Stock Market Signals, Then Versus Now

Clues from the largest-company lists.

10 Years Ago Can you guess the biggest American company in April 2010? It was ... Exxon Mobil XOM. (Oil traded that month at $102 per barrel.) As suggested by that example, the list of the largest U.S. firms has changed markedly over the following decade. The movement reveals not only shifts in corporate fortunes, but also evolving investor attitudes.

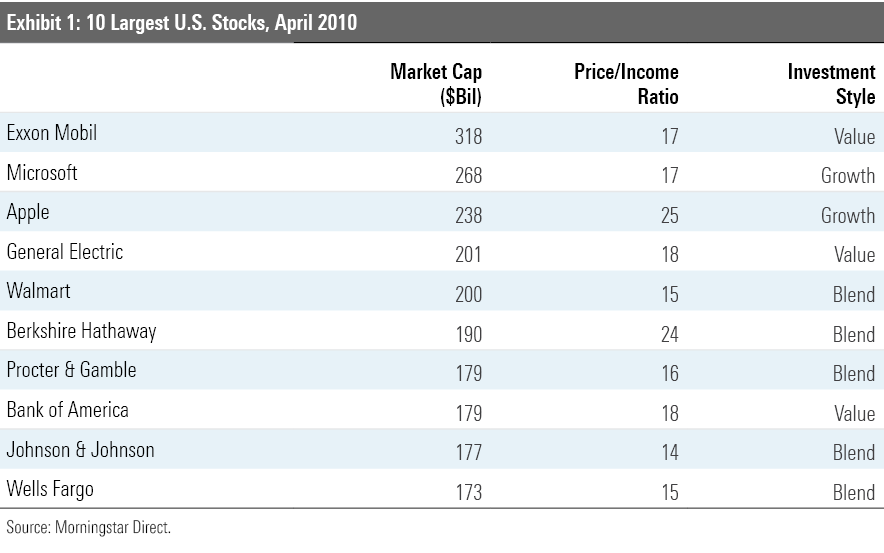

Below is the list of the 10 largest American companies from April 2010. The chart contains each company's stock-market capitalization, its price/income ratio, and its Morningstar investment style. (By price/income ratio, I mean the standard price/earnings ratio, but with the earnings adjusted by removing extraordinary items. Morningstar calls the resulting figure "normalized income.")

Were these 10 securities to form a fund, that portfolio would be surprisingly well-diversified. The companies operated in six sectors. Technology, consumer goods, and financial businesses each held two slots, as did conglomerates (General Electric GE and Berkshire Hathaway BRK.B). The energy giant Exxon Mobil and retailer Walmart WMT rounded off the group. The list also varied by investment style, with two growth companies, five classified by Morningstar as blend, and three value stocks.

Aside from Apple AAPL and Berkshire Hathaway, no stock traded a price/income ratio exceeding 20. Investors at the time were carefully optimistic. Their optimism was demonstrated by their willingness to embrace various industries and investment styles. They believed that many approaches might succeed. However, they were chary with their wallets.

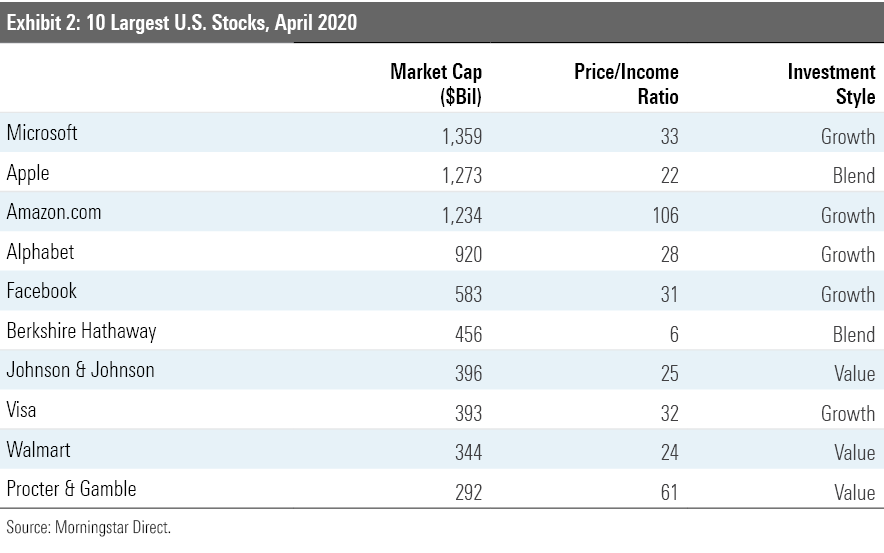

Modern Times Now let's look at today's list.

So much for industry diversification! In 2010, there were two technology companies among the top 10 stocks, with the industry accounting for 24% of those assets. Today, the leaders' list has five tech firms that possess 74% of the top 10's total.

The cost to buy those leaders has skyrocketed. Whereas in 2010 eight of the 10 companies traded at price/income ratios of less than 20, eight now are above that mark, including all five of the tech companies. To be sure, today's valuations are nowhere near New Era levels. By those standards, only Amazon.com AMZN looks steep. But there are few bargains as well.

Hope for the Small Another way of evaluating the giants is to compare them against the other side of the marketplace: the smallest stocks. For this column, I defined the "largest" stocks as being the 10 biggest, as illustrated above, and the "smallest" as being issues that land outside the top 500, but with market caps exceeding $100 million. (Extending the search to businesses valued at less than $100 million increases the chance of data errors without materially improving the analysis.)

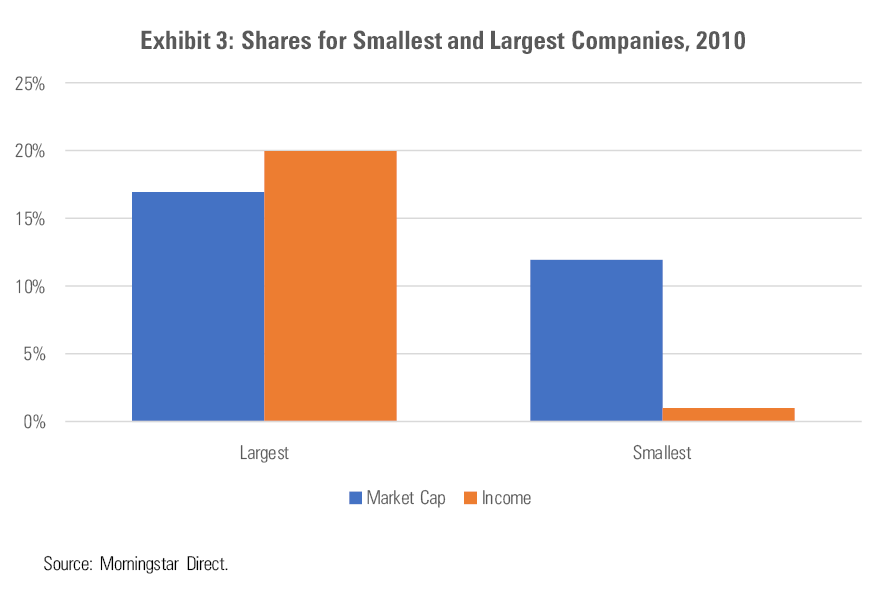

I then asked two questions. First, what percentage of total stock-market capitalization did each of these two groups of stocks command? Second, what portion of total income did they contribute? Let's look at 2010 first.

A decade ago, the 10 largest firms held 17% of stock-market capitalization, while their share of normalized income was 20%. In contrast, the smallest companies attracted 12% of the investment capital but delivered just 1% of income!

For the most part, investors in 2010's smaller companies weren't expecting high ongoing growth rates. Rather, they were anticipating a burst, as the economy returned to normalcy. The recession that followed the global financial crisis had made many smaller businesses temporarily unprofitable. As a result, the group's aggregate income was very low. For every firm that had turned a profit through the very difficult year of 2009, another had not.

Should the economy subsequently recover, as appeared likely in April 2010, these relative weaklings would benefit more than would stronger businesses. Investors in 2010 believed enough in the economy to invest in companies that were currently unprofitable. However, they did not pay heavily for the privilege of doing so. In April 2010, the price/book ratio for Vanguard Small Cap Index NAESX, which held a similar list of the smallest stocks, was a modest 1.6.

Here Come the Skeptics Jump forward with me to 2020.

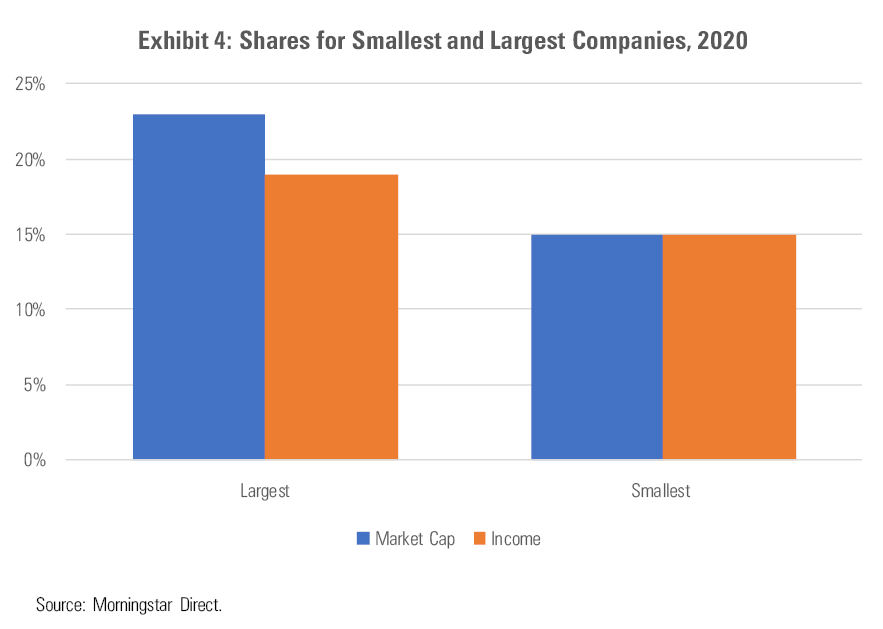

The 10 largest companies now hold 23% of the stock market's assets, with the top five boasting 17%. Their share of income remained just about constant, declining to 19% currently from 20% in April 2010. In short, the behemoths went from being valued at slightly below-market prices to commanding a premium.

Smaller companies behaved as investors had expected. Their income came roaring back, from comprising just over 1% of the market's total to a healthy 15%. In dollars, that meant a jump to $236 billion in combined normalized income from a mere $7 billion. That was still short of the $291 billion in normalized income recorded last year by the 10 largest businesses--an average of $29 billion each!--but a great improvement from where they had begun.

The stock-market capitalization for the smallest companies also grew, to 15% from 12%. In aggregate, such stocks trade at neither a premium nor discount to other U.S. securities--except for the behemoths atop the leader board, that is.

Whereas 2010's attitude was carefully optimistic, today's mindset is warily pessimistic. No longer do investors expect stronger near-term growth for the broad marketplace than for the very largest firms. On the contrary, they increasingly are showing that they wish to own the few companies that already dominate their businesses, rather than take their chances on the many firms that do not.

Implicit in this expectation is that inflation will remain low, interest rates subdued (rising interest rates are particularly damaging to growth stocks), and overall economic growth sluggish. If some of the stocks atop today's leader board look expensive, that is not because investors are giddy. Quite the contrary--those valuations reflect their willingness to pay a premium to achieve relative safety.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)