Sean Bracken, "Why WeWork Won't," Harvard Business School Working Knowledge (forthcoming). It is available as of December 2019.

[2] Wellington Management is the sole subadvisor for Hartford Capital Appreciation and JHFunds2 Mid Cap Stock, but it is one of five subadvisors on Vanguard U.S. Growth. Granted, Vanguard U.S. Growth’s WeWork stake could in theory come from another. In practice, though, Wellington Management is the only Vanguard U.S. Growth subadvisor to participate in WeWork’s funding rounds, and manager Andrew Shilling of Wellington is active in the private space. In Vanguard U.S. Growth’s 2018 annual report, for example, he discusses a position in the then-private company Uber in his sleeve of Vanguard U.S. Growth.

[3] A Vanguard spokesperson, for example, says that its funds’ private company valuations reflect the views of a Vanguard accounting committee, Vanguard investment management personnel, and input from external advisors like Wellington.

[4] "Fair Value Pricing Isn't Always Fair, but It's Needed," Morningstar.com.

[5] Katie Reichart, “Unicorn Hunting: Mutual Fund Ownership of Private Companies is a Relevant, but Minor, Concern for Most Investors,” Morningstar Manager Research December 2016 white paper.

[6] By convention, annualized standard deviation is calculated based on monthly returns. If one altered convention and used daily returns instead while assuming no intervening movement in WeWork’s share price between monthly disclosures, then the damping effect of infrequent pricing would be even greater.

[7] These present-day dollar figures for the debut market caps of Amazon and Facebook differ from but are directionally in line with those found in Michael J. Mauboussin, Dan Callahan, and Darius Majid, "The Incredible Shrinking Universe of Stocks: The Causes and Consequences of Fewer U.S. Equities," Credit Suisse, March 22, 2017. Available at: https://www.cmgwealth.com/wp-content/uploads/2017/03/document_1072753661.pdf. Accessed on Dec. 1, 2019.

[8] "Anarchy in the U.K.," Morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)