Finally, Some Buying Opportunities in Utilities

Coronavirus had an effect on second-quarter earnings, but utilities' long-term outlook remains strong.

Utilities are back to their normal, boring selves. And that’s not a bad thing for investors who want steady, growing income without taking a huge valuation risk.

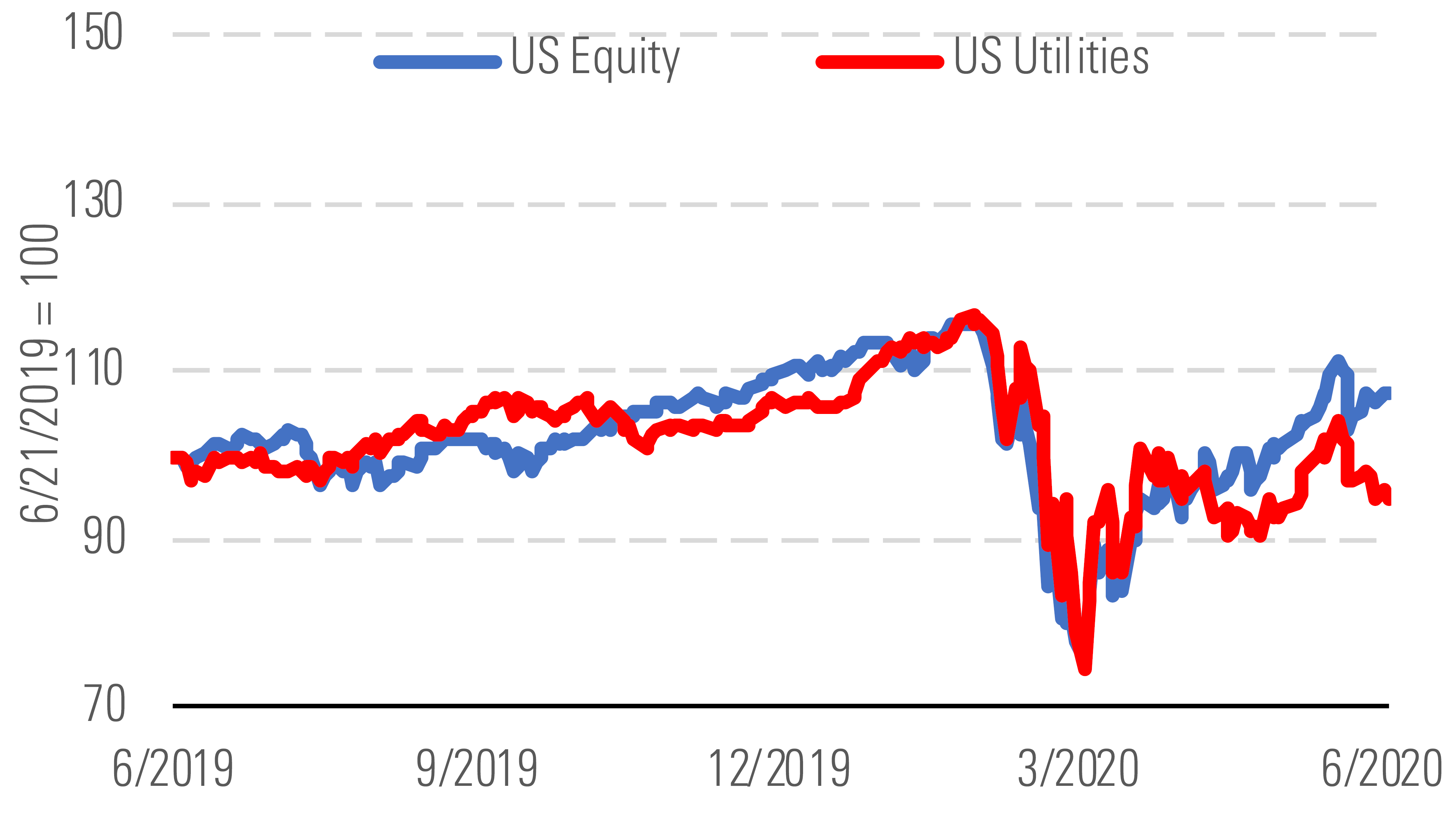

Utilities have lagged the market recovery since April. - source: Morningstar

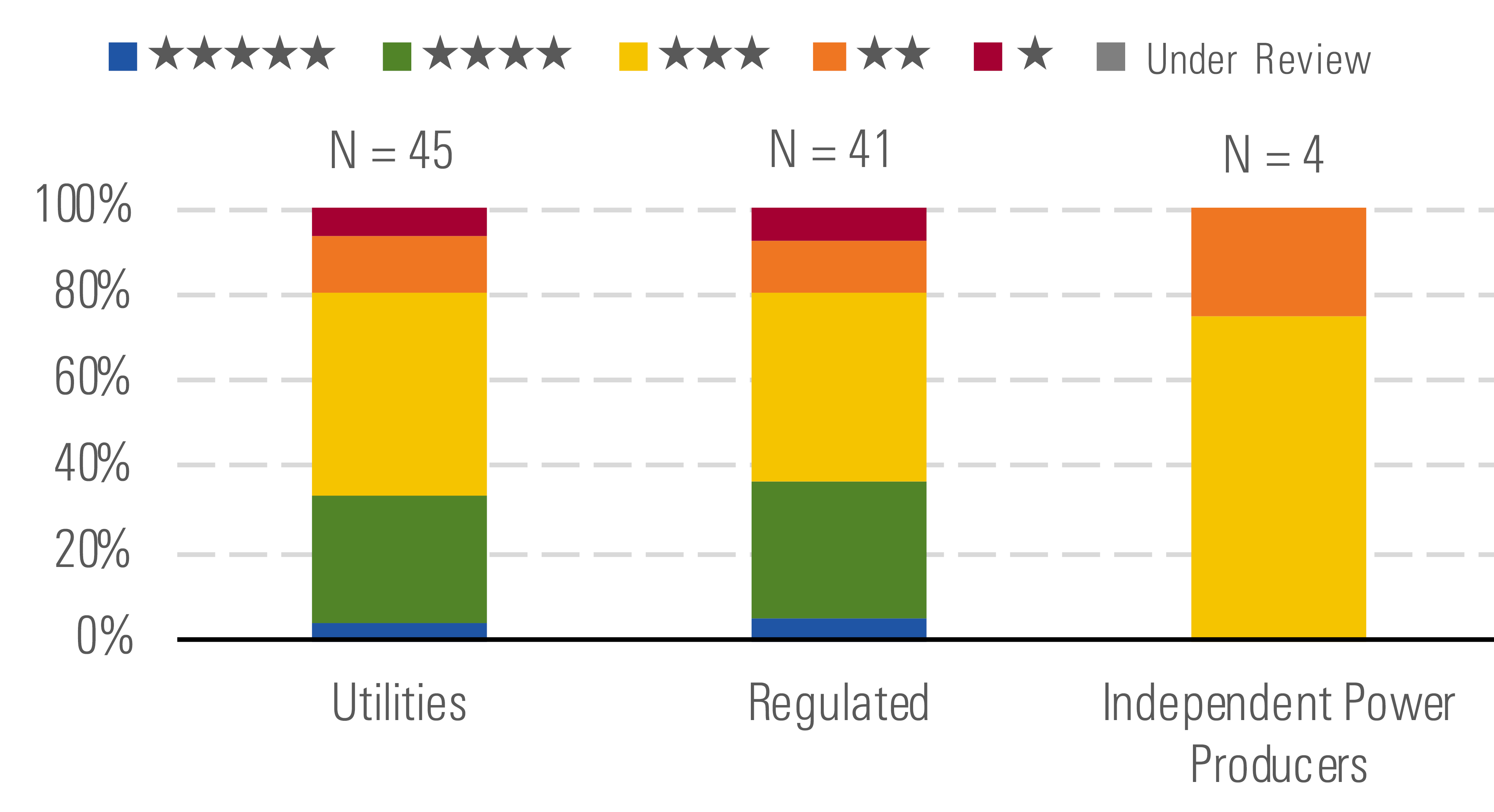

Until mid-February, utilities had trounced the market since early 2018, climbing to all-time high valuations based on Morningstar’s fair value estimates. But frothy valuations now appear to be history. Utilities fell 37% from their February peak and missed out on much of the market’s second-quarter rally. The sector has traded near our fair value estimate on a median basis since May. Several utilities are attractively priced after the revaluation, which means investors finally have opportunities to add high-quality, stable income and growth to their portfolios by buying utilities.

Moderating utilities valuations open more buying opportunities. - source: Morningstar

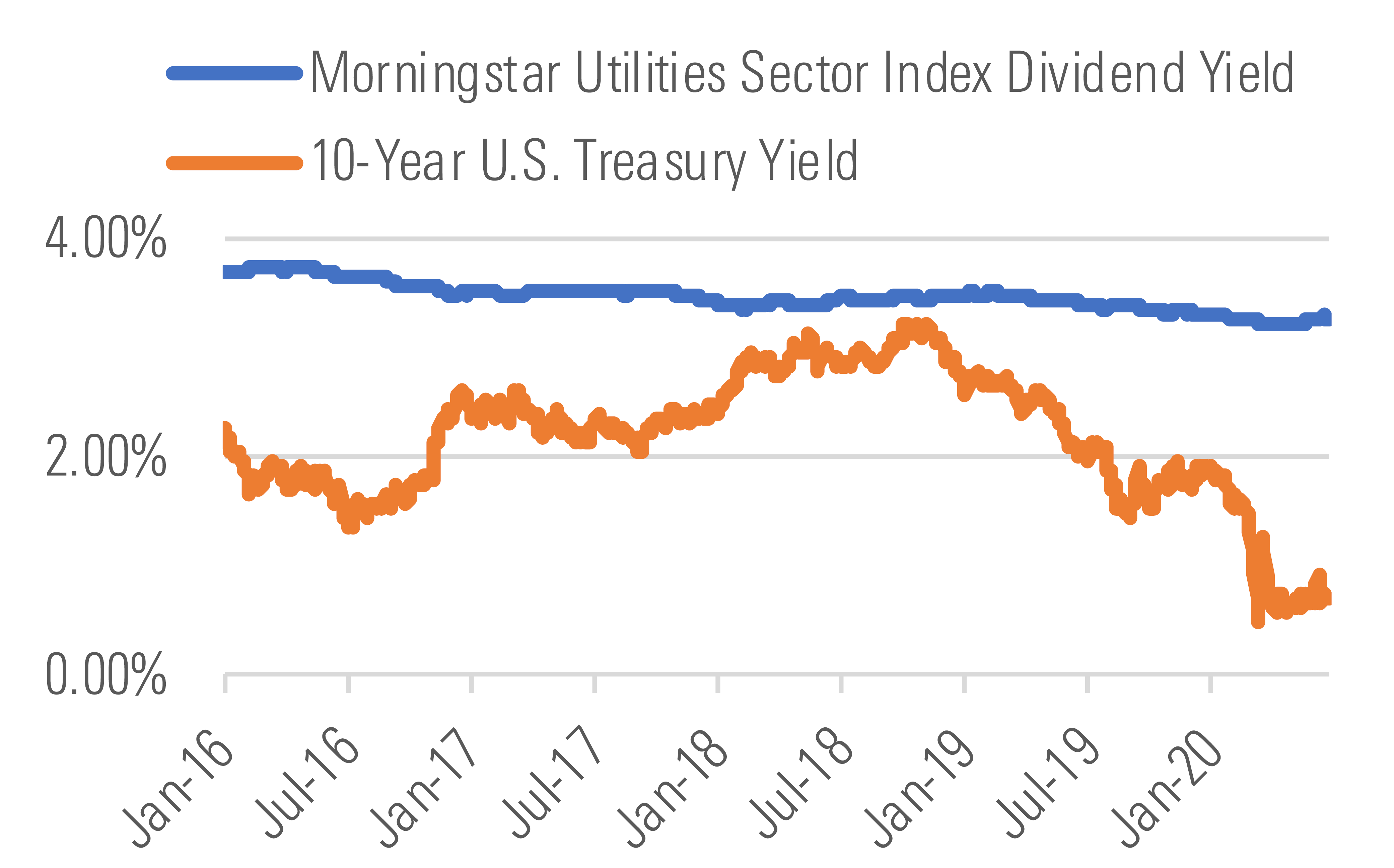

Utilities still a good place to turn for yield. - source: Morningstar

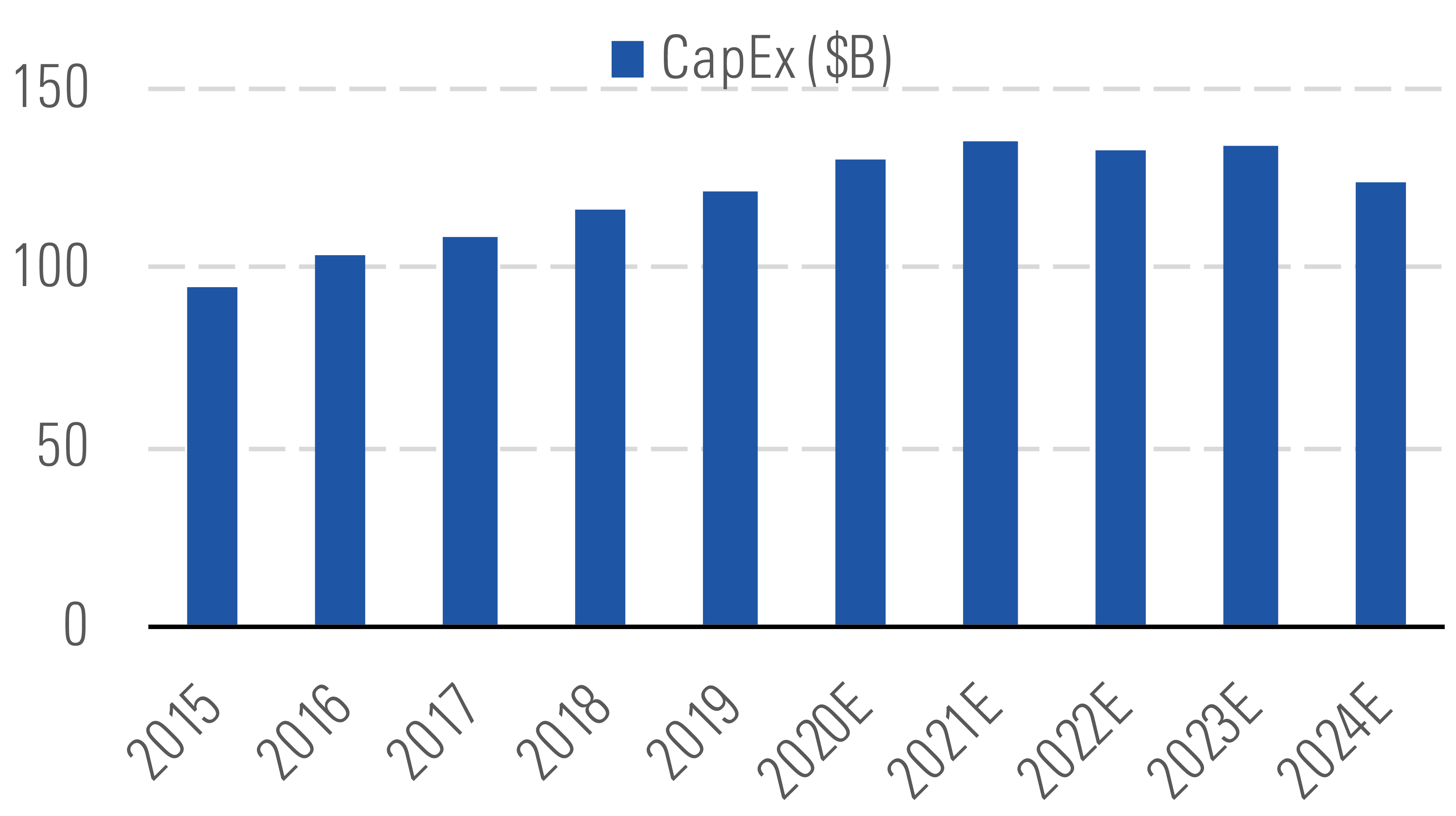

The sector’s fundamentals remain strong. The coronavirus economic disruption has been little more than a blip for most utilities. Big swings in electricity demand will weigh on second-quarter earnings, but normal summer weather and business reopenings should erase any fears of big earnings shortfalls. Most management teams are sticking with their long-term investment plans. We continue to forecast 5% annual growth across most of the sector.

Our sector growth outlook and utilities’ current dividend yields well above 3% offer compelling total returns, especially as interest rates have continued to fall through May and June. The 3.6% yield for the Morningstar Utilities Sector Index was a record-setting 290-basis-point premium to the 10-year U.S. Treasury yield as of late June. Some high-quality utilities with well-covered dividends and strong balance sheets now yield more than 4%, double that of the Morningstar US Market Index.

Utilities’ capital investment plans support 5% industry growth. - source: Morningstar

Natural gas infrastructure development underpinned much of the sector’s growth during the last decade. Renewable energy will be this decade’s growth opportunity. Utilities that are more aggressive, with billion-dollar investments in projects like offshore wind and utility-scale batteries, could be big winners, but delays or cost overruns could stretch the balance sheet and stall dividend growth. Conversely, utilities that ignore renewable energy will likely disappoint investors with lackluster growth. Investors should keep a close eye on policymaking and regulatory support to determine winners and losers.

Top Picks

Edison International EIX Economic Moat Rating: Narrow Fair Value Estimate: $70 Fair Value Uncertainty: Medium

California political risk will always be a concern for Edison. However, the state's progressive energy policies also create more growth opportunities for Edison than for most other U.S. utilities. Edison’s electric-only business, recent regulatory success, and $5 billion annual investment plan give us confidence that it can grow earnings 6% beyond 2020. Edison has stakeholder support to harden the grid against natural disasters, integrate renewable energy, and support electric vehicle adoption. Now with the stock trading at a sizable discount to its peers and a 5% yield, Edison offers a triple play of value, growth, and income.

AES AES Economic Moat Rating: None Fair Value Estimate: $20 Fair Value Uncertainty: Medium

AES has narrowed its geographic and business focus with a growing share of earnings in the U.S. The company has a stronger balance sheet, a rapidly growing renewable energy business, and a well-positioned battery storage joint venture with Siemens. In 2011, only 10% of pretax contribution to the parent was from the U.S. AES has about 5 gigawatts of renewable energy projects under construction or with signed power purchase agreements, many in the U.S. We expect these projects and investments in utility infrastructure will lift U.S. earnings to about half of consolidated earnings by 2024. This will provide more stable cash flow from moaty U.S. businesses that will benefit from our bullish view of renewable energy growth.

Duke Energy DUK Economic Moat Rating: Narrow Fair Value Estimate: $95 Fair Value Uncertainty: Low

We think Duke Energy’s valuation discount to peers is unjustified given its favorable regulation and our outlook for consistent earnings and dividend growth. Florida regulation supports sector-leading allowed returns on equity, automatic base-rate adjustments, and good growth potential. North Carolina continues to support Duke’s growth investments in electric and gas transmission and distribution infrastructure. South Carolina's recent rate-setting decision was disappointing, but we think Duke has enough growth in the state to compensate. We expect the Atlantic Coast Pipeline to withstand legal challenges, but Duke’s remaining capital commitment represents just 4% of its five-year investment plan.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)