Utilities: Sky-High Stocks Flying Too Close to the Sun?

Investors should approach these lofty valuations with caution.

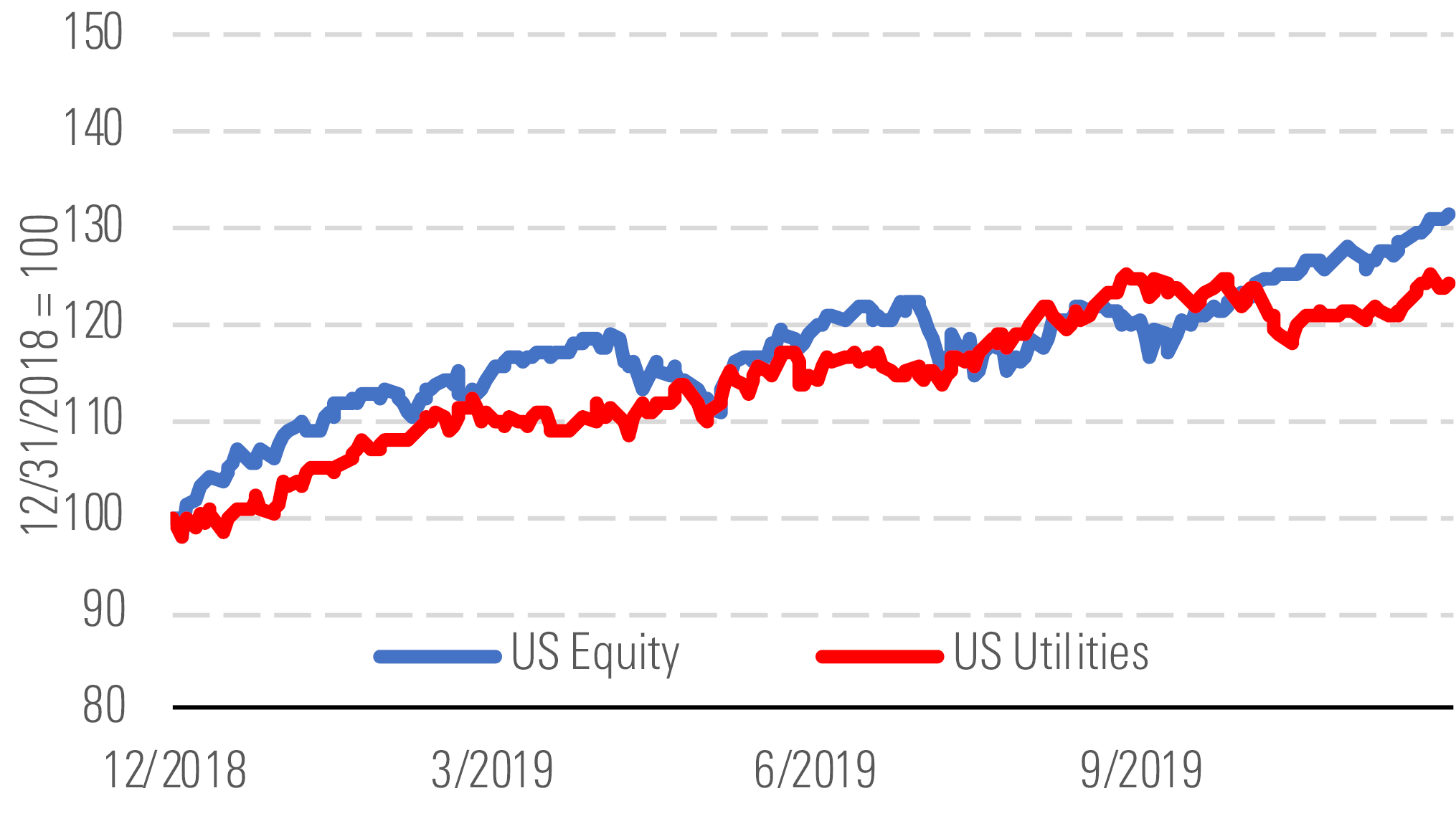

As 2018 wound down, U.S. utilities were foundering. They had reached what we considered fair value for the first time since late 2015 and were limping into 2019. No longer. Utilities head into 2020 flying high. Perhaps too high.

Low interest rates continue to support U.S. utilities’ historically rich valuations. The sector’s average price/earnings multiple stayed above 20 throughout 2019, a 25% premium to the sector’s 10-year average. Average price/book multiples are over 2.0, and the sector trades at a 16% premium to our fair value estimates.

Unlike past bull markets, utilities stayed on pace in 2019. - source: Morningstar

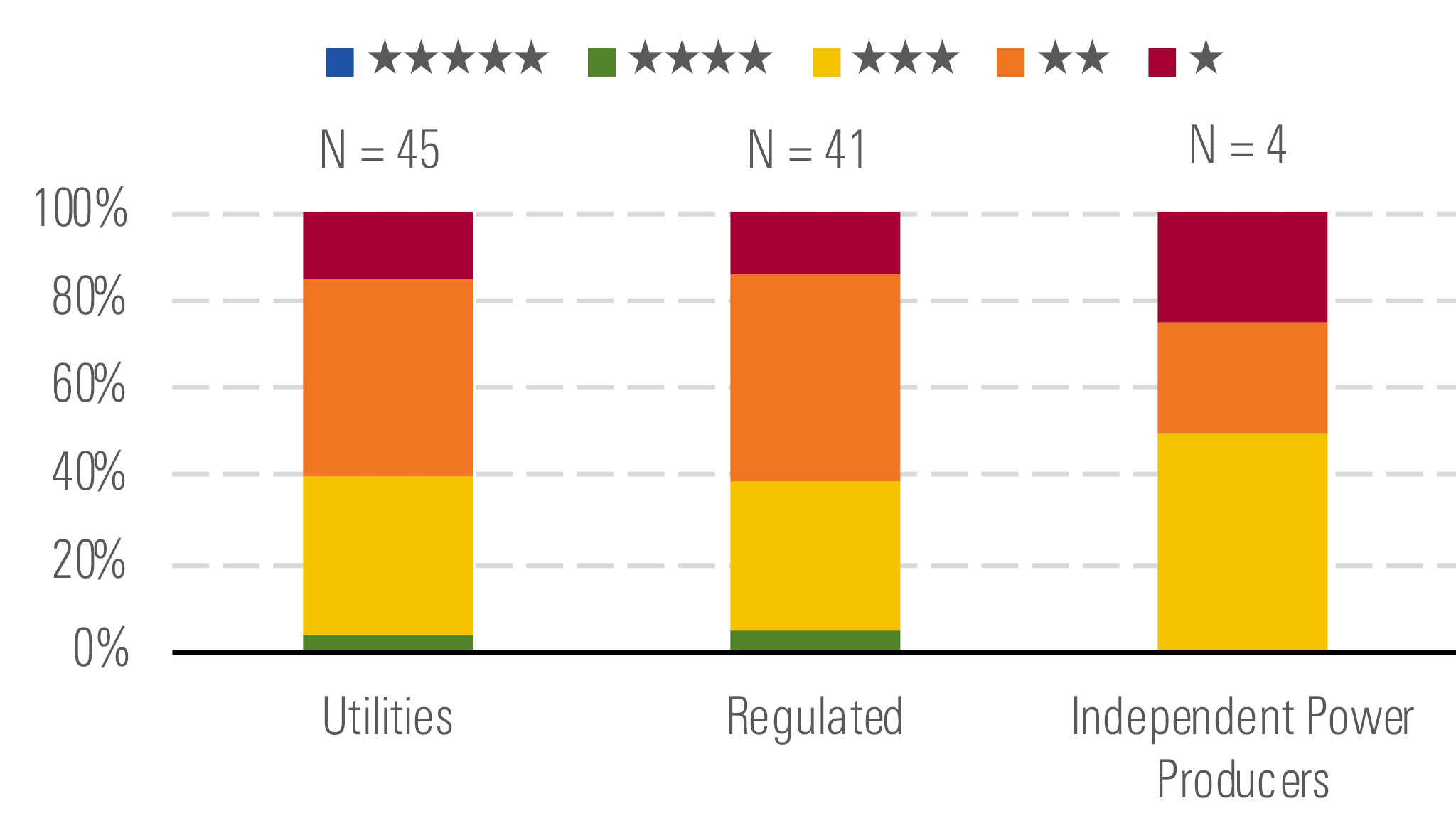

Long-term investors should be wary of rich valuations. - source: Morningstar

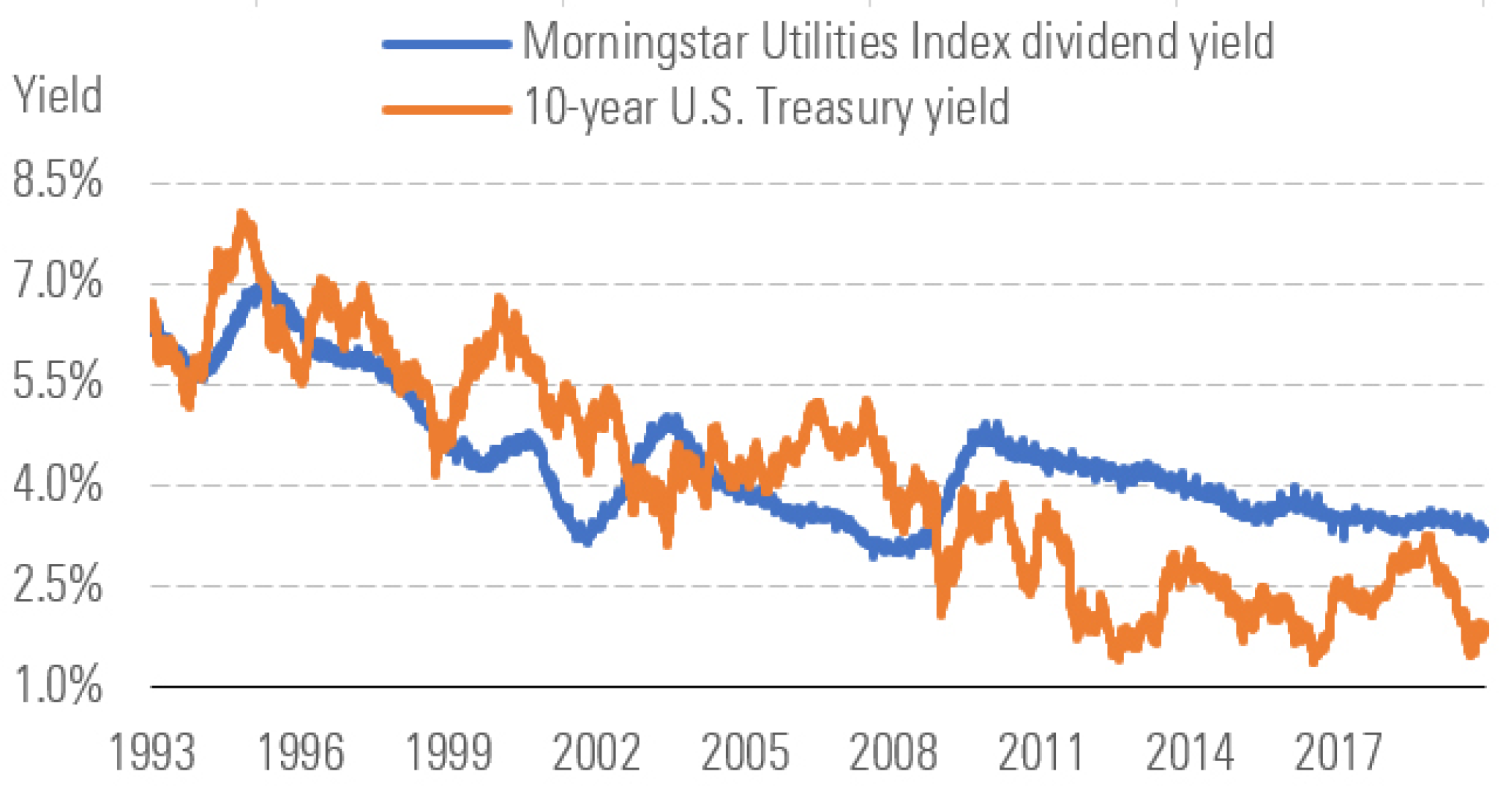

We think these valuations should worry long-term investors most. In the near term, we think utilities are well positioned with strong balance sheets, secure dividends, good growth potential, and public policy support. Their 3.3% average dividend yield remains 130 basis points higher than the 10-year U.S. Treasury yield, nearly double the premium at the start of 2019. This gives utilities enough room to coast into a soft landing if interest rates start climbing in the near term.

Utilities’ yield premium suggests sector might still have room to run. - source: Morningstar

But long-term investors should be cautious. Utilities face fundamental risks besides interest rates. Energy efficiency is cutting into electricity and gas demand. Large investment needs require access to capital. Regulatory support could fade if customer bills rise. We think most U.S. utilities can grow earnings and dividends 5%-7% for several years, but that won’t be enough to sustain 20% annual returns and continued valuation expansion.

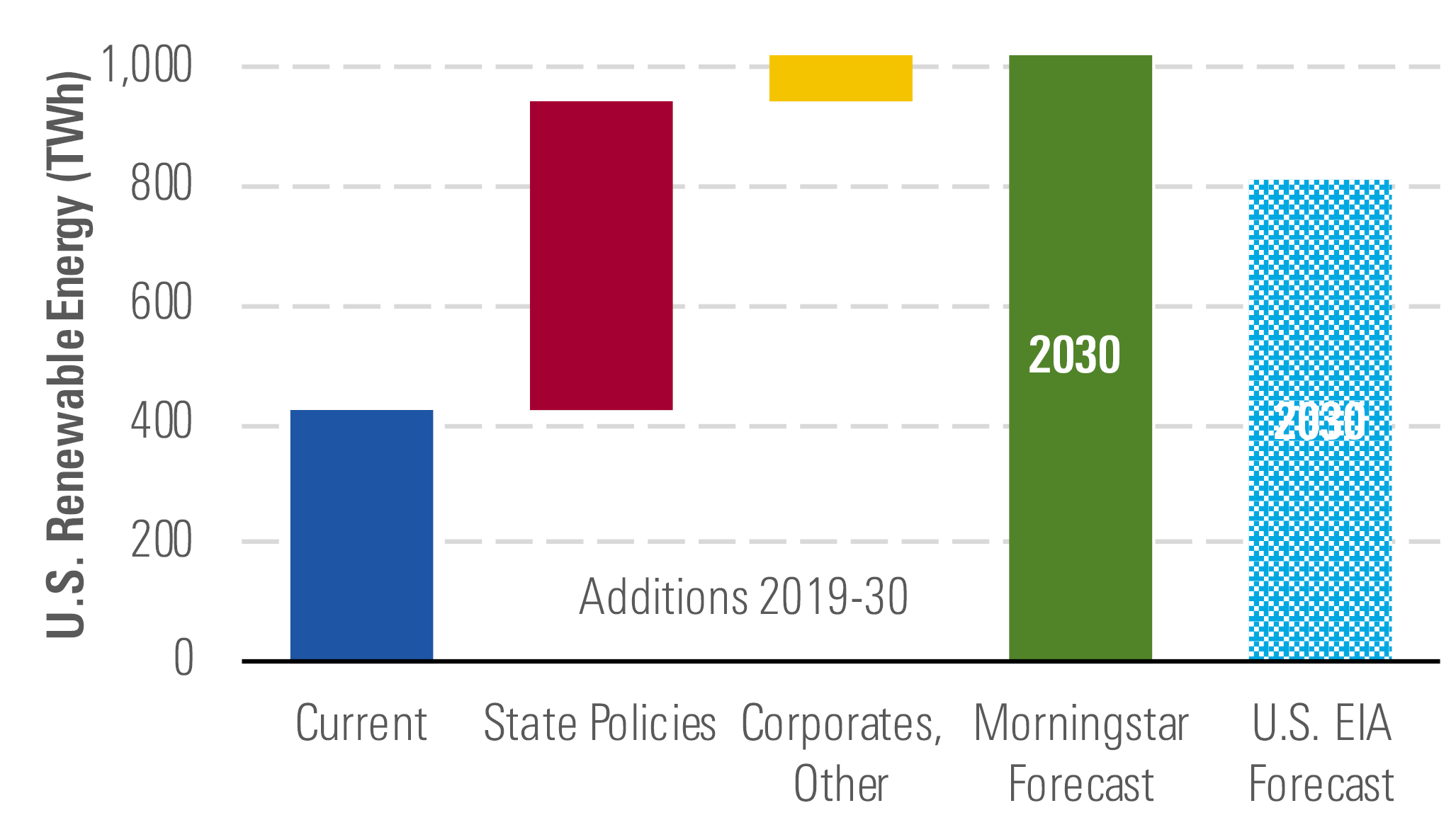

Renewable energy is the sector’s key fundamental tailwind. We forecast that U.S. renewable energy will more than double by 2030, growing 8% annually and reaching one fourth of U.S. electricity use. This means utilities will have investment opportunities in wind farms, solar generation, large-scale batteries, and infrastructure to support the renewable energy buildout. By 2030, New York aims to hit 70% renewable energy and California targets 60%. Thirty other states must meet renewable energy targets. Utilities that can harness that growth might live up to their lofty valuations.

Renewable energy growth is a tailwind for utilities earnings growth. - source: Morningstar

Top Picks

Dominion Energy D Economic Moat: Wide Fair Value Estimate: $86 Fair Value Uncertainty: Low

Dominion historically received premium valuations reflecting its high-return assets and constructive regulatory relationships. But the market remains fixated on the prospect of slowing dividend growth. Dominion's dividend increases have averaged 9% the past five years, but management has targeted 2.5% increases beginning in 2020 due to Dominion’s elevated payout ratio. We believe the dividend is secure due in part to the strong cash flow from Cove Point and earnings growth from its diverse regulated businesses. Investors willing to accept modest dividend growth in the short run should be rewarded with both a valuation uplift, attractive yield, and a return to long-term dividend growth that will outpace Dominion’s peers.

AES AES Economic Moat: None Fair Value Estimate: $21 Fair Value Uncertainty: Medium

In 2011, CEO Andres Gluski began slimming down AES, which at the time operated in 28 countries and aimed to own merchant power plants and utilities across the world. He sold businesses in markets where the company did not have a competitive advantage or growth opportunity. Today, AES has a stronger balance sheet, operations in 13 countries, a rapidly growing renewable energy business, and a well-positioned battery storage joint venture with Siemens. Gluski also has increased AES’ share of U.S. pretax earnings to 33% in 2018 from 10% when he took over. We estimate the U.S. businesses will generate roughly 50% of subsidiary distributions to the parent by 2023. We forecast adjusted EPS growing 9% annually over the next five years, the top end of AES’ 7%-9% guidance through 2022, primarily due to our bullish outlook for renewable energy growth.

First Solar FSLR Economic Moat: None Fair Value Estimate: $59 Fair Value Uncertainty: Very High

First Solar is well positioned to capitalize on worldwide solar energy growth. The U.S. is particularly attractive with huge energy demand to serve, utilities eager to invest, and public policy tailwinds. So far, First Solar has been able to capture this growth opportunity and we think the market underappreciates its ability to keep growing profitably. Bookings in 2018 and 2019 leave First Solar's backlog equivalent to two years of production at current capacity. This provides good visibility into near-term cash flow growth. First Solar’s long-term challenge is staying ahead of a large pack of competitors by reducing panel costs and increasing efficiency. Management also faces a tough decision whether to expand capacity. We think worldwide solar demand will offer fundamental support for First Solar’s business and we’re confident management can allocate capital in a way that creates value for shareholders.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)