15 High-Quality Companies With Exceptional Leadership

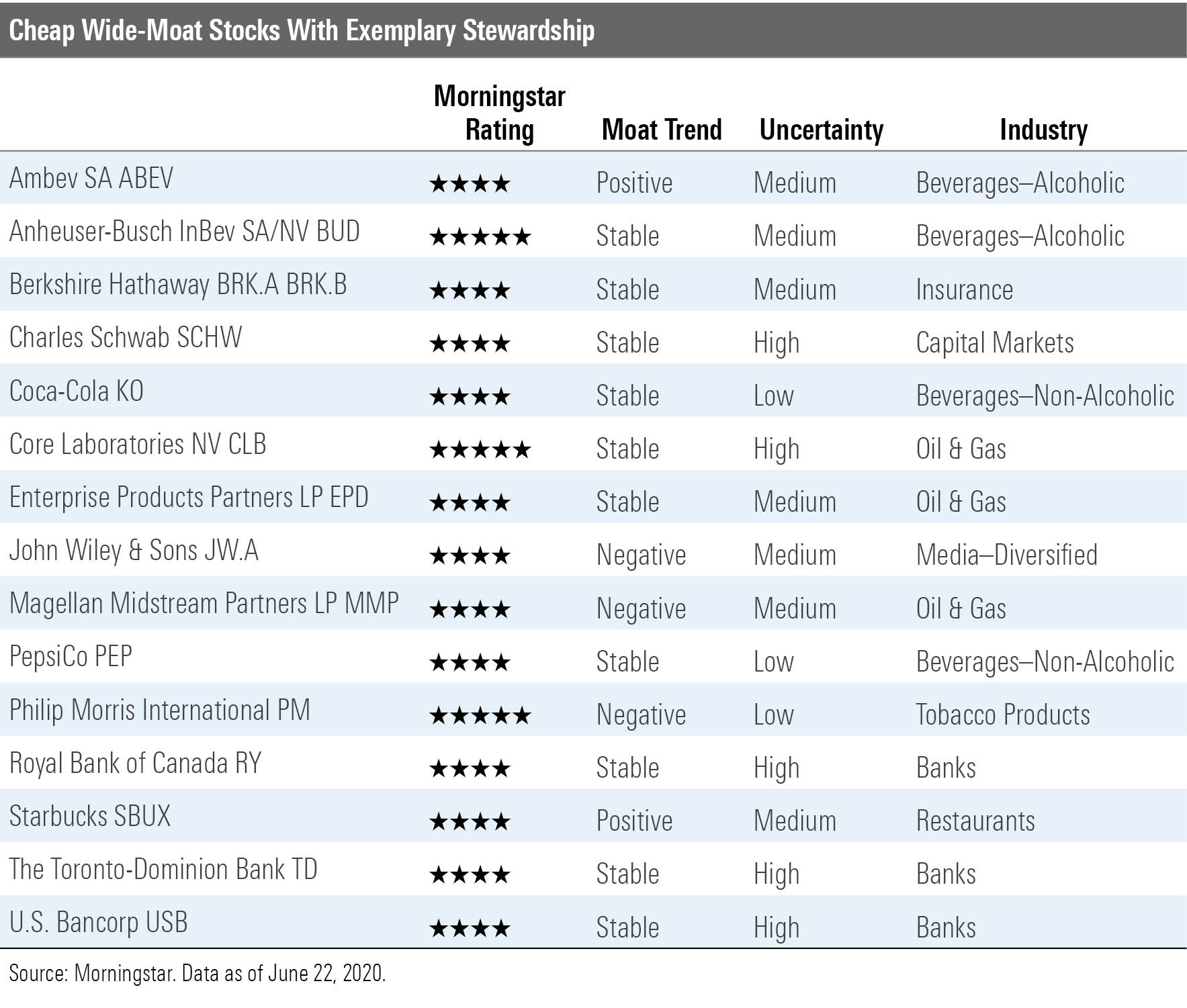

These wide-moat firms all earn Exemplary stewardship ratings and trade in 4- and 5-star range.

Presidential historian Doris Kearns Goodwin spoke at the 2019 Morningstar Investment Conference. Her topic--which is also the focus of one of her books--was leadership in turbulent times. Specifically, the Pulitzer Prize winner examined leadership as it related to four U.S. presidents: Abraham Lincoln, Theodore Roosevelt, Franklin D. Roosevelt, and Lyndon B. Johnson.

These legends took different paths to reach the pinnacle of political leadership, says Goodwin. Further, their unique approaches fit the historical moment during which they led, just as a key fits a lock. She writes: "While there is neither a master key to leadership nor a common lock of historical circumstance, we can detect a certain family resemblance of leadership traits as we trace the alignment of leadership capacity within its historical context." Similarly, at Morningstar we'd argue that great corporate leaders can take many different paths to get where they are. But there are a few things that, for us at Morningstar, define great corporate leadership.

We think great corporate managers are those who master their roles as stewards of investor capital. Such leaders make investments and acquisitions supporting the competitive advantages and core businesses of their companies--and they won't pay an arm and a leg to do so. They'll divest underperforming or noncore businesses. They'll find the right balance of investing in the business and returning cash to shareholders via dividends and share repurchases. And they'll assemble a portfolio of attractive operating assets and skilled human capital, and then execute well.

We wrap up this thinking in our Morningstar Stewardship Rating for stocks. Morningstar equity analysts assess companies on items such as: financial leverage, investment strategy, investment timing and valuation, dividend and share buyback policies, execution, compensation, related-party transactions, and accounting practices.

Analysts assign one of three stewardship ratings: Exemplary, Standard, and Poor.

So, for today's screen, we wanted to find high-quality, undervalued companies with exceptional management. Specifically, we screened for wide-moat stocks with Exemplary stewardship ratings that were trading in 4- or 5-star range. Fifteen stocks made the cut.

Here's a peek at our stewardship commentary on three of the names from the list.

Anheuser-Busch InBev BUD "We believe AB InBev's management team has been a strong steward of shareholders' capital and our stewardship rating is Exemplary. Through a series of acquisitions and a focus on cost control, the global brewer has built a wide economic moat. AB InBev's culture instills the responsibility for the company's performance and the creation of shareholder value into each of its managers. Compensation is heavily skewed to variable performance incentives determined on the basis of a 'stretched but achievable target,'which requires detailed, quantitative performance goals throughout the organization. Management's control over expenses is so tight that, when it acquired Anheuser-Busch, it introduced a zero-budgeting policy that requires all expenses to be justified before being spent.

"A significant portion of AB InBev's senior management consists of the Brazilian team that bought Brazil-based Brahma in 1989, merged the company with Antarctica in 1999 to form Ambev, and then merged with Interbrew in 2004 to create InBev. The team has significant experience dealing with the nuances of integrating acquired firms. CEO Carlos Brito joined AB InBev's predecessor Ambev in 1989, having held various roles in finance, operations, and sales before becoming Ambev CEO in 2004 and AB InBev CEO in 2006. Anheuser-Busch's culture encourages senior management to rotate through different roles throughout the business, a strategy that we think will create a deep bench of management talent. We think management's private equity background helps to keep it focused on cost management.

"Perhaps the only blot on management's copybook is the $5.8 billion reacquisition in 2014 of Oriental Brewery, a business it previously owned and sold five years earlier for a third of the price when it was in deleveraging mode following the Anheuser-Busch acquisition. However, KKR, its owner in the interim, had doubled the earnings of the business in that time, and we believe AB InBev can create value from the deal by extracting duplicate costs and sharing a distribution platform to drive penetration of the Budweiser and Corona brands. The SABMiller acquisition has been more difficult to swallow, with the leverage required to do the deal offputting to many investors. Execution on the integration, however, appears to have gone fairly smoothly.

"There has been some executive turnover in recent months, with former chairman Olivier Goudet being replaced by Altria's former CEO Marty Barrington last year. More recently, Felipe Dutra, who occupied both the chief financial officer and chief technology officer roles, stepped down after 15 years. He was replaced by Fernando Tennenbaum, formerly the vice president of finance in South America. Given the finance-focused culture at AB InBev, the company has a deep bench of financial executives, and we do not envision too much disruption from the move. Indeed, it may indicate an acceleration in the deleveraging process. We would not be surprised to see the roles of CFO and CTO split again. Technology is becoming a significant piece of the route-to-market in the consumer goods industry, particularly as big data becomes a competitive advantage for large-cap companies in the e-commerce channel. Leading the technology and financial activities of a business the size of AB InBev is too much for one person, in our view, and the roles should be separated."

--Philip Gorham, director

Core Laboratories CLB "We award Core Lab an Exemplary stewardship rating. While the fundamentals of its underlying business are quite strong, we believe management has played an indispensable role in generating Core Lab's stellar performance. The company has averaged the best returns on invested capital among all of our covered oilfield-service companies over the past two decades by a long shot.

"The exemplary stewardship begins with the company's long-tenured senior management. Since 1994, when Core Lab originated as an independent company after splitting from Western Atlas, the team has been an excellent steward of Core Lab's foundational core analysis business. Management recognized the ongoing shift away from core rock analysis and toward fluids analysis (owing to the maturing of global oil and gas reservoirs, as well as the complexity of some new high-temperature, high-pressure reservoirs like deep-water), and focused its development of technology and expertise accordingly.

"Management's keen awareness of the company's competitive advantages as well as its shareholder value-centered framework means that Core Lab has rarely ventured to invest in new businesses. However, the company's few major large-scale investments have been spectacular successes. In particular, management assembled the current production enhancement segment in the late 1990s by focusing on a few niche oilfield-service lines where new technology could have a transformative impact. Moreover, management had the foresight to tailor its key production enhancement offerings to the fast-growing U.S. shale market. Since then, the company has generated very strong results from production enhancement, impressively on par with reservoir description results.

"More recently, we think Core Lab's purchase of Guardian, a designer of downhole instrumentation systems, for $49 million, was a good decision. This small acquisition will help expand Core Lab's customer base in the perforating market, benefiting its existing highly profitable product line.

"After 25 years as CEO, David Demshur stepped down and was replaced by Larry Bruno, himself a 21-year veteran of the company and who previously served as chief operating officer. We think the quality of Core Lab's management is consistently strong, and we expect little disruption as a result of the transition."

--Preston Caldwell, analyst

U.S. Bancorp USB "We consider the stewardship of U.S. Bancorp's capital to be Exemplary. Richard Davis served as CEO from 2006 through April 2017. He was clearly the dominant influence throughout the company and one of the few bank CEOs to survive the financial crisis. Andy Cecere took over as CEO in April 2017; he had been named CFO in 2007, COO in 2015, and president in 2016. Cecere has been with U.S. Bancorp since 1985. Given U.S. Bancorp's history of exemplary stewardship, well-planned leadership succession, and Cecere's consistent performance since taking over, we believe our Exemplary stewardship rating remains appropriate.

"During Davis' tenure as CEO, U.S. Bancorp grew to become the fifth-largest bank in the country, up from seventh in 2006. It is now located in nearly half of the United States, has gained share in many of its markets, and came through the financial crisis without realizing a loss in any quarter. He helped nurture the company as a community bank operating in many markets while also being a low-cost provider of numerous services and products. We believe he did an admirable job with strategic acquisitions (such as buying trust segments from Bank of America and others in the U.S. and now from Deutsche Bank and the Quintillion acquisition to begin growth in Europe) and growth initiatives over the years, helping the bank to expand key businesses such as payments, trust, and the capital markets loan group. With Cecere in charge, the bank has continued to control expenses while still investing in technology and efficiency initiatives, and it appears the conservative underwriting culture is still in place. The bank is also embarking on some expansion initiatives in newer markets, a key test for some of Cecere's newer strategic moves.

"Management at U.S. Bancorp have generally been a smart allocator of capital over the years. U.S. Bancorp has grown into higher-return and more-moaty areas in ways that have taken years to play out and should continue to play out over the next decade or more. The bank has optimized its use of capital in ways few other banks have, being able to sustain lower common equity Tier 1 ratios, leading to less trapped capital, and by having some of the best returns/risk-weighted assets among the banks we cover. We think the preservation of capital, as exhibited during the crisis, has played a key role here as well and allowed U.S. Bancorp to grow while others were hurting from past mistakes."

--Eric Compton, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)