February Ratings Activity Features Several Target-Date Series

Manager changes prompt downgrades at two T. Rowe Price funds.

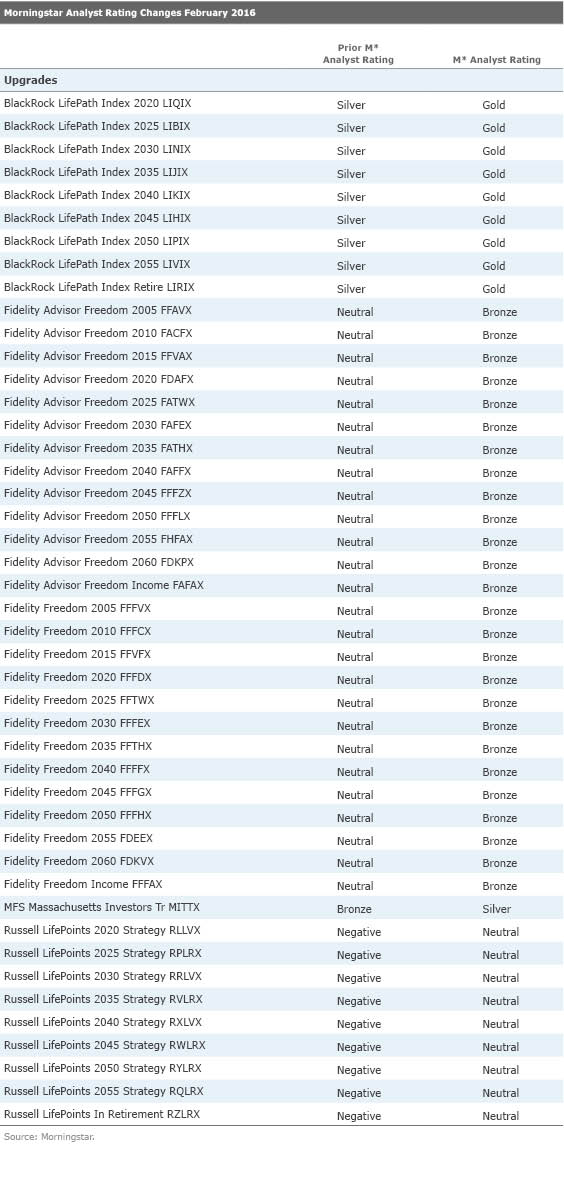

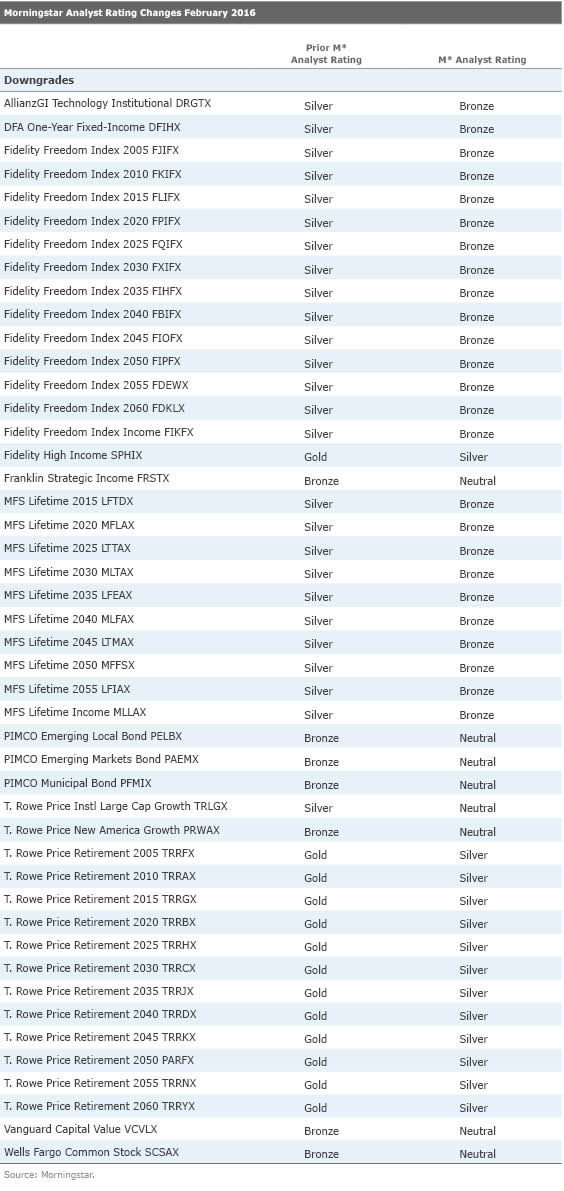

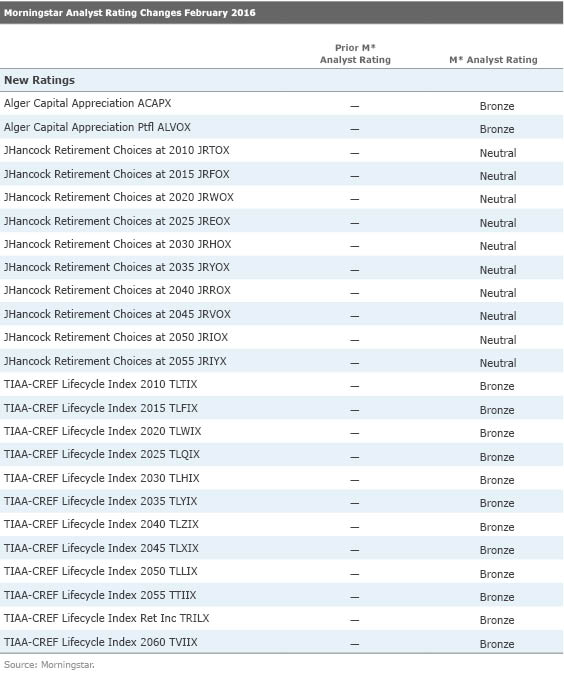

Morningstar manager research analysts upgraded the Morningstar Analyst Ratings of one fund and four target-date series in February, but downgraded 11 funds and three target-date series. We also initiated coverage on two funds and two target-date series. Some notable changes are highlighted here; a complete list can be found in the tables below.

Upgrades

The duo taps the firm's more-than 90 analysts to carry out an investment process focused on identifying high-quality companies, with an investment horizon of three to five years. The fund has outperformed during Beatty's tenure, and its risk-adjusted returns shine. It further benefits from rock-bottom expenses and the strong stewardship practices of its Boston-based parent company, all of which support an upgrade of its Morningstar Analyst Rating to Silver from Bronze.

Among the target-date series that received upgrades are the Fidelity Advisor Freedom and Fidelity Freedom series, which moved to Bronze from Neutral. After three years of significant changes to these strategies, management held tight in 2015. As the dust has settled, the series now appear better positioned for future success than they had in the past. An improved lineup of underlying funds supports the upgrade.

In late 2012, the series' managers inserted funds run by some of Fidelity's most accomplished investors, including Will Danoff. They had bypassed these managers' flexible approaches for years, opting to use funds with more-targeted asset-class exposure instead. The series include some less-proven strategies, but strength in both stock and bond strategies bodes well for investors across the glide path.

Downgrades

Two T. Rowe Price funds were downgraded as the result of manager changes.

On April 1, 2016, Dan Martino will step down as manager of

Meanwhile, the T. Rowe Price Retirement series has fallen to Silver--still a strong vote of confidence--from Gold. Solid underlying funds and a steady asset-allocation approach give the series a discernible edge over most peers. However, the team's tendency to stick with the status quo when underlying manager concerns arise gives pause, and continued asset growth might lead to a small shift away from active management, a driver of the series' outstanding long-term results.

New Ratings The TIAA-CREF Lifecycle Index series follows a straightforward approach to target-date investing. The simplified asset allocation might not offer exposure to more-granular asset classes found at other offerings, but that hasn't hurt the series' performance since the late-2009 launch. A seasoned management team and some of the lowest fees in the industry add to its appeal, helping the series earn a Morningstar Analyst Rating of Bronze.

John Hancock Retirement Choices emphasizes capital preservation, trying to damp market losses, and the asset-allocation glide path emphasizes fixed income over equities. Stocks have generally led bonds since the series' 2010 launch, so the series' funds have struggled to keep pace with most peers from then through the end of 2015. In periods of market stress, such as in 2011 and January 2016, the funds have held up relatively well. The team has so far demonstrated a knack for making additive market-timing moves, though there's much research showing the difficulty of consistently adding value through tactical calls. It's inconclusive whether those decisions can offset the series' weighted-average expense of 0.49%, which is lower than most but high compared with other index-based offerings. That uncertainty contributes to this series' Analyst Rating of Neutral.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)