The Target-Date Fund Problem That Indexing Can’t Solve

There will always be asset allocation losers (and winners).

You’re Fired!

In 2009, participants in Cobham Advanced Electronic Solutions’ 401(k) plan were displeased. The plan’s target-date funds, managed by Fidelity, had recently lost a great deal of money. For example, Fidelity Freedom 2010 FFFCX, theoretically owned by 63-year-olds, had shed 25% of its value in calendar 2008. Ouch!

Given such results, Cobham’s investment committee opted for discretion over valor. While retaining Fidelity as its recordkeeper, the plan sponsor put its target-date funds up for bid, eventually supplanting Fidelity’s Freedom series with American Century’s Livestrong lineup. (Lance Armstrong … remember?)

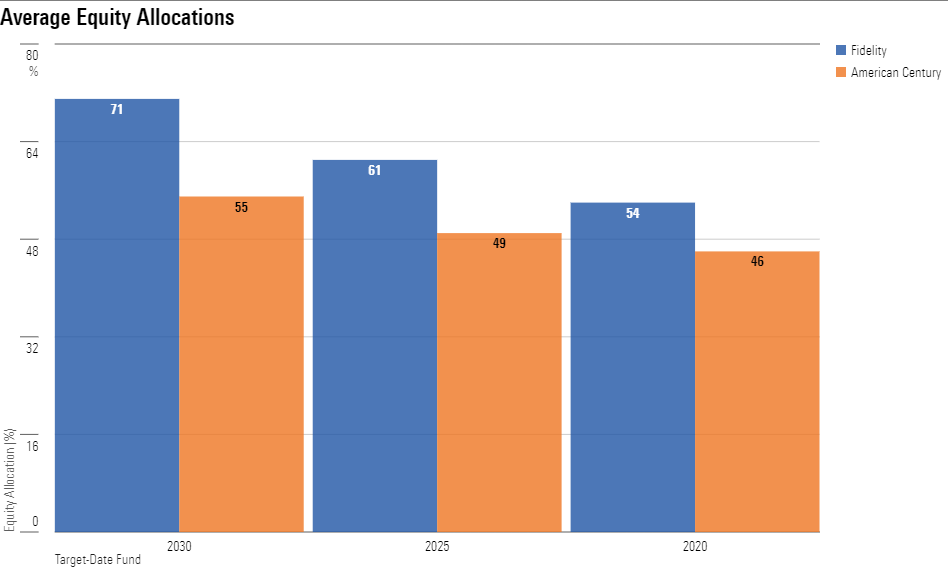

The Livestrong funds had not existed throughout the entire global financial crisis, as they debuted during 2008, but there was no doubt that they would prove a safer option. As shown by the following chart, which depicts the average equity allocations over the past decade for the 2020, 2025, and 2030 funds, American Century’s offerings have been more conservatively positioned than Fidelity’s.

(Note: I wrote too quickly. The Livestrong 2040 fund, which I discussed in last month’s column, did debut in 2008. However, several other funds in the Livestrong series were launched in 2004. Sure enough, each of those funds that did exist held up better than did their Fidelity counterparts during 2008.)

Average Equity Allocations

The Lawsuit

American Century fulfilled Cobham’s expectations. Since the change, its target-date funds have been among the industry’s steadiest. Indeed, last month when I evaluated American Century One Choice 2040 ARDUX (the company long ago shelved the Livestrong brand), it boasted the lowest standard deviation of returns of any fund in its Morningstar Category over the past decade.

The fund’s reward for fulfilling its promise? It has landed on the receiving end of a lawsuit. Technically, I confess, that statement is incorrect. Participants in 401(k) plans do not sue fund companies, because plaintiffs cannot win Investment Company Act of 1940 actions unless fraud has been committed. Instead, they seek damages from the plan sponsor for neglect of Erisa duties. The involved parties at Cobham have thus been served.

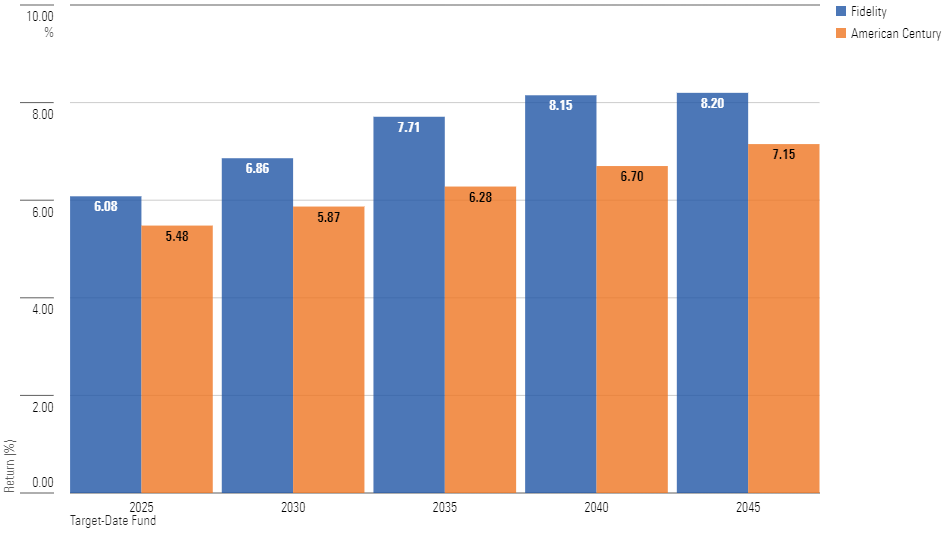

Regardless of the defendant, the complaint is the same: The funds are accused of failing because their total returns have trailed both the category averages and—adding insult to injury—those of the Fidelity Freedom funds that they replaced. The latter, in fact, has been among the best-performing target-date series.

Trailing 10-Year Returns

3 Possibilities

Replacing the Fidelity Freedom series with the American Century One Choice funds necessarily involved a trade-off, as asset-allocation decisions cut in both directions.

1) If bonds outgained equities, as occasionally happens over the long term (for example, the 10 years from 1999 through 2008), the American Century funds would be clearly superior, providing higher returns with lower risk.

2) If equities modestly beat bonds, the American Century funds would slightly trail but would nonetheless be competitive.

3) If equities thrashed bonds, the American Century funds would struggle to keep pace.

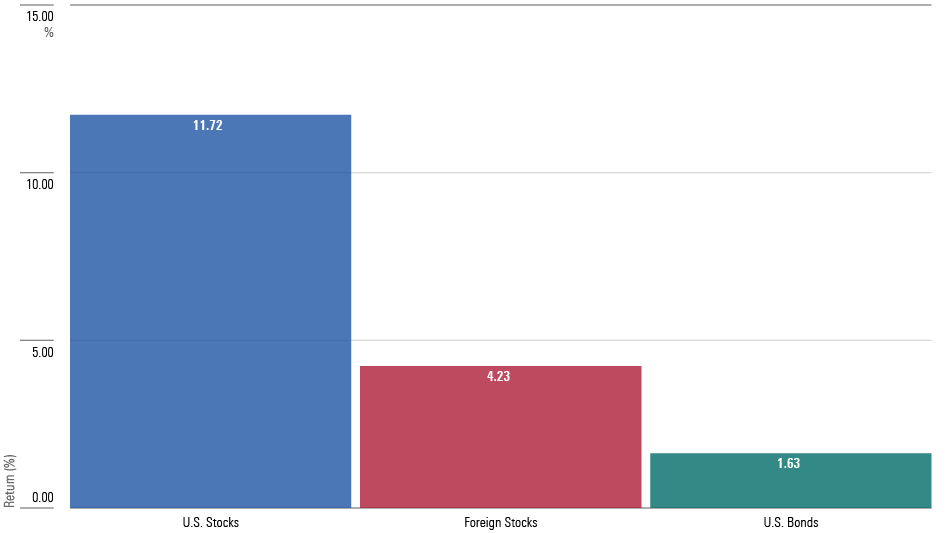

The third scenario occurred. We have already viewed the funds’ performances. The following chart shows those of their underlying assets. (The returns are derived from three exchange-traded funds: Vanguard Total Stock Market VTI, Vanguard Total International Stock VXUS, and Vanguard Total Bond Market BND.)

Stocks Win in a Landslide

In short, Cobham picked an option that would look brilliant one decade in five, sensible two decades in five, and slow-witted for the other two occasions. When the selection was made, those odds struck not only the company representatives but also its institutional advisors as a fair bargain. Thus, it seems peculiar to criticize the selection after the fact because, when measured by relative (rather than absolute) performance, the worst of the three possibilities ensued.

Another Asset-Allocation Decision

This summer, I studied why Fidelity and Vanguard’s mid-horizon target-date funds had worse 15-year returns than their balanced funds, although the target-date funds had similar stock allocations. This reason, I learned, was because the target-date funds placed one third of their equities in foreign securities, while the balanced funds held either one eighth (Fidelity Balanced FBALX) or none (Vanguard Balanced Index VBIAX).

That made sense. The balanced funds are old-line investments, launched when most U.S. investors held only domestic securities. What’s more, balanced funds are retail offerings that need not pass additional scrutiny. In contrast, target-date funds are expected to meet the institutional standards, which require substantial international diversification. No target-date series simply omits non-U. S. stocks, as Vanguard Balanced Index does, for the simple reason that if it did, that series would be routinely eliminated from target-date fund searches.

I therefore assigned no blame when writing my article. As my former boss Don Phillips likes to say, “Describe, not proscribe.” The column concluded on a neutral note: “Vanguard and Fidelity’s target-date funds have failed to keep pace with their organizations’ balanced funds not because they are managed to lower standards, but because they are held to higher ones. Isn’t it ironic?”

To my surprise, nobody appeared to share my view. Across the board, both reader responses and media inquiries blamed target-date funds for holding too many foreign equities. Such criticisms, I have come to realize, are inherent with target-date funds. Their selectors face two major choices: 1) how much to invest in equities, and 2) how aggressively to invest outside the United States. In hindsight, some will always get those decisions wrong.

Along with costs, the asset-allocation decisions largely determine the relative performance of target-date funds. Whether the target-date series should be actively or passively managed is often debated but of secondary importance.

Wrapping Up

I draw two lessons from this experience. One, to underscore November’s argument, mutual fund strategies do not belong on trial. Unless the asset allocations for all target-date series converge so tightly that their differences become immaterial, there will always be allocation losers (and winners). There’s no more logic for suing them than for suing lagging stock or bond funds.

Second, while passive investing does help to prevent second-guessing, the strategy is not foolproof. Had American Century indexed its target-date holdings, the One Choice series would nevertheless have faced the same criticism. (For that matter, Vanguard did index its target-date funds.) With this conundrum, I see no escape. Human nature urges 401(k) plan participants and sponsors to wage the next asset-allocation battle with the tactics that triumphed the last time around.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)