3 Attractive Equity-Income Funds

These mutual funds and ETFs can appeal to investors hungry for dividend yields.

The income landscape has shifted as quickly as it ever has for American investors over the past two years. In the first quarter of last year, the Federal Reserve was holding short-term interest rates near zero in the wake of the coronavirus pandemic. Then, beginning in March 2022, it began raising rates to combat alarmingly high inflation. The Fed hiked the overnight lending rate to 5.25% to 5.50% over the course of 11 increases to date. In less than a year and a half, short-term rates moved from nearly all-time lows to the highest they’ve been in more than two decades.

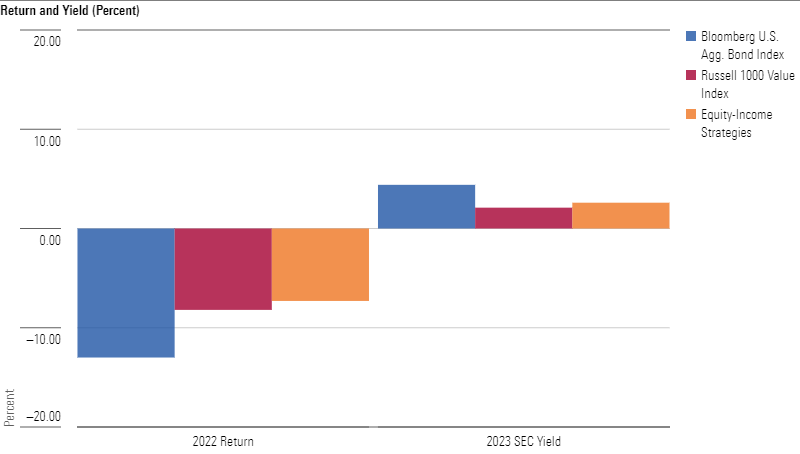

Going forward, the most obvious implication is that short-term bonds and cash have once again become viable sources of income. Looking back, on the other hand, investors can see that having multiple sources of income can have significant benefits. Bond portfolios were crushed as interest rates rose: In 2022, the Bloomberg U.S. Aggregate Bond Index lost 13.0%. Meanwhile, the large-value Russell 1000 Value Index, a territory where many dividend-payers dwell, dropped a comparatively low 8.2%.

Moreover, there are a large number of U.S. funds and exchange-traded funds specifically targeting yield, and they defended capital better than standard large value portfolios in 2022. In the Morningstar database, there are 222 distinct funds and ETFs whose prospectus objective is equity-income or whose names refer to equity income or high dividends. On average, these funds dropped 7.3% in 2022, with 24 of them having positive returns last year and 61 more posting losses of less than 5%.

To be sure, income investors shouldn’t switch from a bond income to a dividend income strategy wholesale, especially now. The SEC yield on Bloomberg U.S. Aggregate Bond Index funds is now 4.4%, compared with 2.1% on a typical dividend-oriented large-value portfolio. But for long-term income investors, having an equity-income fund can prove handy in a year like 2022—or 2020 when many large-value portfolios had higher yields than core bond funds for most of the year.

Return and Yield (Percent)

3 Attractive Equity-Income Funds

Here are three different equity strategies that might suit yield-hungry investors with different preferences.

The passive Vanguard High Dividend Yield Index Fund ETF VYM has a Morningstar Medalist Rating of Gold and systematically achieved a top-quartile yield among equity-income strategies. It tracks the FTSE High Dividend Yield Index, which holds the highest-yielding half of the large- and mid-cap dividend-paying domestic universe. It does not screen out value traps, but there are more than 400 holdings, decreasing stock-specific risk. In 2022, it lost a mere 0.4%, and its SEC yield was 3.2% as of September 2023.

Another option is nearly the polar opposite: Actively managed, Silver-rated Fidelity Equity-Income FEQIX debuted in 1966. It still follows a fairly traditional approach. Specifically, its income target is to have a greater dividend yield than the S&P 500. To get there, portfolio manager Ramona Persaud collects about 120 companies that she sees as inexpensive and strategically well-positioned with enough free cash flow generation to support or increase dividend payments. The strategy tends to be relatively buoyant in bear markets; for instance, it slid just 5.1% in 2002. In September 2023, its SEC yield was 1.8%

Silver-rated Neuberger Berman Equity Income NBHIX offers a distinct approach. Four portfolio managers add a dose of covered calls and puts to a collection of dividend-paying equities that typically leans heavily on utilities and REITs. The recipe doesn’t yield especially lofty income or high returns. But it’s one of only eight strategies of the 222 in the equity-income group discussed here to yield at least 2% in each of the last 10 calendar years without falling more than 6% in any of those years. For instance, in 2022, it retreated just 4.5%, and its income that year was 2.5%. Its SEC yield was 2.2% in September 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/984ff87e-463c-4fca-8c15-ebbf7f9593b2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/984ff87e-463c-4fca-8c15-ebbf7f9593b2.jpg)