Bonds: Where Are We Now?

In part seven, we examine the current environment.

Editor's note: This article is part of our "How and Why to Invest in Bonds" series. Click here to read other articles.

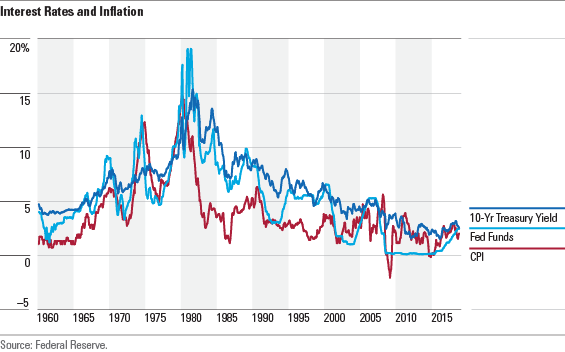

Bond markets have enjoyed one of the greatest 30- to 40-year bull markets on record.

With bond yields falling from highs of over 15% in the early 1980s to lows of around 1% today, the asset class has delivered outsize returns by historical standards for investors on a risk-adjusted basis and on an overall basis. That's been good news for bond investors. But that rally has left yields at historically low levels.

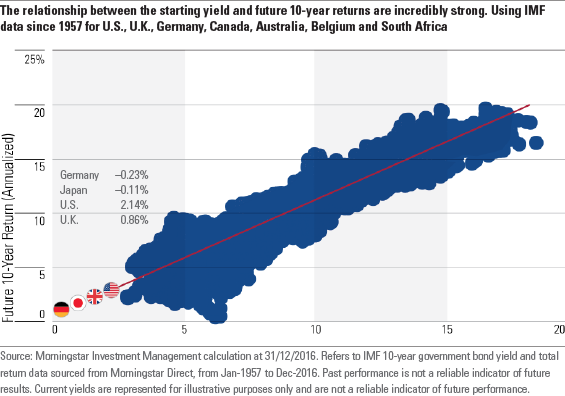

Why does this matter? Because bond markets have a curious feature: The yields today on government bonds tend to be a good predictor of what returns will be for the next 10 years.

The following chart from Morningstar Investment Management shows the tight connection.

For government bonds, the starting yield has been an incredibly powerful determinant of future returns. This is in part because default risk is considered to be very low and thus the contributors to risk and return become simplified.

There are other ways to assess value in the bond market, similar to the ways that stocks are valued. The Morningstar Investment Management group notes that, at a high level, valuation-driven investing is built on two clear principles. First, investors need to believe an asset has a "fair value" that can be estimated through careful analysis. Second, they need to believe that, while the price of an asset may deviate significantly from fair value in the short term, it tends to return to fair value over the long term.

The Morningstar Investment Management group refers to this deviation from "fair value" as "valuation-implied returns," which can be assessed using four key conviction pillars.

Absolute valuation--understand clearly what each asset can be expected to deliver over a 10-year time horizon.

Relative valuation--understand how well the asset ranks compared with other markets.

Contrarian sentiment--identify whether current sentiment is supportive to our conviction in a long-term context.

Fundamental risk--understand clearly the range of possible scenarios, as well as any risk that would cause our base case to be inaccurate over the investment horizon.

Part 8: How Should Bond Investors Position for What Comes Next?

The following authors contributed to this series:

Tom Lauricella, Editorial Director, Professional Audiences Christine Benz, Director of Personal Finance Sarah Bush, Director, Fixed-Income Strategies Jeff Westergaard, Director, Fixed-Income Data

Click here for important information about this commentary.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)