Outsourcing: A Competitive Edge for Financial Advisors?

Financial advisors can potentially gain a competitive edge by prioritizing core functions and outsourcing investment management.

A list of top-performing stocks over the past 20 years would be filled with familiar faces: Amazon.com AMZN, Microsoft MSFT, Domino’s Pizza DPZ, and other well-established brands.

But there would be a few companies on the list you might not recognize.

For example, Tractor Supply TSCO. Despite minimal brand recognition, the company has achieved remarkable success, so much so that it became the subject of a Harvard Business School case study in recent years.

Tractor Supply is a retailer that sells products that supply the lifestyle needs of farmers and ranchers. Their primary customers include homeowners, landowners, and pet owners.

Think about the past 20 years in retail. The trends can mostly be summarized as follows: Amazon is winning, and everyone else is losing.

While that statement is made in jest, the finer point is that retail stores have been running into the wind. More than 200,000 retail stores were closed in 2019 versus the year prior, according to data from the U.S. Census Bureau.

A second problem—in theory—for a company like Tractor Supply would be competition from Home Depot HD, Lowe’s LOW, and other prominent retailers that cater to similar customers. These competitors are better funded with bigger stores and more assortment, among other factors.

Despite it all, Tractor Supply has taken its annual sales from $330 million in 2000 to nearly $15 billion in 2023, with consistent annual growth throughout the period.

How did Tractor Supply do it? Relentless focus and prioritization.

By focusing its product assortment on core customers, the company has tried to be one thing for one set of customers rather than everything for everybody.

In the process, Tractor Supply has differentiated itself from general merchandise, home center, and other specialty retailers.

Tractor Supply is an interesting case study for any industry, but it’s especially applicable to financial advisors where differentiating yourself from the competition is equally important.

Key Focus Areas for RIAs

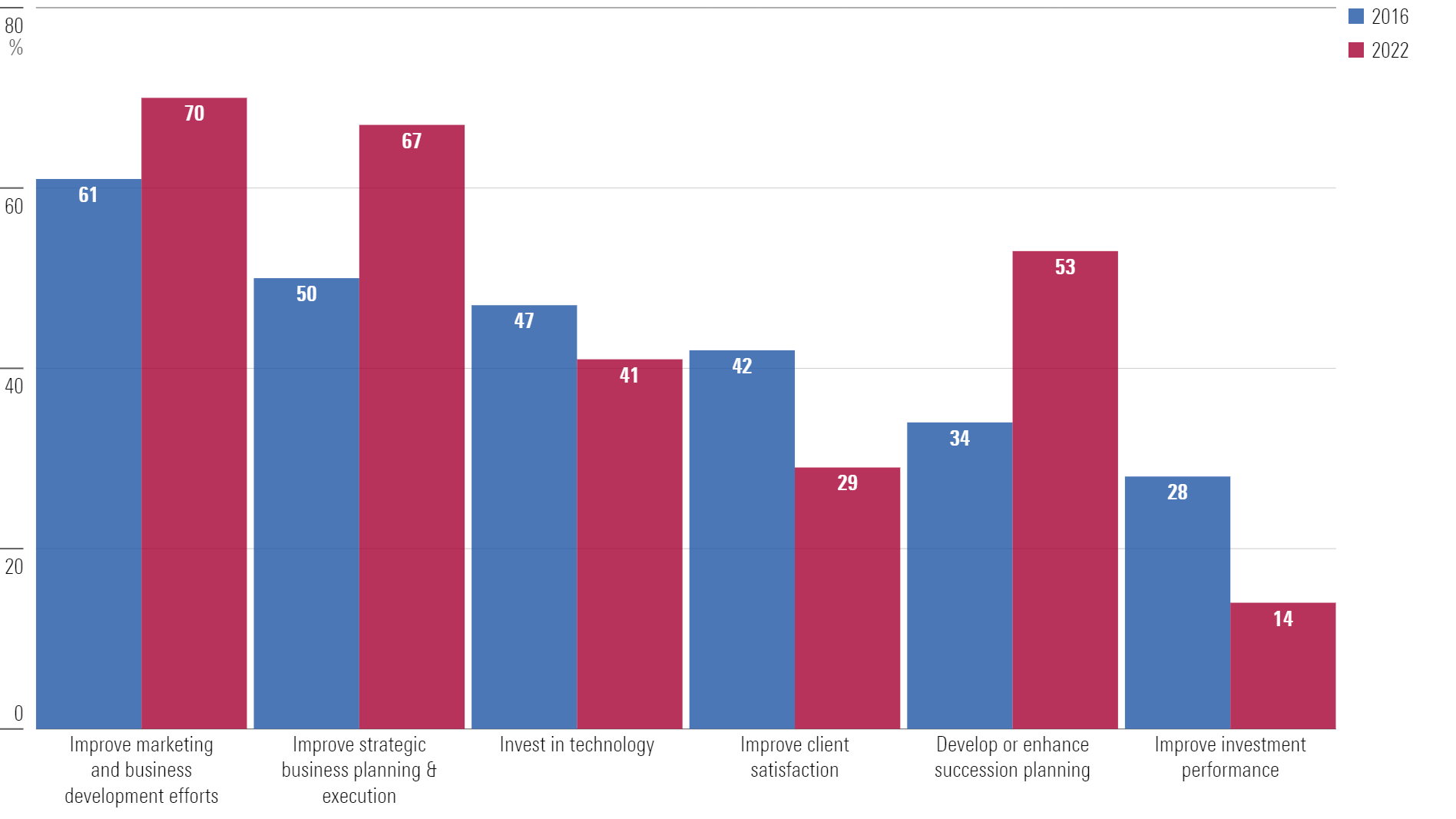

There’s an annual research study from Fidelity that depicts how registered investment advisors prioritize business objectives. Last year’s study gathered insights from over 250 RIAs nationwide, representing a range of asset levels.

The six largest common priority areas where RIAs are seeking to improve—in order—are:

- Marketing and business development.

- Strategic business planning and execution.

- Investing in technology.

- Client satisfaction.

- Succession planning.

- Investment performance.

Strategy and Growth: Top Strategic Focus Areas for RIAs

It’s a delicate balancing act. Dedicating the time required to be effective in each is difficult, if not impossible. At some point, there’s not enough time in the day.

Fidelity’s study also shows how these priorities have shifted since 2016. Across RIAs large and small, the initiatives capturing the most attention are business development and strategic planning.

Meanwhile, the investment function has been declining. The focus on investments and performance has been deprioritized.

Why? It’s not because investment performance doesn’t matter. If your investment performance is bad, clients will likely seek advice elsewhere. Rather, it’s potentially because outsourcing the investment function has proved to be effective.

The lesson from Tractor Supply might apply: prioritization.

Outsourcing = Time Freedom

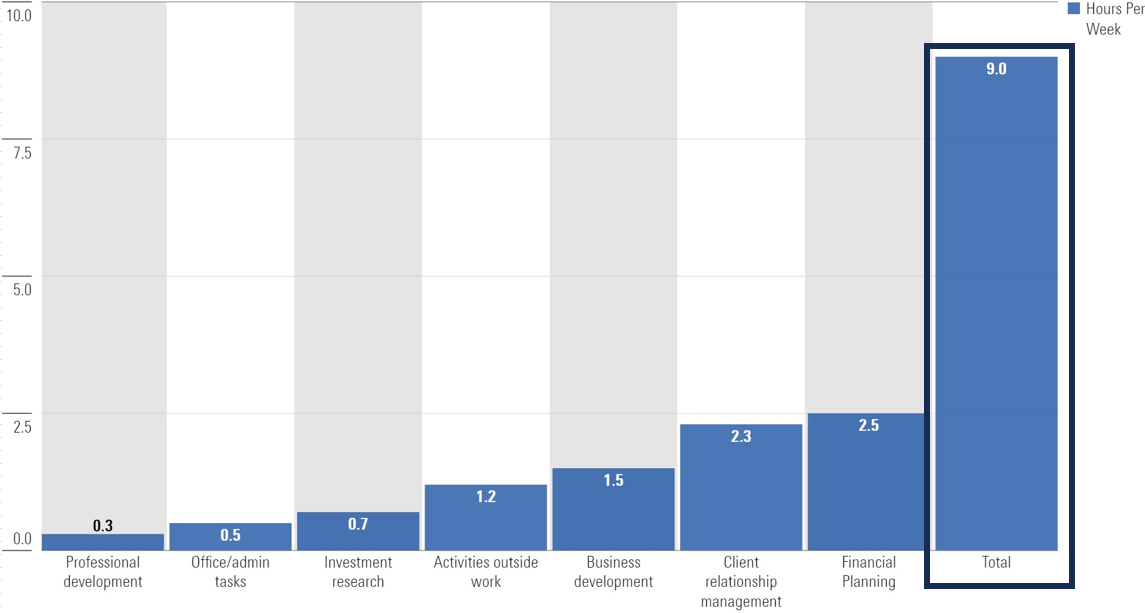

Outsourcing can be great for unlocking financial advisors’ time. Fidelity’s study shows that advisors who outsource investments create about nine hours per week of extra time.

Allocation of Time Saved by RIAs (Hours Per Week)

Effectively, outsourcing the investment function to a third party has the potential to free up about an entire workweek every month.

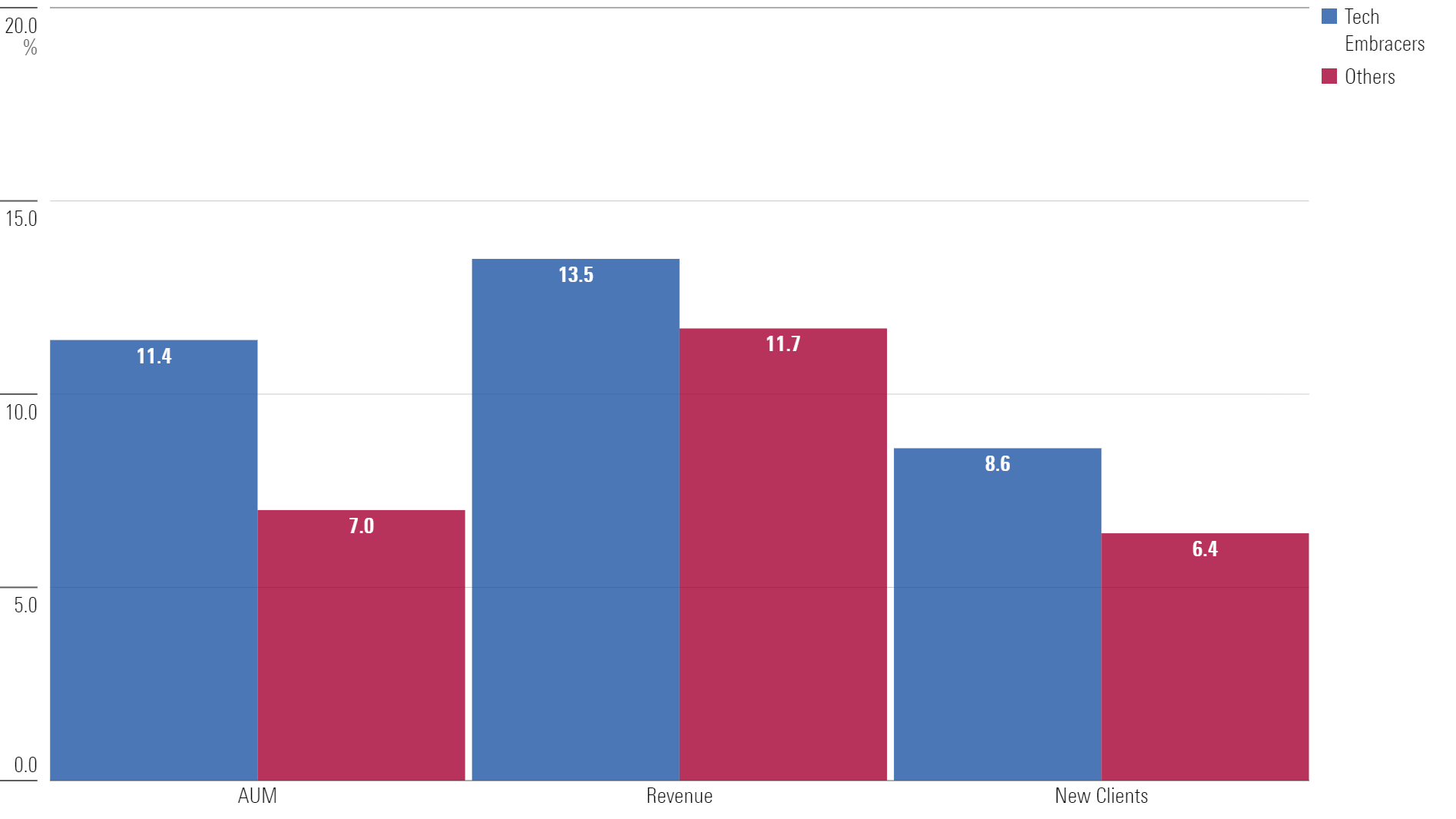

And it seems to be delivering results.

Fidelity’s study shows that freeing up time to focus on your highest priorities creates strong business outcomes. Advisors who are outsourcing are seeing more asset growth, higher revenue, and signing up more new clients.

Growth Rates for Tech Embracers vs. Others

Of course, it’s also true that some RIAs create excellent in-house investment functions; dedicating the time and developing the personnel to serve as selling points for clients.

But the adage, “If you’ve met one RIA, you’ve met one RIA” comes to mind. Which is to say, no two advisory firms operate identically.

For instance, certain RIAs may adopt a hybrid strategy, managing certain investment functions internally, like small-cap equity selection, while outsourcing others.

The point is that flexibility reigns supreme—it’s not necessarily an all-or-nothing scenario.

Embracing Outsourcing to Enable Prioritization

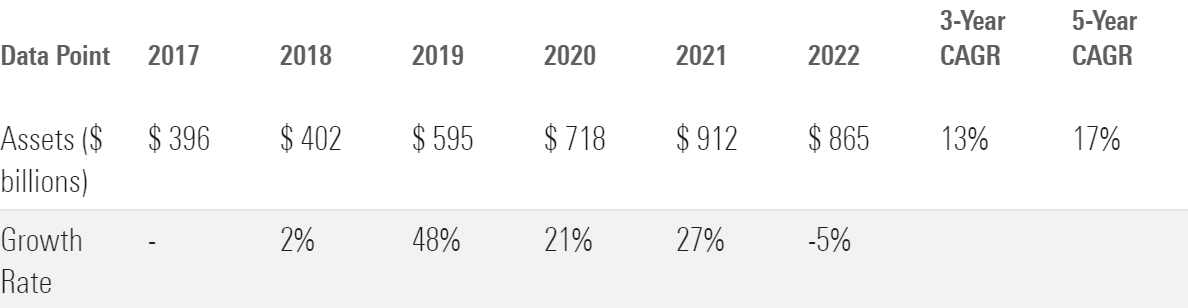

But the point remains, a substantial number of RIAs are benefiting from outsourcing. According to Cerulli, advisory turnkey asset-management programs, or TAMPs, more than doubled in assets over the past six years, growing from $396 billion in 2017 to $865 billion through year-end 2022.

Advisory TAMP Historical Growth, 2017-22

Like Tractor Supply, many advisors might benefit from the ability to focus on a few priorities, rather than many.

Whether advisors choose to outsource or utilize in-house investment functions depends on a variety of factors, including unique business goals, client preferences, and resources. Outsourcing won’t be the right decision for every advisor, but evidence suggests that it has the potential to deliver meaningful benefits.

By tailoring services to meet the specific needs of clients and freeing up more time to be available to clients, advisors can differentiate themselves in a crowded market.

In effect, outsourcing can represent a competitive edge.

Ready to Elevate Your Practice? The Morningstar Wealth Platform can help you simplify your processes, improve client outcomes, and support your clients’ financial goals through every life stage. Gain access to curated investment strategies, a wealth of market insights, and advanced technology to help expand your business. Learn more.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)