First Quarter in U.S. Equity Funds: Growth Dominates Value

After a tough 2016, growth made a comeback in 2017's first quarter.

U.S. stocks continued their march higher during 2017’s first quarter to date through March 30. The S&P 500 was up 6.3%, while the Russell 2000 Index was up 2.2%. For most of the quarter, investors remained upbeat that a Donald Trump presidency would result in pro-growth policy changes, though doubts are mounting after a failed effort to reform U.S. healthcare in late March. Economic data--including employment reports and consumer confidence--was generally strong during the first quarter, contributing to the Federal Reserve's March decision to raise short-term interest rates for the second time in four months.

Technology stocks within the broad Russell 3000 Index have led the way in the first quarter, climbing 12%. Tech giants

After rising more than 50% in 2016, Brent crude prices fell 7% to $52.42 for the quarter to date. As a result, the energy sector was down about 7% in the first quarter. Poor performers include exploration and production players

Morningstar Style Box Categories

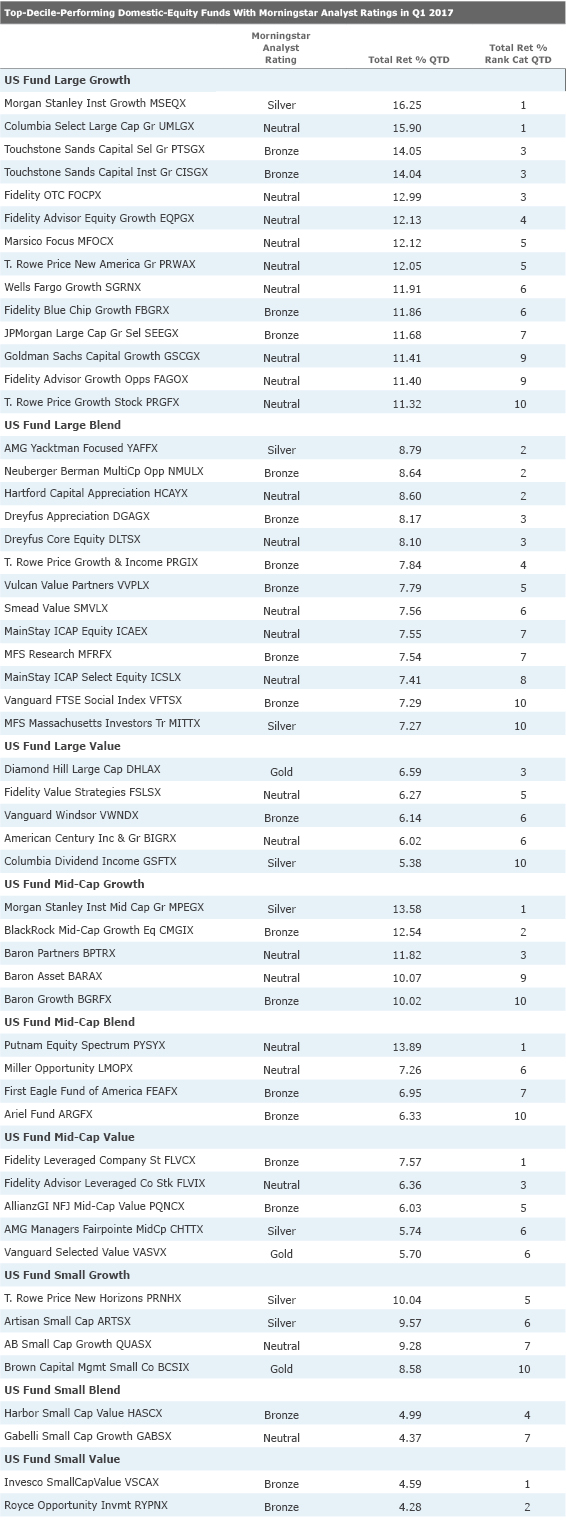

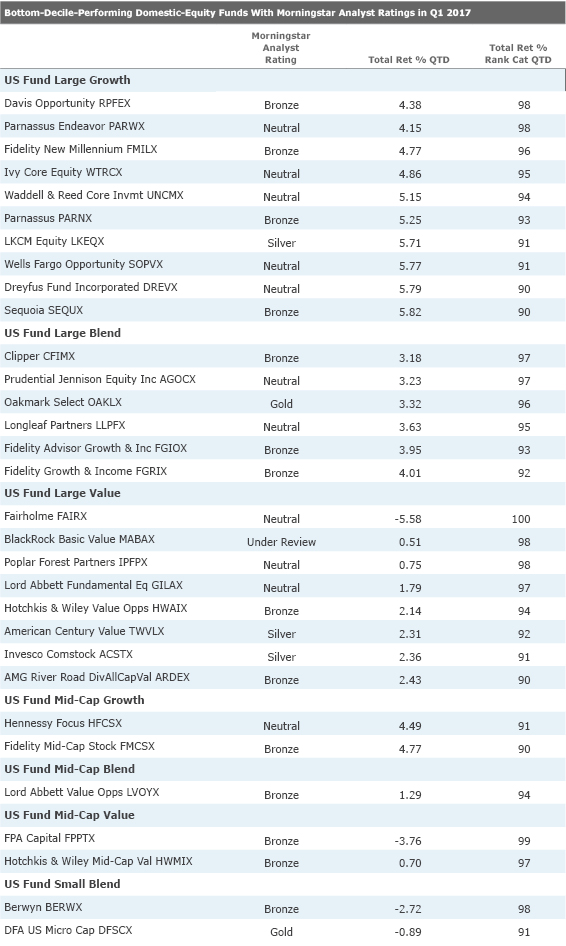

Large-cap funds outperformed their smaller-cap counterparts in the first quarter of 2017. The large-growth Morningstar Category was the top-performing category in the Morningstar Style Box for the quarter to date through March 30, gaining 8.8%. Silver-rated

In the mid-cap space, growth also fared better than value during the quarter: The mid-cap growth category gained 7.3%, while the mid-cap value category was up 3.5%. In the mid-cap growth category, Bronze-rated

After posting the highest returns of the Morningstar Style Box categories in 2016, small-value and small-blend were the weakest-performing categories for the quarter to date through March 30, 2017, gaining just 0.1% and 1.6%, respectively. Gold-rated

For additional details on Morningstar Categories, visit this Fund Category Performance page. PDF versions of the tables are available: Top and Bottom.

- source: Morningstar Analysts. Data through March 30, 2017.

- source: Morningstar Analysts. Data through March 30, 2017.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)