Do Fund Managers Think Inflation Is Here to Stay?

Nobody knows how long inflation will stick around.

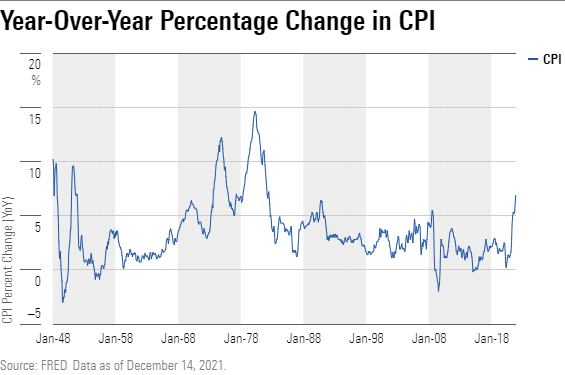

Inflation has reared its head as massive government stimulus and pent-up demand have collided with snarled supply chains in a resurgent post-coronavirus-recession economy. The Consumer Price Index has reached levels not seen since the 1970s, and even Federal Reserve Chairman Jerome Powell has stopped calling price trends transitory. Morningstar asked some of the biggest equity money managers if they think recent inflation is transient or tenacious and how their views are influencing their portfolios.

The Tenacious Camp

Many of the managers disagreed outright with the notion of transitory inflation. Charlie Dreifus, manager of Royce Special Equity RSEIX, said he believes the Fed "is enormously behind the curve" and that Powell has been hedging his wording on inflation. Despite the warning, Dreifus said that he and comanager Steve McBoyle have not changed their process. They continue to look at leverage, cash conversion, and fixed versus variable costs. He thinks companies with a lot of floating-rate debt could be in trouble if rates rise in response to inflation.

Other managers also said politics may have been behind Powell's reluctance to drop the use of the word "transitory" when referring to inflation. Bert Boksen, the manager of Carillon Eagle Small Cap Growth HSIIX and Carillon Eagle Mid Cap Growth HAGIX, said people don't want to go back to work because of the ongoing pandemic and believes workers are going to demand pay raises, putting pressure on wages over the next year. Companies that will do the best are those that can pass on the cost of higher wages and other expenses to consumers, while businesses that serve other businesses will have a harder time.

The Transitory Camp

Philip Evans of MFS International Intrinsic Value MINFX and Filipe Benzinho of MFS Institutional International Equity MIEIX agreed that inflation is a big topic but differed on its potential duration. In response to the rising concerns about runaway inflation, Evans and his comanagers have been adding gold-related stocks such as Wheaton Precious Metals WPM.

MFS International Intrinsic Value is a more eclectic, very long-term-focused strategy intently focused on downside risk. That philosophy informs its process. Benzinho's MFS Institutional International Equity also is conservative and long-term-focused, but it is designed to provide exposure to large, consistently growing, and reasonably priced non-U.S. stocks. He has less leeway to make the kind of long-term bets his colleagues at MFS International Intrinsic Value can but thinks recent inflation spikes are somewhat transitory and the result of pent-up demand and supply chain issues. Benzinho does not dismiss inflation risks but thinks his strategy's focus on companies with strong pricing power will see it through.

Juan Hartsfield of Invesco Small Cap Equity SMEAX and Invesco Small Cap Growth GTSAX thinks pandemic-induced supply chain issues have caused most of the inflation, which will eventually subside. If you peel back CPI and see what is contributing to inflation, much of it, such as car and airline ticket prices, is supply related, he said. Hartsfield and his team believe these issues are fixable and haven't changed their process.

Cathie Wood, manager and CIO of ARK Invest's suite of exchange-traded funds, is not worried about persistent inflation and thinks deflation is more likely. She expects that rapid technological innovation will reduce costs and prices in a wide swath of industries.

Somewhere in the Middle

Not all managers felt as strongly about inflation one way or the other. Ross Glotzbach and team from Longleaf Partners LLPFX said they do not live their lives waiting for a crash and they are not changing their process, which already seeks companies with pricing power.

Vanguard's recent 2022 economic and market outlook said the cyclical effects of supply constraints will persist well into early 2022 and then normalize in the second half of the year.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)