Investing in a Core Low-Carbon Fund

Carbon-risk metrics reveal dozens of choices.

If you are concerned about global warming and are a fund investor, one thing you can do now is invest in a low-carbon mutual fund. By that, I'm not talking about devoting a small portion of your assets to a fund focused on renewable energy or green solutions, although I think that's a good idea, too. I'm talking about lowering the carbon risk in your core portfolio by investing in a diversified low-carbon large-cap stock fund. Morningstar made that easier than ever to accomplish last May when we began identifying low-carbon funds across the universe of open-end funds and exchange-traded funds.

Based on Sustainalytics' innovative new company carbon-risk scores, funds earn the Morningstar Low Carbon Designation if the companies they hold exhibit low overall carbon risk and have lower-than-average exposure to companies with fossil-fuel involvement.

Carbon risk is an assessment of how vulnerable a company is in the transition away from a fossil-fuel-intensive economy. Specific risks include policy and legal regulations that limit carbon emissions or put a cost on emissions; public and consumer pressure on companies to align their strategies with the Paris Agreement's 2-degree scenario; and switching costs to new green technologies. According to Sustainalytics' analysis, more than half of the 4,000 companies in its coverage universe have some exposure to carbon risk.

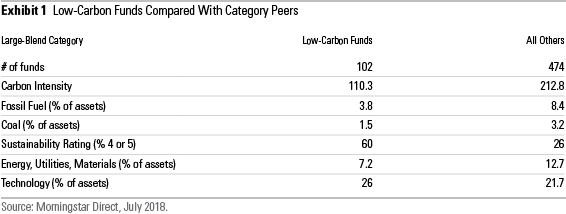

To find low-carbon funds that provide core exposure to U.S. large-cap stocks, the place to start is the large-blend Morningstar Category. As of July 2018, the group contained 102 funds with the Low Carbon designation. That's about 18% of the funds in the category.

These funds not only have low carbon risk based on an asset-weighted average of their holdings, their average carbon intensity is 55% lower than the average of higher-carbon funds. Carbon intensity measures a portfolio's carbon footprint by aggregating the carbon intensity of each holding on an asset-weighted basis. A company's carbon intensity is its total emissions per million dollars of revenue.

The low-carbon funds average only 3.8% of assets with direct exposure to fossil fuels compared with an 8.4% exposure among higher-carbon funds, and only a 1.5% exposure of assets to coal versus 3.2% for higher-carbon funds. Eleven of the low-carbon funds are completely fossil-fuel free, and 10 more have less than 1% of their assets exposed to fossil fuels.

As a group, the low-carbon funds tend to also have Morningstar Sustainability Ratings of High. In fact, 60% receive either 4 or 5 globes. The Sustainability Rating is a broader indicator of how well the holdings of a fund rate on a range of environmental factors in addition to carbon risk, as well as on social and corporate governance factors.

From a sector perspective, low-carbon large-blend funds are naturally underweight energy and utilities, but they are not, on average, completely devoid of exposure to those areas. The average low-carbon fund has 7.2% of assets in the energy, utilities, and materials sectors, compared with the 12.7% exposure of higher-carbon funds to those sectors. To offset those underweightings, low-carbon funds are overweight technology, where the average low-carbon fund has 26% of assets compared with 21.7% for higher-carbon funds.

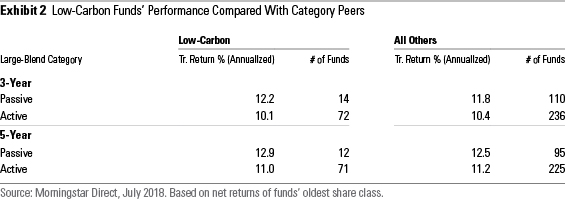

As for performance, track records never provide definitive answers, but less so in this case. For one thing, our first carbon-risk assessment for funds was made just this past May based on company carbon-risk ratings covering 2017. While we can look at the longer performance track records of low-carbon and higher-carbon funds, we can't say for certain which group a fund would have fit into, say, three or five years ago. Second, the idea that carbon risk may have negative performance implications if not properly managed is a long-term view that may not have affected fund returns thus far.

Keeping those caveats in mind, you can see that the 102 low-carbon funds, on the whole, have performed roughly in line with the large-blend category. Because passive index strategies have become the choice of so many investors for their core holdings, I split out the actively managed funds from the index funds. While active higher carbon has slightly outperformed active low carbon, passive low-carbon funds have outperformed other passive funds on a trailing three- and five-year annualized basis.

What are some of the better low-carbon choices? About one in four low-carbon funds are also intentional sustainable-investing funds, which provides some assurance that they will retain their low-carbon profile going forward.

Among them, TIAA-CREF Social Choice Low Carbon Equity TNWCX is a version of

Among actively managed conventional funds that nevertheless receive a Low Carbon designation are

Investing in low-carbon funds is a way for fund investors to begin managing the portfolio risks associated with global warming. In so doing, you are in the company of a growing number of large institutional investors who run pension, insurance, and sovereign-wealth funds, and are signaling to companies your concern about the impact of global warming on your investments.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)