Economy Has More Than Trump Policy Uncertainty to Worry About

Our new president will likely inherit an economy that is losing steam.

With earnings season behind us and only minor economic reports released this week, markets could focus full-time on the election and Donald Trump's surprising win. And focus they did.

Wednesday, after the election, investment-related firms spent all day gearing up for expected large market declines. Many companies, including Morningstar, set up calls to reassure investors, to encourage them not to panic, and to stick with their carefully crafted investment plans. With 5%-10% declines after the equally surprising Brexit vote in June and large overnight losses in many world markets, everyone was geared up for the worst. In retrospect, it looks like the focus of those calls should have been why Trump won't get everything he wants, and to remind investors of weakening economic fundamentals and relatively high valuations.

After a very brief decline in the first half-hour of trading, U.S. equities moved up sharply on Wednesday and Thursday and a little more on Friday's Veterans Day holiday, which limited market activity. For the week, the S&P 500 was up almost 4%, and the Dow was up an even better 5% or so. European stocks didn't do much, with a gain of about 1%.

Not everyone was a winner. Emerging markets fell over 5% Friday to Friday and an even stronger 9% from Tuesday night's close to Friday's close, as worries about Trump's trade policies and potentially higher interest rates weighed particularly hard on this sector. Bonds did terribly, too, as investors feared a combination of Trump tax cuts and less spending restraint would lead to higher inflation and higher interest rates. The interest rates on U.S. 10-year Treasuries moved from 1.8% to 2.1% in a single week and are well off their July low of 1.5%. This will not be great news for the housing industry, as market-based 10-year rates, not the U.S. Federal Reserve, set mortgage rates. So while everyone is quibbling about which month a potentially small 0.25% interest rate increase by the Fed might occur, back in the real world, rates are up 0.6% on the 10-year, which will likely drive mortgage rates up and affordability down. It had nothing to do with the election, but commodities also had a down week as high inventories and warm weather took a toll on the energy complex.

After Trump's election, many strategists, almost all of whom assumed he would lose, dusted off the broad outlines of Trump's policies and discovered that a few of them might help the economy in general and some businesses in particular. He wants to cut taxes, is not fixated on cutting costs, and has shown interest in more infrastructure spending. Except to bond investors, that didn't seem like a bad idea. He had also talked about less regulation, particularly Dodd-Frank regulations, and that made many financial types very happy. And maybe the energy industry wouldn't feel quite so under the gun. Gee, maybe Trump wouldn't be so bad after all.

However, conveniently forgotten, at least through Friday, were trade policies that are likely to provoke at least some retaliation, and immigration policies that might limit labor force growth, which is one of the pillars of GDP growth. In addition, the stimulus plan could create more inflation, which was already on the rise without the help of Trump. And, of course, there is the issue of implementing his policies, which a lot of new presidents have found surprisingly difficult.

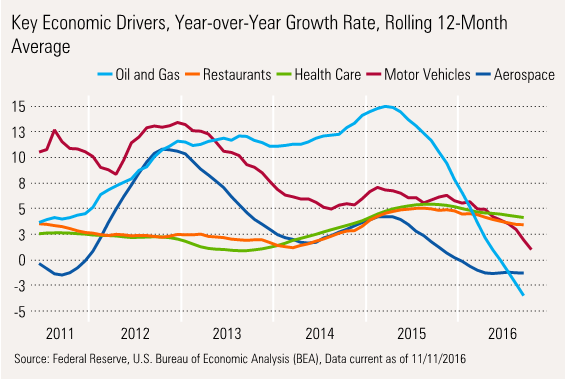

Trump Will Likely Inherit an Economy That Is Losing Steam I believe that the exact policies and winners and losers will prove to be just about as difficult to predict as who would win the current election. And even if all of those were clear, a lot of that would be priced into stocks and bonds. However, it is clear that a lot of clouds, perhaps not storm clouds, were gathering over the U.S. economy. A few weeks ago, we ran a chart of industries that were driving the economy and were clearly past their prime.

We believe that erosion continues. The auto industry got some more bad news as

We note the weekly chain-store sales have shockingly gone into negative territory on a year-over-year basis. Business-related construction spending also looks worse than we had hoped, and billing by architects, a great economic indicator, continues to worsen.

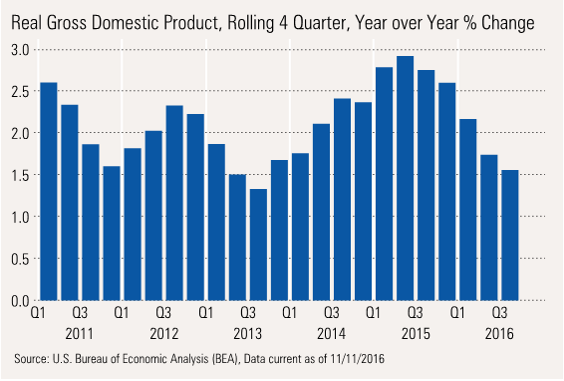

More broadly, measured on a rolling 12-month basis, GDP growth has slowed from 2.9% to 1.6% and taken employment growth with it.

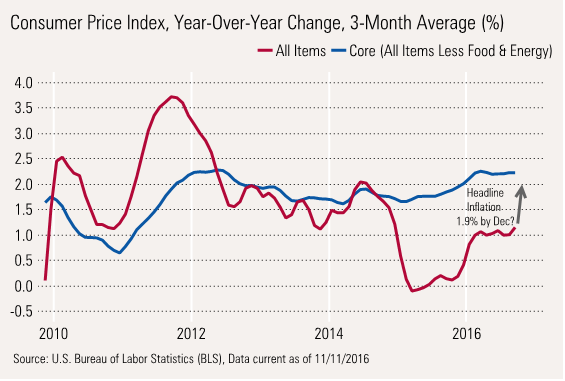

We have also raised concerns about accelerating inflation rates for some time. With gasoline prices failing to make their usually large autumn declines, headline inflation could approach 2% by December.

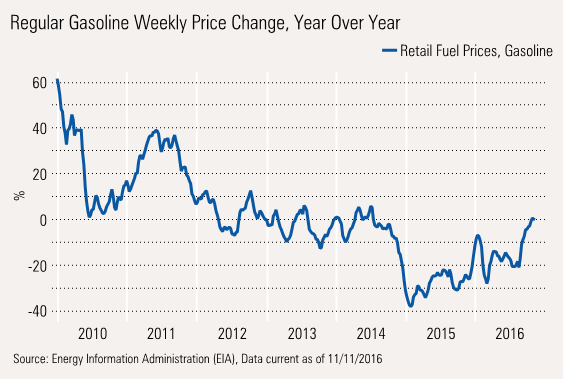

Core inflation has been relatively robust for some time, but falling energy prices have masked a lot of those increases. On a year-over-year, weekly basis, gasoline prices are now higher than they were a year ago, as shown below.

As we have said before, large increases in inflation, no matter which categories are causing the issue or whether they are core, are the number-one killer of recoveries. Potential fiscal stimulus, on top of inflation rates that have already moved uncomfortably higher, could throw more gasoline on smoldering inflationary embers. The bond market has figured that out relatively quickly. Equity markets, not so much.

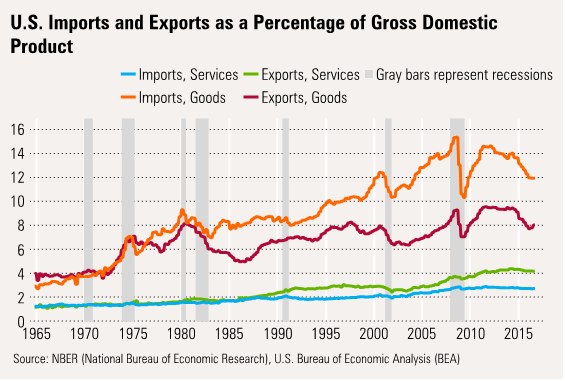

Trade Remains an Important Part of the Economy; Solutions Are Less Than Clear A lot of discussion about world economic growth and numerous elections and referendums have centered on trade. Even in the relatively insular U.S., exports still comprise 12% of GDP, and that number is way up from the 5% level of 50 years ago. However, imports, with a relatively large open door in the U.S., are an even larger 20%, and also have grown.

As economists, we have generally cheered these developments as they have raised much of the world out of poverty, eliminated wasteful duplication of effort, allowed specialization that increased productivity and decreased prices, and therefore, led to faster growth. I still believe that is generally true, but am less sure that the playing field was always level. And for those left behind by shifting manufacturing/mining activities, the government turned a relatively blind eye. In some cases there was acceptance if not cheering that that grubby, dangerous, and polluting industries were driven out. However, there was little or no thought about what to do about those left behind. That lack of concern and empathy hurt the Democrats in the Rust Belt and was at least a factor in the election.

Now, with Trump in charge, it won’t be clear for some time if his objective is just to level the playing field or if he plans to take wholesale action to limit trade via tariffs or other barriers. With trade representing such an important part of the economy, as we noted above, we hope he moves carefully so as not to damage the golden goose we call trade.

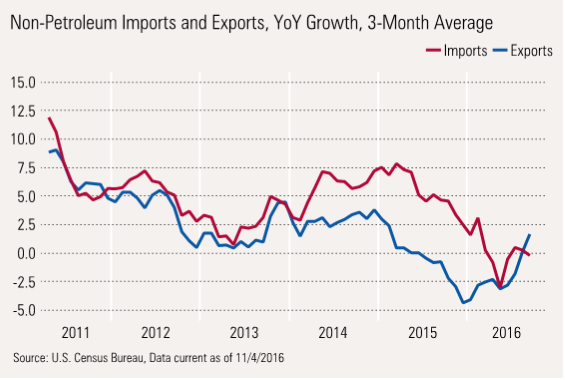

Trade May Be Rebalancing Some on Its Own While the reasons are not entirely clear, some of the trade issues may be balancing out at least a little. For whatever reason, import growth has slowed dramatically. Using our three-month moving-average methodology, the table below shows that non-petroleum export growth is growing ever so slowly, while imports are showing no growth at all. Shipments from China were down between September and October. Whether this is a short-term blip related to iPhones and clothing or something deeper will become clearer in the months ahead.

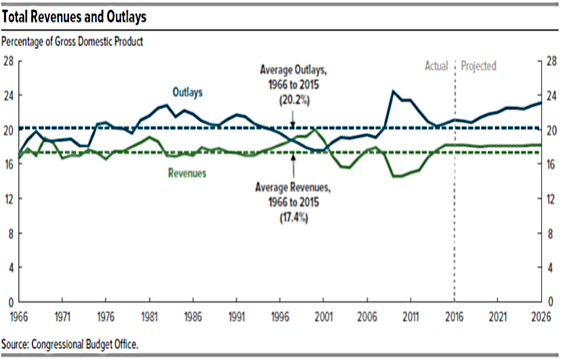

Budget Worries Could Keep a Lid on Trump's Grand Plans Rising government debt remains a major concern and could limit some of Trump's options. Trump has repeatedly offered up tax cuts and alludes to more stimulus measures, which will potentially drive budget deficits higher than they already are. He does offer that better growth and less regulation could easily limit the damage. We aren't so sure. Mainly because of Medicare, Medicaid, and Social Security, the debt can't help but get worse over the next decade, even without any other dramatic increases in other categories of spending. The chart below spells out that dilemma. Spending looks destined to hit a budget-busting, nonwar period record 24% of GDP.

Just Maybe Things Will Work Out

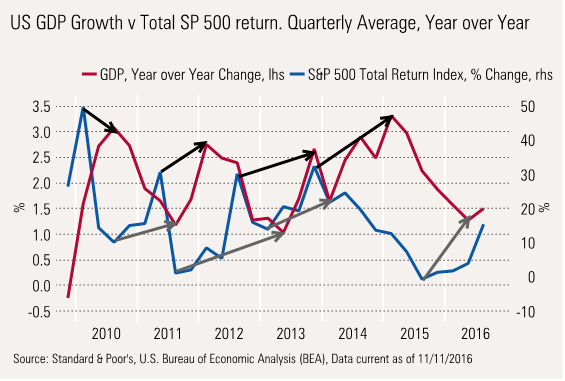

One thing that I have often found is that when you can "prove" with a lot of charts and tables that things can only get worse, most of that data has been factored into markets. The more airtight the case, the less likely it is to happen. Conclusions based on a few key indicators turning, while others are mired in the mud (or glued to the ceiling) often prove to be more correct. One of those rare bullish indicators at the moment is the stock market, which is now up over 8%, year to date, in 2016 versus a full-year performance of just about 1% in 2015. Many would have you believe that they predict the economy, which helps them project the stock market. The reality is, stock-market turns almost always beat economists to the punch. The graph below shows that markets generally move two to five quarters before the real economy.

The value of the chart is not in making exact forecasts. With largely variable lead times, hard to identify tops (at least at the time of the top), and rolling average lead times, this methodology isn't very helpful. Still, it does say that stocks almost always identify even relatively small economic turns before they happen.

And as many have pointed out, you can never underestimate the resourcefulness and flexibility of U.S. workers. That certainly proved to be the case in 2009 as many workers dramatically shifted career paths while workers in other developed markets dug in their heels in current professions.

Though Trump is no Ronald Reagan, we note that after a few years of pain, the last time we had movie star/TV personality win the White House on a platform of tax cuts, unfunded spending requests, and less regulation, the economy managed to fare pretty well, in what some view as the good old days of the 1980s. We note the contrast between the two is strong and wouldn't use the trajectory of one to project the other. But it does say the unexpected can and does happen.

As every forecaster was reminded this week, the world is a set of probabilities, and things besides the expected case can happen. That is why we have offered up both of our worries, which are the very real and likely case, and the more bullish case.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)