Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Valuations look more attractive as the market reacts to persistent near-term headwinds affecting several industrial subsectors.

- Our industrials coverage currently trades 1% above our fair value estimates, despite broader market declines. However, select stocks within the group are trading at steep discounts to our fair value estimates, providing attractive opportunities for investors.

- Industrials have been buffeted by strong global economic crosscurrents. Oil and many commodity prices have continued their downward spiral, while growth in China remains relatively weak, and worries are mounting over whether the Chinese government can effectively manage the economy to avoid a hard landing. The strength of the U.S. dollar against most other currencies continues to hamper firms that generate significant portions of their sales outside of the United States. The Federal Reserve has begun tightening monetary policy and lifting the discount rate in the U.S., even as the European Central Bank continues its program of quantitative easing and several European markets currently have negative-interest-rate environments.

- Despite the global turmoil, the U.S. economy remains relatively strong, with third-quarter GDP rising 2.0% and the headline unemployment rate declining to 5%. Demand for automobiles remains healthy, and both residential and nonresidential construction continue to expand. We believe that continued strength in the U.S. will buoy many of our companies as they continue to improve cost efficiency, preparing for more-stable commodity prices and a return to stronger growth in emerging markets. Merger and acquisition activity, which has been somewhat muted in the industrials space relative to healthcare and some other sectors, could also begin to play a bigger role for industrials.

Since our last update, the global economy has continued to convulse from the effects of dropping commodity prices and slower growth, especially in many emerging markets. At the time of writing, our industrials coverage list is trading at a 1% premium to our fair value estimates. We believe that declines in select industrials stock prices

provided long-term investors with several attractive opportunities. Below, we highlight multisector industrial

Prices in the energy and many commodity markets continued to slide this quarter, in keeping with the trend that has been in place since last year. West Texas Intermediate crude oil prices recently touched $36 per barrel, breaking lows seen during the financial crisis in 2009. Other commodities, such as coal, copper, and iron ore, have seen steady price declines as emerging-markets demand, especially in China, has stagnated while production has expanded or held stable. The ongoing pressure on energy and commodity prices has led to sharp reductions in capital spending plans among oil producers, miners, and farmers, resulting in decidedly lower order books for many machinery and equipment makers in the industrials sector. Eventually, commodity markets will balance as prices move toward levels needed to incentivize exploration and production to meet future demand.

Energy and commodity weakness, as well as sluggish world trade growth, has negatively affected the transportation-related names in the industrials group. Global trade has been somewhat volatile, with the CPB World Trade Monitor index rising 0.5% in September, following a 0.6% decline in August. Total carloads for North America's six major railroads have declined by between 2% and 8% during the past 13 weeks, according to AAR data. Coal has seen the largest volume declines, but intermodal and merchandise volumes have been generally weak as well. Trucking tonnage has held up somewhat better with the ATA Truck Tonnage Index, rising 1.9% in October, versus September's 0.7% drop. Even here, however, there are concerns, as supply-chain inventories have risen relative to sales.

Global automobile demand remains a clear bright spot in the industrials sector. U.S. auto SAAR reached 18.1 million in November, a number not achieved since before the financial crisis and up nearly 8% from year-ago levels. Auto demand remains similarly strong in Europe, with European automobile registrations hitting 1.1 million in October, 16% above the year-ago period. At Morningstar, our outlook calls for continued growth in auto sales in 2016 for both the U.S. and Europe.

The U.S. construction market is another positive area and continues to generate gradual but steady growth. Both residential and nonresidential construction spending continue to expand. New home starts, including multifamily units, were 1.06 million in October, down from September's level of 1.2 million and roughly even with last October's 1.1 million figure. Job growth should encourage more first-time home purchases, but builders are currently struggling with shortages of construction labor in many markets, which limits what might otherwise be a stronger housing recovery. Nonresidential construction continues on a similar path, with the architectural billing index declining moderately to 53.1 in October from 53.7 in September. Any reading above 50 indicates an expanding market.

Global merger and acquisition activity remains strong as companies look for new growth and cost-reduction opportunities, while taking advantage of very low interest rates. While healthcare and energy have been leading sectors for consolidation, the industrials sector has also seen M&A activity. Within the past quarter, French industrial gas giant

) announced the acquisition of U.S.-based

), DSV (

) and

Emerson Electric

EMR

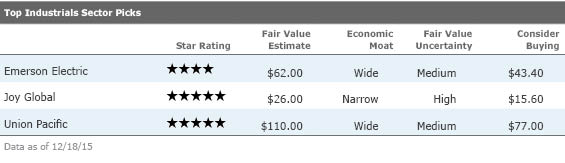

Shares of Emerson Electric currently trade in the 4-star range and offer a nearly 20% discount to our fair value estimate of $62 per share, as negative sentiment surrounding the company's oil and gas and emerging-markets exposure continues to pressure the name. Nearly 80% of the sales in Emerson's process management segment touch the oil and gas supply chain from upstream to downstream, and fears of an extended downturn in the sector have weighed heavily on the company's share price for the majority of 2015.

That said, we continue to believe that Emerson's entrenchment in process automation helps to mitigate cyclicality, and the company has historically been a consistent producer of healthy returns on invested capital, even as its segments experienced boom and bust cycles.

In addition, Emerson announced the intent to spin off or sell its lagging network power segment in 2016, an event we believe will ultimately serve as a catalyst for the depressed shares for two main reasons. First, letting go of the segment will ultimately free time, talent, and capital resources to be more productive in Emerson's remaining segments, which include the moaty, high-return process management, climate technologies, and commercial and residential solutions segments. Second, we expect that any proceeds realized in the transaction may be deployed toward tuck-in acquisitions that increase end-market diversification in process management, which suffers from overexposure to the beleaguered oil and gas segment.

We stress that this investment idea requires a long time horizon: Share gains in automation often occur at a glacial place, and acquiring new end markets in process management requires finding acquisition targets at reasonable valuations in an M&A environment that has recently felt rich. Nevertheless, we believe the foundation of Emerson's wide economic moat remains strong, and we expect stronger returns on invested capital to emerge as the company works through its portfolio repositioning.

Joy Global

JOY

We believe that the market is undervaluing mining equipment manufacturer Joy Global. While we do not think the mining equipment industry is on the cusp of a dramatic recovery, we do believe that Joy, which is trading under 7 times our 2015 free cash flow estimate and in 5-star range, is inexpensive for a business where conditions are close to a trough.

Joy Global is unique among its peer group in that roughly 70% of sales come from aftermarket parts and service. Most competitors have given this business to their dealers. While mining capital expenditures are under pressure in 2015-16, mining customers have reached a point where they have to begin rehabilitating their existing fleet of equipment, and this should benefit Joy Global.

Joy also stands apart because roughly 60% of its business is exposed to coal (predominantly in the United States). While the near-term outlook for U.S. coal consumption is not one of growth, our basic materials team sees upside in Powder River Basin coal prices and stability in Illinois Basin coal prices beyond 2015, which should spur more spending from mining customers. We think these conditions mean that Joy Global is inexpensive relative to near-term earnings, with share-price upside to a future recovery in new equipment sales.

Finally, Joy is not solely captive to the environment. Over 2014, management pulled $80 million of costs out of the business, with plans to remove another $50 million of expenses in 2015. The company's attractive free cash flow has been used to buy $483 million of stock during the past 24 months, and it has the authorization to buy back another $517 million of stock through August. We believe this cash flow deployment is particularly attractive relative to Joy's $1.5 billion market cap.

Union Pacific

UNP

Trading at a 23% discount to our $110 fair value estimate and in the 5-star range, wide-moat Union Pacific is the largest North American railroad and our top pick among transportation names. At 13.6 times forward price/earnings (2016) and 7.8 times forward enterprise value/EBITDA, Union Pacific trades cheaper than all but the lagging Eastern railroads, which continue to struggle with cost-disadvantaged Appalachian coal. We think it should trade closer to Canadian Pacific and

Coal constituted 18% of Union Pacific's sales last year, and year-to-date coal carloads have declined 15.8% versus the year-ago period, as still-low natural gas prices, mild weather, and high utility coal inventories have suppressed demand. We incorporate a 17% full-year coal decline and maintain our expectations of coal declines this year and next, offset somewhat by growth in intermodal units going forward.

Managing headcount is complex, but matching labor to work is key to operating ratio performance, as this is the rails' greatest expense line. After a half year of mismatches, Union Pacific dialed in labor in the third quarter to better meet demand and delivered a record 60.3% operating ratio--a 200-basis-point improvement year over year despite the coal drag and a 6.3% overall volume decline in the period. We still model a 63% operating ratio for 2015, but recently tempered our projected progress in 2016 to 61%, up from our previous projection of 60%. However, we think the firm will continue beyond this into the 59% range by 2018.

We like Union Pacific for its diverse portfolio (Powder River Basin coal, intermodal franchise at Los Angeles/Long Beach, California, Mexican trade, and fast-growing domestic, high auto exposure, and frac sand), room to slightly improve the operating ratio, conservative management, and 2.4% dividend yield. We think the market is focused excessively on the near term, and with a larger decline than expected in coal volume this year, earnings are down (1.7% decline in the third quarter) and shares are trading off. We maintain our wide moat rating, founded on a duopoly of efficient market structure and low cost compared with competing modes.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Energy: Pain Persists as OPEC Refuses to Play White Knight

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Healthcare: Even After Uptick, Some Great Values Remain

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)