How Have Liquid Alternatives Fared in the Sell-Off?

Their sensitivity to equity markets tells much of the story.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

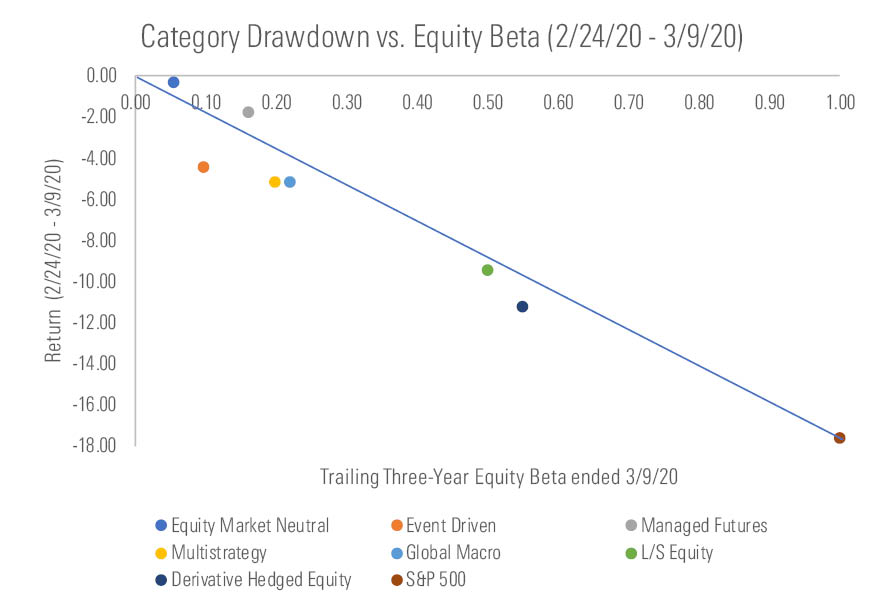

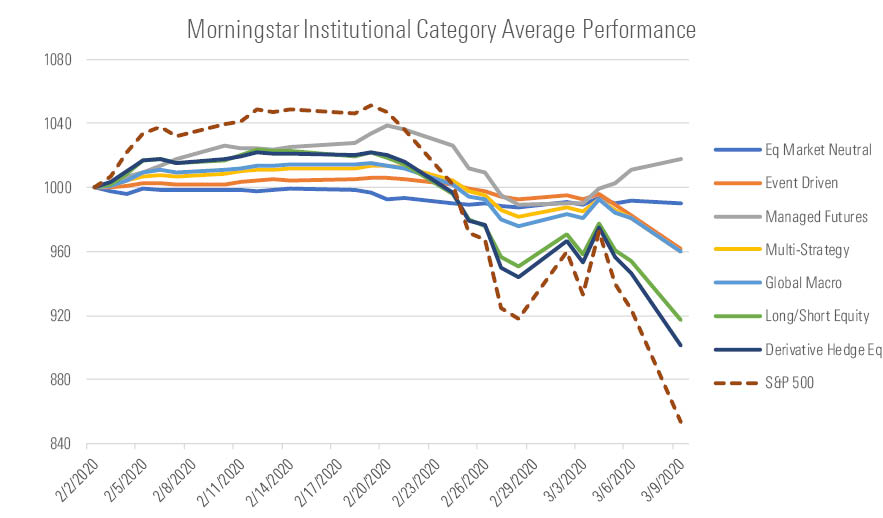

Liquid alternatives (hedge-fund-like strategies in a daily liquidity fund package) encompass a wide range of strategies that try to achieve a variety of goals, but many claim to offer diversification from traditional market risks. Although the current market environment continues to evolve, it’s worth taking a closer look at how some liquid alternative strategies fared in the shockingly severe stock market downturn that started on Feb. 24 through March 9, 2020, when stock trading was briefly halted.

Overall, liquid alternative fund performance has been mixed, but most have been able to soften the downside to some degree after coming off a strong 2019. Because the coronavirus-fueled sell-off started largely as a stock market phenomenon (at least until high-yield bonds started to feel the pressure from the oil-price war), the best indicator of how much a strategy sold off during the period seems to be its sensitivity to equity markets, or equity beta. Credit and liquidity risk, factors to which certain alternative strategies are exposed, remained relatively subdued through the first couple of weeks of volatility but have started to show signs of stress.

The chart below shows the average returns for the institutional Morningstar Categories (a more granular grouping of our alternatives categories) plotted against their average trailing three-year beta to the S&P 500.

- source: Morningstar Analysts

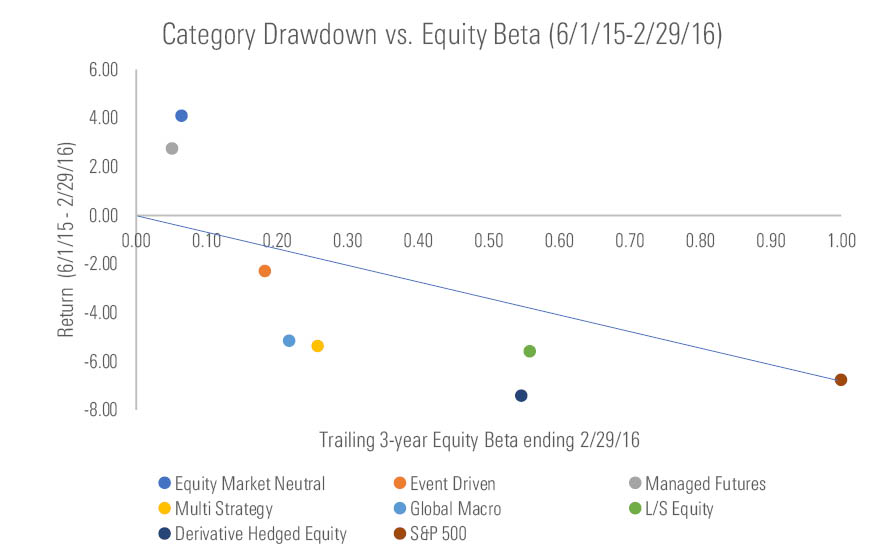

On average, none of these categories delivered positive returns during the turmoil, though their returns did generally reflect their level of equity market exposure. Things haven’t always shaken out this way in prior equity sell-offs, however. For example, in mid-2015 through early 2016 (admittedly a much longer period of market volatility), equity market struggles were accompanied by a sell-off for lower-quality credit. As shown below, alternatives provided a less predictable experience during that stretch but were able to add value in some instances (equity market-neutral and managed-futures strategies, for example).

- source: Morningstar Analysts

Again, in the latest panic, equity market-neutral and managed-futures strategies have thus far withstood the elevator ride down better than other alternative strategies. Event-driven and multistrategy funds had fared well in the first leg of the downturn, but they were more broadly bruised when equity and credit markets fell sharply on March 9.

- source: Morningstar Analysts

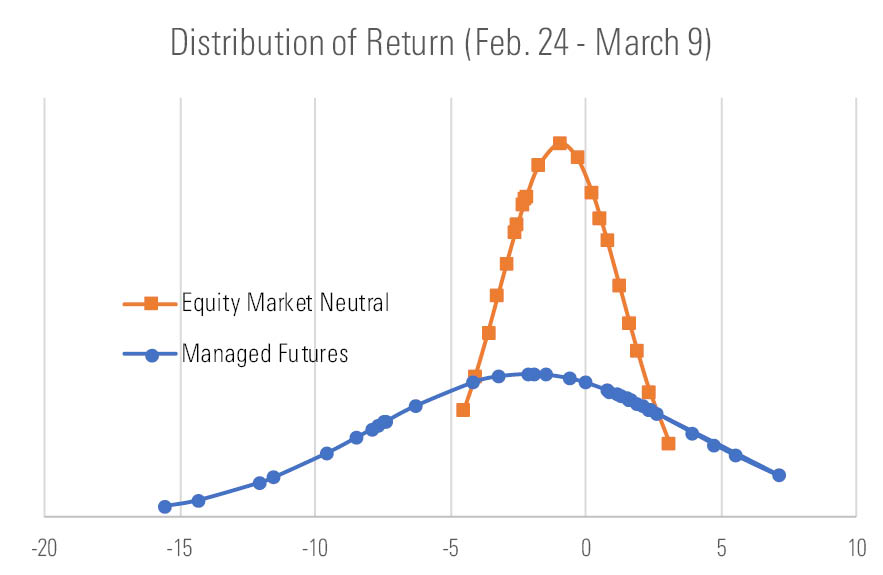

The Good (Enough) Managed-futures strategies, or systematic strategies that aim to profit from trends in various markets, have been best positioned to ride the momentum-driven market losses thus far because of their long bond and short energy commodities exposure during the past few weeks. Since the S&P 500 started falling in earnest on Feb. 24, managed futures have generally provided a better outcome compared with the equity market, with an average loss of 1.7% through March 9 compared with the S&P 500's 17.6% dive. There was a much higher level of dispersion in that group, though, so some investors felt a lot more pain than others. Returns ranged from up 7% to down more than 15%. The smaller group of funds with Morningstar Analyst Ratings of Bronze have stood up well so far. American Beacon AHL Managed Futures Strategy AHLIX returned 2.4% (benefiting from its slightly faster trading models) while Abbey Capital Futures Strategy ABYIX, AQR Managed Futures Strategy AQMIX, and Natixis ASG Managed Futures Strategy AMFNX returned between 1.3% and 2.1%.

- source: Morningstar Analysts

Equity market-neutral strategies, which seek to hedge out equity exposure through roughly matched long and short positions, were generally the best at thwarting losses during the tumultuous period from Feb. 24 through March 9, but they haven’t been able to produce the same level of positive returns over the past few days as effectively as managed-futures strategies. On average, the category was down 0.3%, somewhat in line with expectations given its average three-year trailing equity beta of 0.05. Fund returns ranged from slightly positive to down a few percentage points, but overall there was little dispersion. Leading up to the sell-off, the equity market-neutral group had been struggling as these strategies’ short positions continued to increase in price through the market rally, but at least that lack of market exposure protected them in the latest downturn. On the other hand, long-short equity strategies (higher beta strategies, in particular) fared relatively poorly. The average return of the long-short equity category was negative 9.5%.

The (Not Too) Bad Event-driven managers look to take advantage of mispricings in securities driven by specific catalysts and generally hedge out directional equity market exposure. Since Feb. 24, event-driven strategies lost 4.4% on average. These results are a bit worse than expected considering the category's average three-year trailing equity beta of 0.10. This is likely due to merger deal-spreads widening as economic headwinds increase uncertainty that announced deals will successfully close. Bronze-rated AQR Diversified Arbitrage ADAIX, Arbitrage Fund ARBNX, BlackRock Event Driven Equity BILPX, and Merger Institutional MERIX lost between 3.3% and 5.1% during the period, with the bulk of that coming on March 9.

The diversified multistrategy institutional group, which includes strategies that combine multiple alternative strategies in one portfolio, was a mixed bag. For example, Blackstone Alternative Multi-Strategy BXMIX (negative 4.6%) had initially weathered the downturn relatively well thanks to its nondirectional equity positioning and heavier weight to structured credit. Conversely, AQR Multi-Strategy Alternative ASAIX (negative 10.8%) added to its accumulating losses during the sell-off as its equity value and defensive factors continued to work against it. On average, the multistrategy category lost 5.1%.

The Ugly Options strategies have suffered major pain in the swift market move. These strategies aim to capture the volatility risk premium (the difference between expected and realized stock market volatility) by selling options contracts. They can experience sharp losses when volatility spikes and equity markets whipsaw, which is exactly what occurred when the level of the CBOE Volatility Index (VIX), a measure of the S&P 500's expected volatility, jumped from the midteens to the upper 40s in a matter of days. The options-based Morningstar institutional category equivalent, derivative hedged equity, was down 11.3%, on average. The category is made up of a heterogenous group of options strategies with varying objectives, but generally, a quick burst in realized volatility results in short-term hardship for these strategies. If all goes well, these strategies have the potential to make up lost ground, as higher levels of implied volatility allow the strategies to collect more-attractive premiums on new contracts. Careful manager selection is critical here, though, as this group hasn't been immune from blowups in the past.

Stay Tuned With coronavirus cases on the rise and global policymakers scrambling to respond, it's unlikely that we've seen the last of the market volatility. While liquid alternatives strategies haven't offered a cure to the stock market's troubles, their equity beta has proved to be a decent indicator of how they've fared in the downturn. This could change as the environment evolves and correlations rise across asset classes. As always, these complex investments should be handled with care.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)