Housing Losing Its Luster

It doesn't appear that the housing market is going to save us from slower economic growth.

This week’s economic calendar was almost devoid of data as all the important stuff was squeezed into last week’s releases. About the only data we got this week was housing starts and permits along with the relatively useless builder sentiment report.

Starts and permits data haven't budged that much on a year-over-year basis versus past trends. So it doesn't appear that the housing market is going to save us from slower economic growth. The GDPNow forecast remains at 2.5% for the second quarter after this week's data release, and we continue to believe that looks too high based on the consumption numbers they are using.

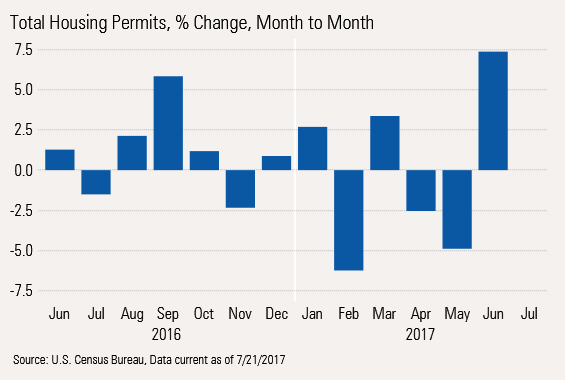

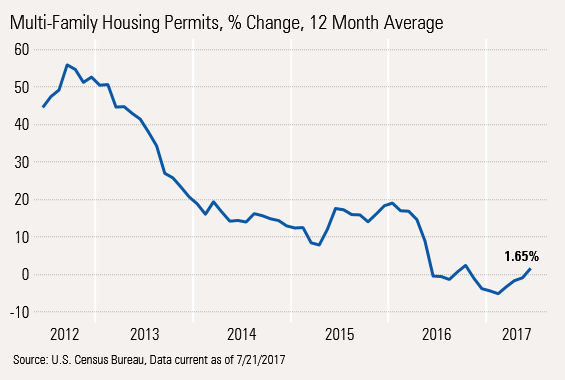

Monthly Permits Data Had a Good Month Following Months of Poor Data Because weather strongly influences starts, we tend to look at permits as a better measure of housing activity. Furthermore, permits data generally leads starts data by a month or two.

The short-term news here was good, with a nice month-to-month jump overall of 7.5%. However, that does follow the previous months that showed declines on three out of four occasions.

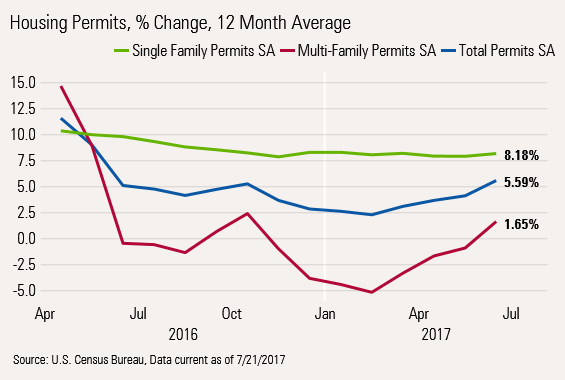

Year-Over-Year Data Looks Like It Is Stabilizing, Too On a year-over-year 12-month average basis, permits are up 5.9% following a winter low of 2.5% growth. Unfortunately, almost all of that improvement was from the less-value-adding apartment sector, which has moved from negative territory to barely measurable growth.

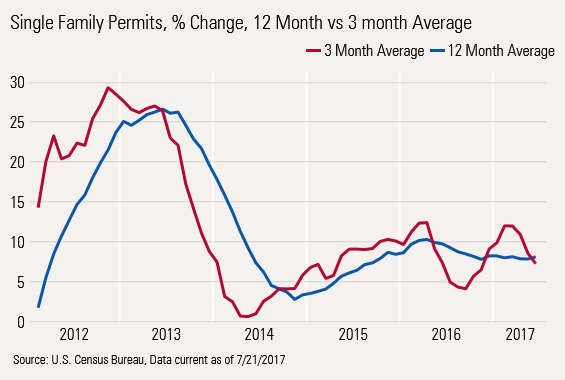

Single-Family Is Our Key Focus The most important sector of this report is single-family market. Both our three-month and 12-month averaged data suggest growth of 7%-8%. That seems like a relatively healthy and sustainable rate, but it has crept down from 10%-12% at the beginning of 2016. Lack of land, lack of workers, higher materials prices, and affordability issues are all weighing on the new home market. Again, certainly not disastrous results, but certainly not the magic bullet everyone had hoped for.

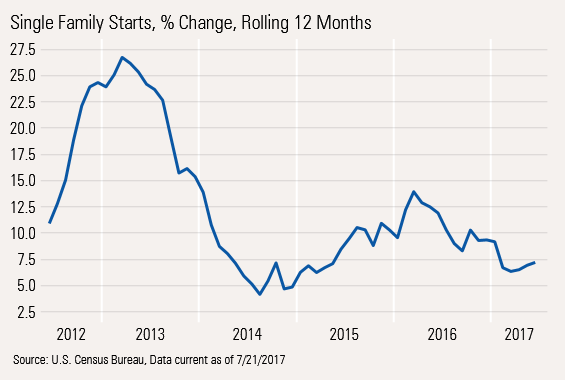

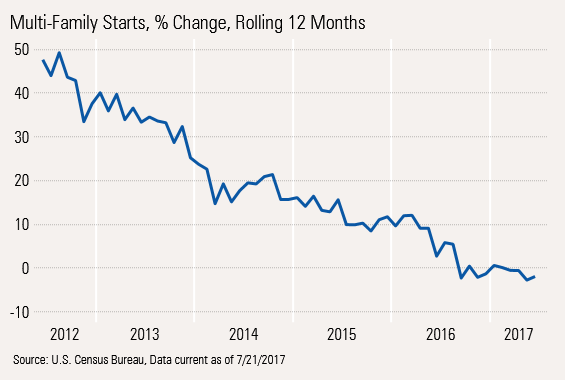

Starts Growth Now In Line With Permit Data Because of weather and tax issues, permits and starts don't always move in lockstep, but the patterns currently look fairly similar, suggesting inventories remain under good control. Even the end value is relatively similar, with both starts and permits in the 7%-8% range.

Multifamily Stabilizing? The market for apartments had a huge demographic and tax-related pop that has faded in relatively dramatic fashion. Single-family permits are now back in the black, which will stop the bleeding in starts. But we doubt that growth will accelerate much from here because of some overbuilding in major metro centers and unfavorable demographics.

Which Should Eventually Aid Starts and Finally, GDP

Because it takes longer to move from a permit to a start on a large multifamily complex, the clear bottom that showed up in permits early this year is now just beginning to show in the starts data, which is still mired in negative territory.

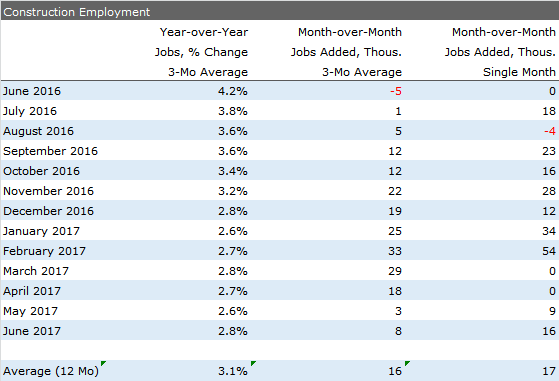

As Residential and Nonresidential Investment Has Slipped, So Has Construction Employment With single-family housing slowing some from levels of a year and a half ago, and apartment starts in negative territory, construction spending and employment are also showing some softening, although there is some sign of stabilization here, too.

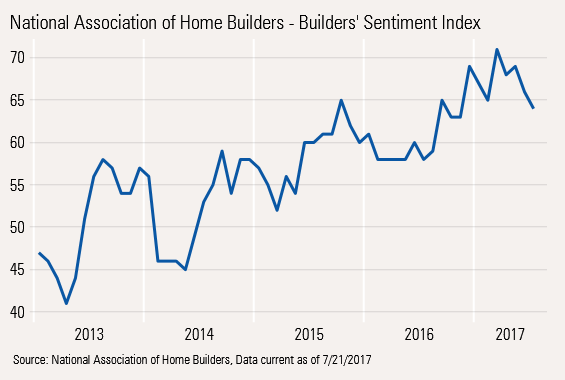

Builder Sentiment Is Slipping, Too Builders, while still relatively optimistic, have been losing some of their enthusiasm, though we caution that is not the world's best indicator.

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)