A Rating Upgrade as Legg Mason Mends

We've raised Legg's Parent rating to Positive from Neutral following improvements to its affiliate portfolio, but challenges do remain.

Legg Mason operates a multiaffiliate model, in which the parent company handles distribution and marketing while affiliates--all owned by Legg Mason--operate with a fair amount of autonomy on the investment side. The firm has been on the mend since its poor showing during the financial crisis of 2007-09, making several changes to its leadership team and its affiliate portfolio.

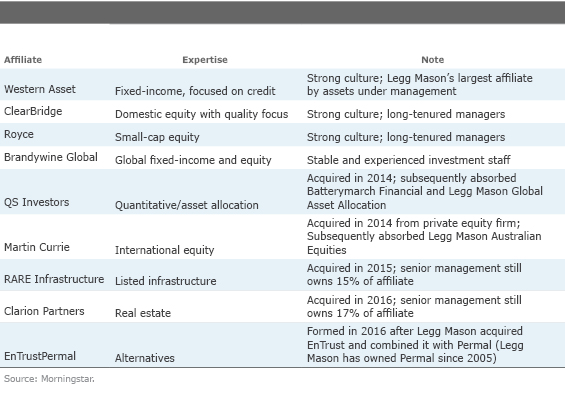

There are now nine affiliates, down from more than a dozen a few years ago, including Western Asset, a major fixed-income player traditionally focused on credit, and ClearBridge Investments, a quality-driven fundamental equity shop. Other prominent affiliates include Royce & Associates, a specialty small-cap equity player, and Brandywine Global, a global fixed-income and equity firm. Western Asset, ClearBridge, Royce, and Brandywine Global account for more than 85% of Legg Mason’s assets under management, and all have strong investment cultures and stick to their areas of expertise.

To reflect the strength of its underlying affiliates’ investment cultures--and its progress addressing risks in recent years--Legg Mason’s Parent rating was recently upgraded to Positive from Neutral. Below is an overview of the affiliates, changes that have taken place in recent years, and challenges that remain.

Tough Times Spurred Improvements to Legg's Affiliate Portfolio Legg Mason fell on hard times during the financial crisis of 2007-09, as several of its prominent funds performed poorly, leading to steep outflows and personnel turnover.

In the wake of these problems, and partly because of pressure from activist investor Nelson Peltz, CEO Mark Fetting left in the fall of 2012. Joe Sullivan then became interim CEO before taking over as permanent CEO in early 2013. Sullivan has since helped make the firm more focused by merging some affiliates and buying new ones to fill holes in the lineup.

Just a few years ago, there were more than a dozen affiliates, some of which filled similar roles in investor portfolios, leading them to compete for Legg’s distribution attention. Today’s affiliate portfolio numbers nine, each with its own investment culture and area of expertise. Overall, Legg’s collection of affiliates seems more complementary, with representation from various asset classes and no real redundancy.

As had been the case, Legg continues to afford its affiliates complete investment autonomy, and it is encouraging to see its largest affiliates sustain their strong investment cultures. But Sullivan has also made a change in its treatment of affiliates. Historically, Legg Mason has owned its affiliates outright, but equity has increasingly been offered to affiliates’ senior management. For example, employees of RARE Infrastructure and Clarion Partners continue to own 15% and 17% of their respective affiliates after being purchased by Legg Mason.

Furthermore, Legg Mason has restructured agreements with its older affiliates such as Royce and ClearBridge. Royce senior management members now own 16.9% of the affiliate, which can increase up to 24.9% by 2018. ClearBridge senior management members are now eligible to participate in a program that rewards them based on ClearBridge’s enterprise value growth over time. All told, these equity--or equitylike--structures can help improve employee retention and align long-term incentives.

Legg Mason and its affiliates have also addressed vulnerabilities that hurt them in the past. Western Asset has traditionally had a somewhat higher risk tolerance than many other big fixed-income shops and isn't afraid to make bets that run against consensus. The firm's emphasis on credit investments has helped its funds in good times but hurt badly in the 2007-09 financial crisis, when poor performance--especially in

Meanwhile, although four of Legg’s nine affiliates comprise more than 85% of assets, the firm has moved away from an emphasis on star managers in favor of team-based environments. Legg Mason Capital Management was once the centerpiece of Legg’s fund lineup in the heyday of Bill Miller. But LMCM fell on hard times, and its asset base plunged between 2006 and 2008 amid terrible performance and shareholder redemptions. LMCM was ultimately merged into ClearBridge in 2013. There was originally some trepidation about the merger and rebranding, but the former LMCM employees in Baltimore have collaborated with the ClearBridge team in New York. (Miller did not join ClearBridge at that time; instead, he operated under LMM LLC, a subsidiary jointly owned by Miller and Legg Mason. Miller purchased Legg Mason’s stake in LMM in February 2017, formally ending their relationship after more than 35 years.)

Legg Mason's fund lineup has always included some fine funds. Seven of the firm's funds have Morningstar Analyst Ratings of Silver, including

Potential Challenges Temper Enthusiasm, However Whereas Sullivan's work on Legg's affiliate lineup has produced a more balanced collection, some combinations could still be considered works-in-progress. In addition to the LMCM merger into ClearBridge in 2013, Legg Mason Australian Equities was merged into Martin Currie in 2014, Batterymarch Financial Management and Legg Mason Global Asset Allocation were merged into QS investors in 2014, and EnTrust and Permal were combined to form EnTrustPermal in 2016. Sullivan says the ultimate decisions to merge investment shops have been the affiliates', and they do corroborate that assertion; however, performance and asset woes could lead the parent to make changes even in the face of opposition.

With any acquisition or merger, integration and culture clash risks can percolate. Martin Currie’s integration into Legg Mason has been more difficult than expected, for example. Martin Currie has consolidated its investment lineup since becoming a part of Legg Mason, leading to some portfolio manager departures. And it is too soon to tell whether the EnTrust and Permal combination will be a success.

Meanwhile, Royce, which Legg purchased in 2001, has been plagued by asset outflows amid poor performance in the postrecession low interest-rate environment (asset outflows have slowed significantly as performance improved in 2016). Royce has also consolidated its fund lineup, closing 10 funds since 2014 in an effort to reduce product overlap. Its investment culture remains strong and packed with industry veterans such as Chuck Royce and Charlie Dreifus, but further tough times could trigger changes that suggest less autonomy at the affiliate level.

Legg has the power to effect change, and its decision to act or not act puts the firm in a delicate spot, as either not enough or too much meddling can have a derogatory impact on investment cultures. Over the past several years, Legg Mason seems to have performed that balancing act well. That, combined with the cultural strength of many of its affiliates, supports its Positive Parent rating.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)