Mutual Fund Strategies Don’t Belong on Trial

The marketplace can serve as judge, jury, and (if necessary) executioner.

The Complaint

This summer, four former employees of a company called Cobham Advanced Electronic Solutions, or CAES, filed a class-action lawsuit. Their claim: The organization breached its fiduciary duties by selecting unsuitable funds for its 401(k) plan. Receiving the most attention in their suit—and the topic of today’s discussion—was the target-date series American Century One Choice Portfolios.

The plaintiffs start by questioning the series’ costs. That case does not appear strong. The current expense ratio of American Century One Choice 2040 R6 ARDUX—the fund specifically cited by the plaintiffs—is 0.49%. While above the 0.41% median recorded by institutional share classes of target-date 2035 funds, that ratio is far from the category’s highest. If that One Choice Fund breaches the legal barrier, then so, it seems, would its many rivals that charge steeper fees.

That said, the cost allegation is certainly acceptable. Although I dislike policing fund expenses through the courtroom, I have learned to accept such efforts. There is, after all, a logic for such claims. As confirmed by the Supreme Court’s 2010 Jones v. Harris Associates verdict, it is effectively impossible to win a suit against fund companies for overcharging. If investors wish to overpay, the courts have decided, that is their choice. But investors do not select 401(k) lineups—plan sponsors do. If they perform the task negligently, Erisa holds them responsible.

The Attack on Performance

Fair enough. However, the plaintiffs devote most of their energy to performance. By 2014, the document states, “the American Century Target Date Series have been historically an imprudent selection.” (The document’s grammar, not mine.) It then juxtaposes One Choice 2040′s returns with those of three competitors.

You can guess which fund lost that contest. Naturally, I was suspicious. Cherry-picking three investments from a lengthy candidate list for a fund faceoff may suffice for lawyers, but not for researchers. In this instance, though, the argument was entirely correct. The One Choice series has indeed trailed its rivals.

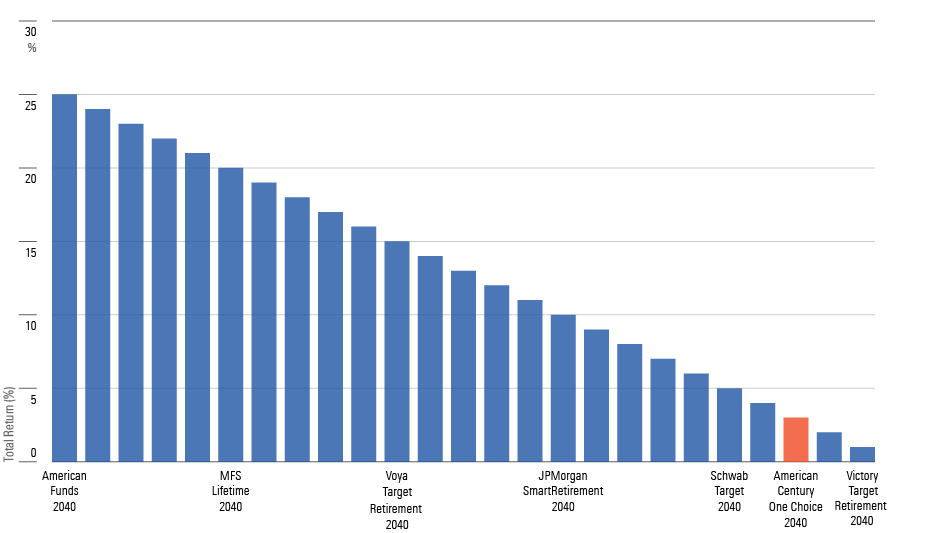

The chart below shows the rankings for the 10-year total returns for the oldest share classes from each of the 25 target-date 2040 funds, both institutional and retail, that have existed during that time. (Technically, there were 27 funds, but as two of them lacked the necessary data for this study, I omitted them.) The fund with the highest bar, American Funds 2040 RFGTX, recorded the best total return. In contrast, American Century One Choice 2040 placed third from the bottom.

Target-Date 2040 Funds: Total Returns

That result was no fluke. One Choice 2040 has trailed almost all its competitors over longer periods. Nor did the plaintiffs select an unrepresentative example. When I ran the same test on One Choice 2035, it fared even worse.

What’s the Equity Allocation?

But here’s the counterpoint: Target-date funds are generic. During their early days, some target-date series took big chances. Most notably, the Oppenheimer Transition 2010 fund, designed for older employees who were approaching retirement, dropped a shocking 41% in 2008, courtesy of its junk bonds. The combination of a Senate investigation and marketplace reaction scotched such idiosyncratic strategies. Now, target-date funds stay on the straight and narrow.

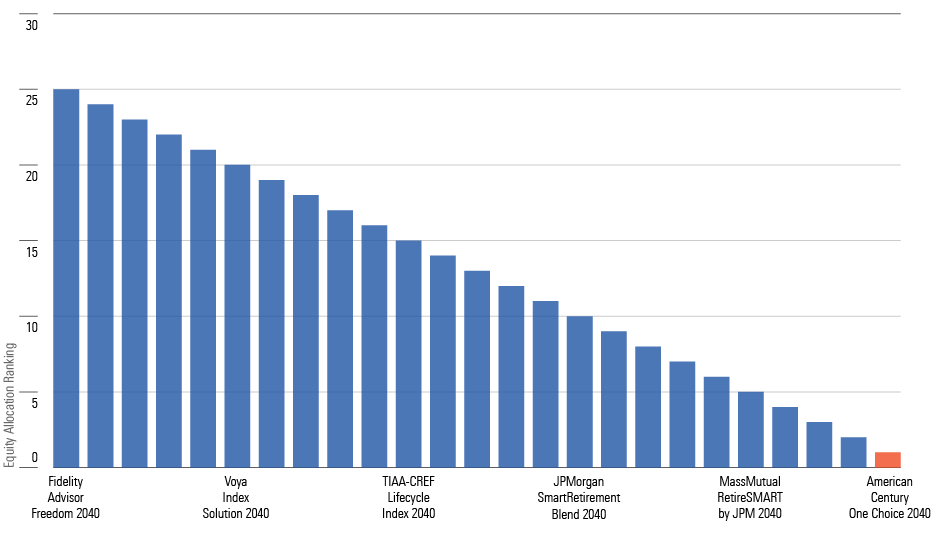

This means that their relative returns are largely determined by their stock market exposures. Because equities have clobbered bonds over the past decade, aggressive target-date funds have outgained their conservative rivals. As a first approximation of the truth, the analysis truly is that simple. And American Century One Choice funds have been very cautious. In fact, over the past 10 years, the company’s 2040 fund has held its category’s lowest equity weighting.

Target-Date 2040 Funds: Equity Allocations

It’s one thing to call a fund “imprudent” (to use the plaintiffs’ term) if it invests speculatively, as with Oppenheimer’s Transition 2010. It’s quite another if the putative imprudence consists of holding a conservatively allocated conventional portfolio. That seems a whole lot more like an investment policy that hasn’t yet found its time than an open and obvious mistake.

To put the matter another way, in the decade from January 1999 through December 2008, long government-bond funds earned 7% annualized while U.S. stocks lost money. Had the One Choice funds existed through that period, would 401(k) participants have filed suit against plan sponsors who selected them, accusing the fiduciaries of negligence? The answer, of course, is “not a chance.” The funds would have been among their category’s top performers.

Considering Risk

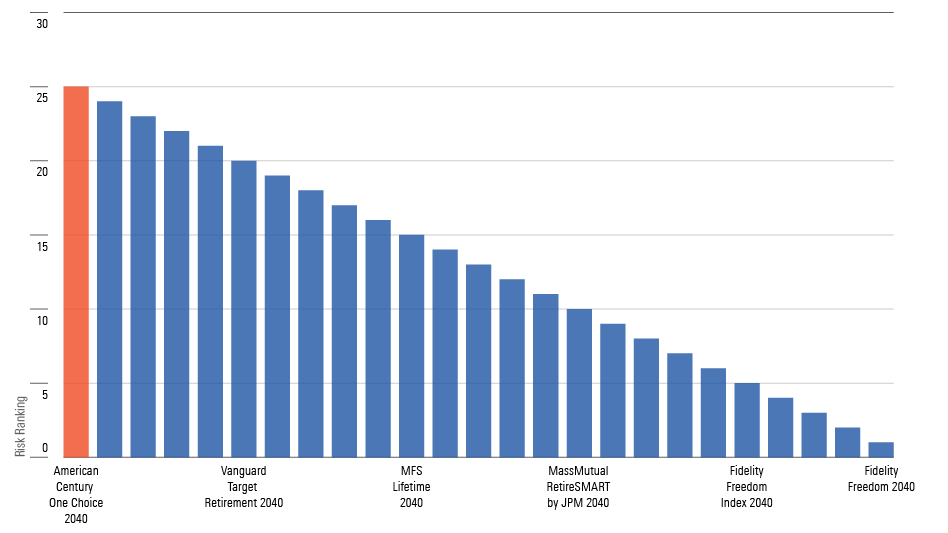

If total returns for target-date funds have been positively correlated with stock market exposure, then risk should be negatively correlated—and it was. Three target-date series from Fidelity recorded the largest equity allocations. They accordingly posted the group’s first-, second-, and fifth-highest standard deviations. Meanwhile, the One Choice fund boasted the lowest risk score.

Target-Date 2040 Funds: Least Risky

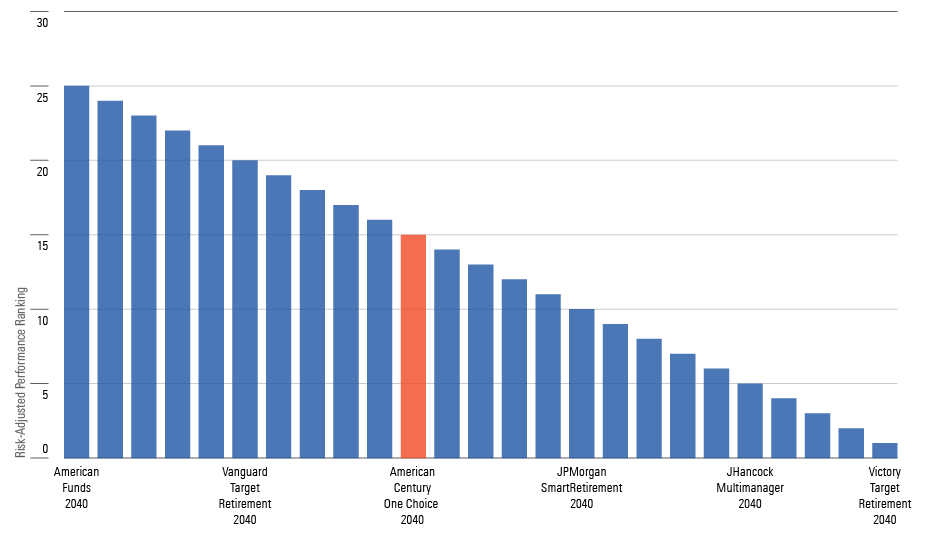

In that context, finishing with the third-lowest returns doesn’t seem so bad! As several statistics combine returns and risk to arrive at a single performance summary, we can combine the two measures into a single statistic. One common technique is the Sharpe ratio. By that yardstick, One Choice 2040 slightly exceeded the norm.

Target-Date Funds: Risk-Adjusted Performance

Conclusion

If a fund with roughly average overall performance as measured by the academically sanctioned approach of risk-adjusted returns can end up on the business end of a lawsuit, what investment cannot? This question, it should be noted, is not limited to actively managed funds. An indexed target-date series that used One Choice’s asset allocation would also have recorded low returns. The primary issue was the equity allotment, not the securities selected.

Surely a sounder policy than playing legal Whac-A-Mole is to let the marketplace adjudicate. Since January 2018, American Century One Choice 2040 has shed one third of its asset base, despite market appreciation. Retirement-plan participants and sponsors have decided that despite the academic view, the fund has not accomplished enough. That remedy is their right. And that remedy is sufficient.

Correction: (Dec. 1, 2023) An earlier version of this article should have said the Supreme Court’s Jones v. Harris Associates verdict was in 2010, not 2009.

Correction: (Dec. 1, 2023) In the first exhibit, Target-Date 2040 Funds: Total Returns, the date range has been updated to November 2013-October 2023.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)