A Dose of Quality Keeps Risk at Bay for Value Funds

The best value funds successfully avoid value traps.

After underperforming for more than a decade and facing loud allegations of its death, value investing made a comeback. From December 2021 through December 2022, the Morningstar US Value Index outperformed the Morningstar US Growth Index by 43 percentage points. Staunch advocates of value investing who insisted a rebound was coming were vindicated at last.

Value investing at its core involves buying companies at a discount to their intrinsic value and selling them once the market price more accurately reflects their value. Historically, this strategy has proved its merits by delivering long-term outperformance.

In an efficient market, prices should reflect the present value of all future cash flows, and mispricings should resolve quickly. The value factor premium should not persist. However, the premium has persisted over long periods and in markets around the globe. As a plausible explanation, academics and practitioners cite that investors demand higher returns for holding cheap companies that tend to be riskier. Their modest valuation reflects their poor growth outlook and weaker financial footing. These types of companies don’t hold durable competitive advantages and tend to be less profitable than their peers. However, performance relative to expectations is what counts, and these firms face a lower hurdle to deliver solid returns. Lower valuations indicate higher expected returns—if you can stomach the risk.

Improving Value Investing’s Odds of Success

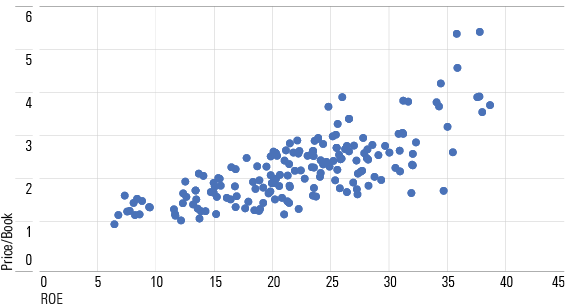

Blindly chasing value increases the likelihood of holding companies with deteriorating fundamentals, commonly known as “value traps,” instead of undervalued businesses. The probability of holding companies with sound financial health and enduring competitive edges decreases in the cheaper corners of the market because higher-quality companies tend to trade at higher valuations. Exhibit 1 demonstrates this relationship by plotting the average return on equity of U.S. value exchange-traded funds against their price/book ratio.

Although contradictory to the premise of value investing, paying up for quality names does not necessarily suppress performance. There is strong academic research supporting the quality factor, too. Higher-quality companies come with heftier price tags because they should generate higher future cash flows.

While quality and value are distinct investment philosophies, they can meaningfully complement each other. Striking a balance between bargain-hunting and stability is a delicate endeavor. If done well, the end portfolio gets the best of both worlds by mitigating the risk of value traps and not overpaying for profitability.

Quality is Costly

Dividend ETFs Can Teach Us About Value Investing

When sorting the universe of value ETFs based on the quality of their portfolios, well-constructed dividend-focused funds make the top of the list. They are a case study that highlights ways to maintain value exposure without compromising a portfolio’s quality.

Dividend yield is a metric that dividend funds aim to maximize. A stock’s dividend yield can increase in two ways: dividend payments increase or the stock’s price decreases. Stocks with consistently rising dividend payments often come with sound financial footing and a stable growth outlook that merits a higher price tag. Higher dividend payments may not result in higher yields as their prices rise, so these companies appear less often in the highest-yielding segment of the market.

On the other hand, a company with deteriorating fundamentals is more likely to exhibit high trailing dividend yield because their declining stock prices make past dividends appear larger. A hyperfocus on dividend yield can lead funds to scoop up these value traps.

The goal of dividend funds should be to maximize future dividends. Optimizing yield today may risk dividends tomorrow. Value traps can’t afford to maintain past levels of dividend payments, so they will be forced to cut their dividends substantially, if not altogether. The best dividend funds incorporate quality in their quest for future dividends, ensuring stable dividend payments for years to come.

Different approaches are taken by dividend strategies to sidestep the risk of holding value traps. Some strategies set explicit quality thresholds. For example, FlexShares Quality Dividend ETF QDF, which has a Morningstar Medalist Rating of Silver as of March 2023, constructs a quality score that incorporates profitability (return on assets and return on equity, for example), cash flow (dividend coverage ratio), and management efficiency. It then ranks stocks by their quality score and removes the lowest-ranked quintile from each sector, limiting the risk of investing in the lowest-quality companies. Schwab U.S. Dividend Equity ETF SCHD (rated Gold as of April 2023) requires 10 consecutive years of dividend payments, then ranks qualifying stocks by a combination of quality measures and yield. After selecting the top 100 companies, it weights each holding by market cap, which further emphasizes larger, more-stable companies. Similarly, Fidelity High Dividend ETF FDVV (rated Silver as of June 2023) constructs a dividend score based on yield, payout ratio, and 12-month dividend growth. The latter two measures tilt the portfolio toward fundamentally sound stocks that should be able to maintain their dividends.

Other strategies are more subtle in their quest for quelling value traps. For example, Vanguard High Dividend Yield ETF VYM sweeps in the top half of the dividend-yielding universe of U.S. stocks, then weights constituents by market cap. This effectively diversifies away stock-specific risk while market-cap weighting mitigates exposure to distressed firms. Similarly, SPDR S&P Dividend ETF SDY requires that each stock has increased its annual dividend in each of the past 20 years. Only reliably profitable firms check this box, tilting the portfolio into higher-quality names.

It’s Not Just Dividend Funds

Quality tilts in the value fund universe are not exclusive to dividend strategies. Dimensional U.S. Large Cap Value ETF DFLV (rated Silver as of July 2023) and Avantis U.S. Large Cap Value ETF AVLV (rated Bronze as of December 2022) tilt their portfolios toward companies with higher profitability, lower valuations, and smaller market caps by scaling each stock’s market cap with a market-cap multiplier. Emphasizing profitable names pushes the portfolios away from riskier ones, although smaller companies tend to be of lower quality. These strategies do not compromise their guiding principle of buying cheap. They trade at cheaper valuations compared with the market.

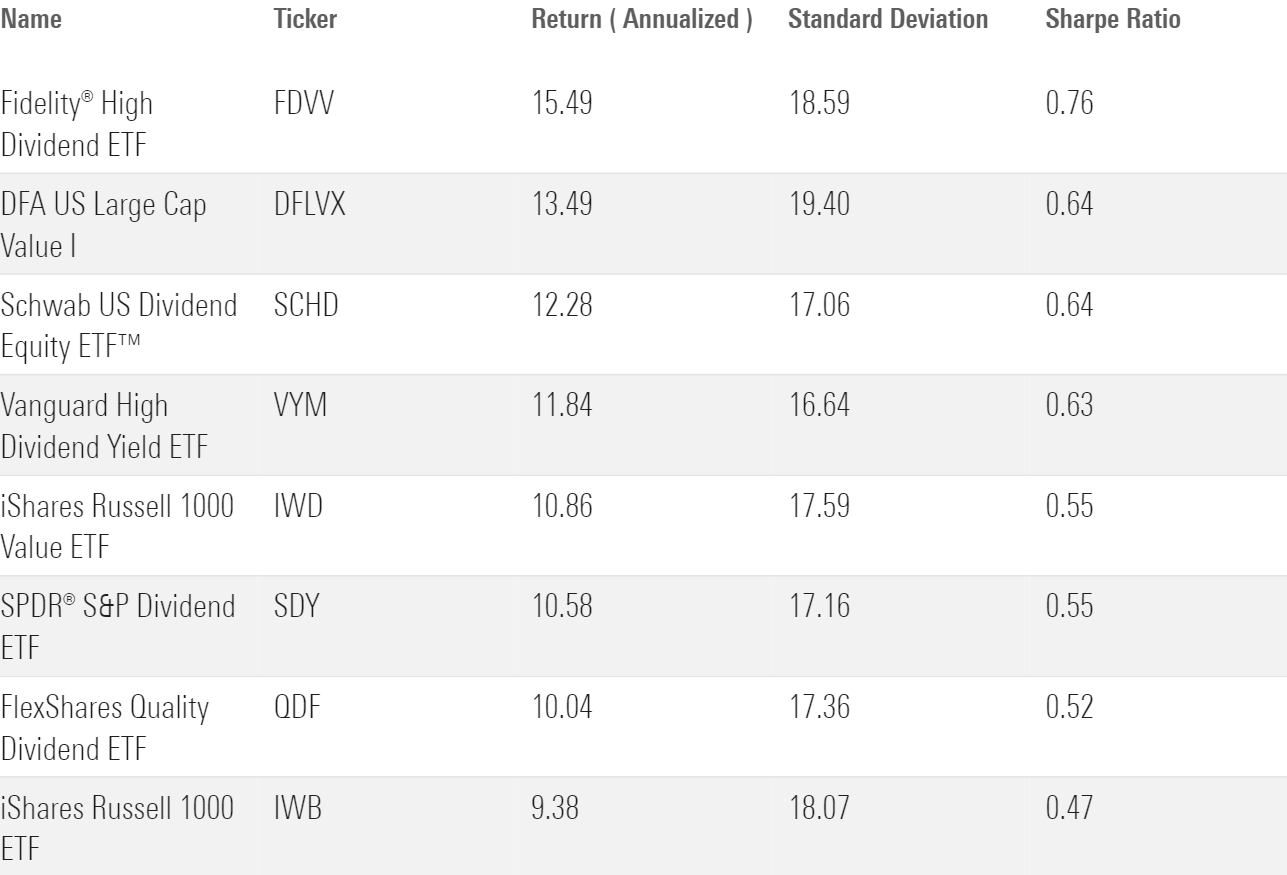

Three-Year Performance of Value/Quality Funds

How Have These Funds Stacked Up?

We have extolled the virtues of value and quality, but does performance match expectations? In theory, leaning into value should increase returns, while emphasizing quality in a value portfolio should reduce its volatility. Each fund emphasizes the value and quality factors differently, but risk-adjusted performance (as measured by Sharpe ratio) gives us an apples-to-apples comparison of each fund’s ability to turn risk into reward. Exhibit 2 highlights the market-beating performance of these funds as compared with the Russell 1000 and Russell 1000 Value indexes. In short, harnessing value and quality together outperformed broader value and blend strategies over the past three years.

A Better Approach to Value

A myopic focus on bargain-hunting risks investors falling into value traps. However, value investing can be a worthy investing philosophy when tempered by an emphasis on financial durability and resilience. The previously mentioned strategies showcase how this balance can be achieved by juggling both quality and value.

3 High Quality Stock ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)