You Might Be Invested in the Most Expensive Parts of the Corporate-Bond Market

What to know about exposure to BBB rated bonds.

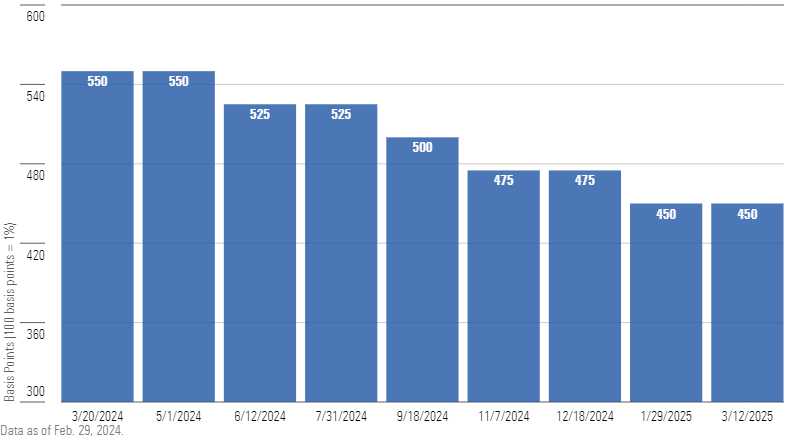

Asset managers’ expectations for the economy are all over the place, but most aren’t predicting the worst. The bond market, however, expects the Federal Reserve to cut its short-term federal-funds rate, which it usually does to avoid the risk of a recession. At the end of February 2024, bond futures prices implied expectations that the Fed will cut its federal-funds policy rate to 4.5% by the end of 2024 from its then level of 5.5%.

Futures Markets Expectations for the Federal-Funds Interest Rate

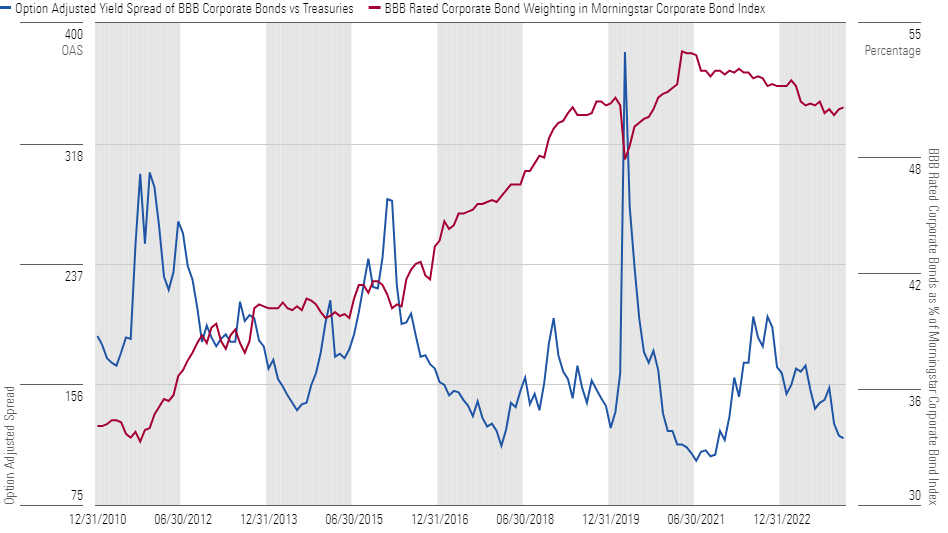

There’s a long-term shift in a corner of the bond market that could prove even more sensitive if we do wind up in a recession, though. Although corporate bonds overall are close to their long-term average weightings in the Morningstar US Core Bond Index, concentration in the sector’s BBB rated debt (the lowest rung of the investment-grade ladder) of 51% was close to its all-time high at the end of January 2024. Meanwhile, the extra yield that this market segment generates compared with US Treasuries has been lower only a couple of times over the past decade. In other words, the index has been more heavily exposed to the lowest-quality investment-grade corporates at a time when those bonds are historically around their most expensive, and therefore at greater risk of losing money if their yields simply move closer to average.

Yield Spread of BBB Rated Corporate Bonds and Percentage Weighting in the Morningstar US Corporate Bond Index

Trying to predict when a particular slice of the corporate-bond market will underperform is exceedingly difficult. And it’s possible that BBB valuations could stay rich for some time, especially if the Fed manages to pull off the elusive goal of a soft landing for the economy. Slipping into a recession, however, would likely cause pain for the economically sensitive lower tiers of the investment-grade corporate-bond universe, such as BBB rated issues. That’s not a prediction of doom—especially since trouble, in this case, could mean underperforming Treasuries at a time that yields overall are still coming down—but rather a caution that allocations to those bonds could lag more than they might have during earlier periods of economic weakness.

BBB Heavy Funds

Against that backdrop, we looked at funds with the largest exposures to BBB rated debt in the Morningstar FundInvestor 500 that are also heavily invested in corporate bonds.

There is a little good news in that many of those offerings performed within close range of their Morningstar Category averages during the 2020 coronavirus selloff, the most recent severe test of their mettle. A few of the largest funds that performed well versus their categories included Vanguard Intermediate-Term Investment Grade VFIDX, Vanguard Global Wellesley Income VGYAX, and BlackRock Systematic Multi-Strategy BAMBX.

Of course, that’s no guarantee they will perform the same way in a future crisis, but the results of such comparisons are usually indicative of a fund’s temperament.

By contrast, a handful of other Morningstar FundInvestor 500 funds heavily weighted in BBB rated debt underperformed their category averages during the coronavirus selloff, including Vanguard Long-Term Corporate Bond Index VLTCX, Loomis Sayles Investment Grade Bond LIGRX, and Loomis Sayles Strategic Income NEFZX.

None of that is meant to serve as advice to dump your funds if they have large BBB concentrations. If one or more constitute a large share of your portfolio, or if a handful of funds do, it would be worth looking to see if you have a large collective exposure to those issues. If you do, consider whether you have as much diversification as you would like.

This article first appeared in the February 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)