Emerging Trends in U.S. Fund Flows Accelerate in March

U.S. value equity funds see record inflows in March.

Editor’s note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for March 2021. Download the full report here.

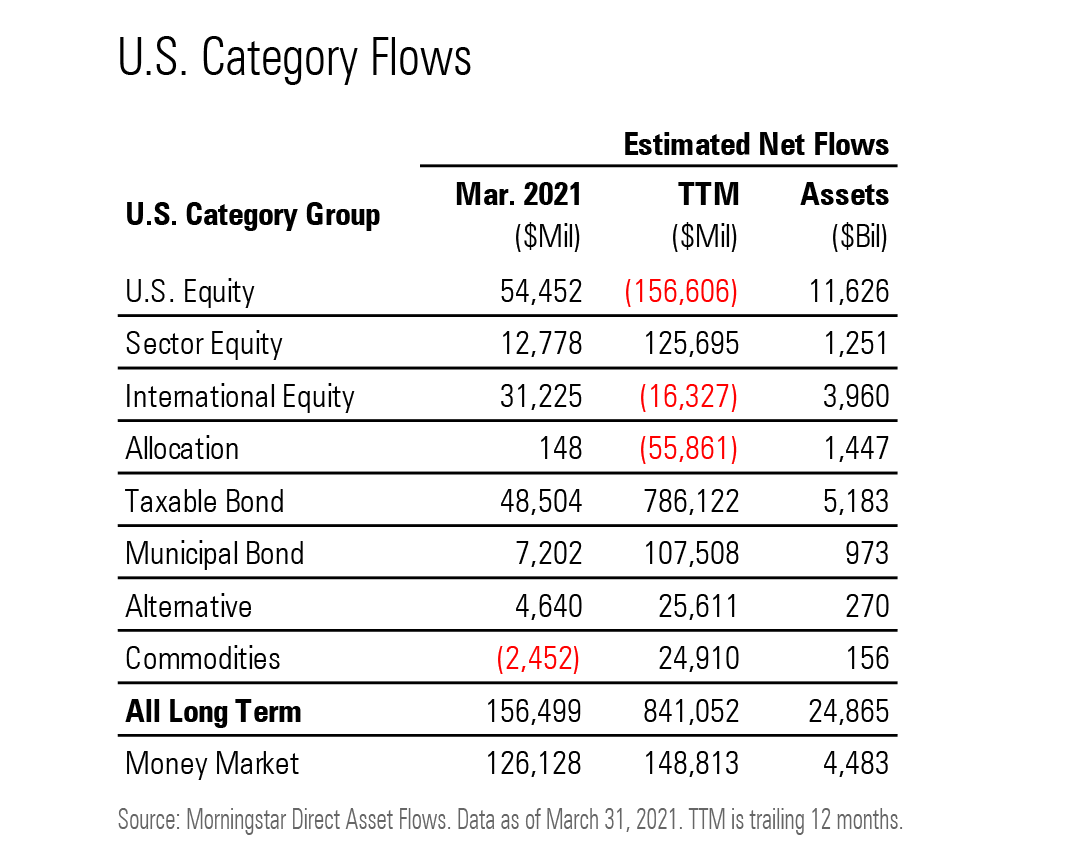

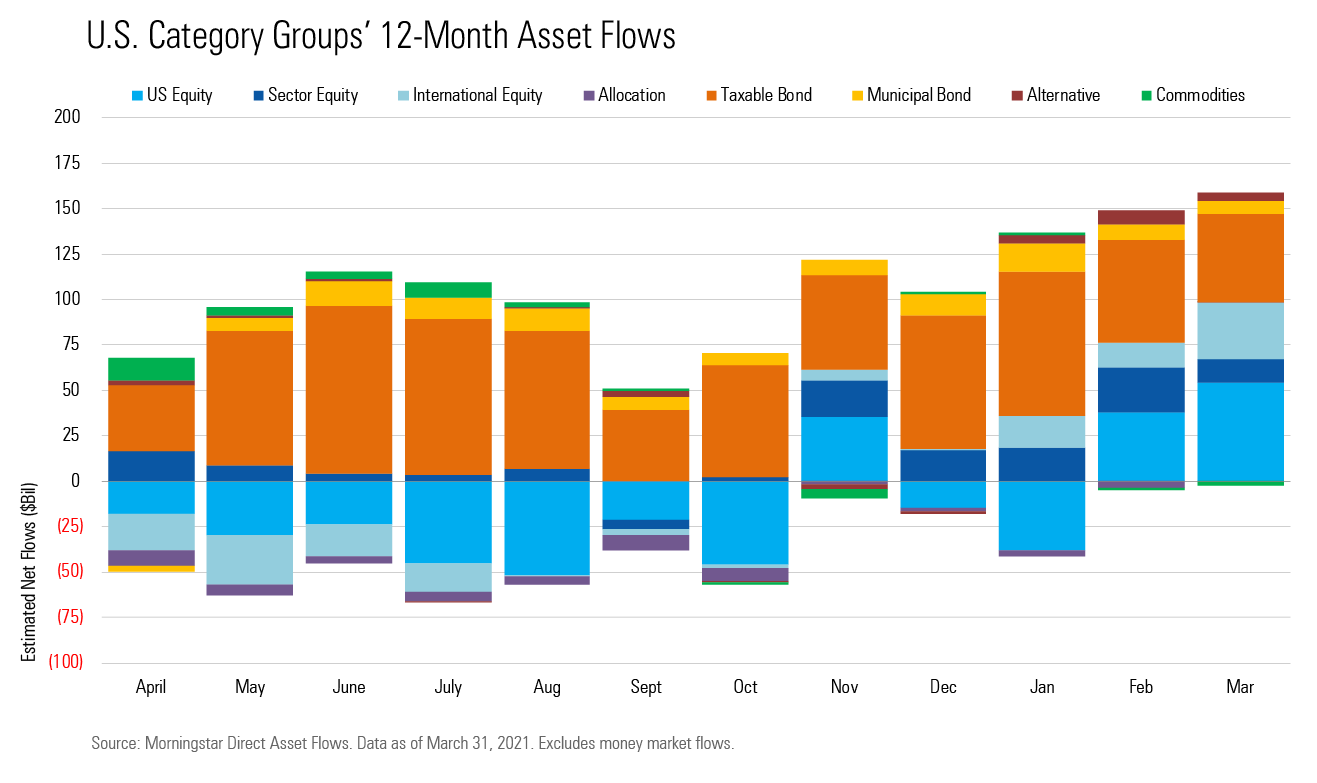

Surging equity markets attracted a wave of capital from an already bullish investor base. Long-term mutual funds and exchange-traded funds took in $156 billion during March, surpassing the $144 billion record established in February 2021. Exchange-traded funds, most of which are passively managed, raked in a record $98 billion. Open-end mutual funds pulled in roughly $59 billion. For the quarter ended March 31, long-term flows totaled $400 billion, far ahead of the next highest sum of $243 billion in the first quarter of 2013.

As a category group, U.S. equity funds gathered the most assets in March. They took in $54 billion, dwarfing the previous monthly record of $38 billion set in February 2021. Their month-over-month organic growth rate of 0.49% was the highest since October 2013's 0.53%. Resurgence in investor appetite for cheap stocks drove the inflows.

Taxable-bond funds gathered over $48 billion in March and a whopping $786 billion over the past 12 months, the most by far among U.S. category groups. Intermediate core bond funds once again led the group with roughly $12 billion of inflows, followed by short-term bond funds with $10 billion, and intermediate core-plus bond funds with $6 billion.

International equity funds took in $31 billion in March, the most since January 2018. Emerging-markets funds collected their highest monthly total ever with over $14 billion in inflows, bringing their trailing 12-month total to $25 billion, easily the highest within the category group.

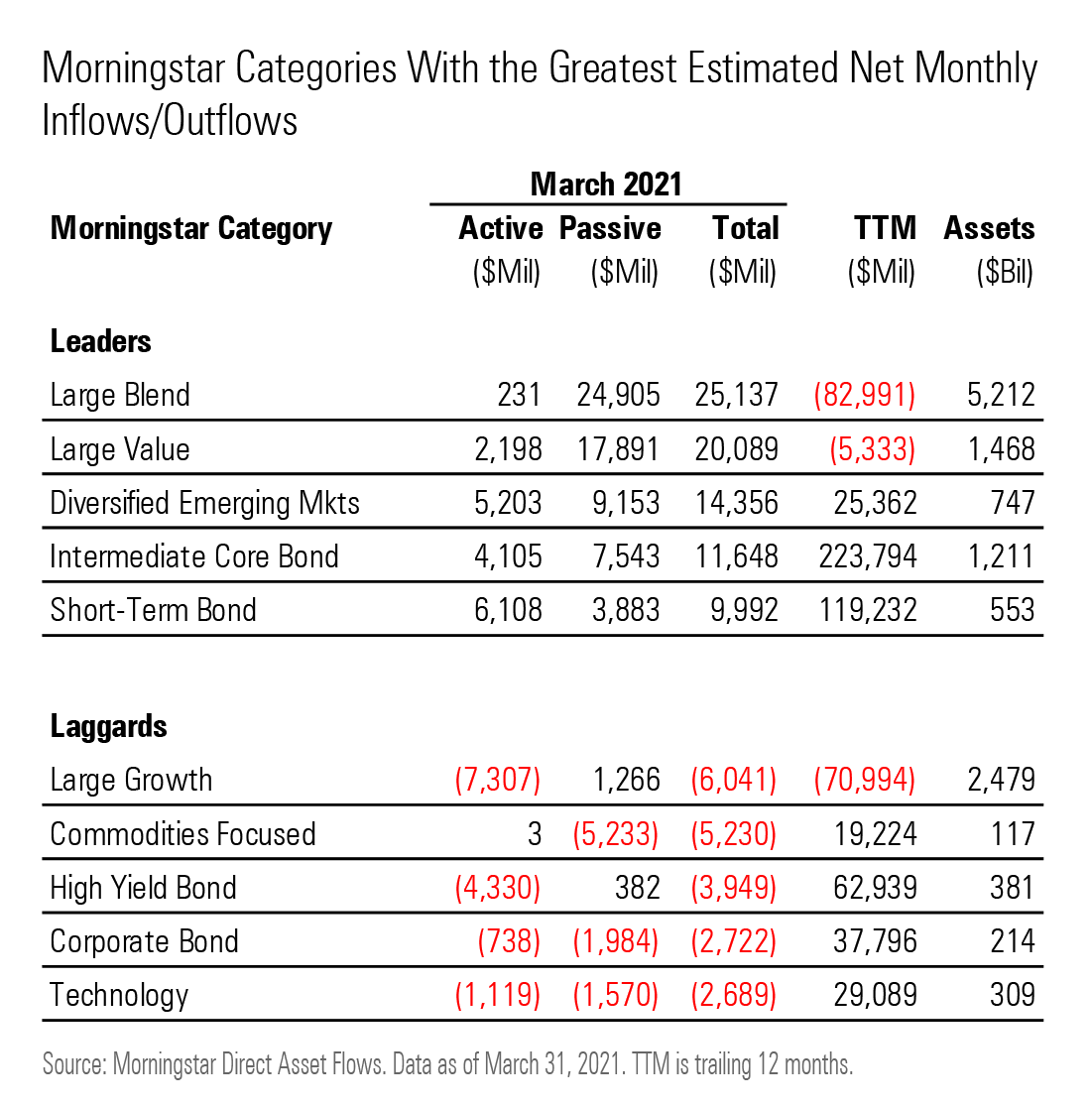

Among Morningstar Categories, equity groups took home the top three spots. Large-blend funds took home the most assets, with $25 billion of inflows, followed by large-value and diversified emerging markets. Investors poured into value-oriented and cyclical funds at some of the sharpest rates in history. Large-value strategies collected a whopping $20 billion, by far the largest sum ever. Their 1.47% organic growth rate in March was the highest since the 1.68% mark set in January 2004. Small-value strategies achieved a similar feat, picking up $5.4 billion, more than double January 2017's previous record of $2.2 billion. The 2.77% organic growth rate was the highest since April 2002, a period when investors were reeling from the dot-com bubble crash.

Despite investors' push into value-equity strategies, the influx of cash hasn't exactly been a windfall for active managers. Actively managed large-value funds took in just $2.2 billion of the category's $20 billion in total inflows in March, breaking their streak of 78 consecutive months of outflows totaling $318 billion. The market's preference for passive strategies was even more pronounced across other U.S. equity categories. In total, active U.S. equity funds managed to shed $2.3 billion in March, while passive funds gathered nearly $57 billion.

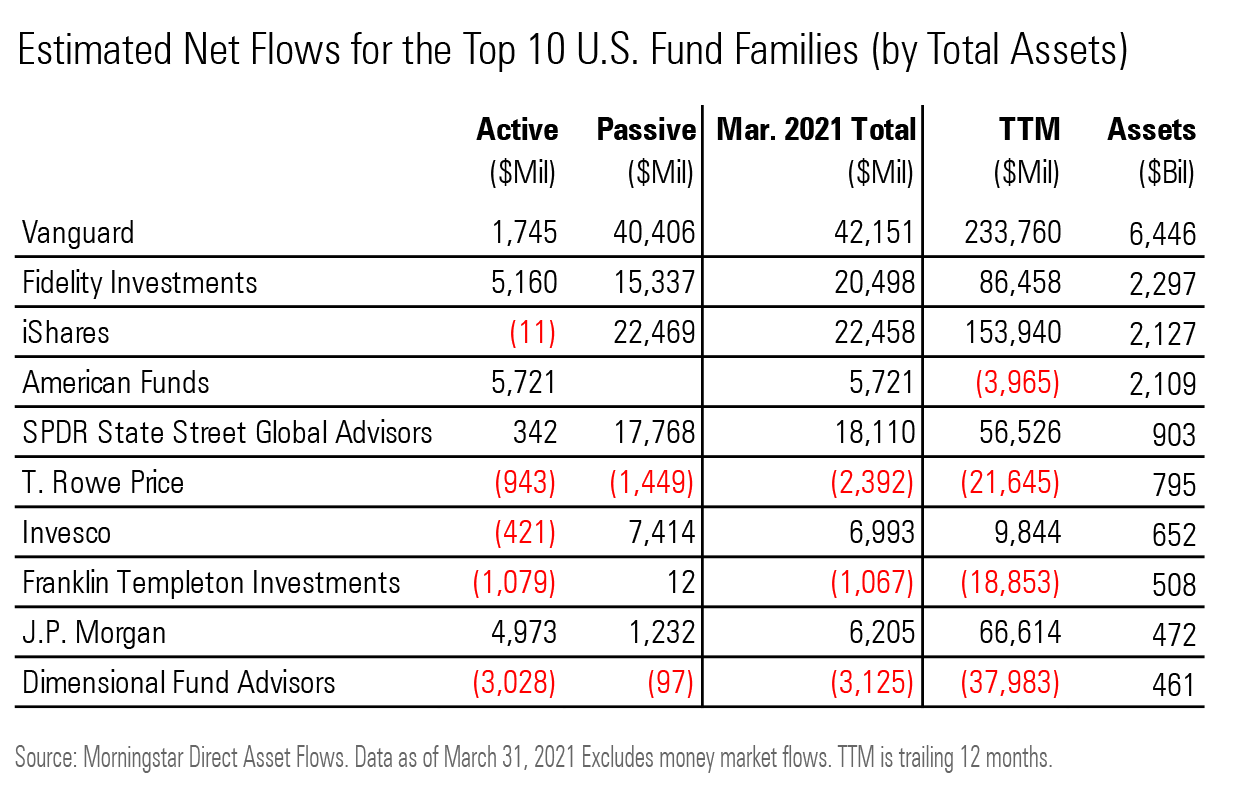

As flows into passively managed equity strategies continued, index-fund behemoths Vanguard and iShares once again raked in the most assets. Vanguard collected roughly $42 billion assets in March, over 95% of which went to passive strategies, while iShares gathered $22 billion.

Fidelity had a record intake of more than $20 billion for the month, the majority of which came through passively managed equity strategies, topping its previous record from February 2021 of more than $19 billion. Fidelity 500 Index FXAIX gathered more than $3 billion in March after it shed roughly $290 million in February.

After ARK ETF Trust’s ARKK staggering $8 billion intake in February, the firm stepped out of the limelight in March, collecting a comparatively modest $880 million for the month. Global X Funds, a firm whose investment lineup consists primarily of passively managed ETFs, has grown notably over the last year; the firm collected $1.6 billion in March, with flows into Global X U.S. Infrastructure Development ETF PAVE comprising nearly half of the intake.

Note: The figures in this report were compiled on April 13, 2021, and reflect only the funds that had reported net assets by that date. Artisan had not reported. Morningstar Direct clients can download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)