Utilities: Valuations Near Peak, but Dividend Yield, Growth Are Tough to Pass Up

Exceptional buying opportunity if the sector makes a modest correction.

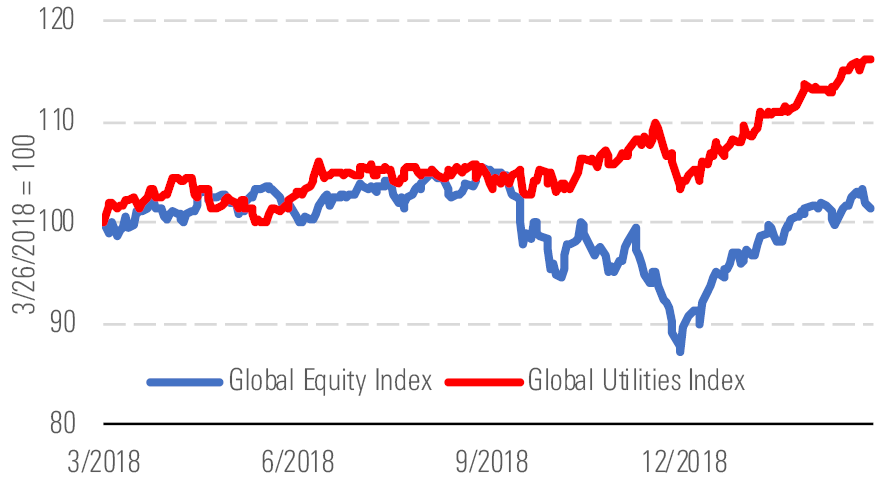

Once again, the utilities sector yield paradox is developing. The utilities rally since early 2018 has resulted in valuations that are well above historical norms and roughly 10% above what we consider fair value. Dividend yields remain near decade lows, well below 4%.

Strong fundamentals, low interest rates have powered utilities - source: Morningstar Analysts

Yet for income investors, utilities’ dividends have rarely looked so attractive. U.S. utilities’ 3.4% average yield is 90 basis points above the 10-year U.S. Treasury yield as of late March, a reliable buy signal. Most utilities’ dividends are well-covered and set to grow more than 5% annually the next three to five years. We think some utilities’ dividend growth could top 10% for several years. Apart from a few special situations, we see no risk of dividend cuts across the sector.

Buying opportunities are fleeting for utilities investors - source: Morningstar Analysts

Thus, investors seeking stable, growing cash flows should not ignore utilities. We also think there could be an exceptional buying opportunity if the sector makes a modest correction. U.S. utilities went into 2019 trading at fair value on average and have rallied 9% year to date. When utilities dipped below fair value in mid-2015 they went on to rally 30% during the next 12 months.

For now, we think there are a few high-quality utilities that still look cheap on an absolute and relative basis. We think investors should look for utilities with yields above 4% and modest growth potential, or utilities with 3% yields and exceptional growth potential.

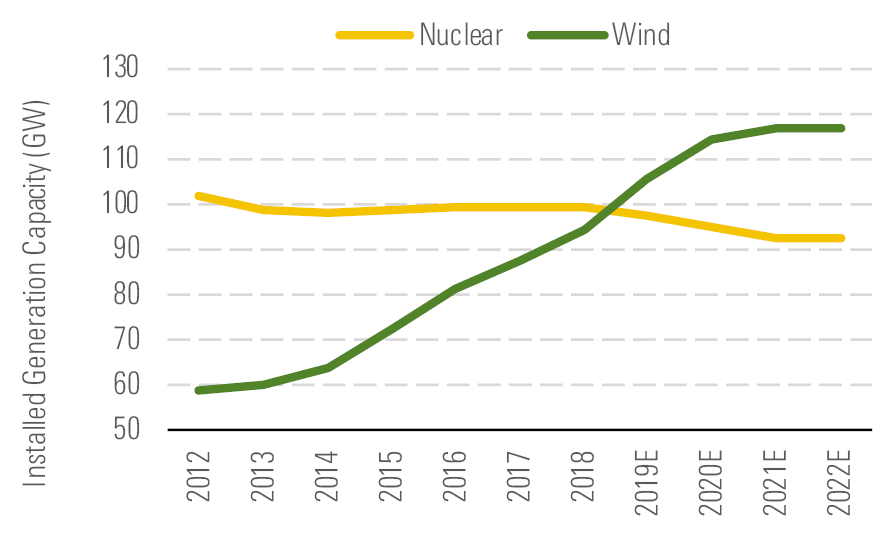

Utilities with regulatory support to invest in distribution networks, renewable energy, and reliability should have the smoothest growth trajectory. Low interest rates have created a favorable environment for capital investment, which should continue given recent Federal Reserve commentary. Progressive energy policy also supports growth investment.

U.S. wind generation capacity set to surpass nuclear this year - source: Morningstar Analysts

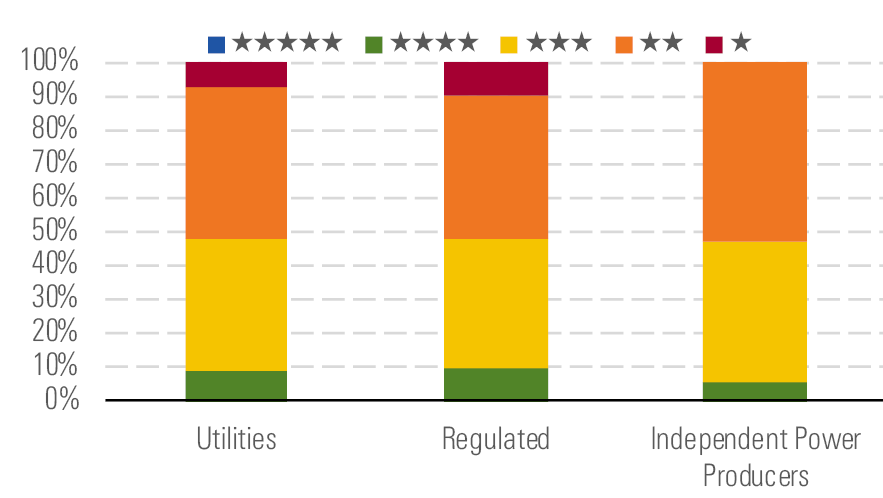

Utilities around the world have similar policy-supported growth opportunities, particularly in Europe, where utilities now trade 5% above our fair value estimates after the rally since early 2018. Despite inflated valuations, utilities yield 5%—above the 4.7% historical average—and most dividends are secure. We think diversified utilities with international and renewable energy exposure; 5% yields; and aligned earnings and dividend growth are most attractive. Utilities with less international exposure face more regulatory uncertainty and commodity exposure but could have more attractive valuations.

Top Picks Dominion Energy D

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $84

Fair Value Uncertainty: Low

Tax reform, a surprise regulatory ruling, and the Scana acquisition required Dominion to rethink its financing plans. However, its underlying profitability remains intact. The company has made a strategy pivot, divesting no-moat businesses while investing heavily in wide-moat infrastructure projects. Examples include the $4 billion Cove Point liquefied natural gas export facility and the $8 billion Atlantic Coast Pipeline. We expect wide-moat businesses to generate half of Dominion's earnings by 2023. Although dividend growth will slow, we still think Dominion can deliver double-digit total annual returns for the foreseeable future.

Edison International EIX

Star Rating: 3 Stars

Economic Moat: Narrow

Fair Value Estimate: $68

Fair Value Uncertainty: Medium

Wildfires have scared investors out of California, but we think this makes Edison International a rare buying opportunity. We forecast 6% annual earnings and dividend growth for at least the next five years based on its $5 billion annual investment plan and regulatory support. California's focus on safety, renewable energy, electric vehicles, and energy storage support growth. Regulatory delays and policy shifts could make earnings growth lumpy, but the dividend should grow steadily. Shareholders face less fire risk from Edison’s Southern California territory and should benefit from policy changes that save bankrupt neighbor PG&E.

Engie ENGI

Star Rating: 3 Stars

Economic Moat: None

Fair Value Estimate: EUR 14.50

Fair Value Uncertainty: Medium

Engie trades at a 20% discount to the sector on 2019 price/earnings and yields 5.4% as of late March, above the 5% sector average. We think this discount is unjustified. Engie has solid fundamentals and lower leverage than its peers. Its investments in renewable energy, rising achieved power prices, and cost-cutting should drive 8% annual EPS growth and 6% dividend growth in 2018-21. A partial exit of the French gas transmission assets and the sale of the French state’s stake in Engie’s capital would be positive catalysts.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)