Spot Ethereum ETFs Begin Trading

Spot ethereum ETFs finally reach the US stock exchange. Should you invest?

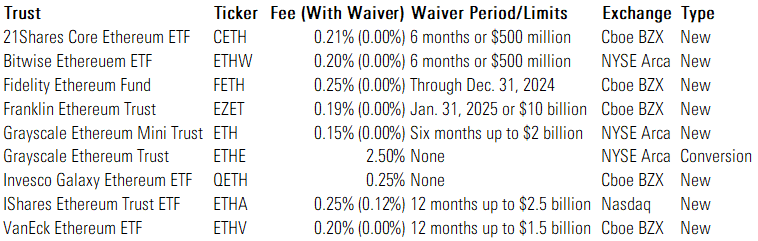

Spot ethereum exchange-traded funds made their US market debut on July 23, 2024. The nine new ETFs, including one converted from an existing trust, are listed below:

Spot Ethereum ETFs Ready to Debut

In a surprise move in May, the US Securities and Exchange Commission approved 19b-4 proposals for the first spot ethereum ETFs in the US. It’s the first cryptocurrency to receive such approval since spot bitcoin ETFs burst onto the scene this January.

What Are Spot Ethereum ETFs?

Spot ethereum ETFs will directly hold ether, the cryptocurrency that supports the ethereum blockchain. Ether currently trades on cryptocurrency exchanges, like Coinbase COIN, and is the second-largest cryptocurrency to bitcoin. Like spot bitcoin ETFs, spot ethereum ETFs will be set up as grantor trusts, meaning investors will own a share of the ether held by the trust.

The main difference between spot ethereum ETFs and spot bitcoin ETFs is the cryptocurrency they hold; otherwise, they should be much the same.

Choosing a Spot Ethereum ETF

Spot ethereum ETFs all offer the same exposure to ether. Picking the best ETF for you depends on a few things, which we refer to as the total cost of ETF ownership:

1. Trading Costs

First, crypto ETF traders that buy and sell often should focus on the most liquid ETF, meaning the one with tight bid-ask spreads and substantial assets. We don’t know which ETF will serve as the liquidity center for ethereum ETFs right off the bat, but it may start with Grayscale and its head start on assets. If spot bitcoin ETFs are an indicator, expect iShares and Fidelity to quickly take over Grayscale as the top ethereum ETFs by assets and volume.

Best bets: iShares Ethereum Trust ETF and Fidelity Ethereum Fund.

2. Holdings Costs

Other ETFs may have small differences that impact holding costs, but spot ethereum ETFs uniformity distills these costs down to fees. The difference between a 15- and 25 basis-point fee is small, so even buy-and-hold investors should balance fees with trading costs and choose an issuer with staying power.

Best bets: Anything other than Grayscale Ethereum Trust.

3. Issuer Preference

Crypto ethos may be important to investors, and issuers vary on their commitment to crypto. Choosing an issuer that gives back to the crypto community may hold an edge for such investors.

Best bets: Bitwise Ethereum ETF, VanEck Ethereum ETF, and Fidelity Ethereum Fund.

Spot Ethereum ETF Advantages

1. Fees

Fee wars broke out in ethereum ETF S-1 filings as issuers jockeyed for position as the low-cost provider. Fee waivers only build on spot ethereum ETF’s advantage over current alternatives, like ethereum futures ETFs, which start for a fee of 0.66% to as high as 2.50% for Grayscale Ethereum Trust ETHE.

Grayscale plans to keep the same fee after converting its private trust to an ETF, so spot ethereum ETF’s fee advantage only extends to the other seven ETFs. New buyers of ethereum ETFs should avoid the expensive Grayscale ETF.

2. Futures Drag on Performance

Futures-based ETFs typically gain exposure to ether by holding the ethereum futures contract that’s closest to expiring. Each month, the fund has to sell out of the expiring contract and roll into the next month. The further from expiration, the higher the price, so these ETFs end up paying a higher price for the same ether exposure at each futures roll. The cost is small, but the advent of spot ethereum ETFs renders it pointless.

Spot Ethereum ETFs Aren’t as Efficient as Most ETFs

ETFs’ tax magic comes from their in-kind creation/redemption process, which means they don’t have to sell holdings (and therefore realize capital gains) to meet redemptions.

Spot ethereum ETFs won’t benefit from these in-kind creations or redemptions (at least, not yet). The SEC only approved cash creations and redemptions, meaning the ETF will need to bear the costs of buying and selling ether when ETF shares are created or redeemed. Trading costs could eat away at the edges of spot ethereum ETF performance. The extent of these costs remains to be seen. Investors on the fence about whether to buy a spot ethereum ETF may prefer to stick with traditional ETFs until this inefficiency is resolved.

How Spot Ethereum ETFs Might Shortchange Investors

Staking is at the heart of the SEC’s issue with ether. Cryptocurrencies run on blockchains, which are ledgers validated by peers (bitcoin miners, for example) rather than intermediaries. Bitcoin uses a proof-of-work system that rewards the first miner to validate a block and add it to the blockchain. Unlike bitcoin, ethereum uses a proof-of-stake model after switching from proof-of-work in 2022, commonly known as The Merge. The proof-of-stake model operates more like a lottery system than a competition: Rather than being first to mine rewards, ether holders could “stake” (that is, commit) their ether to be used to update the ledger and receive rewards.

Staking generates passive income for ether investors willing to lock up their coins. The SEC sued Coinbase based on this interpretation, claiming that staked tokens qualify as investment contracts and should therefore be considered securities (Coinbase disagreed). The SEC relies on precedent known as the Howey Test in its conclusion. Where bitcoin fails and ether passes the Howey Test is in the expectation of profits from the efforts of others. Bitcoin miners earn their rewards, while staked ether is lent for rewards, almost like interest on a savings account.

The SEC approved these ETF filings only after staking was disallowed for the ETFs. The average annual reward for ether staking is roughly 2-4 percentage points. Unlike bitcoin, holding ether directly could hold a meaningful performance edge over spot ethereum ETFs for investors willing to engage in staking.

Should You Invest in Spot Ethereum ETFs?

As to ether’s viability as an investment, ether is a cryptocurrency that should continue to garner investor attention. Ethereum is a major platform that operates using ether as its cryptocurrency. Ether’s $420 billion market cap was second only to bitcoin’s $1.3 trillion market cap as of July 19, 2024. No other cryptocurrency was particularly close to its size.

That said, any ethereum price predictions are guesswork and should be taken with a grain of salt. Ethereum is highly volatile, and investors should only invest as much as they are willing to lose.

What’s Next for Spot Crypto ETFs

While the SEC decision-making process around crypto has been mercurial, I don’t expect approval of other cryptocurrencies without them first having a regulated market. So far, that regulated market has been Chicago Mercantile Exchange futures.

Spot bitcoin and ethereum ETFs were made possible by predecessor bitcoin and ethereum futures ETFs, the futures held by those ETFs being listed on the CME. But the CME doesn’t currently list any other cryptocurrency futures.

It stands to reason that ETF approval is distant for cryptocurrencies other than bitcoin and ethereum.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)