Fed Inches Closer to 2024 Rate Cuts

Despite Powell’s hedging, we expect the Fed will lower interest rates by 2024.

While Federal Reserve chair Jerome Powell remains circumspect, the central bank appears to be inching closer to our expectation for a rate cut in March 2024.

The Fed kept the federal-funds rate unchanged at its Wednesday meeting. The rate currently stands at a target range of 5.25%-5.50%, following 5 percentage points in hikes implemented from March 2022 to July 2023.

Today, most attention centered on whether the Fed would signal any upcoming rate cuts. Market expectations for interest rates have shifted significantly in the past six weeks, moving closer to our view that the central bank will enact heavy cuts over the next two years. The two-year Treasury yield has fallen around 0.6 percentage points in the last six weeks, while the 10-year has dropped almost a full percentage point.

Treasury Yield and Federal-Funds Rate

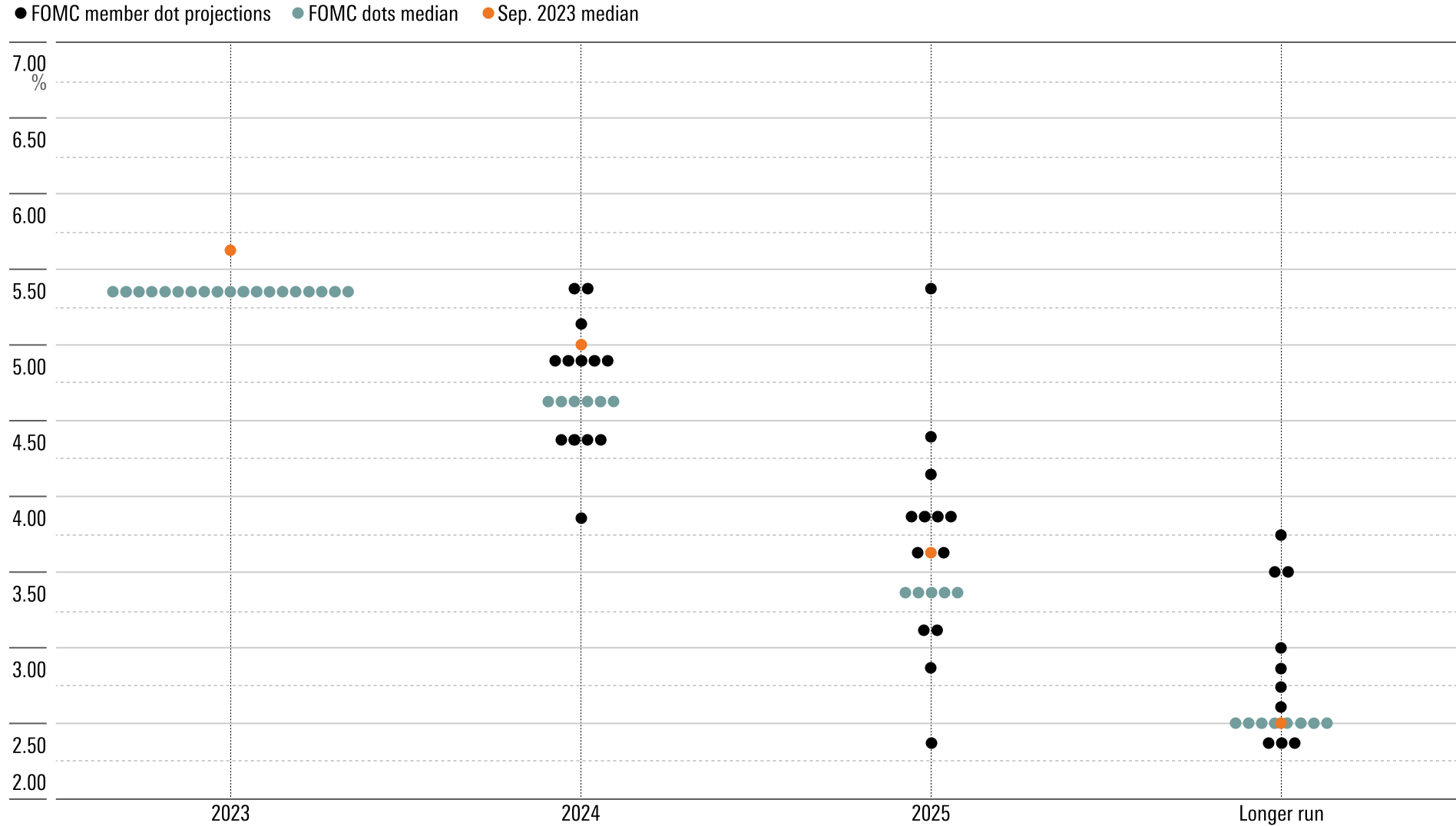

The Fed is also starting to shift its views. Updated figures released today show the median FOMC member projection is for three rate cuts in 2024, taking the federal-funds rate target range down to 4.50%-4.75% by year-end.

The Dot Plot: Federal-Funds Rate Target Level

We believe that six cuts will take the federal-funds rate down to 3.75-4.00% by year-end 2024. That is in line with the median expectation implied by the federal-funds rate futures market, according to the CME’s tracker.

A month ago, we were nearly alone in projecting a rate cut by March 2024, but that expectation is now priced into the market with a two-thirds probability. FOMC member Christopher Waller recently suggested the Fed might be ready to cut in as soon as three months if inflation continues to progress down to the Fed’s 2% target.

Federal-Funds Rate Target Expectations

While Powell cautioned today that it “would be premature to declare victory,” we believe inflation will continue to trend lower. Core PCE inflation was just 2.4% annualized in the three months ending in October. Further downward pressure should come as housing inflation normalizes. Thus, we expect year-over-year core PCE inflation to drop from 3.5% in October 2023 to 2.4% by March 2024.

Powell acknowledged that the Fed would likely cut even before hitting the 2% inflation target exactly, given the lags in monetary policy. As long as the trajectory to 2% looks clear, the central bank will have a green light to begin cutting rates.

Interest rates are currently at “restrictive” levels as assessed by the Fed (compared to its long-run expectation of 2.5%), so a large degree of normalization will be in order if 2% inflation is in sight. This will be the case even if the economy looks to avoid a recession and a concomitant rise in unemployment.

We expect core PCE inflation to fall further to 2% year-over-year in the fourth quarter of 2024, below the Fed’s current expectation of 2.4%. This will help push the Fed to cut more than its current projections suggest.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_71ef63f757f74b3aae2e7d089590e821_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)