The S&P 500 Grows Ever More Concentrated

Does this bode well for small-value stocks?

Ahead of Their Time Entering this year, observers had long complained that the S&P 500 was overly concentrated, thereby relying too heavily on the performance of its largest positions. Such was the lament in 2016, and in 2017, and again in early 2019.

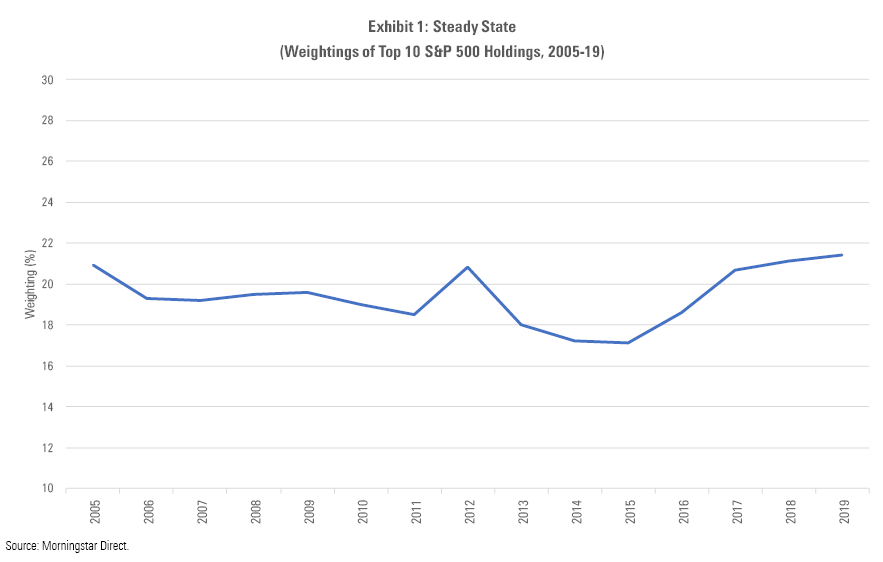

However, as measured by the size of the index’s 10 largest positions, the charge didn’t stick. The graph below depicts the cumulative weighting of Vanguard 500 Index’s VFINX Top 10 holdings, using each year’s June portfolio, from 2005 through 2019. The recent results were unremarkable, landing only slightly above the 15-year norm, and matched by two previous showings.

Of course, one can assess portfolio concentration in various ways, including by industry exposure and investment style. The amount invested in a portfolio’s largest holdings provides but one perspective. Nevertheless, it’s difficult to embrace a thesis that can’t withstand an initial, simple test. Through 2019, the S&P 500’s leading stocks weren’t commanding significantly more assets than in the recent past.

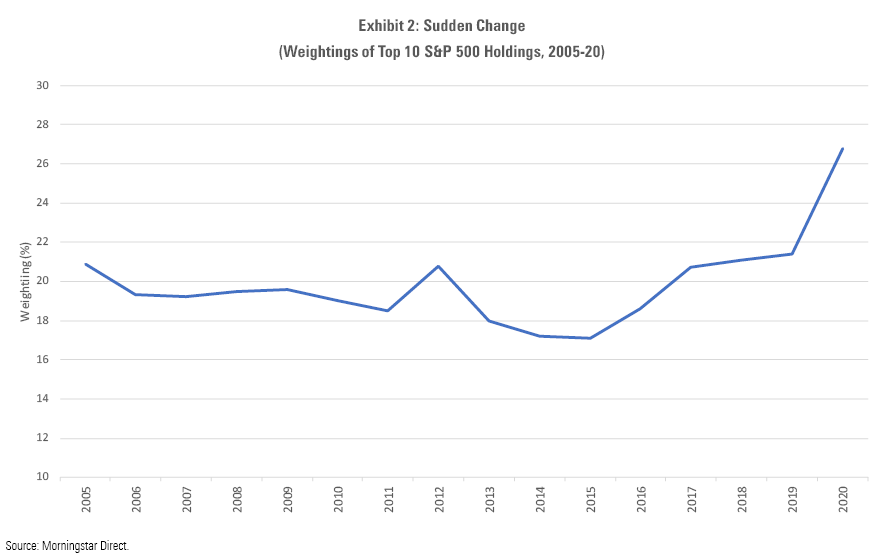

Now and Then That has since changed, in a big way. Thanks in part to gains from Microsoft MSFT, Apple AAPL, and Amazon.com AMZN, which have each appreciated by at least 48% over the trailing 12 months, the percentage of assets held by the S&P 500's 10 largest positions leapfrogged to 26%. Adding one year to the previous graph sharply alters the narrative.

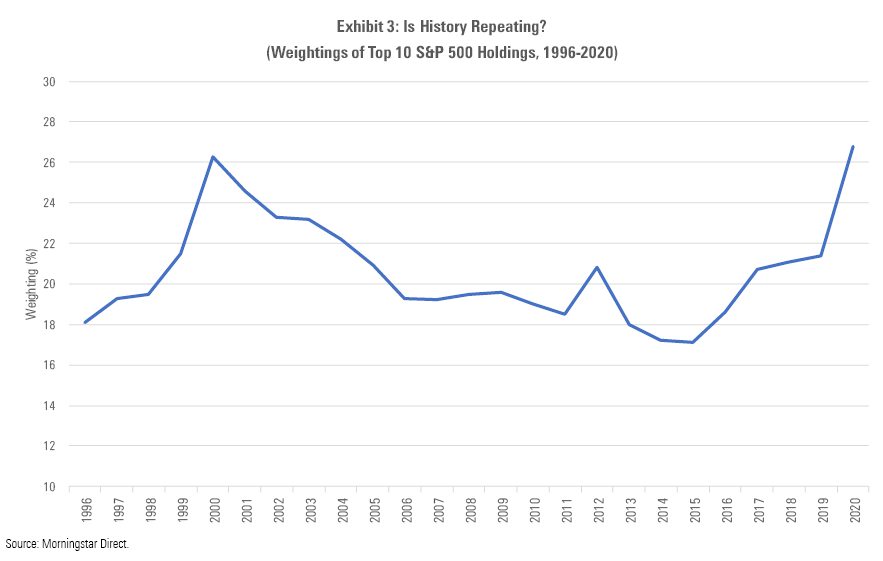

I then wondered how the picture would have looked during the New Era, when so many stock-valuation charts behaved anomalously. During that infamously speculative period, had the same pattern appeared? Indeed, it had. In June 2000, the percentage of assets held by the S&P 500’s 10 largest holdings temporarily spiked above 25%, then subsided over the next few years.

Setting a New Record As with the current leaders, the New Era's biggest firms were almost all growth stocks. One might think that usually occurs because growth companies typically command steep price/earnings multiples, which translates to higher stock-market capitalizations. But that is not necessarily so. In 2006, Exxon Mobil XOM, Citigroup C, and Bank of America BAC were three of the index's five largest positions. Half a decade later, ExxonMobil remained atop the chart, joined by such veterans as Chevron CVX, General Electric GE, and AT&T T. Exciting new businesses they were not.

Today’s list, though, is more top-heavy than that of the New Era, as well as more dependent on technology. In June 2000, no single company exceeded 4.2% of the S&P 500’s portfolio. Twenty years later, Microsoft, Apple, and Amazon each eclipse that mark. In addition, whereas tech stocks accounted for three of June 2000’s six largest positions, they currently occupy all six slots. (The seventh is Johnson & Johnson JNJ, at 1.4% of the index’s assets.)

Never, to paraphrase Winston Churchill, have so many stocks owed so much to so few. To be sure, the U.S. stock market remains the world’s deepest. Elsewhere, having 10 stocks account for one fourth of an index’s portfolio would rate as well-diversified. For example, the 10 largest holdings of the United Kingdom’s FTSE 100 Index take up 37% of its portfolio. The figures are higher yet for smaller bourses.

That said, summer 2020 has established a new American record, at least during recent memory. The top positions of the S&P 500 are at their most concentrated.

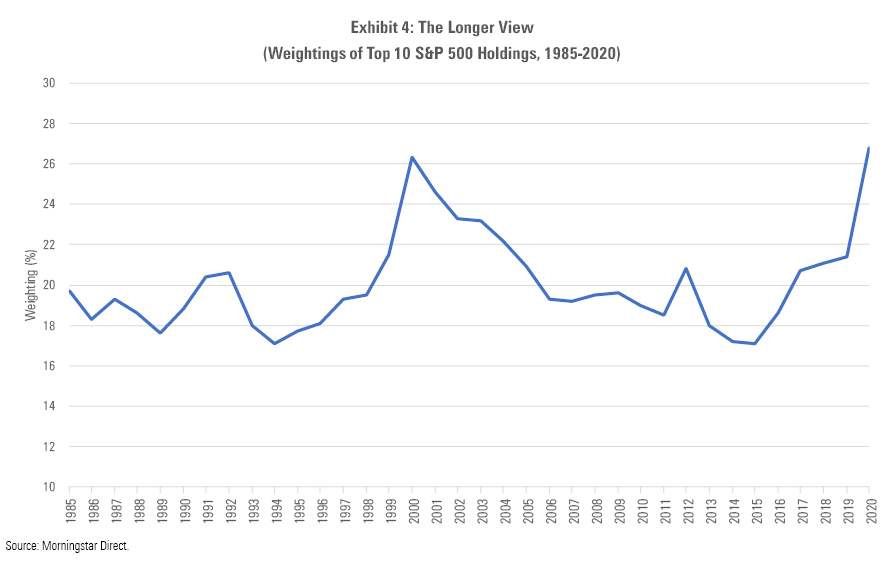

As a final test, I extended the analysis another 10 years, beginning with 1985. (I would have preferred to start with Vanguard 500 Index’s 1976 inception, but that predates Morningstar’s existence. Morningstar calculates total returns for funds that were launched before its 1984 debut but does not possess portfolio data.) The additional results strengthen the narrative. The only period that resembles today is summer 2000.

Drawing Conclusions At first glance, that final chart suggests that U.S. stocks are in big trouble. Only once before during the past 35 years has the top 10 percentage behaved comparably, and that occurred as the market was about to suffer its longest downturn over the entire time period, a shellacking that persisted (with the occasional respite) for the next two years. History does not appear to be friendly.

There are other similarities. On both occasions, tech stocks enjoyed record popularity, thanks in part to aggressive participation from retail investors. Twenty years ago, everyday investors discovered day trading, through online brokerage platforms. If recent media reports are to believed, they have now reclaimed the pleasure, spurred by the current brokerage innovation: free transactions.

Each period also follows a long string of outperformance by large-growth stocks, accompanied by poor returns from small-value companies. Over the past half-century, the two weakest showings by small-value stocks occurred during the late 1990s, and then again over the past half-decade. For many value investors, the lesson is obvious: Expect a prolonged small-value rally, at least in relative terms.

As I have written, that remains a distinct possibility. After all, the current situation not only resembles that of summer 2000, but in certain aspects exceeds it. One might reasonably expect the glamorous tech stocks to at last give way, just as they did two decades ago. On the other hand, investment history typically offers a general guideline rather than a precise blueprint. It repeats, but only vaguely.

Also, the parallels are incomplete. While S&P 500 concentration is higher today, other signs of speculation were greater in the past. The gap in valuations between the glamor stocks and small-value securities was much larger 20 years ago than it is today. Also higher was retail investors’ fervor. At the peak of the New Era, several readers sent death threats to pessimistic Morningstar researchers. This year, thankfully, has not resuscitated that trend.

My take: This column’s findings add another tally to small-value stocks’ ledger. They appear to be the soundest bet among U.S. stocks over the next three to five years. However, the evidence is not yet overwhelming.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)