How Value ETFs Still Benefit From Meme-Stock Mania

Analyzing the performance of meme-stock winners over the past three years.

After bursting onto the scene as the number-one roulette game in the markets, social-media-fueled meme stocks took center stage in early 2021. The returns were undoubtedly impressive. GameStop’s GME share price jumped 1,600% in January 2021. No one saw it coming, but the fear of missing out spurred investors to throw more money into the raging fire. Hedge funds that shorted GameStop suffered losses, while exchange-traded funds that held GameStop at the start of the market frenzy enjoyed the upswing. Today, the trailing three-year performance of these ETFs—a performance metric that many investors examine—still accounts for the meme-stock boom. But did these ETFs continue to outperform, and can they strike gold once again?

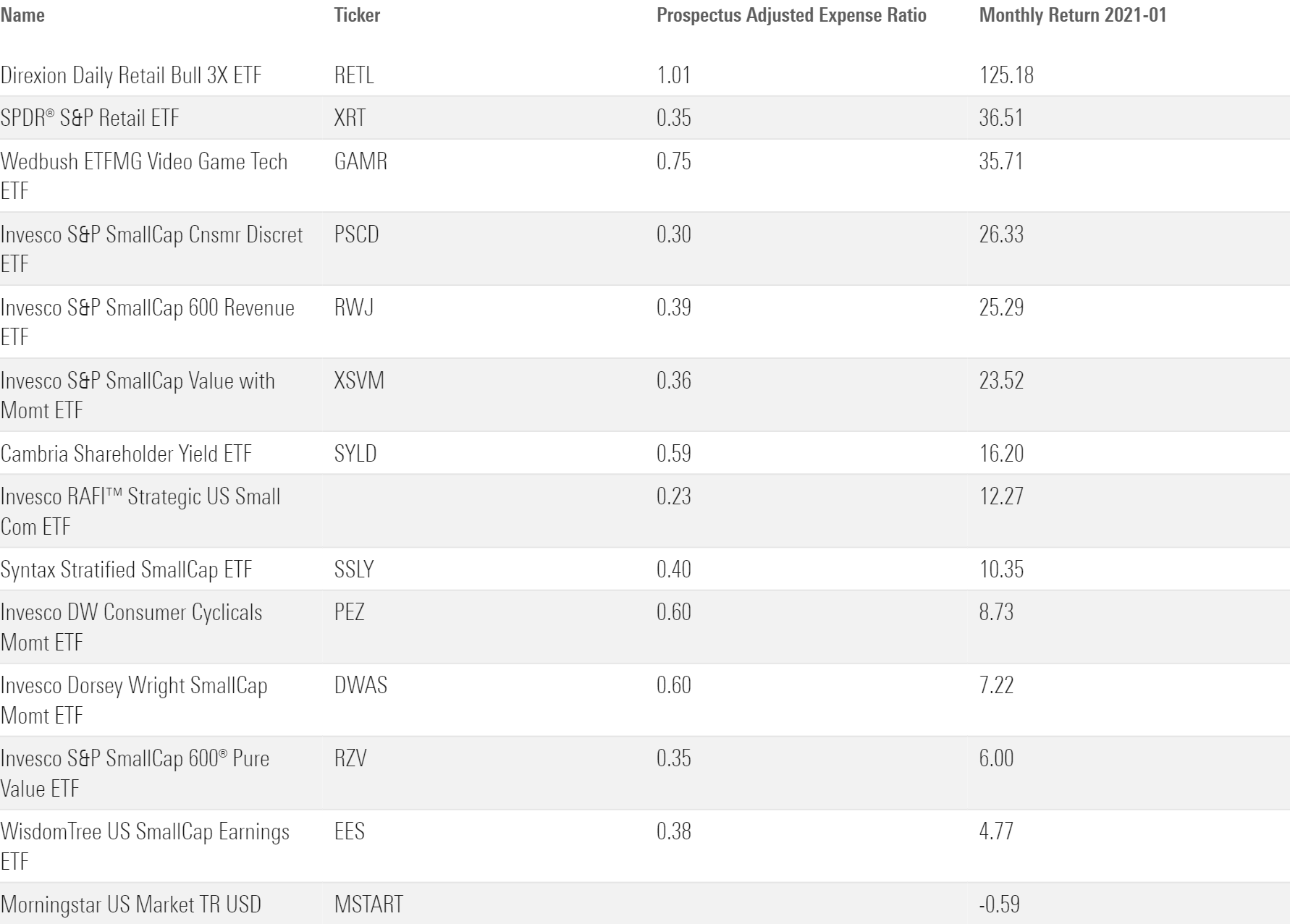

I sorted the universe of U.S. ETFs that held GameStop in December 2020, leading up to the January 2021 frenzy. I imposed a minimum weight of 0.5% to eliminate total-market ETFs. Only 13 ETFs made the final list. Seven were small-cap ETFs of various flavors and factor tilts, four were sector ETFs investing in the consumer cyclical and technology sectors, and one was a leveraged sector ETF.

While holding GameStop in January 2021 seemed prescient, the 13 ETFs had varying reasons for why the stock landed in their portfolios. Sector ETFs in retail and technology held GameStop because of the company’s video game retail operations. Both SPDR S&P Retail ETF XRT and Wedbush ETFMG Video Game Tech ETF GAMR were up about 36%. Similarly, Direxion Daily Retail Bull 3X ETF RETL, which aims to magnify the returns of the S&P Retail Select Industry Index threefold, was up 125%. But most interestingly, a few value-oriented ETFs managed to be on the right side of GameStop’s rise.

The January 2021 Returns (%) of 13 ETFs That Held GameStop

Below I unpack the three highest-performing value-oriented ETFs with at least a 0.5% allocation to GameStop in January 2021.

Cambria Shareholder Yield ETF

With 2.85% of its assets in GameStop at the end of 2020, Cambria Shareholder Yield ETF SYLD subsequently enjoyed a 16-percentage-point run in January 2021. SYLD, which has a Morningstar Medalist Rating of Neutral, systematically holds value stocks with a high combination of dividend and net buyback yields. The objective is to locate companies that return the most cash to shareholders at attractive valuations. This approach favors small-value stocks but also promotes an ever-changing portfolio and high risk.

SYLD’s stake in GameStop benefited as its price skyrocketed. SYLD sold half of its stake in GameStop each time it hit the portfolio’s 5% weight constraint. SYLD locked in gains at several points through January 2021 as a result. The portfolio ultimately shed the last remnants of its GameStop position at the next rebalance a couple of months later.

Invesco S&P SmallCap Value with Momentum ETF

Invesco S&P SmallCap Value with Momentum ETF XSVM narrowly bets on the value, small size, and momentum factors and selects 120 stocks from the S&P SmallCap 600 Index with modest valuations that exhibit the highest momentum. It had the second-highest tracking error among all U.S. strategic-beta ETFs over the trailing five years through August 2023, and it sports a 99.5% active share versus the market. It reaped the benefits of straying far away from the broad market as it posted a 23-percentage-point increase in January 2021.

Staying true to its passive roots, this strategy hung on to GameStop until its next rebalance in June 2021, at which point it sold its stake completely. Ultimately, GameStop contributed about 10.1% to the fund’s performance that year.

Invesco S&P SmallCap 600 Revenue ETF

Invesco S&P SmallCap 600 Revenue ETF RWJ sets out to weight the constituents of the SmallCap 600 Index by their revenue. It systematically holds stocks with the largest economic footprint, tilting away from growth stocks and toward stocks with low prices compared with their revenue. This steers the fund away from the market, but its contrarian approach paid off when it posted a 25-percentage-point jump in January 2021. RWJ sold out of most of its GameStop position in March 2021 before finally exiting completely by the end of August 2021—a bit later than SYLD and XSVM. In the end, GameStop contributed 8.6% to the fund’s performance that year.

The Value Bet

The common thread among SYLD, XSVM, and RWJ is value investing, which at its core involves buying companies at a discount to their intrinsic value and selling them once the market prices accurately reflect their value. However, this is a risky proposition. Companies are usually cheap for a reason. They often have poor growth outlooks and weaker financial footing. These types of companies don’t hold durable competitive advantages and tend to be less profitable than their peers. But performance relative to expectations is what counts, and these firms face a lower hurdle to deliver solid returns. Lower valuations historically come with higher expected returns—if you can stomach the risk.

Mining for hidden gems in the small-cap segment of the market adds more gasoline to the fire because small-cap stocks are generally more volatile, lack the coverage and investor attention of larger names, and are harder to trade. On the other hand, academics and practitioners have shown that the small-size and value factors have provided excess returns over long periods and in markets around the world.

Narrow Bets

Narrow bets on cheaply valued small-cap companies or a specific sector come with considerable risk. The average volatility of the 13 ETFs in the table above was 91% higher than the Morningstar US Market Index over the three years through September 2023. Investments that focus on a narrow market segment end up holding companies with similar risks, leading to higher volatility and drawdown potential. But the reward can be enticing. Diversification can smooth out some of the volatility, making price swings easier to stomach.

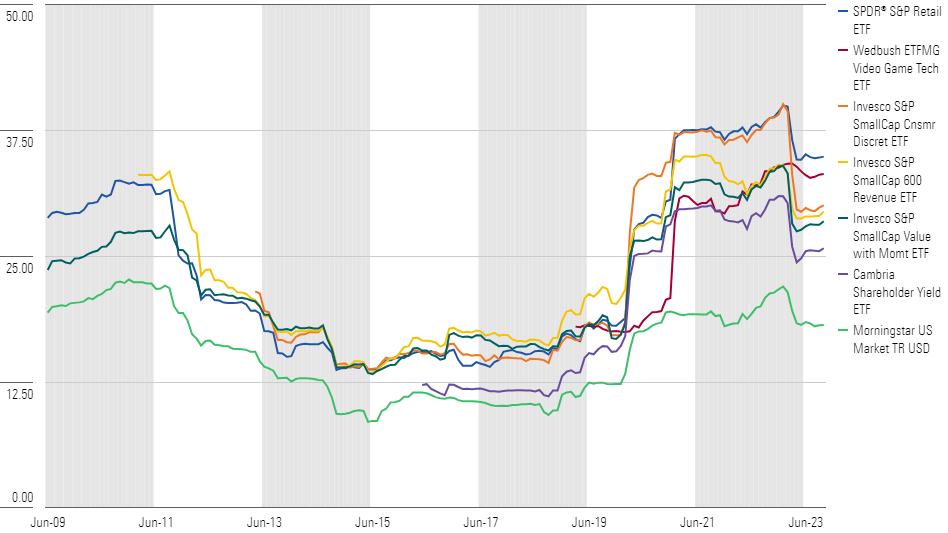

Rolling Volatility for Selected ETFs That Held GameStop in January 2021

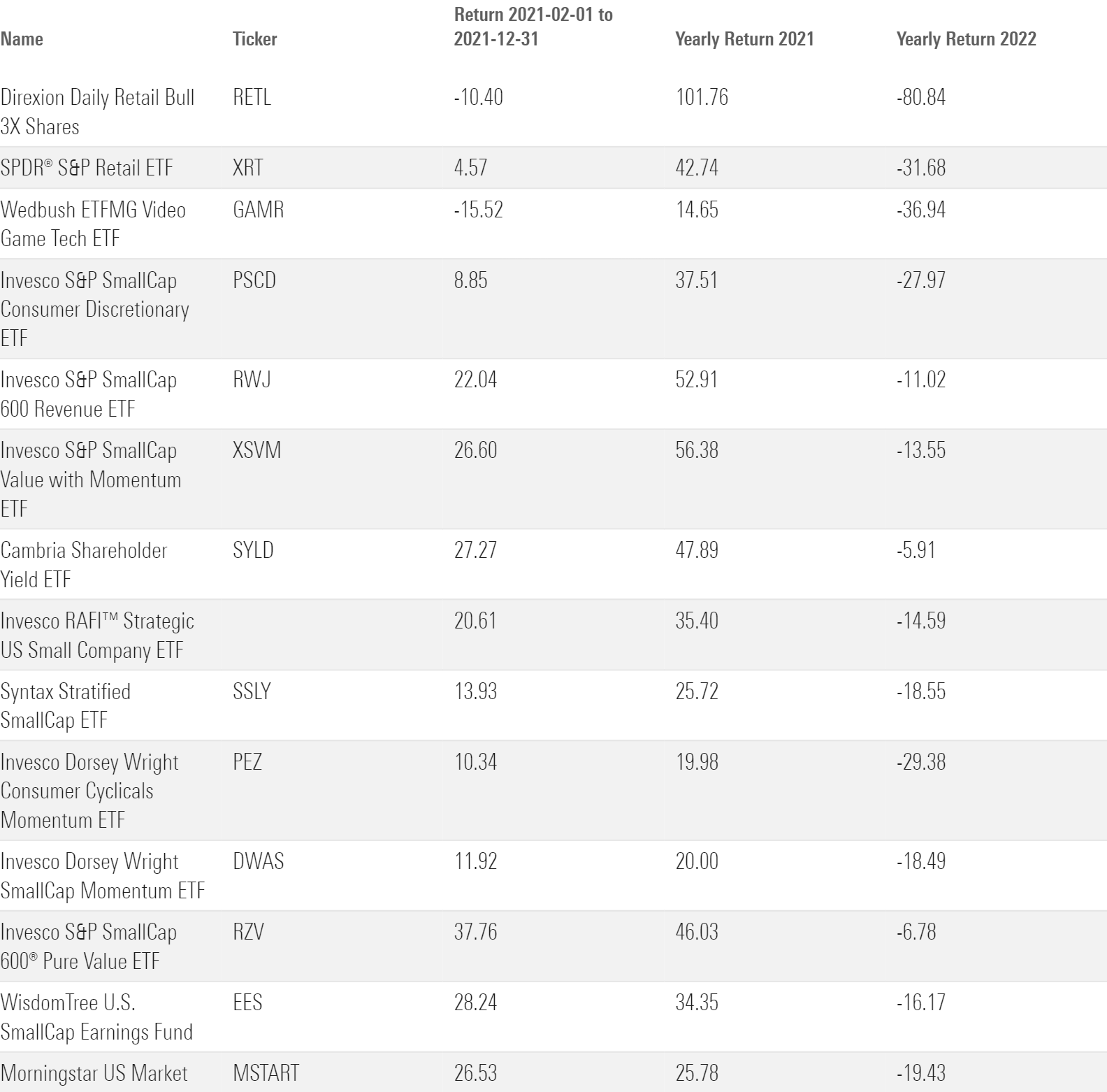

Sector bets, like those of XRT and GAMR, may not pay off again in the future. They can occasionally hit the jackpot, but there’s no way to predict when that may happen. And the payoff was fleeting; sector ETFs could not hold on to their January gains even though markets continued to rally further into 2021. RETL, XRT, and GAMR lagged the value-oriented peers mentioned above. RETL and GAMR even finished 2021 in the red. The meme-stock boom resulted in paper gains for these funds, meaning they continued to hold the meme stocks after they fell back down to earth. On the other hand, XSVM, SYLD, and RWJ systematically cashed out their GameStop gains and reinvested the money in cheaper companies.

In contrast, value investing aims to exploit the market’s systematic behavioral and risk misallocations, slightly improving the odds of hitting the jackpot again. It might not be at the scale of a social-media-fueled meme-stock frenzy, but the odds are slightly better than sector bets that do not systematically respond to the market. In addition, value continued to rally in 2021 even after the meme-stock craze slowed down. SYLD, XSVM, and RWJ were up 47, 56, and 52 percentage points by the end of 2021, respectively. While the 2022 market drawdown hurt ETFs across the board, value strategies managed to hold up slightly better that year.

2021-22 Returns (%) for 13 ETFs That Held GameStop

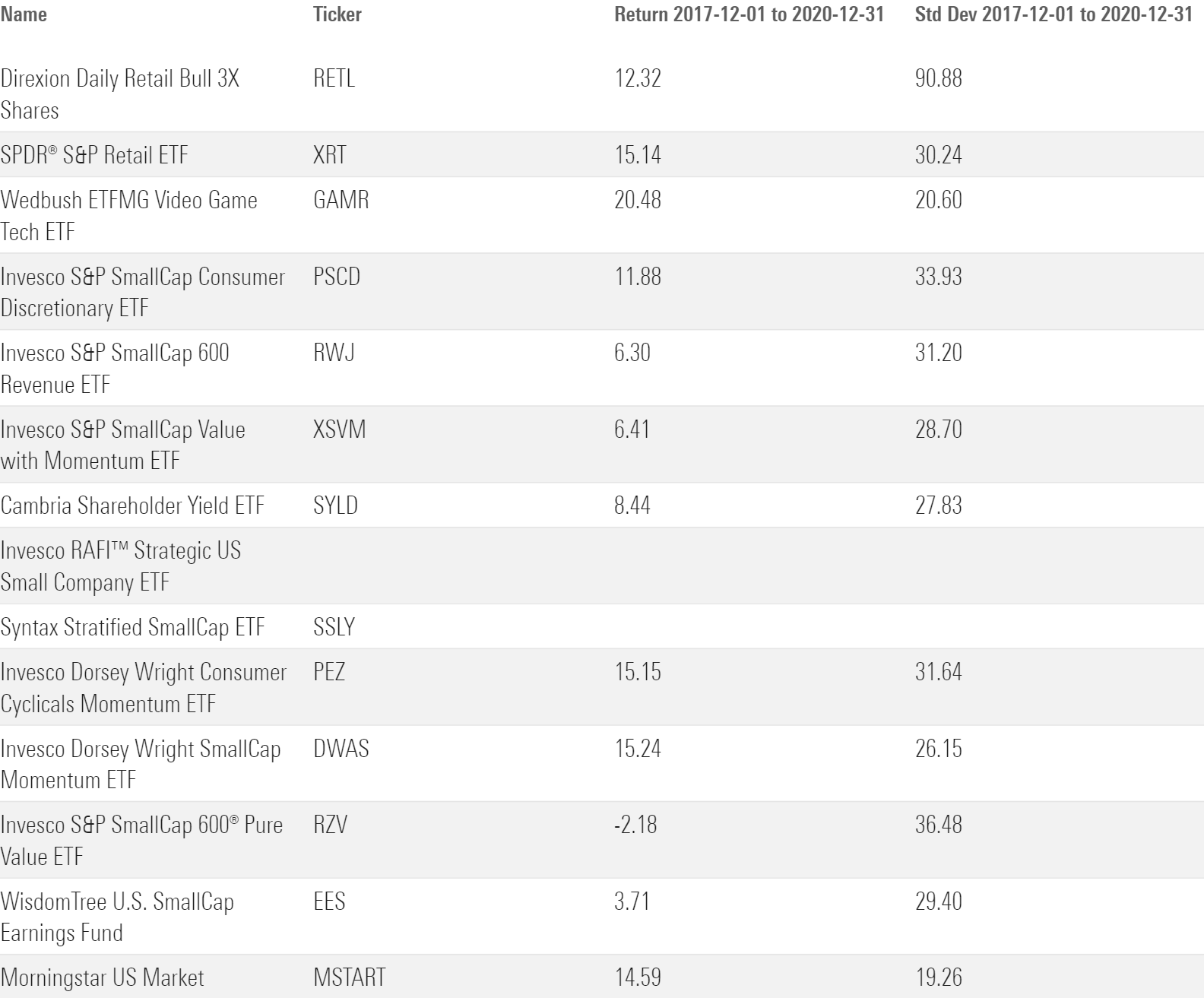

Hindsight distorts the appeal such value-oriented ETFs had before the meme-stock rally. In December 2020, SYLD, XSVM, and RWJ were not seen as remarkable investments because of their paltry returns combined with elevated levels of volatility. They lagged the U.S. market by between 8.3 and 6.2 percentage points over the trailing three years through December 2020. In addition, they were on average 50% more volatile than the U.S. equity market. A bleak performance indeed.

Trailing 3-Year Volatility and Returns at the End of 2020

Comparing value- and sector-focused bets amid the whirlwind of meme-stock mania reveals important considerations for investors. While sector bets, as exemplified by XRT, GAMR, and RETL, may occasionally strike gold during market frenzies, the sustainability of their performance is questionable because of their subsequent struggles to maintain gains. In contrast, value-focused ETFs such as SYLD, XSVM, and RWJ showcase the steadfastness of value investing—although it may come with higher volatility than a market portfolio.

While value-focused ETFs may not offer the same explosive returns as meme stocks or narrow sector bets, they provide a calculated and methodical approach to contrarian investing that captures gains before stocks fall back to earth. What became clear in the meme-stock saga was that you may never know which stocks will rebound from low valuations or why.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)