Signal or Noise?

Introducing a new metric for Premium Members for gauging the funds that investors are most interested in.

Today, we're beginning the rollout of a new Morningstar fund metric called "Signal." This data point, which is now available for open-end funds and exchange-traded funds for all Morningstar Premium Members, combines information about a fund's web traffic on Morningstar.com with measurements based on the Morningstar Analyst Rating and, to expand the coverage universe, the Morningstar Quantitative Rating. These forward-looking ratings are used as an indication of an investment's quality.

This offers you a new way to evaluate the level of interest in an investment among your peers, placed in the context of Morningstar's rigorous framework for rating these investments.

The Morningstar Signal Data Point--Simplifying the Information The Signal data point helps you systematically assess funds on two dimensions-- "Attention" and "Appeal."

The Attention of an investment is measured by the relative strength of the traffic (that is, page views) that the fund receives on Morningstar.com for a particular month. Funds that fall in the top third of the universe by page views are labeled High Attention, followed by Medium and Low for the next two thirds of the fund universe.

Appeal summarizes the forward-looking rating for a given fund, based on considered analysis of the management of the fund, fees, and more. Funds that Morningstar analysts rate as Gold, Silver, or Bronze are given a High Appeal, followed by Neutral for Neutral, and Low for Negative-rated funds.

The Morningstar Signal data point is available for over 27,000 open-end funds and ETFs domiciled in the United States. For instance, Vanguard Growth Index Admiral VIGAX had High Attention as well as High Appeal in October 2020; 1,800 other such funds also had that Signal designation.

As another example, consider Principal Global Diversified Income PGDCX, which had High Attention and Low Appeal in October 2020. See below how this data point takes shape visually.

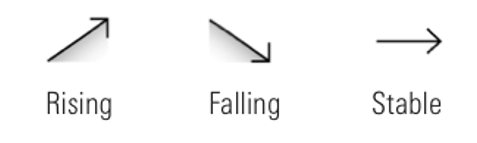

Attention Trend Along with the Signal data point, users will also be able to view the fund's Attention Trend. Funds that have received increased web traffic over the past month will show a Rising trend. Those whose traffic has fallen will be shown to be Falling. For others where no material change in web traffic is observed, a Stable trend is assigned.

To avoid noisy data, changes in trend must be greater than 125% of the previous level to show Rising and less than 75% to show Falling. We do not assign a trend to funds with no page view data in the preceding or current month.

For the month of October 2020, we saw around 11,000 funds with a Stable trend, followed by approximately 7,700 and 5,600 funds with Rising and Falling trends, respectively. Other funds had no trends for this month.

One interesting example of a fund with a Rising trend is American Beacon Large Cap Value ALVAX. It had Low Attention in September 2020, but its popularity increased substantially in October 2020, leading to an assignment of a High Attention value.

- source: Morningstar Analysts

Using the Signal Data Point: A Chance to Find Underappreciated Opportunities Investors and advisors can use the Signal data point to evaluate how much interest an investment fund is receiving from other users and how it fares against the Appeal (that is, quality) of the funds. Funds that have High Attention and Low Appeal may be considered crowded or potentially overhyped investments, while those with Low Attention and High Appeal can be thought of as "underappreciated" opportunities. Combining the information on Attention from other investors with Appeal of a fund can offer investors, or those who are helping them make decisions, a new perspective on possible investments.

Why We've Developed Signal: Applying a Behavioral Lens Signal provides a new data point that investors can incorporate into their process for evaluating investment options. Beyond its informational value, there is a deeper reason why we've developed Signal. We hope to address a very specific problem behavioral science has identified in investing: the mind's limited attentional resources in the face of overwhelming choice.

Whether it's crossing the street or engaging in conversation, attention helps us focus on and perform our day-to-day tasks. However, in the field of investing, how our attention works can cause problems. With so many investment options available to us, considering all the options can be both emotionally and cognitively draining. As a result, researchers have found that we are more likely to focus on and buy investments that are prominently covered in the news or that "glitter" with attributes such as exciting past returns. But not all that glitters is gold. Such investments don't always correspond to high quality. However popular a fund may be with the media and other investors, if investors choose funds based on their popularity and disregard quality, they may not reach their goals.

The challenge is that it can be quite difficult to avoid social conformity--because it often doesn’t just affect us consciously but also subtly through what we pay attention to and our intuition about an investment. We may hear about popular investments in the news or from friends more frequently than we hear of underappreciated ones.

The Morningstar Signal data point seeks to counter the existing pressures for social conformity. Signal seeks to contextualize and relabel that information by pairing it with additional information about the underlying quality of the investments.

In particular, it helps investors gain a different perspective on investments by distinguishing between the following pairings:

- High Attention, High Appeal funds, which may be useful options for investors who don't have much time or information.

- High Attention, Low Appeal funds, which are likely to be overhyped and potentially risky for investors.

- Low Attention, Low Appeal funds, which are likely safe to ignore,

- Low Attention, High Appeal funds, which are potential diamonds in the rough.

While this data point is meant to provide investors with meaningful comparisons while investing, bear in mind that the Morningstar Signal data point should not be used in isolation. Instead, use the new Morningstar Signal data point along with our fund Analyst Reports, ratings, and a knowledge of your own financial goals, investment objectives, experience, and financial position to help you understand your investing process in a broader context.

For more about how social signals can drive investor behavior, read our paper, "The Power of Signal."

The opinions expressed herein are given in good faith, are as of the date written, and are subject to change without notice. Investments in securities are subject to risk and may lose value. Morningstar's Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. Morningstar Analyst Ratings are based on Morningstar's Manager Research Group's current expectations about future events and therefore involve unknown risks and uncertainties that may cause such expectations not to occur or to differ significantly from what was expected. To expand the number of funds that Morningstar covers, Morningstar developed the Morningstar Quantitative Rating in 2017, which uses a machine-learning model to emulate the decision-making processes of Morningstar’s Manager Research Group’s past ratings decisions, and the data used to support those decisions. The machine-learning model is applied to the "uncovered" fund universe and creates the Morningstar Quantitative Rating, which is analogous to the rating an analyst might assign to the fund if an analyst covered the fund. Morningstar Analyst Ratings and Morningstar Quantitative Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Morningstar Analyst Ratings and Morningstar Quantitative Ratings are not guarantees nor should they be viewed as an assessment of an investment product’s underlying securities' creditworthiness. This commentary is for informational purposes only; references to specific investment products or strategies should not be considered an offer or solicitation to buy or sell the investment product or to invest in accordance with that strategy.

Learn more about the coverage and methodology of our Morningstar Signal data point here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)