High Equity Yields Often Come at a Cost

Growing (yield) pains and how to fix them.

Despite attractive bond yields, dividend stocks still appeal to investors who want to grow their principal while receiving regular income. But the path to high equity payouts is typically littered with value traps—distressed companies with low stock prices and inflated yields. Downside protection can be tricky for index funds seeking high yields. Consider one of the highest-yielding index funds investing in US equities: SPDR Portfolio S&P 500 High Dividend ETF SPYD. It lost more than 45% during the market shock between Feb. 20 and March 23, 2020, compared with the S&P 500′s 33.8% drop.

Total return usually isn’t the prime focus of income-seeking investors, but they shouldn’t compromise their principal. Quality high-yield funds can get them to the happy middle place: moderate drawdown protection alongside above-average yields.

Weeding Out Value Traps

The SPDR ETF’s problems start with its construction process: The fund ranks stocks by their 12-month projected yield and picks up the top 80 names. It does nothing to filter out companies with tumbling stock prices and rocky prospects that keep up dividends to pacify shareholders. For instance, the fund held on to Macy’s M until the firm suspended dividends in March 2020, absorbing the stock’s 70% loss during the trough of the coronavirus pandemic shock. Macy’s stock prices have been spiraling since the mid-2010s amid growing struggles for brick-and-mortar retailers.

Fortunately, some high-yield dividend funds incorporate guardrails into their stock-selection processes. Fidelity High Dividend ETF FDVV also starts with yield, but it also looks at each stock’s payout ratio and year-over-year dividend-growth rate. Similarly, WisdomTree US High Dividend ETF DHS targets the top 30% highest-yielding US stocks, but it weeds out those with low-quality fundamentals and recent price drops. The strategy calculates a composite score using profitability ratios, cash flow metrics, and short-term historical returns, then removes low-ranking stocks.

These metrics point the Fidelity and WisdomTree ETFs toward financially healthy firms and rein in their exposure to low-quality names. Both ETFs’ holdings have some small overlap with the SPDR ETF, but they enlist many stable blue chips such as Procter & Gamble PG and ExxonMobil XOM.

Both funds tilt toward high-yielding stocks in their weighting process to ramp up payouts, yet neither struggles with portfolio quality. Their holdings tend to possess higher profitability ratios and lower leverage than SPDR Portfolio S&P 500 High Dividend ETF. As of March 2024, the trailing 12-month return on invested capital for the Fidelity and WisdomTree ETFs clocked in at 10.03% and 20.16%, respectively. In contrast, the figure stood at 5.75% for the SPDR ETF. Profitable stocks shone through in stress periods such as the pandemic shock mentioned before, when both funds outpaced the SPDR ETF by 8.7 and 5.7 percentage points, respectively.

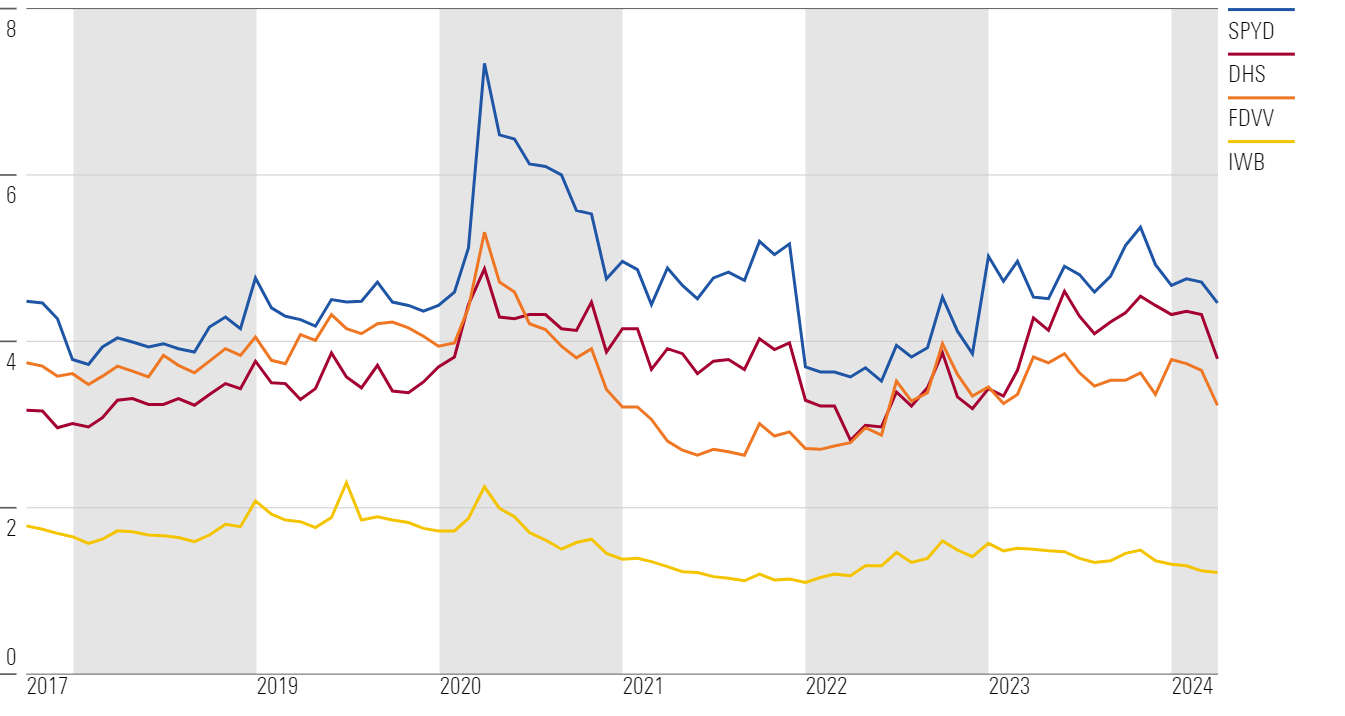

That safety comes with a slight drop in yield, but their trailing 12-month yields are still leagues ahead of the broad market thanks to their weighting methods. The exhibit below displays historical 12-month yields for all three ETFs against iShares Russell 1000 ETF IWB. Both the Fidelity and WisdomTree ETFs still consistently enjoyed a yield of 1.5–2 percentage points more than the broad market.

Historical Trailing 12-Month Yield

A Tale of Two Yield-Screened Funds

Weighting also plays a critical role in a dividend fund’s balance between risk and reward. Two high-yield ETFs that use similar selection criteria, such as Vanguard High Dividend Yield ETF VYM and SPDR Portfolio S&P 500 High Dividend ETF, can help illustrate the impact of different weighting approaches. Both select stocks with the highest expected dividend yields. The SPDR ETF limits its portfolio to 80 stocks, while the Vanguard ETF is broader and holds the highest-yielding half of the large- and mid-cap market.

But the most drastic difference between the two is the way each assigns weightings. Vanguard High Dividend Yield ETF uses a simple market-cap-weighting scheme that can make it top-heavy during market frenzies. However, it also controls risk and cushions the impact of the yield-based screen. Price and yield have an inverse relationship: Yields rise as prices fall. So, value traps with declining prices will naturally take on a smaller role in its portfolio.

Alternatively, SPDR Portfolio S&P 500 High Dividend ETF equally weights its holdings, and that comes with some trade-offs. It will tilt toward smaller names with higher yields, but it also completely ignores a stock’s past or present market capitalization and places greater emphasis on smaller and more volatile names. It will also cause the fund to double down on stocks with declining prices when it rebalances, which can increase its exposure to value traps.

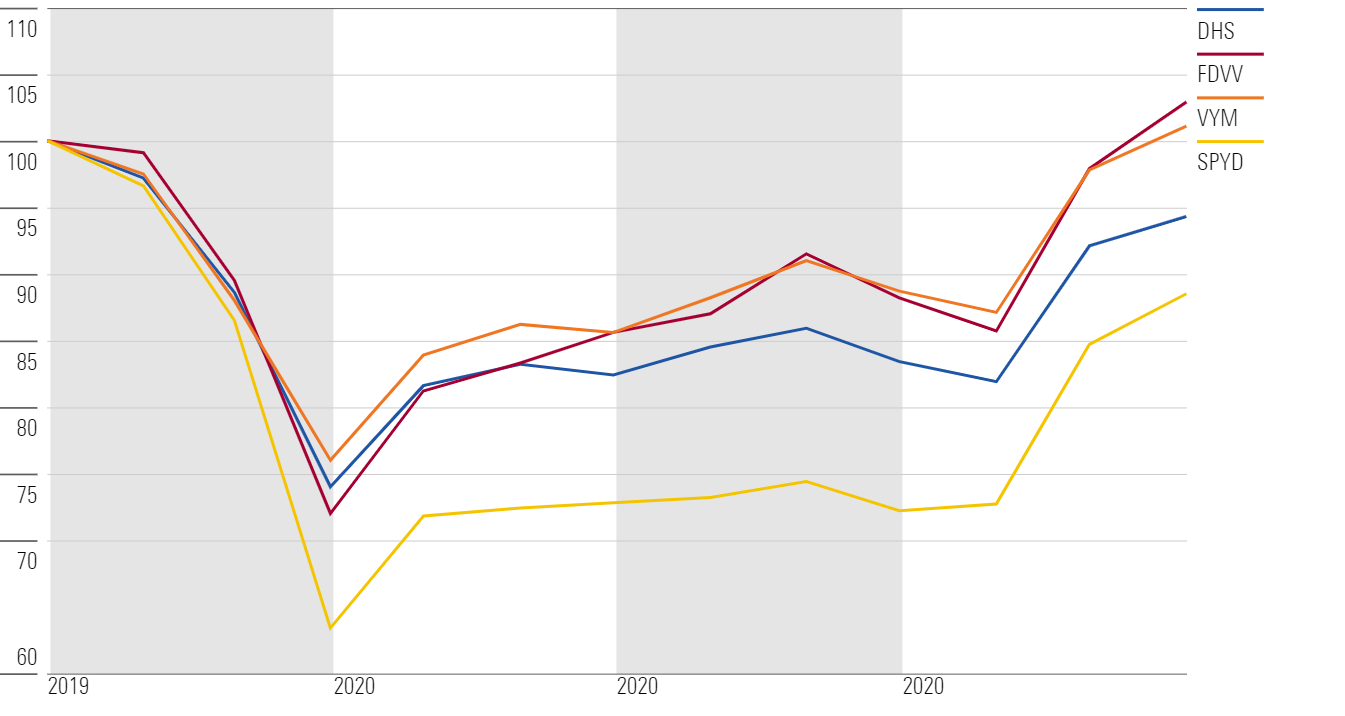

The market-cap-weighting approach becomes more obvious during stressful periods. Similar to WisdomTree US High Dividend ETF and Fidelity High Dividend ETF, Vanguard High Dividend Yield ETF beat SPDR Portfolio S&P 500 High Dividend ETF by an impressive 10.9 percentage points during the trough of the pandemic-driven shock in March 2020. The Vanguard ETF has consistently outperformed the SPDR ETF since its October 2015 inception, with less volatility.

Performance of 4 High Dividend Yield ETFs in 2020

SPDR Portfolio S&P 500 High Dividend ETF isn’t doing this to be different. Its equal-weighted portfolio contributes to its higher yield. As of March 2024, the Vanguard ETF’s 12-month yield stood at 2.82% compared with its 4.45%. That roughly 2-percentage-point gap in yield between the two has been fairly consistent. Vanguard High Dividend Yield ETF still provides above-market yields, but not to the same extent.

Sector Quirks

A pure yield-maximizing approach comes with risks. Chasing yield can quickly push a dividend ETF toward stocks with falling prices that are consistent with distressed companies—those that are cheap for a reason. Each of the high-yield alternatives to SPDR Portfolio S&P 500 High Dividend ETF offered a brake to slow down its exposure to this negative price momentum, whether in the stock-selection process or weighting process.

No strategy is perfect, and the alternatives carry quirks of their own, though their shortcomings are familiar issues plaguing dividend funds at large. A yield focus favors certain sectors, such as utilities. Stable stocks in this segment often distribute healthier dividends than budding tech companies. Overweighting these names drives up yield, but investors will likely experience a different outcome path compared with the broad market. These sector tilts are not entirely driven by performance, so there’s no certainty the differences will be positive.

In some instances, sector weightings can evolve over time that help or hurt performance. For example, the weightings of energy and technology stocks in WisdomTree US High Dividend ETF and Fidelity High Dividend ETF began diverging a few years ago. The WisdomTree ETF’s dividend-based weighting screen pushed it toward energy stocks in December 2021. This came at the expense of technology stocks, which it underweighted. Favoring energy over technology positioned it perfectly for the energy rally in 2022.

On the other hand, Vanguard High Dividend Yield ETF’s market-cap-weighting scheme kept its stake in energy stocks in line with their market prices. The sector trailed behind faster-growing segments of the market in 2021, and it represented a small portion of the fund’s portfolio at the end of the year. That caused it to underperform the WisdomTree ETF by 7.6 percentage points over the first nine months of 2022. But the advantage didn’t persist for long. The same sector tilts pulled the Vanguard ETF ahead of the WisdomTree ETF by 6.7 percentage points in 2023 when the trends reversed.

Dialing up yield can push high-yield dividend funds further away from the broad market. These quirks do not necessarily make for bad investments, but they will lead to a different pattern in return. Investors should understand where they stand on the yield spectrum. Higher yields will likely lead to a bumpier and less predictable ride.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)