10 Superb Defensive Stock Funds

These highly rated mutual funds have a fondness for wide-moat stocks.

Even infrequent readers of Morningstar.com probably know that when it comes to stock investing, we're advocates of a wide-moat approach: We favor companies that have established competitive advantages, because they can more effectively fight off challengers than those companies that haven't carved out economic moats. And from a performance standpoint, wide-moat stocks tend to hold up better in market downturns: The Morningstar Wide Moat Focus Index lost less than 20% in 2008, versus a 37% tumble for the S&P 500.

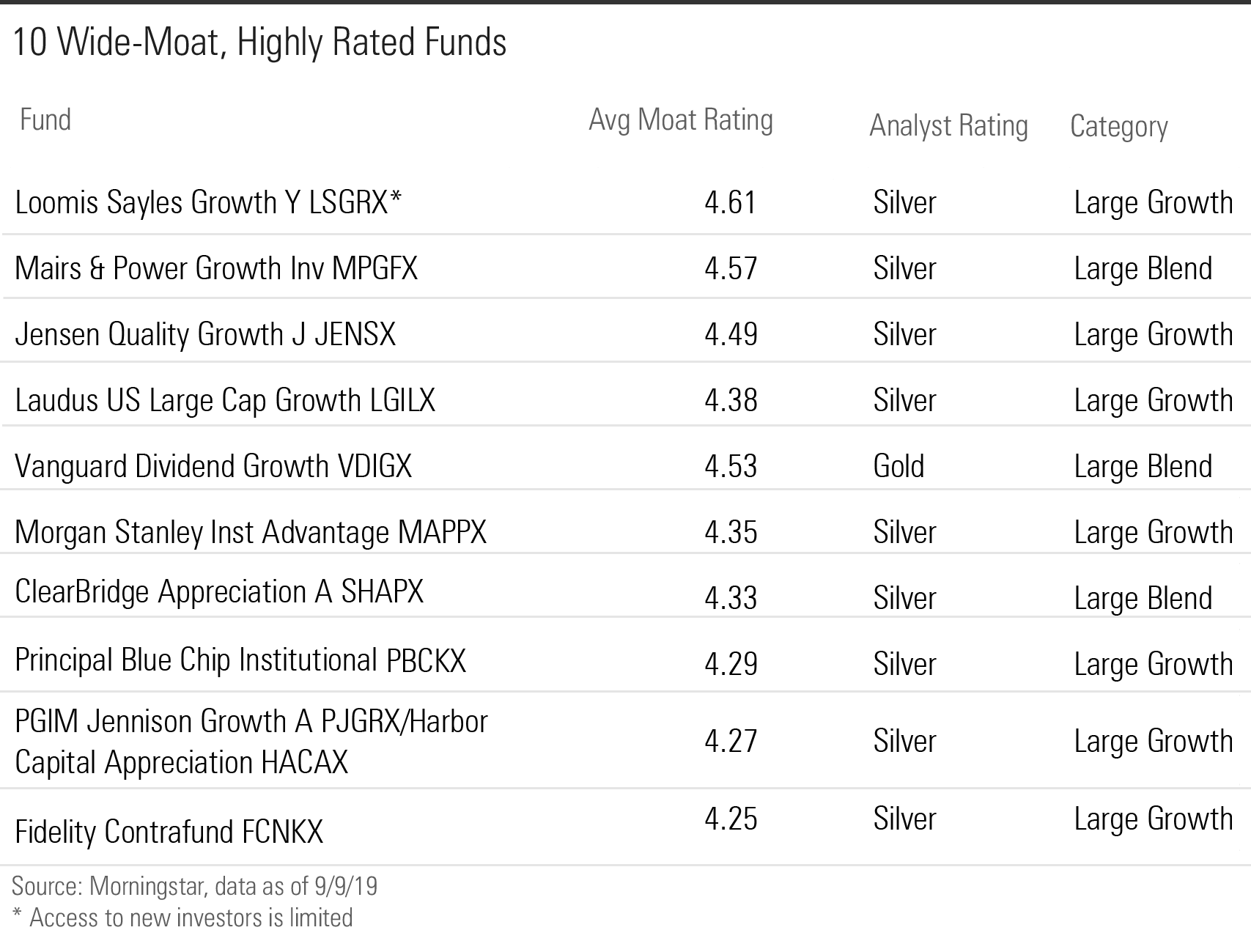

For those investors who dig the moat concept but don't invest in individual stocks, we created Morningstar's average moat rating. A fund's average moat rating marries our Morningstar Economic Moat Ratings for stocks to a mutual fund's portfolio. To receive an average moat rating, funds must have at least 50% of their assets in stocks that earn moat ratings from Morningstar. Those funds with a rating of 4 or higher can be considered wide-moat funds; from 3.5 to 4.0, moderately wide; 2.5 to 3.5, narrow moat; 1.5 to 2.5, minimal; and 0 to 1.5, no moat.

Average moat ratings are available to Premium Members via our Premium Fund Screener. Using that tool, we screened for U.S. equity funds with Morningstar Analyst Ratings of Silver or higher and average moat ratings of 4.0 or better. Twenty-four funds made the cut. Premium Members who'd like to recreate the list can do so as follows:

Fund Category = U.S. Equity AND Morningstar Analyst Rating >= Silver AND Distinct Portfolio Only = Yes AND Average Moat Rating = Wide

These are the 10 mutual funds with Analyst Ratings of Silver or better and the highest average moat ratings as of their latest portfolios.

Here are some excerpts from our analysts' latest reports on each fund.

Loomis Sayles Growth LSGRX Note: This fund is currently closed to new investors. "Loomis Sayles Growth is a bold, focused offering that effectively uses a research-intensive approach. It retains a Morningstar Analyst Rating of Silver.

"Through the proprietary bottom-up research framework, lead manager Aziz Hamzaogullari looks to invest in high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value.

"The process leads to a high-conviction, concentrated portfolio of 30-40 stocks. Hamzaogullari looks for three major characteristics in companies: quality, growth, and attractive valuation. They also need to have difficult-to-replicate business models and competitive advantages. The focus on quality and growth has been consistent, and the strategy has had one of the largest stakes in stocks with wide Morningstar Economic Moat Ratings relative to peers (typically 75%-80% of assets). The contrarian nature of the approach means there is little overlap with the index, as demonstrated by an active share of more than 70%. Although this is a compact portfolio of pricey growth stocks, the focus on wide moats and diversification by different business drivers have kept volatility average.

"The strategy's long-term record remains strong. Since the manager's May 2010 start through January 2019, the strategy's performance exceeded the Russell 1000 Growth Index and the large-growth Morningstar Category."

--Lena Tsymbaluk, analyst

Mairs & Power Growth MPGFX "Like all Mairs & Power strategies, this strategy's guiding principle is to buy and hold financially sound businesses with durable competitive advantages and above-average returns on equity. The managers also favor companies headquartered near the firm's St. Paul, Minnesota, office. Local knowledge gives the team valuable insights, but the regional preference does not keep the managers from investing elsewhere given the right opportunities.

"The managers' conservative notion of growth might disappoint more-aggressive investors. They prefer firms that can grow sustainably over time, often at rates only slightly faster than the overall economy. As a result, the strategy is typically light on racy technology and biotech firms, embracing machinery makers and healthcare equipment suppliers instead.

"The managers invest across the market-cap spectrum but think that larger businesses tend to have more competitive advantages. Small-cap holdings make capacity an issue, however, and the team estimates this $4.4 billion mutual fund could hold $5.0 billion.

"To further diversify and thereby manage risk, the managers monitor the portfolio's sector exposure at the Morningstar Super Sector level, ensuring that its helpings of cyclical, defensive, or sensitive stocks don't deviate more than 10 percentage points from the benchmark S&P 500's levels. This clever move emphasizes stock-picking and diversification without forcing the managers into sectors that aren't suitable to their process. Additionally, they cap individual position sizes at 5% of assets."

--Tony Thomas, senior analyst

Jensen Quality Growth JENSX "Jensen Quality Growth still deserves a Morningstar Analyst Rating of Silver because its reach does not exceed its grasp.

"The team running this fund knows its circle of competence and doesn't leave it. Its members won't look at any stock that doesn't have at least $1 billion in market capitalization and hasn't achieved 15% return on equity or better in 10 consecutive years. The managers cast their lines into a higher-quality pond from the start--one that's easy replicable by anyone with a historical stock database. The managers' forte, however, is discerning which historically profitable firms have the business models, market positions, balance sheets, and management teams to fuel steady earnings and cash flow growth for years, and which trade at discounts to their estimates of intrinsic value.

"This deliberate and selective approach produces a portfolio that tends to be less volatile than its peers, S&P 500 benchmark, and normal expectations for funds of 30 or fewer stocks. Its strict profitability and valuation requirements tend to lead it to steady growers rather than highfliers, which makes the portfolio less speculative than its typical rival and index alternative. Its longtime horizon keeps turnover and transaction costs low."

--Dan Culloton, director

Laudus U.S. Large Cap Growth LGILX "Laudus U.S. Large Cap Growth's resilient management team and nimble approach earn it a Morningstar Analyst Rating of Silver.

"The team uses bottom-up research to assemble a portfolio of 40-60 stocks of superior, durable, or cyclical growth firms, shifting among them as fundamentals and opportunities dictate. Superior companies are market-share-gobbling industry leaders with often higher valuations, such as top active bets Amazon.com AMZN and Tencent. Durable growers are more mature and are returning cash to shareholders, but they may be under a cloud, as with recent addition Boeing BA. Periodic growers are more-cyclical stocks positioned to do well in expansions, such as building-materials supplier Vulcan Materials VMC. Since 2017, management has upped the fund's helping of superior firms that can grow no matter the economic climate as earnings and margin improvements get more scarce in the 10th year of economic expansion. The team added to Chinese Internet giant Tencent when it retreated in late 2018 and sold Tesla TSLA because of slowing orders and an uncertain path to profitability. The latter example shows how management is willing and able to be venturesome while staying attentive to risk."

--Dan Culloton, director

Vanguard Dividend Growth VDIGX "Vanguard Dividend Growth's strategic focus and reliability earn it a Morningstar Analyst Rating of Gold.

"Longtime manager Donald Kilbride looks for cash-rich firms with good prospects for continued dividend increases and tries to get them at a reasonable price.

"Competitively advantaged large caps tend to be well-positioned to grow their payout, and they predominate in the fund's 40-55 stock portfolio.

"The fund's weightings result from Kilbride's bottom-up focus on sustainable dividend growth. Within technology, for instance, he prefers mature service and software-oriented firms, such as top-10 holding Microsoft MSFT, while eschewing businesses with products that need to be replaced to maintain profitability. That explains why Kilbride has never owned Apple AAPL, for example.

"Kilbride's discipline can prove costly at times. Not owning Apple held the fund back relative to the broader market in 2017's rally. The fund, though, remains at its relative best when markets are at their worst. It held up better than the Nasdaq U.S. Dividend Achievers Select Index during late 2018's near bear market, just as it has in every major market drop since that benchmark began in April 2006."

--Alec Lucas, Ph.D., senior analyst

Morgan Stanley Institutional Advantage MAPPX "Morgan Stanley Institutional Advantage has used its tool kit well, resulting in a Morningstar Analyst Rating of Silver.

"Dennis Lynch has built a long-tenured team that's thoughtfully planning for the future.

"The team has also evolved its thinking to keep up with changing times. It ditched the 'growth' moniker in its name in favor of 'counterpoint global' to reflect that it's not tethered to one section of the Morningstar Style Box. Most of its holdings still fall in the growth bucket and cluster in established growers with competitive advantages. Indeed, all but two of the portfolio's 34 holdings as of December 2018 had wide or narrow Morningstar Economic Moat Ratings.

"The team's focus on steady growth companies has provided ballast, particularly in turbulent times. Indeed, the strategy held up better than the Russell 1000 Growth Index during 2018's fourth-quarter pullback, echoing a trend that's led to it losing just 90% as much as its benchmark in downturns.

"That's not to say the portfolio is stodgy. Indeed, the strategy has benefited from some of the high-growth stocks that are mainstays at the team's other offerings. Of course, letting winners run can introduce risks, even for a strategy that has otherwise provided a relatively smooth ride, but investors remain well positioned here."

--Katie Rushkewicz Reichart, director

ClearBridge Appreciation SHAPX "ClearBridge Appreciation earns a Morningstar Analyst Rating of Silver for its seasoned management team, consistent approach, and resilient portfolio.

"Comanagers Scott Glasser and Michael Kagan look for stocks whose potential upside outweighs their potential downside by 3 to 1. They focus on companies with underappreciated assets or earnings power and firms with sustainable and increasing growth potential. They've struck a nice balance between the two and have consistently provided a large-core portfolio with defensive characteristics.

"The strategy has consistently delivered on its objective of generating total returns a bit higher than the S&P 500's with much less volatility.

"Caution, patience, and a focus on quality have helped achieve the goal of low volatility. The team prefers blue-chip firms with dominant market positions, healthy balance sheets, and proven, shareholder-oriented management teams. The team avoids large sector bets. Once the managers buy, they don't often sell. Annual portfolio turnover tends to stay below 10%. The quality preference is evident. Over the past five years, relative to the S&P 500, this portfolio has had a larger percentage of assets invested in companies with either narrow or wide Morningstar Economic Moat Ratings."

--Jack Barry, analyst

Principal Blue Chip PBCKX "A capable team plying a large-cap version of a proven mid-cap strategy earns Principal Blue Chip a Morningstar Analyst Rating of Silver.

"Lead manager Bill Nolin has honed his approach over two decades. He favors owner-operator companies where managers are also major shareholders. Such leaders tend to be long-term-focused. Nolin and his team look for these well-led firms among the largest 200 stocks in the Russell 1000 Index, targeting the more profitable and competitively advantaged. The team also factors in valuation, preferring to buy firms at a 30% discount or more to its fair value estimates.

"Long-term performance looks good, helped by better durability in down markets. The fund gained 15.7% annualized from its June 2012 inception through January 2019, outpacing the 13.5% large-growth Morningstar Category average and edging the Russell 1000 Growth Index's 15.2%. It has gained most of its edge in downturns. For example, it lost 12.6% in 2018's tough fourth quarter, but the index and typical peer each dropped more than 15%."

--Tony Thomas, senior analyst

PGIM Jennison Growth PJGRX Harbor Capital Appreciation HACAX Note: These funds are near clones of each other.

"Managers Kathleen McCarragher, Michael Del Balso, and Sig Segalas look for market-leading firms with above-average top-line growth prospects. The team focuses on the durability of a company's growth by favoring businesses with healthy financials, strong research and development capabilities, and defensible franchises. Industry dominance is preferred.

"The managers invest in 55-70 stocks. Position sizes generally stay below 7% of assets, while the top 10 combined typically account for 30% to 40% of the fund.

"Turnover typically ranges between 35% and 55%, implying average holding periods of two to three years. But some of the managers' favorite stocks have been owned much longer than that.

"The managers' commitment to high-growth, competitively advantaged firms is clear. Aggregating the fundamental characteristics of its underlying equity holdings, the June 2018 portfolio's average estimated five-year earnings-growth rate ranked among the top decile of the large-growth Morningstar Category. Meanwhile, 95% of equity assets were held in stocks with either a wide or narrow Morningstar Economic Moat Rating.

"Fast-growing firms with economic moats typically don't sell cheap, and the managers have abidingly paid a premium for such businesses.

"Jennison's stock-picking skills tend to be strongest in the technology and consumer cyclical sectors, which anchor the fund's high-growth portfolio."

--Robby Greengold, senior analyst

Fidelity Contrafund FCNKX "Fidelity Contrafund has excelled during manager Will Danoff's nearly three-decade tenure, supporting its Morningstar Analyst Rating of Silver.

"Danoff looks for best-of-breed companies with good business models, competitive advantages, and improving earnings potential, placing much emphasis on company management. While that premise could define many large-growth competitors, the fund's process has been successful because of Danoff's execution. He's hands-on, participating in many of the hundreds of company meetings that occur at Fidelity every year.

"Indeed, Danoff consistently crafts a seemingly inimitable portfolio. The fund's stake in the technology sector, which has ranged from 30% to 40% of assets over the past three years, looks hefty next to the fund's S&P 500 prospectus benchmark but modest relative to the Russell 1000 Growth Index. Still, within the large-growth Morningstar Category, the fund stands out for its relatively colossal 20% stake in financial-services firms such as Berkshire Hathaway BRK.A. The fund also owns some privately held companies, notably WeWork and SpaceX. These remain a small portion of the fund's overall assets, but investing in them early could prove beneficial down the line if they have successful IPOs. Plus, they are another way the fund differentiates itself from popular passive funds."

--Robby Greengold, senior analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)