What Omicron Means for the Economy and Inflation

The economic recovery shouldn't slow much, but renewed supply chain snarls could keep inflation high.

Despite the massive waves of coronavirus cases spreading around the globe thanks to the omicron variant, investors can expect only a slight hit to economic growth, but when it comes to inflation, the news isn't as good.

We now have enough data on omicron to hazard a projection for how the new variant will affect the U.S. economy in 2022 and beyond. While omicron’s extreme transmissibility is leading to a surge in cases in the U.S. in first-quarter 2022, its greatly reduced severity compared with prior variants should prevent a large disruption to economic activity. As such, omicron has a minor impact on our 2022 gross domestic product forecast. The impact to our inflation forecast is larger, as China’s pursuit of the “zero-COVID” strategy in the face of omicron could exacerbate global supply chain issues.

- We're reducing our 2022 U.S. GDP forecast to 3.9% from 4% previously, as omicron will modestly depress consumer services spending, mainly in the first quarter.

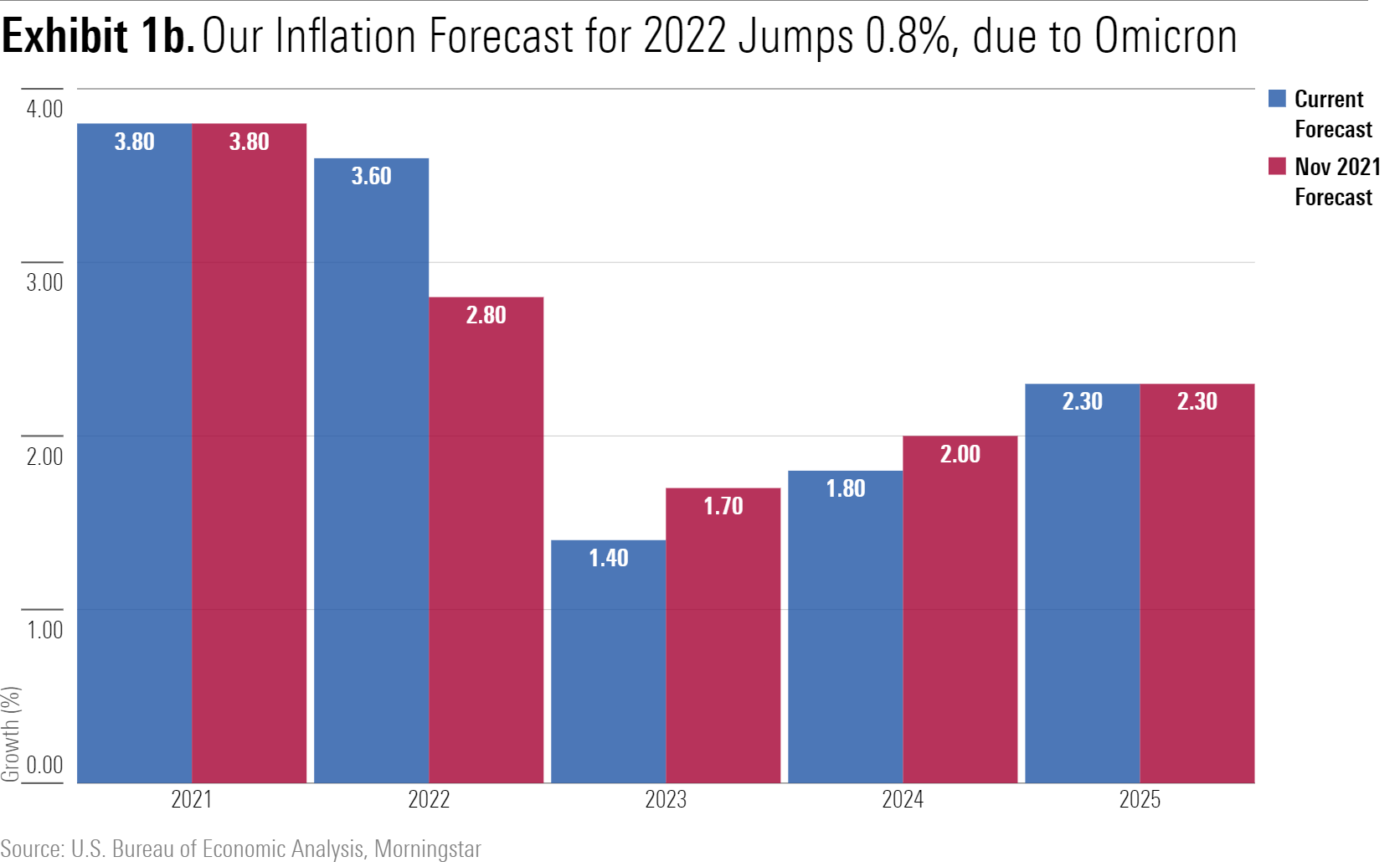

- While we think inflation will have peaked in 2021, we are increasing our 2022 inflation forecast to 3.6% from 2.8% previously, owing greatly to omicron's deleterious impact on the functioning of global supply chains. We still expect supply constraints to eventually ease, delivering significant deflationary pressure. Our inflation forecast is below the consensus, which we think is overreacting to near-term issues.

- Sufficient data has arrived to essentially rule out an economic disaster scenario when it comes to omicron, such as a return to the social distancing measures rolled out in spring 2020. While omicron has caused case levels to soar to new records, the variant's drastically lower severity means that interruption to normal economic activity should be small over 2022 as a whole.

- The biggest consequence for the global economy from omicron will probably occur via the countries still hanging on to a "zero-COVID" strategy (namely China), which looks untenable in the face of omicron's extreme transmissibility. China's attempts to stem the tide of omicron via lockdown-like measures could have a severe impact on already highly stressed global supply chains.

- Omicron has no negative long-run impact on the return to normal, in our view, and could even make the path to normal easier under certain scenarios.

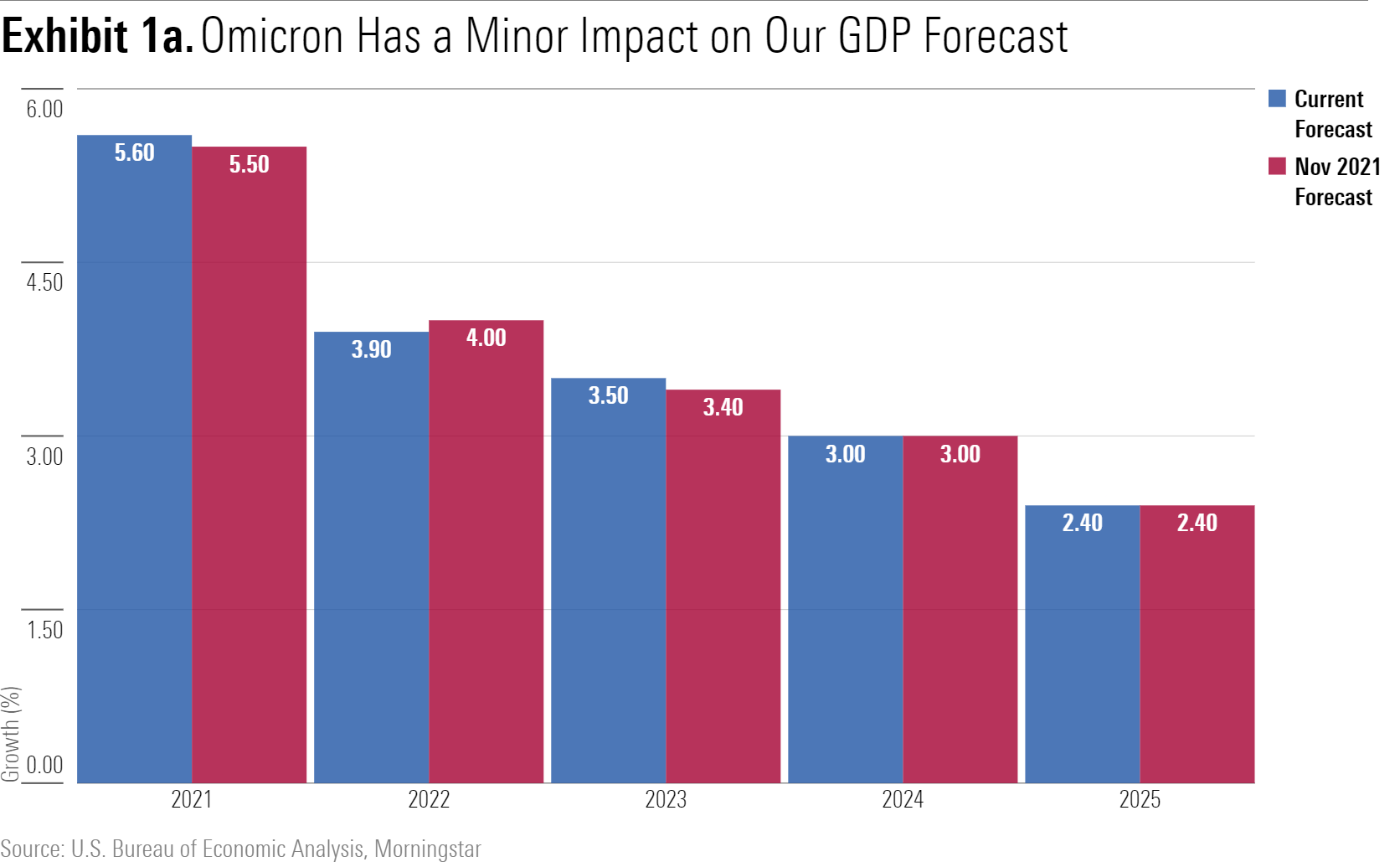

Omicron Has a Minor Impact on Our GDP Forecast (More So on Inflation)

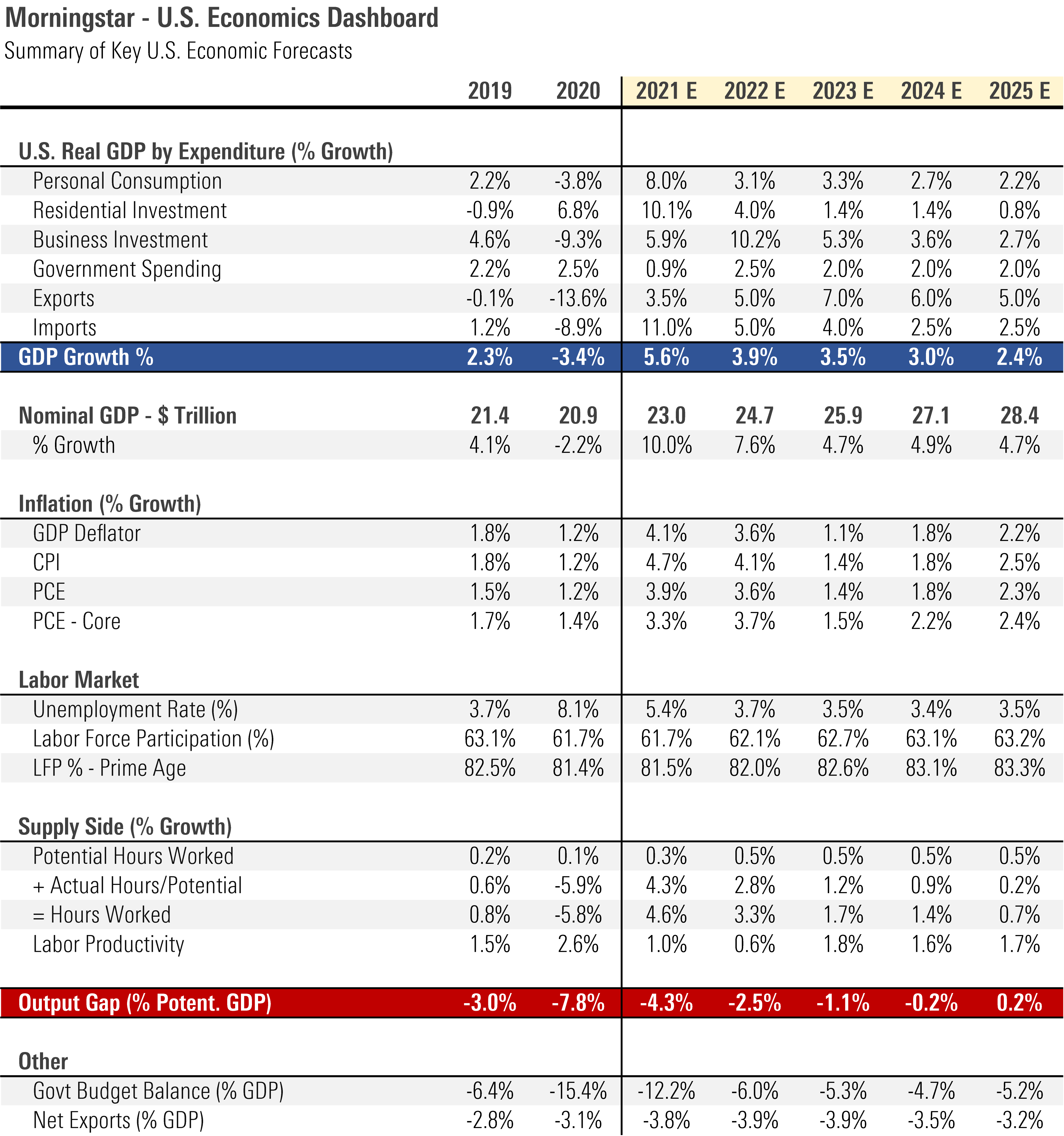

Exhibit 1a below compares our updated economic outlook with forecasts published in our U.S. Economic Outlook: Fourth Quarter 2021. In response to the omicron variant, we're notching down our 2022 GDP growth forecast to 3.9% from 4% previously. Omicron's impact is about 0.2% (driven by reduced consumer services spending), but this is offset by the fact that consumer goods demand is running stronger than previously expected. Omicron's impact will be focused in the first quarter, and we expect a sharp rebound in services activity after that. As we discuss below, even with an astronomical rise in cases, omicron's greatly reduced severity should prevent a large disruption to economic activity.

We're increasing our 2022 inflation forecast to 3.6% from 2.8% previously. This is first because, even before omicron, supply constraints look slower to ease than we previously expected. But omicron is likely to exacerbate the situation. As discussed below, China's attempts to maintain its "zero-COVID" strategy are likely to lead to escalating lockdowns in the face of omicron's increased transmissibility.

However, we still see little reason why supply constraints won't eventually be resolved, so we've reduced our 2023 and 2024 inflation forecasts in aggregate by nearly as much as we've increased our 2022 forecast. The unwinding of price spikes in autos and other durable goods should deliver significant deflationary pressure in 2023 and 2024. Our views on inflation are below consensus, which we think is overreacting to near-term issues. In terms of the consumer price index, we're expecting an average 2.4% inflation over 2022-25, compared with about 2.9% expected by the bond market.

Our GDP forecast remains above consensus, as we're expecting about 200 basis points more cumulative growth over 2023-25 than the consensus average. This is because of our views on the supply side of the economy, in particular our view that labor supply will eventually surpass pre-pandemic levels.

Omicron's Impact on Return to Normal Will Be Small and Temporary

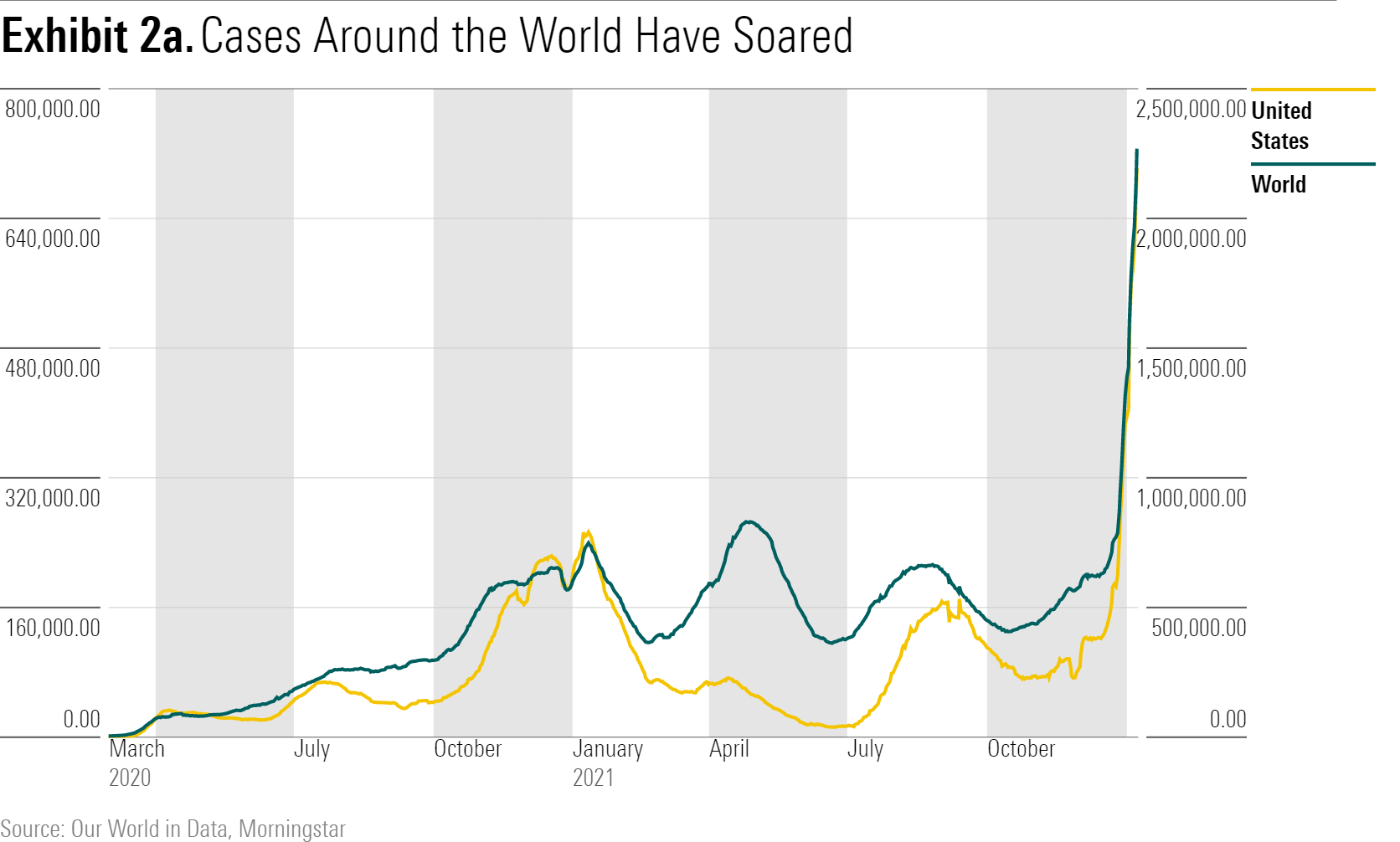

Sufficient data has now arrived to essentially rule out any economic disaster scenario when it comes to the omicron variant of COVID-19, such as a return to the social distancing measures rolled out in spring 2020. While omicron has caused case levels to soar to new records (Exhibit 2a), the variant's drastically lower severity means that interruption to normal economic activity should be small over 2022 as a whole. And irrespective of the near-term impact, we see no reason why omicron would thwart a return to normal in the U.S. and global economies in the long run.

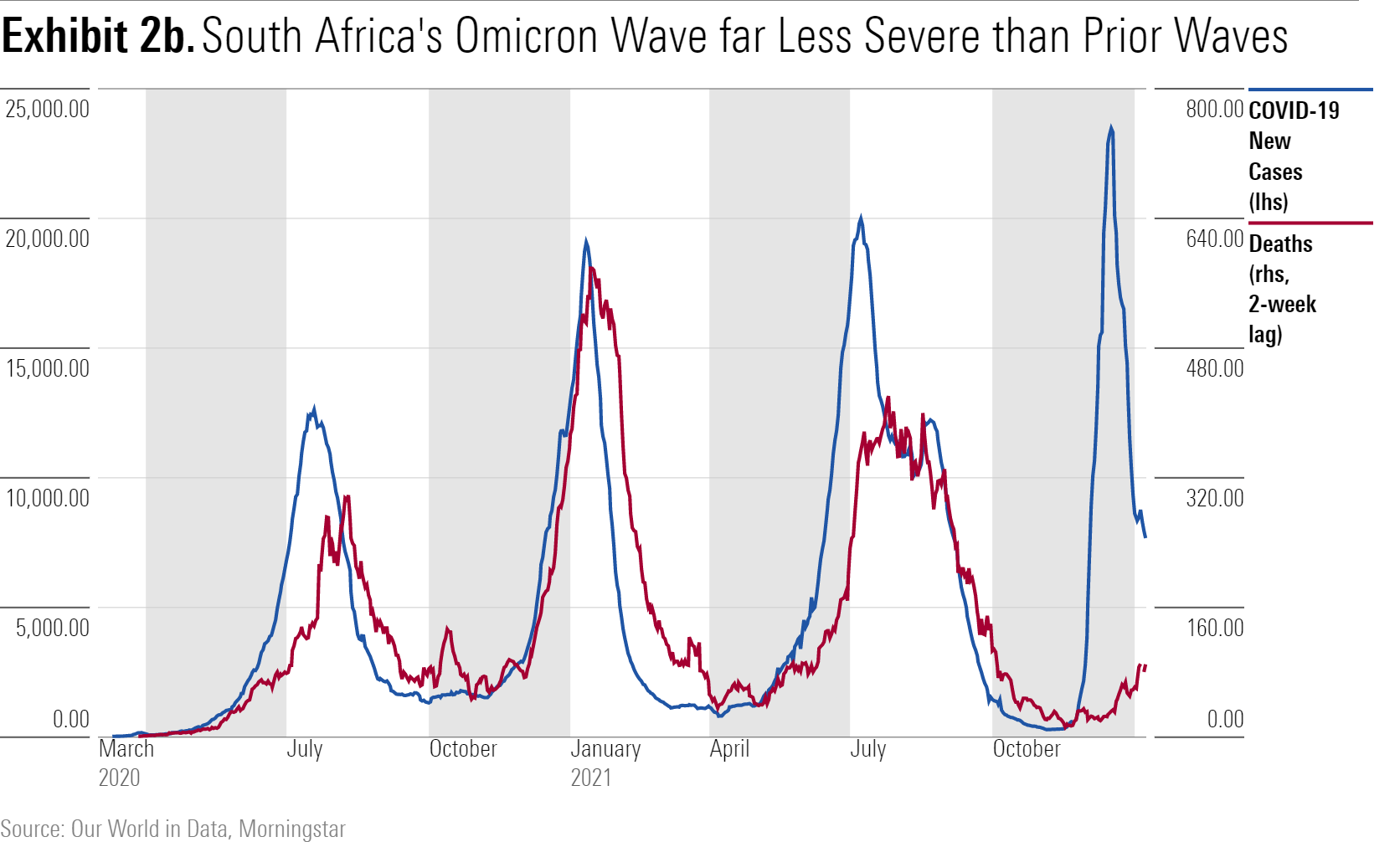

In Exhibit 2b we show COVID-19 cases and deaths (the latter at a two-week lag) for South Africa, where the omicron variant first appeared in November 2021. At the peak in mid-December, the number of new cases easily surpassed prior waves. Yet, deaths look likely to peak at only a fraction of the level seen in prior waves. This large decoupling between cases and deaths is strong evidence for omicron's reduced severity.

Early scientific studies largely back the picture painted by looking at South Africa's aggregate numbers. This extends to early data outside of South Africa, such as a study in the U.K. that found that risk of hospitalization for omicron was about one third of that for the delta variant.

That said, the U.S. will be somewhat challenged by its low rates of booster uptake, at just 23% in January 2022 compared with 43% in the U.K., according to Bloomberg. The aforementioned U.K. study found that unboosted individuals had just 52% protection against hospitalization 25 weeks after their dose 2 (protection against death may remain high, but there isn't sufficient data yet to say). On the other hand, high-risk people in the U.S. have higher booster rates, including 60% of those 65 or older, according to CDC data.

Omicron's Near-Term Impact Could Be Sharp; "Zero-COVID" Countries Pose Largest Problem

While omicron's reduced severity is good news, the variant's extreme transmissibility is still going to create issues in the near term. As Exhibit 2a above shows, cases are surging to new heights in the U.S. and globally. Even with a drastically reduced infection fatality rate for omicron, the sheer number of infections could cause a surge in short-term death rates. Even if that doesn't occur, the mass quarantining from positive cases will disrupt labor supply and consumer spending moderately, at least in the first quarter of 2022.

The biggest consequence for the global economy will probably occur via the countries still hanging on to a "zero-COVID" strategy (namely China), which looks untenable in the face of omicron's extreme transmissibility. China's desperate attempts to stem the tide of omicron cases in 2022 could entail ever more stringent lockdowns. This could have a severe impact on already highly stressed global supply chains, given China's pivotal role therein.

Several other Southeast Asian countries important to global supply chains have already pivoted away from more stringent policies on COVID-19, including Thailand, Malaysia, and Vietnam. This should help to avert some disruptions to manufacturing and logistics that occurred in 2021. But China seemingly remains wedded to its "zero-COVID" policy for now.

Outlook for Long-Run Return to Normal Remains Bright Despite Omicron

We still expect a steady drift back to (essentially) the pre-pandemic normal over the next two to three years, omicron notwithstanding.

In fact, omicron could actually make the return to normal easier in the long run. The advent of an unstoppably contagious yet low-severity variant could make a nonchalant attitude toward COVID-19 both necessary and very palatable. This is particularly the case if cross-immunity is high enough to push out more severe variants like delta. Further supporting this scenario, there's evidence that omicron is spreading far quicker than official case numbers report. Random sample-based surveys suggest that around 6% of Englanders had COVID-19 the week of Dec. 31, quadruple the official case rate of about 1.5%. This may sound like a bad thing, but holding the incidence of severe illness constant, a higher true case rate means an even lower severity for omicron than we currently suspect. It also means that the new variant could sweep through the global population fairly quickly, helping to establish widespread immunity.

Pfizer's Antiviral Paxlovid Could Be a Game-Changer

Another reason for bolstered long-term optimism is good news regarding Pfizer's PFE antiviral drug Paxlovid. Phase 2/3 clinical trial results released in December show an 89% reduction in risk of hospitalization or death for high-risk, unvaccinated patients with COVID-19. The early results didn't find a statistically significant risk reduction for lower-risk (including vaccinated) patients, but this could change with later results offering a larger sample size. Importantly, Paxlovid should be very resilient against omicron and other variants, given its mechanism of action. Pfizer is planning on producing at least 80 million courses globally in 2022. Perhaps the main challenge for Paxlovid is ensuring that the people who need it are tested soon enough so that they can start treatment within the required five days after symptom onset. But if this and other hurdles are surmounted, this new treatment could slash the COVID-19 death rate.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)