Revisiting 80 Years of Sloth

Voya Corporate Leaders Trust has defied expectations for decades.

A version of this Fund Spy was originally published on Feb. 8, 2011.

Warren Buffett could have been describing passively managed Voya Corporate Leaders Trust's LEXCX approach rather than his own when he said, "Lethargy bordering on sloth remains the cornerstone of our investment style." Buffett has nothing on this fund, which celebrated its 80th birthday in 2015, when it comes to sloth. Nevertheless, it has beaten the S&P 500 over a number of decades despite maintaining a largely static portfolio. This makes the fund an anomaly among open-end offerings (even among index funds). But its uncommon strategy and success hold potential lessons for investors of all stripes.

Less Active Than the S&P 500 The fund takes passivity to a level that would be intolerable for most investors. Knowing how difficult it is for most investors to do nothing, the fund's founders mandated in 1935 that the 30 stocks originally bought for the portfolio would essentially never be sold. (Buffett again: "For investors as a whole, returns decrease as motion increases.") It was just six years after the 1929 crash, and the Great Depression was in full swing, so memories of swashbuckling investors who had gone down in flames were still fresh. They didn't want any part of manager risk.

The fund would never add holdings, either. In fact, the only way that new stocks could enter the portfolio would be through spin-offs or mergers and acquisitions. On the other hand, a company would only be sold if it suspended its dividend or was in danger of being delisted or going bankrupt. As a result, the fund often goes years without selling a position, although it will dump a stock if its share price falls below $1, as

Over the years, there has been about as much turnover in the fund's corporate parent as in the portfolio itself. The original sponsor, Corporate Leaders of America, merged into Piedmont Capital in 1971. The fund changed its name to Lexington Corporate Leaders Trust in 1988 when Lexington Management became the sponsor. Pilgrim Investments acquired Lexington Management in July 2000, and the fund briefly became Pilgrim Corporate Leaders Trust. After ING Investments and Pilgrim merged in 2001, the fund changed its name in March 2002 to ING Corporate Leaders. In 2013, ING U.S. spun out from ING Group, and the company was rebranded as Voya Financial, leading to yet another name change.

With the very long term in mind (the fund was originally scheduled to liquidate in 2015, since extended to 2100), the original advisors wanted to find blue-chip, dividend-paying companies that could thrive for decades. (This could perhaps be considered the first smart-beta fund.) When looking this far out, decisions are driven more by enduring factors such as brands and sustainable competitive advantages rather than earnings projections. This is a very different mindset from most active management. Indeed, many portfolio managers look out about 18 months or so, with some considering a three-year holding period as long term.

It's notable that no financials companies of any kind were included originally. (The fund did hold Citigroup for a time after original holding American Can combined with what became Citigroup in 1993, and insurance company

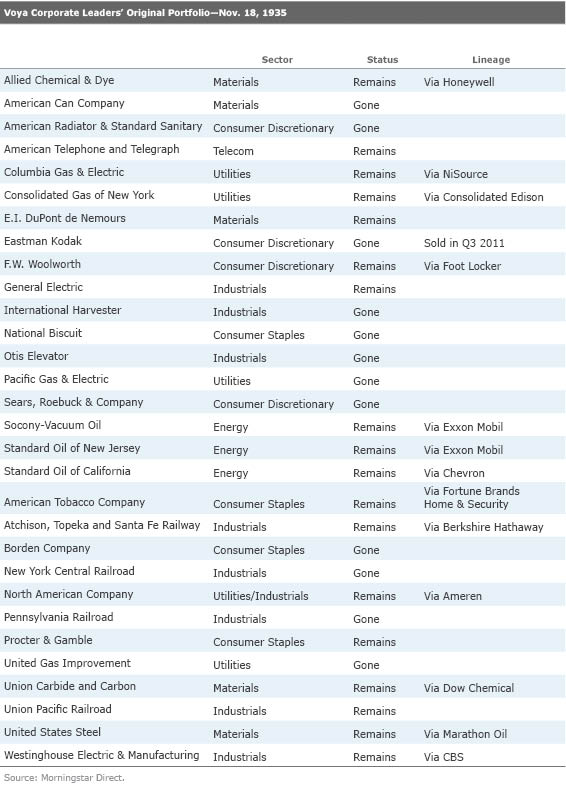

How have these original 30 companies fared? Quite well overall. (See the table below.) Only four have gone bankrupt, with Eastman Kodak the latest example in January 2012, although, as mentioned above, the position was sold in 2011's third quarter after the share price fell below $1. Eighteen of those stocks still remain in the portfolio in some form. But many of these have morphed through mergers and acquisitions. Only five companies remain in their original incarnation:

Some, in fact, have evolved beyond recognition. For example, Berkshire Hathaway is now the second-largest holding and the portfolio's only financials stock, having gained entry after it acquired Burlington Northern for shares in 2009, which itself had acquired Santa Fe, an original holding. (It should be noted, too, that although Berkshire is technically an insurance company, it is more of a diversified conglomerate. It is also one of the more financially sound companies in the United States.) Foot Locker FL derived from F.W. Woolworth. Comcast can trace its lineage back to AT&T. U.S. Steel is now represented by

The original emphasis on blue-chip companies still holds today. Nearly 90% of the fund's assets are invested in companies with a Morningstar Economic Moat Rating, as determined by Morningstar's equity analysts. Overall, 61% of the portfolio is in wide-moat companies, led by Union Pacific and Berkshire Hathaway. By comparison, 47% of the S&P 500 is in wide-moat stocks.

The fund's conservative mandate has made the fund far less active than even the S&P 500, which has annual turnover of roughly 5% to 10%. That owes to Standard & Poor's adding or subtracting names from the index in an effort to mirror the broad composition of the U.S. economy. Since the S&P 500 was introduced in the 1950s, hundreds of companies have been added and subtracted from the index. (Of course, this in itself is a form of active management.)

While these efforts have kept the S&P 500 in tune with the U.S. economy, they haven't necessarily led to better returns. Wharton professor Jeremy Siegel pointed out in his 2005 book,

The Future for Investors

, that the original S&P 500 stocks outperformed the annually reconstituted index from 1950 through 2003. Interestingly, many of the largest stocks from the original S&P 500 are also in this fund's portfolio, including AT&T,

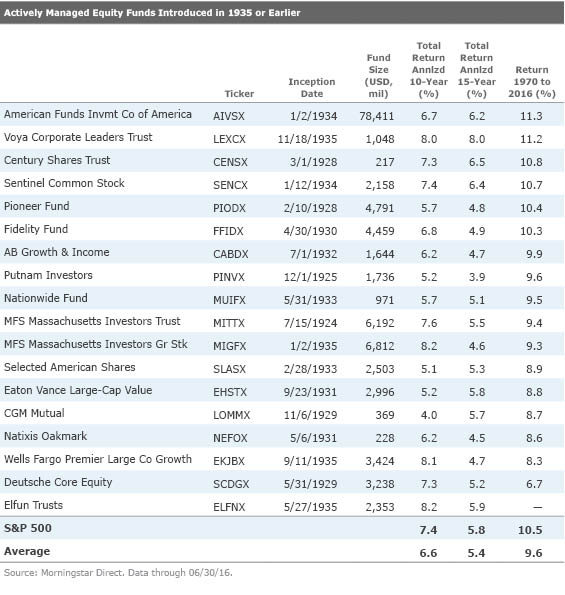

The fund has benefited from the same dynamics that have powered the returns of the original S&P 500 constituents. In fact, the fund has returned an annualized 11.2% since 1970 (which is as far back as our database goes) versus 10.5% for the S&P 500. It has also beaten all but one of the 17 other actively managed equity funds introduced in 1935 or earlier. (See the table below.) This group includes such esteemed offerings as

Happily Stuck in the 1930s So, what has driven this outperformance? The fund has earned these results with a portfolio that hasn't looked cutting-edge in decades. It has generally been dominated by railroads, utilities, consumer goods, and oil and gas companies. These sectors don't normally get an investor's pulse racing. But, as Siegel pointed out, railroads, tobacco, and energy companies have, perhaps surprisingly, been some of the best-performing stocks since the 1950s.

That means that the fund has beaten the S&P 500--at least over the past four and a half decades--even though it has largely missed out on the booms in technology and healthcare. Technology companies such as

This can invite a certain amount of skepticism. I speak from experience. I first covered the fund nearly 20 years ago at a time when its 15-year trailing return, again, led the S&P 500 by about 50 basis points annualized. Looking at its top holdings at that time--such as Exxon Mobil, GE, and DuPont--I thought that the fund had little hope of repeating its market-beating returns for the next 15 years, particularly considering that the market was just entering the Internet boom.

Thriving on Skepticism But it has continued to outperform over the long term, although it lags the S&P 500 over the trailing five years. Who would have expected this portfolio to beat the market over its lifetime, much less the past 15 years? Yet, perhaps that's the point. This fund has thrived for more than 80 years on chronically low expectations for its old-economy holdings. As Siegel indicated in his book, low investor expectations can often lead to market-beating returns. He also credited simply reinvesting dividends at attractive prices. This compounding has an incredibly powerful impact on returns over the long term.

On the other hand, sectors with great earnings growth often come with inflated investor expectations and the attendant high valuations. Tech companies grew quickly in the 1990s, but their stocks were also burdened with astronomical price multiples. Investors expected their exponential earnings growth to continue indefinitely. When it inevitably slowed, stock prices plummeted. (Studies have shown a similar dynamic with countries: Those with the fastest gross domestic product growth don't always have the best long-term equity market performance.)

There is likely a company lifecycle dynamic at work for this fund's holdings, too. Siegel and others have found that companies often deliver their best shareholder returns once they have reached maturity (that is, the cash-cow phase). At that point, a company is largely self-funded and is kicking off large amounts of free cash flow. Alternatively, fast-growing companies often need to access the capital markets to fund their growth, potentially diluting current shareholders. The main beneficiaries at this early stage are typically company founders and their initial investors (that is, angels and venture capitalists), as well as the investment banks who underwrite the IPOs. This is not to say that such stocks can't perform well, because there are legions that have, but the soaring stocks of rapidly growing companies often have a way of coming back to earth, even if the underlying fundamentals remain strong.

So, where does the fund stand now? There's as much reason for skepticism as ever. The portfolio has become quite concentrated, owing in part to years of mergers and acquisitions. The fund's top-five holdings now absorb roughly 50% of assets. Nearly 38% of the portfolio is in energy and materials stocks. If that's not enough to scare one away, one could replicate the portfolio on his or her own--or construct a similar one--using individual equities and save the 0.53% expense ratio. There are also cheaper exchange-traded fund options with a similar focus on quality, dividend-paying companies, such as

However, regardless of whether one is interested in owning the fund or not, it remains a powerful testament to the benefits of sticking to quality, dividend-paying companies for the long term. Given that its charter runs through the year 2100, it follows one final Buffett teaching perhaps better than even the Oracle of Omaha: "Our favorite holding period is forever."

/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)