For Bond Funds, Is Core-Plus Really a Minus?

This year's turbulent fixed-income market sheds some light on the limitations of intermediate core-plus bond funds.

If you're looking to fill out your portfolio's fixed-income sleeve, the intermediate core bond and intermediate core-plus bond Morningstar Categories are logical places to start. Both categories are home to funds that invest in a diversified mix of intermediate-maturity investment-grade U.S. bonds, including Treasuries, mortgage-backed securities, and corporate bonds. Thus, they afford investors exposure to a big swath of the U.S. bond market in one fell swoop, with core-plus funds going further afield than core funds into areas like high-yield bonds, bank loans, and foreign currencies. These funds have proved to be popular with investors; the two categories combined were home to nearly $1.7 trillion in assets as of March 31, 2020.

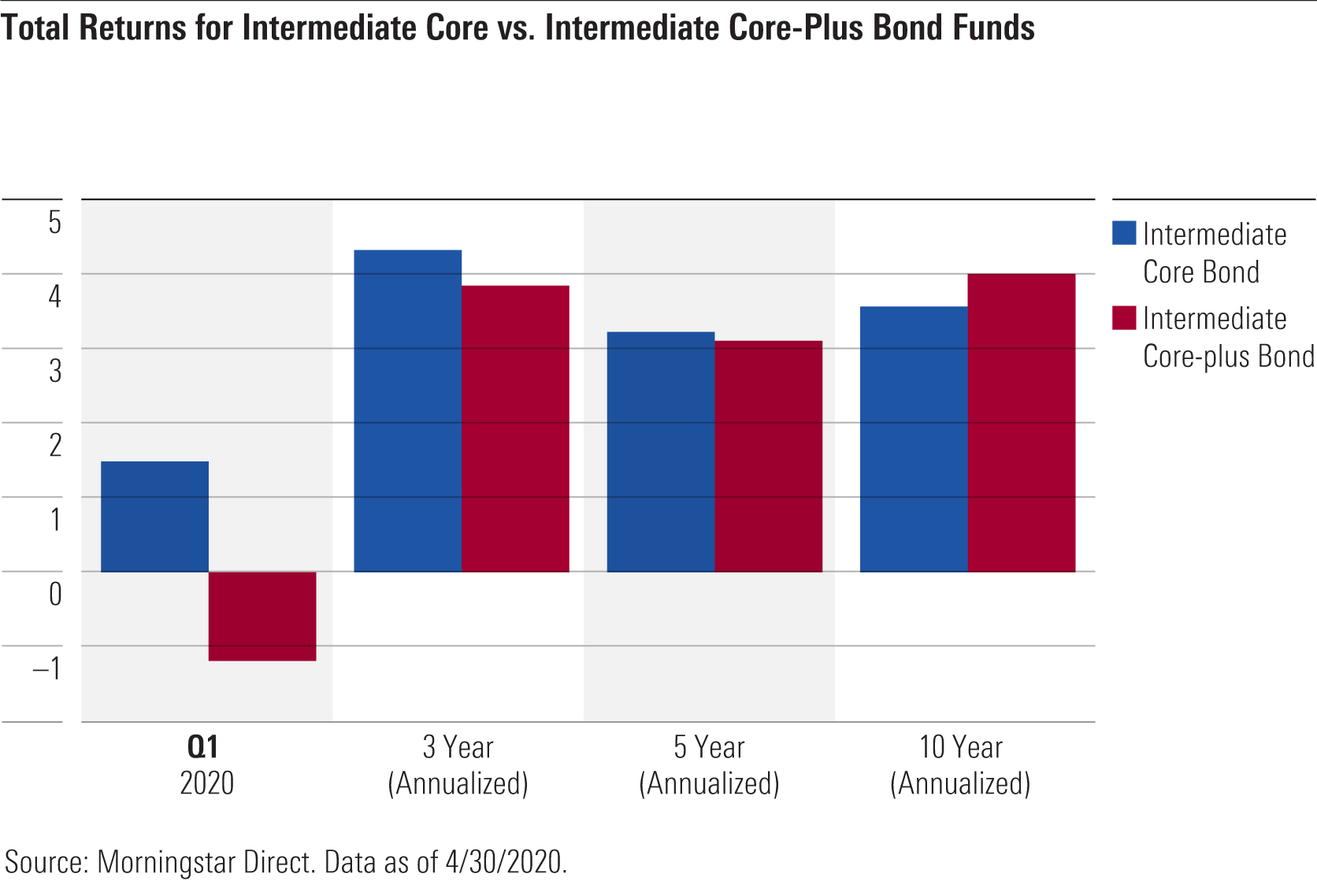

Similar but Different While the two groups look similar on the surface, the recent market sell-off has brought some important differences into stark relief. In the first quarter of 2020, the average intermediate core bond fund gained 1.49%, whereas the typical intermediate core-plus bond fund lost 1.19%. Why the divergence? Investors fled lower-quality assets for the safety of Treasuries, which were by far the best-performing fixed-income sector for the quarter. Since core-plus bond funds by definition go beyond Treasuries, it means they held more of these lower-quality bonds than core bond funds did. Indeed, investment-grade corporates were down about 3.6% for the quarter, and high-yield corporates were down even more, with losses of 12.7%.

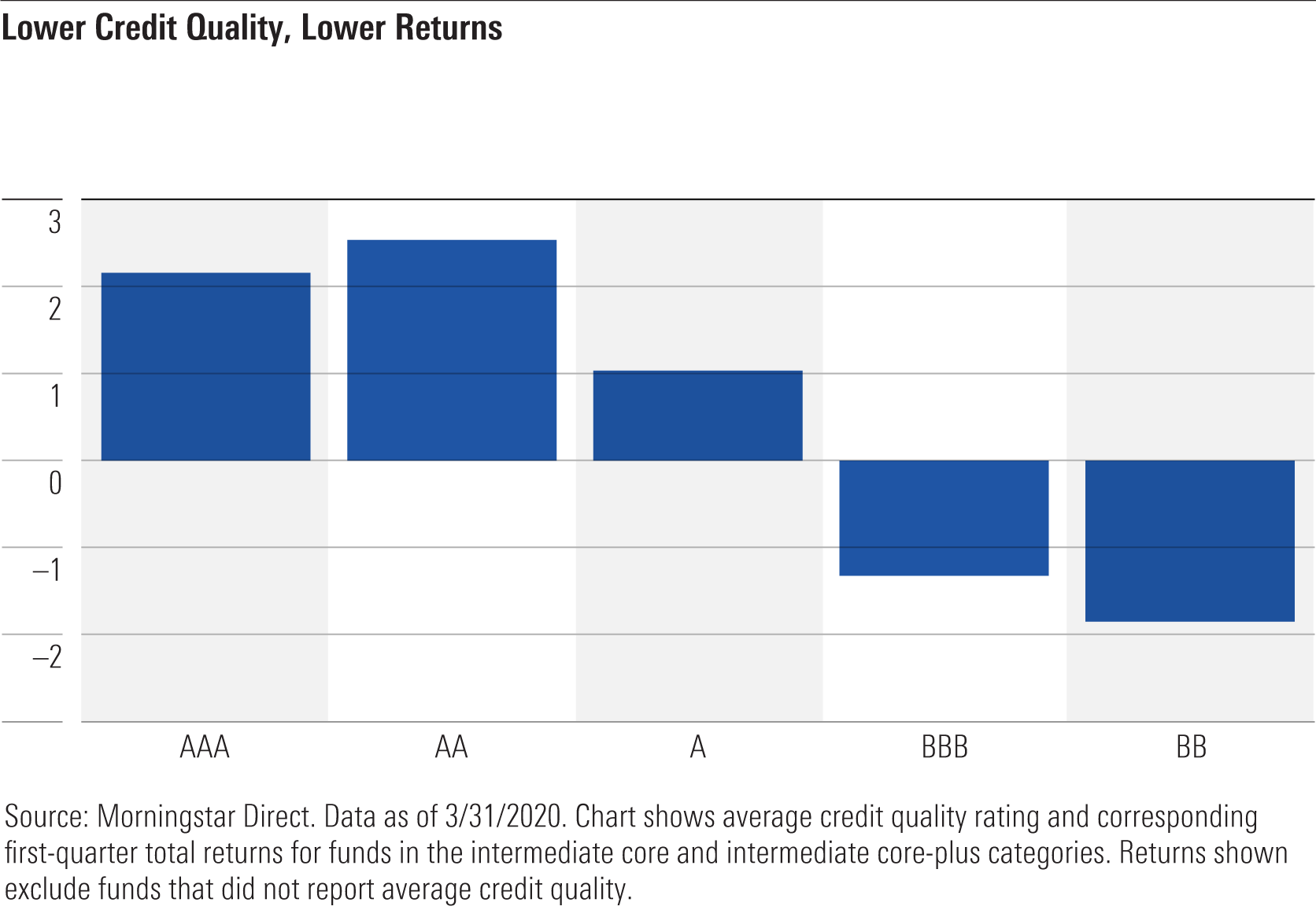

We can clearly see the relationship between first-quarter performance and credit quality in the chart below, which sorts funds in both the intermediate core and intermediate core-plus categories based on their average credit quality. Core-plus funds have shown similar patterns during previous downturns, such as the commodity and high-yield market sell-offs in the second half of 2015 and early 2016.

The Yield Advantage Of course, there are some areas where the intermediate core-plus bond category has the edge. Income generation is one. The average intermediate core-plus fund paid out 2.77% in income over the trailing 12 months ended April 30, 2020, compared with 2.42% for the typical intermediate core fund. Thanks to widening credit spreads, this yield advantage looks even more compelling now. The average SEC yield--an annualized income figure based on distributions made over the past 30 days--for intermediate core-plus funds was 2.4% as of April 30, compared with just 1.9% for intermediate core funds.

This extra income has also translated into stronger long-term returns. Over the past 10 years, intermediate core-plus funds have generated annualized returns of 4.01%, compared with 3.57% for intermediate core funds. However, this return advantage has also brought higher risk, as this year's losses for intermediate core-plus funds attest.

Role in Portfolio Because of their exposure to riskier corners of the fixed-income market, intermediate core-plus bond funds also don't excel as portfolio diversifiers. Over the past three years, the category has shown a stronger correlation with equity market benchmarks than other fixed-income categories, such as intermediate core bond and government bond. Indeed, the average intermediate core-plus fund has a correlation of 0.36 with the S&P 500, compared with just 0.12 for the intermediate core category. When the going gets tough in equities, intermediate core-plus funds are likely to feel pain at the same time. While some investors might be able to tolerate this trade-off in exchange for extra yield, it's important to keep the downside in mind.

From a portfolio construction standpoint, a key question is what role you want your fixed-income holdings to play. If you're looking for a buffer against volatility in down markets, other fixed-income categories are better suited for that role. The intermediate core bond category has a number of strong performers, such as Morningstar Medalists Vanguard Total Bond Market Index VBMFX, Fidelity U.S. Bond Index FXNAX, and Baird Aggregate Bond BAGSX. High-quality municipal-bond funds can also make sense for the taxable portion of a portfolio, particularly now that taxable-equivalent yields have edged up from earlier this year. From a diversification perspective, intermediate and long-term Treasuries are the most effective way to offset equity risk, although their rock-bottom yields may lead to lower returns going forward. If you're approaching retirement or already in retirement, you'll probably want to include some Treasury Inflation-Protected Securities exposure to help offset the risk of future inflation.

If you're looking for higher yield and long-term returns, an intermediate core-plus bond fund can fill a legitimate role in your portfolio. But as this year's performance illustrates, it's important to understand the trade-offs--and make sure you're willing to tolerate occasional losses when riskier fixed-income assets are out of favor.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)