33 Undervalued Stocks

Here are our analysts’ top ideas in each sector this quarter.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

The S&P 500 staged a remarkable comeback in the second quarter, rising 20% in just three months. We think stocks overall are about fairly valued: The median stock in our North American coverage universe traded at just a 5% discount to our fair value estimate at the end of the second quarter, compared with a 20% discount at the end of the first quarter.

"Of the roughly 800 North American stocks we cover, 34% carry an undervalued rating of 4 or 5 stars," observes Jeffrey Stafford, Morningstar's director of North American equity research, in his latest stock market outlook. "Three months ago, a hefty two thirds of our coverage was undervalued."

Stocks in the technology and healthcare sectors are starting to look expensive, adds Stafford, while plenty of opportunities remain in energy and consumer cyclical stocks.

Here are some specific undervalued stocks across sectors that are among our analysts' best ideas.

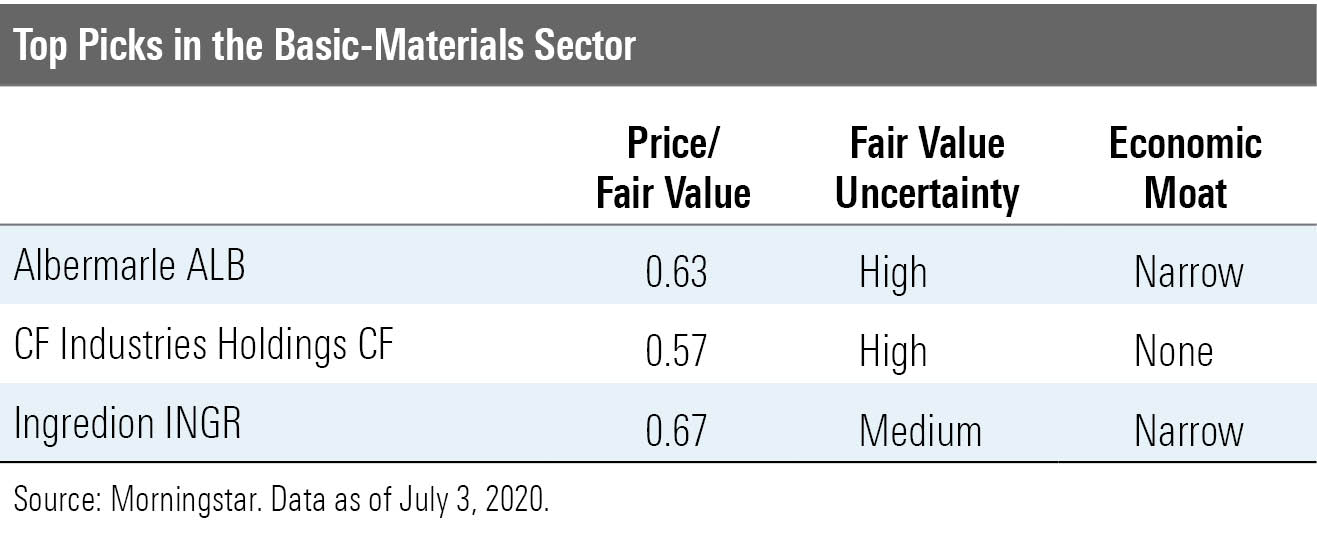

Basic Materials About one third of the stocks in the basic-materials sector are undervalued, notes director Kristoffer Inton. We think stocks in the agricultural and chemicals industries hold the most value today.

"Because of more favorable weather this spring, crop plantings for both corn and soybeans, which account for most acres planted in the U.S., are well ahead of recent historical averages," reports Inton. "Further, South American farmer economics remain solid." And although the pandemic will lead to reduced lithium demand this year, we expect the decline to be short-lived.

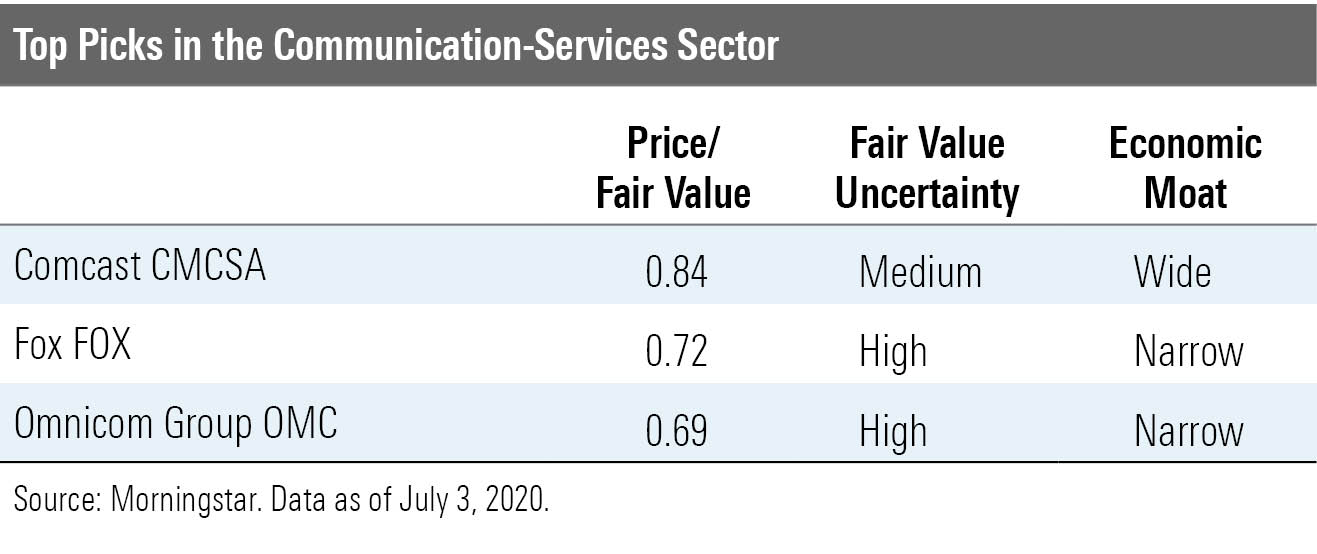

Communication Services We think traditional television and advertising names hold the most opportunity in the communication-services sector, notes director Mike Hodel.

"The market appears concerned with two primary factors: the accelerating decline in traditional television customers and the potential for a very sharp drop in advertising revenue during the pandemic," he explains. But we think older consumers and dedicated sports fans will lend stability to the pay-television market, and we expect advertisers to return to the television medium as the economy recovers.

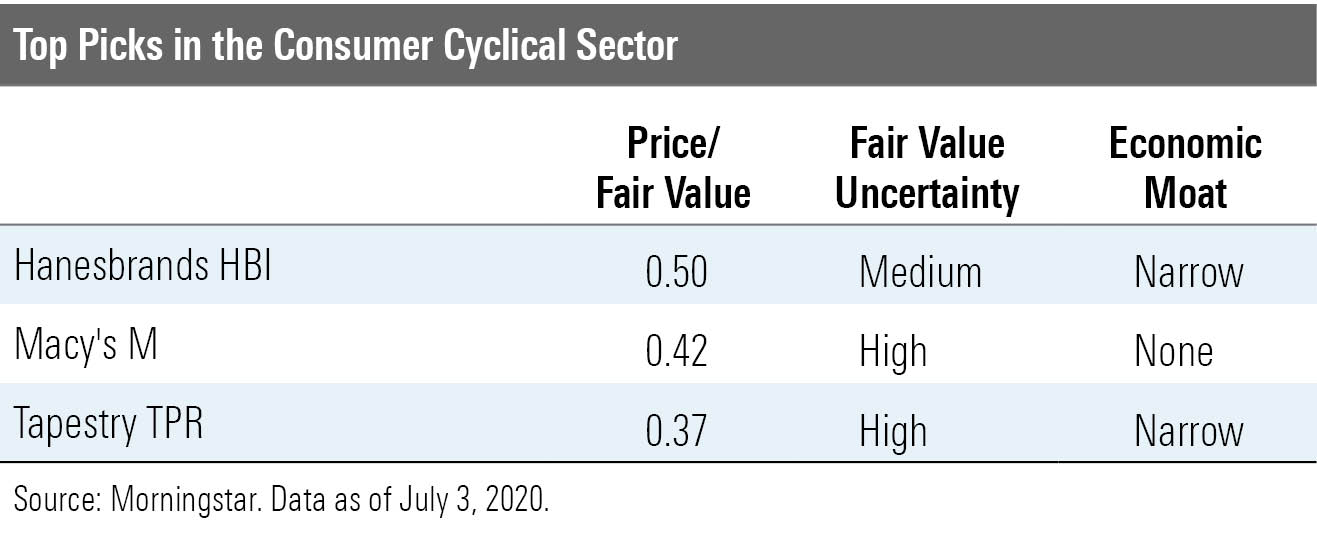

Consumer Cyclical We see plenty of opportunity in the travel and leisure industries, with more than half of the names we cover trading in 4- and 5-star range, says director Erin Lash.

"As states start to lift mandatory lockdowns, which has extended to include the reopening of nonessential businesses, we think consumers' pent-up demand could aid the trajectory of these more discretionary operators," she argues. And although we have seen a moderation in the decline of U.S. chain restaurant traffic, we expect uneven patterns to persist this year, as they may need to reduce capacity again.

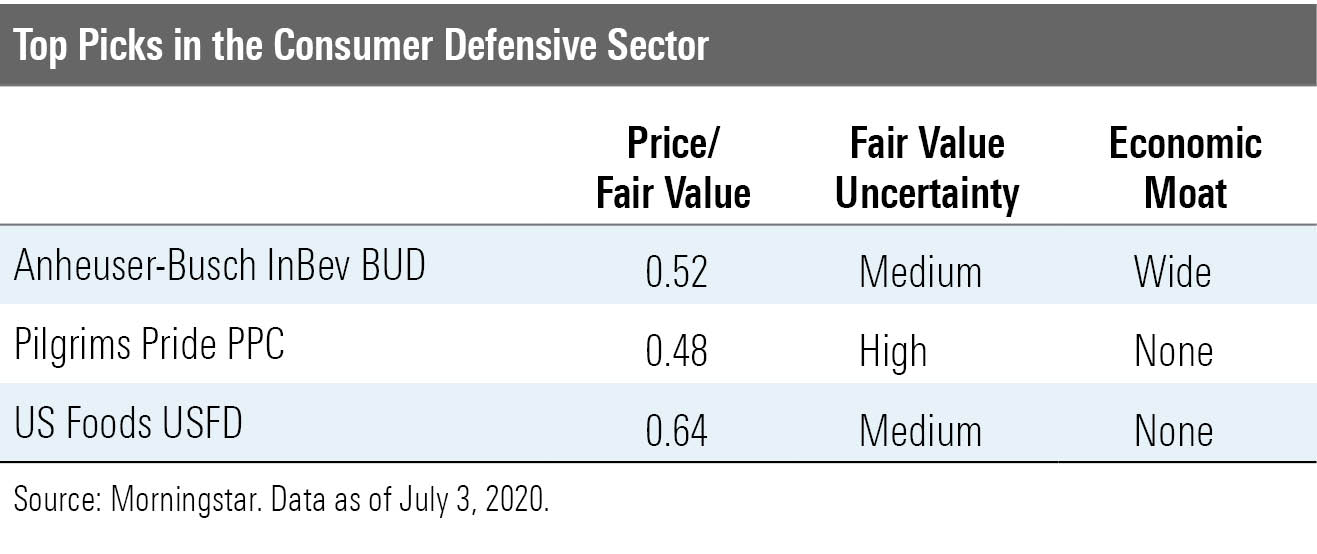

Consumer Defensive The sector certainly became more heated last quarter, asserts Lash, with the median stock in our coverage universe trading at just a 1% discount to our fair value estimates, versus a 14% markdown the quarter prior. The tobacco and alcoholic beverage industries look attractive, though, trading at 26% and 16% discounts, respectively.

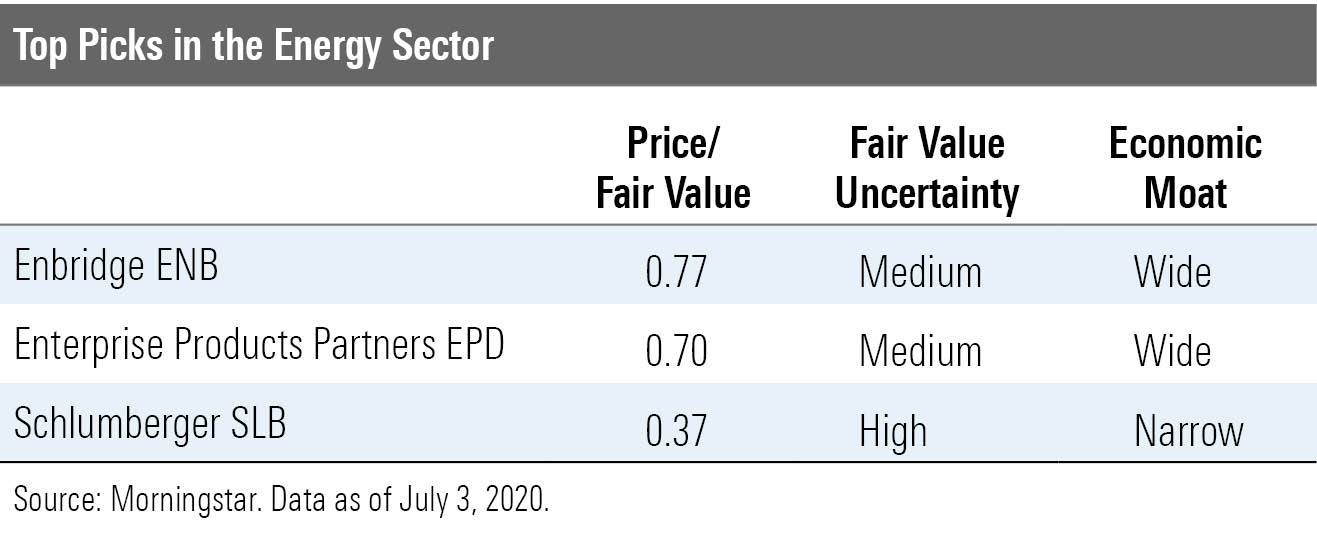

Energy The energy sector remains undervalued, trading at a 23% discount to our fair value, points out director Dave Meats.

"The energy industry still faces a very difficult environment, but the outlook brightened somewhat during the second quarter," says Meats. Most of the economies around the world are showing signs of reopening, suggesting that the worst of the pandemic-related collapse in oil and gas consumption is likely over. We expect crude stockpiles to drift back to normal levels in 2021 and therefore are sticking with our midcycle price estimates of $55 per barrel for West Texas Intermediate and $60 per barrel for Brent.

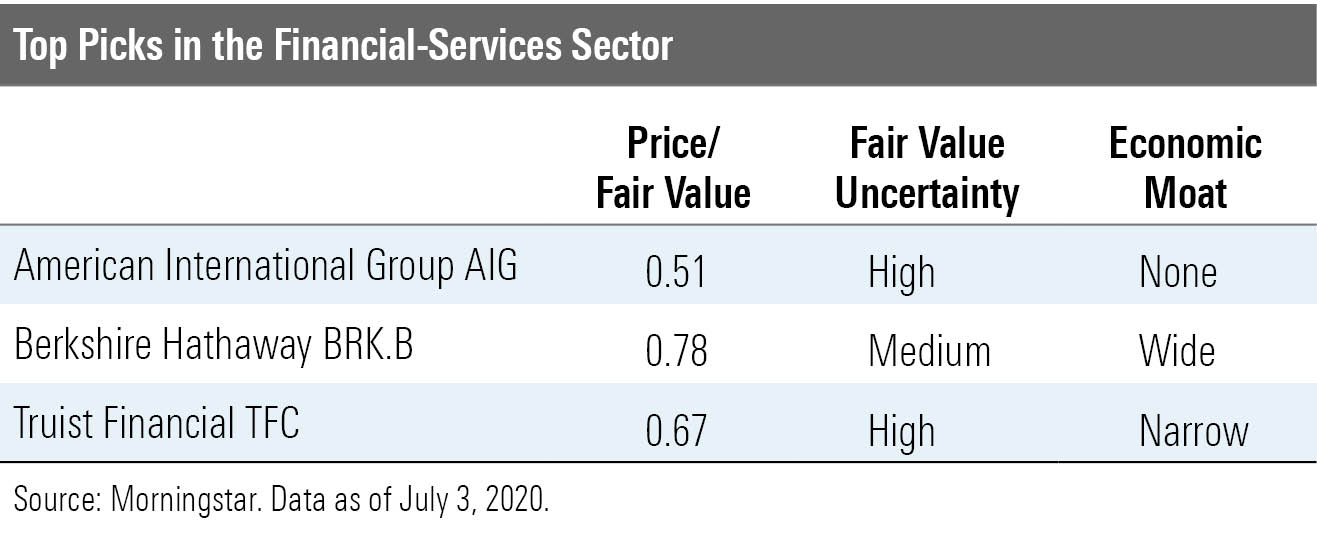

Financial Services Stocks in this sector still trade at an 11% discount to our fair value estimate, compared with a 30% discount one quarter earlier, reports director Michael Wong.

"With our assessment that many financials sector stocks are less undervalued than they were a quarter ago, investors should be much more discerning of which stocks they choose and cognizant of the risks they're taking," he warns. Banks remain the most undervalued industry in the sector according to our metrics--and we think most are good long-term investments despite short-term negatives.

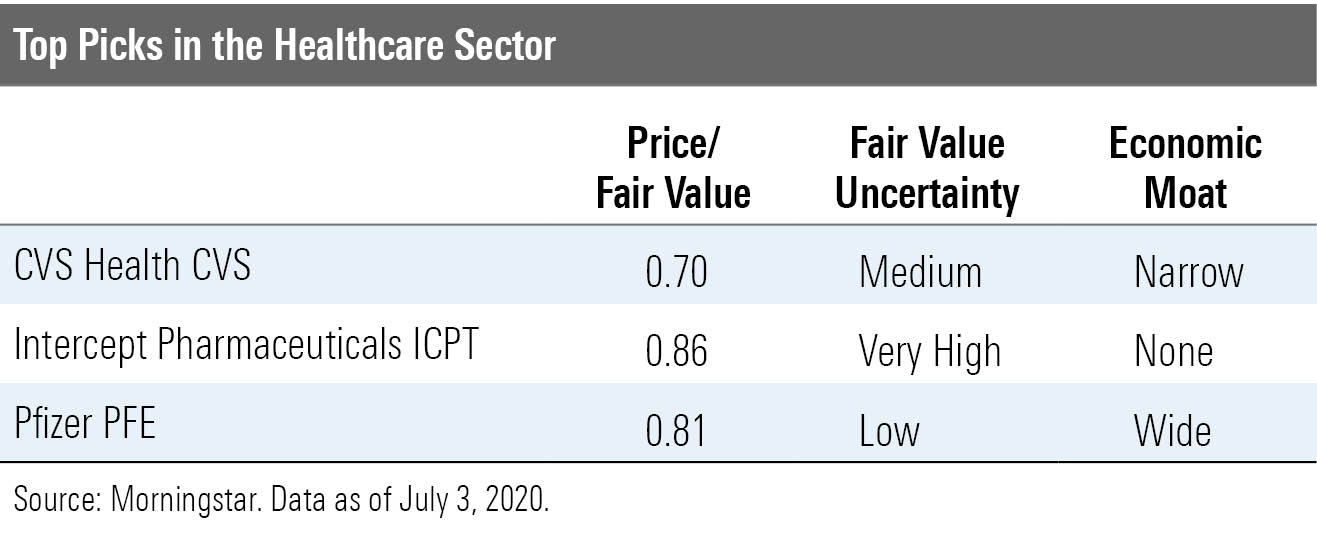

Healthcare The median stock in our healthcare coverage universe trades at a 6% premium to our fair value estimate, and less than one fourth of the stocks we cover land in 4- or 5-star territory, summarizes director Damien Conover. We're finding the most opportunity among drugmakers and managed-care firms.

"On the policy front, we expect investor attention to return to potential changes in the U.S. with the upcoming elections," he maintains. "However, the fears of a major healthcare policy change in the U.S. appear to have faded, with the more moderate Joe Biden being the presumptive Democratic nominee for president."

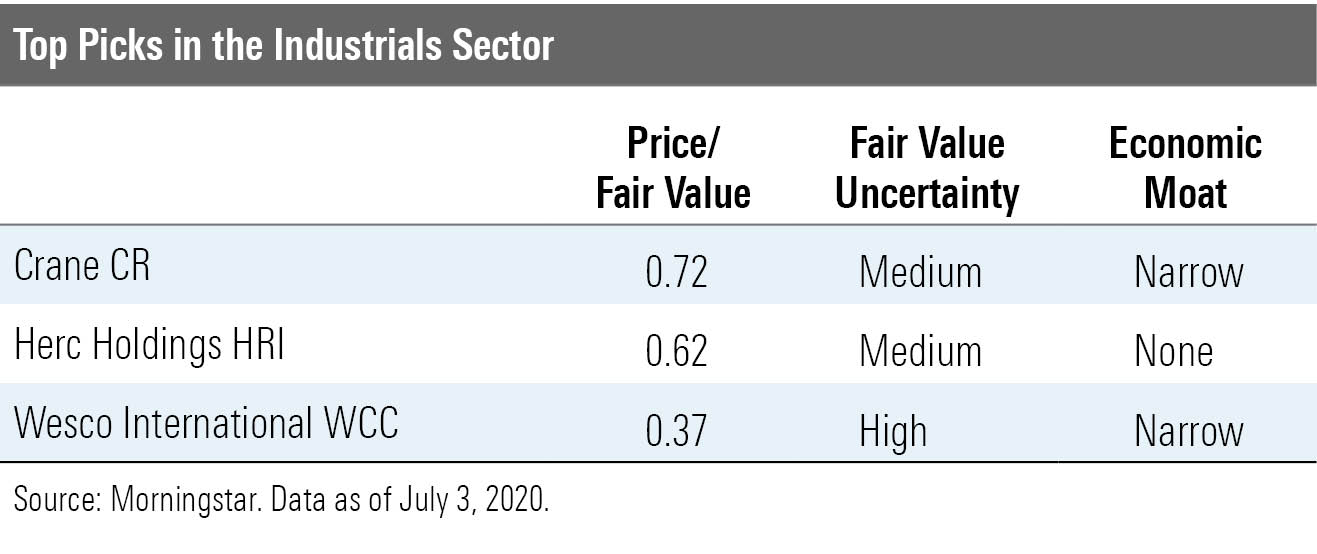

Industrials About 20% of our U.S. industrials coverage looks undervalued to us, with the most attractive investment opportunities across the aerospace and defense, construction, and industrial distribution industries, says director Brian Bernard.

"We expect industrial production will continue to rebound as the U.S. economy recovers, which will benefit manufacturing and industrial distribution companies," he suggests. In addition, the housing market has been a bright spot during the pandemic, and a potential infrastructure bill would be a boon for construction-oriented industrials companies.

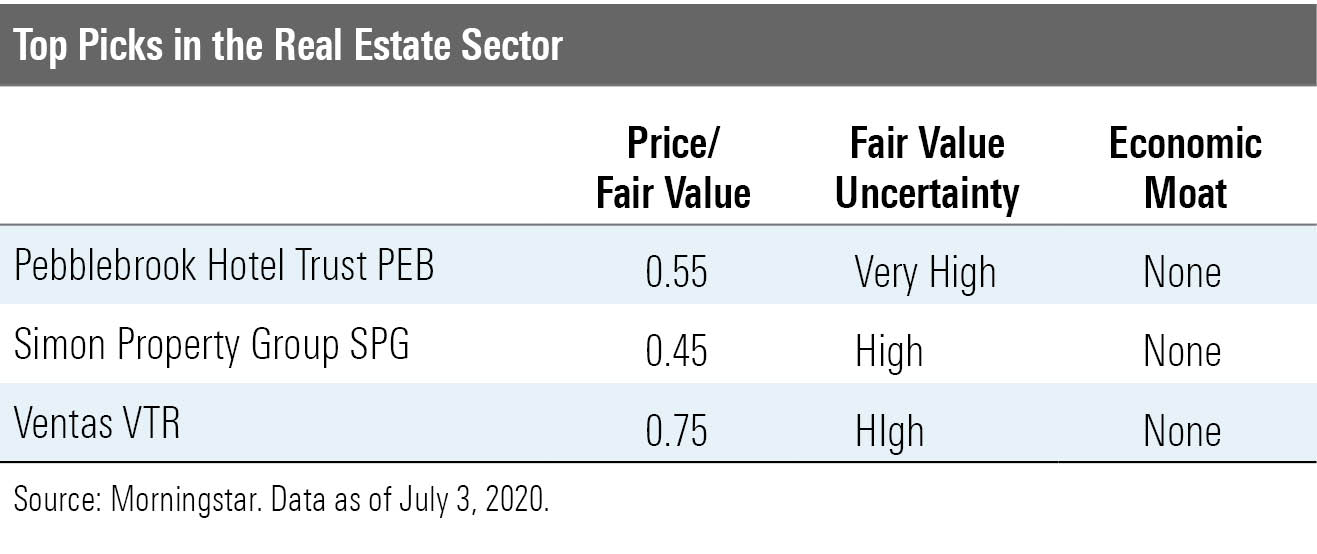

Real Estate Real estate stocks are trading at a significant 19% discount to our fair value estimate, with nearly half of our coverage carrying 4- and 5-star ratings, reports analyst Kevin Brown. "We have seen significant bifurcation in the performance of the different real estate subsectors," remarks Brown. "Sectors that are more sensitive to the impacts of the coronavirus have seen significantly worse total return performance year to date."

The industrial and self-storage sectors have outperformed the broader real estate sector. However, we currently see some of the best values among the hardest-hit parts of the market: the hotel, mall, and healthcare sectors. We expect all to rebound and see years of strong growth once the global crisis is over.

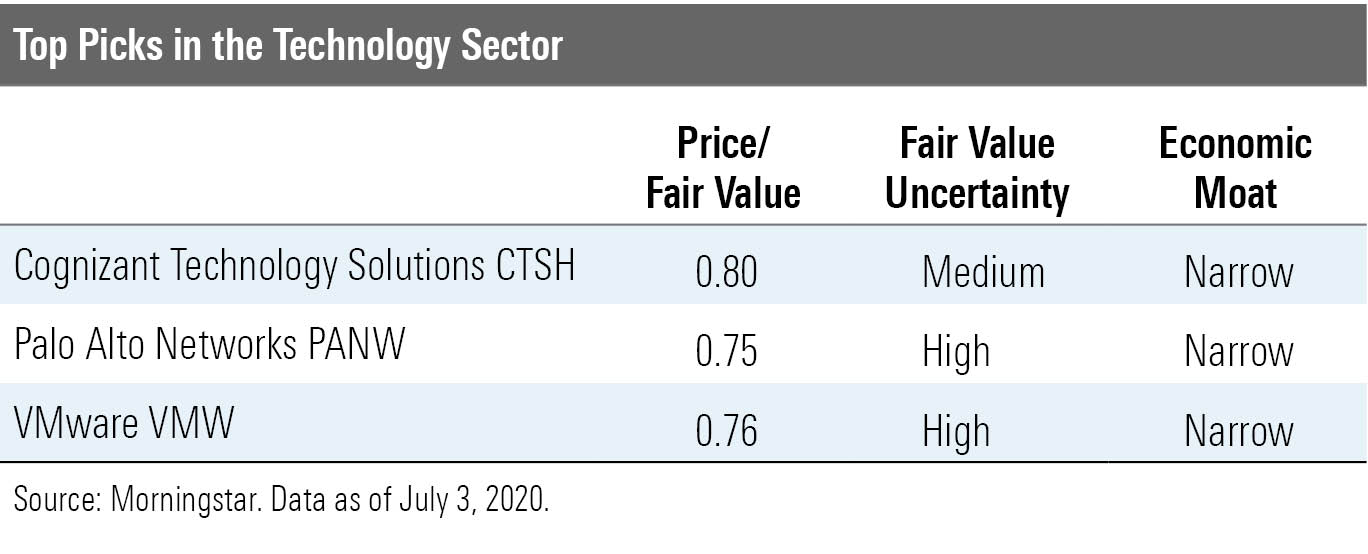

Technology The average tech stock in our coverage universe is about 6% overvalued, which is a dramatic change from just one quarter earlier, when the sector traded at a 20% discount to our fair value estimate, says director Brian Colello. Hardware is the cheapest subsector today. However, we like high-quality software names and cybersecurity firms and would look for opportunities in both pockets during times of market weakness.

"The long-term tech story is compelling, as the pandemic might be accelerating the trend toward cloud computing, remote working, and other technology productivity solutions," posits Colello.

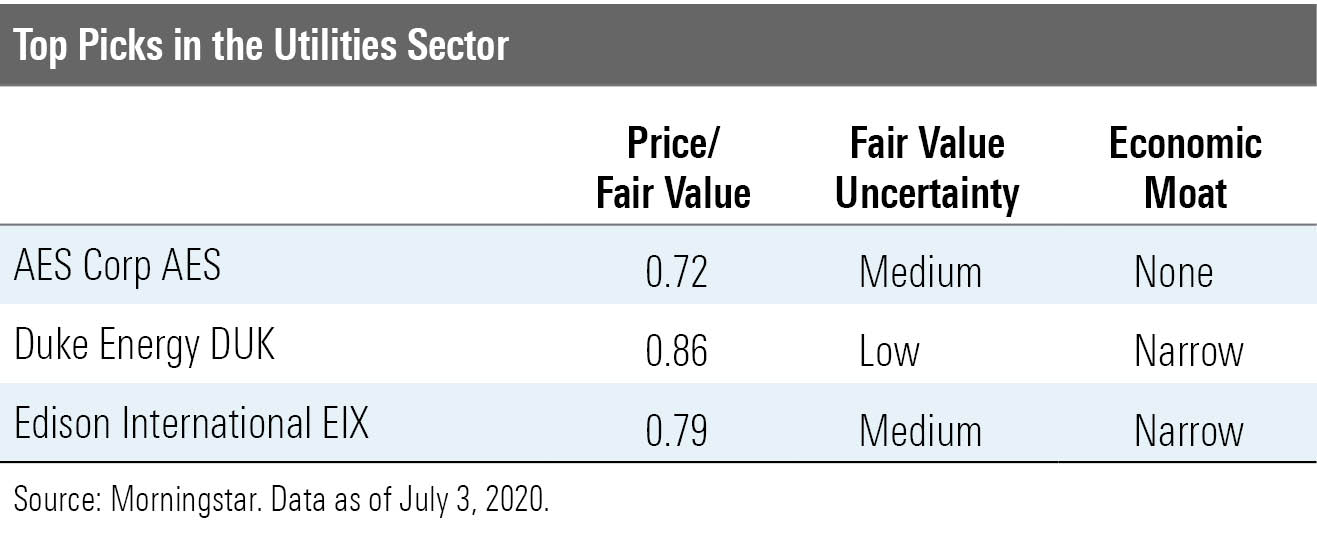

Utilities After trading well above fair value, utilities valuations fell back to earth during the second quarter and now trade close to fair value, observes strategist Travis Miller. However, the sector's fundamentals remain strong, and we see renewable energy as this decade's growth opportunity. We think that utilities that ignore renewable energy will likely disappoint on the growth front.

“Several utilities are attractively priced after the revaluation, which means investors finally have opportunities to add high-quality, stable income and growth to their portfolios by buying utilities,” he adds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)