Did Alternative Funds Stand Tall or Fall Down?

Late August provided a stress-test.

When the markets swooned in late August, many eyes pivoted to liquid alternatives. Would these newfangled investments, promoted in part for their ability to provide a cushion to portfolios during times of turbulence for the markets, fulfill their promise? A sharp six-day market correction (or even a multimonth downturn, if you count the S&P 500's decline from its high point in May 2015), is probably not sufficient to take the full measure of these funds, but it's enough of a deviation from the largely placid bull market of the last half-decade to at least offer some relevant insights. Call it a stress-test, if you will, of alternative mutual funds' resiliency.

The Wall Street Journal weighed in quickly with a fairly negative assessment: Alternative funds offer "limited protection," read the headline (I was quoted as a source in that article, in full disclosure). But the disappointment voiced in the article seems to be based on faulty, or at least overly ambitious, expectations: that alternatives should provide complete protection in a downturn or at a minimum outperform intermediate-term bonds.

This somewhat misses the point and ignores the design of most alternative funds. Indeed, they should provide diversification from equities, which tend to be responsible for most of the risk in investor portfolios, and ideally will protect better on the downside than stocks while allowing for some upside participation. But most of these types of funds do have exposure to the markets--sometimes through direct stock market investments, at times through exposure to other global asset classes--so in a sell-off as widespread and steep as we saw in late August, you shouldn't expect complete immunity. From that perspective, using U.S. Treasuries as a benchmark seems like an unfair comparison.

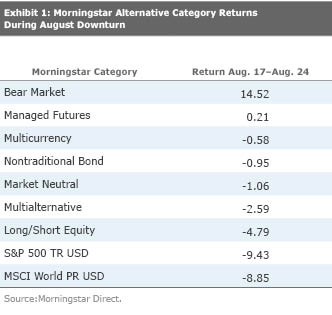

You should expect a muted downside capture, and that's what we've seen. By my reckoning, liquid alternatives have performed well within expectations. Of course, within any given category there are a range of outcomes, and I'll look into those further in a bit. But here are averages for Morningstar's alternative categories (expanded to include non-traditional bond) for the period Aug. 17-24, compared with the S&P 500 and MSCI World Index.

Unsurprisingly, bear-market funds, which bet against the stock market at all times, fared best. Morningstar believes that bear-market funds have a limited place in the portfolios of most investors and does not have a Medalist in that category.

Of greater interest is the second-best performer, managed futures. Managed-futures strategies tend to have very low, and even negative, correlations to the stock market; they gained notice after 2008, when the small number of mutual funds in the category and their many hedge fund counterparts held up very well. Since then, the number of managed-futures funds has skyrocketed to more than 50. Based on the results of last week, those diversifying qualities are still in force, as managed futures was the only category other than bear market to post a number in the black.

Other alternatives categories were in the red, but usually only slightly so, and generally well ahead of the major stock indexes. The multicurrency, non-traditional-bond, and market-neutral categories were all down about 1% or less, while the S&P 500 and MSCI World Index lost about 9 times that much (negative 9.43% and negative 8.85%, respectively). Currency funds generally have little correlation to the movements of stock markets, while market-neutral funds are expressly designed to minimize exposure to beta (though in reality, a number of them are slightly net long).

The biggest losses came in the long-short equity and multialternative categories, but even those were well within expectations. For instance, the long-short equity group lost 4.79%, about half the S&P 500's decline. Given that the average beta for the category has hovered around 0.5 over the past three years, that degree of downside capture is right on schedule. As I noted in a recent Fund Spy, however, there is a wide range of betas within the category around that average, and so individual fund results vary quite a bit.

Multialternatives constitute a fairly heterogeneous group, but many take an absolute return approach or strive to achieve set return and/or volatility targets. In recent years we've expressed concerns about relatively high correlations across the group, but the results in the August downturn provided some reassurance. The 2.79% category loss was about one fourth that of the stock market, a reasonable if not stellar result given the category's beta of 0.28. It appears that a number of managers have taken steps over the past year to adjust their strategy mix or net exposure to rein in market risks.

Notable Medalist Performances

Within the strong managed-futures category,

Of Medalists in the long-short category, the best-performing fund in the downdraft was Bronze-rated

Among more traditional long-short equity managers, Silver-rated

Within the multialternative category, global-macro type strategies, which typically have heavier directional components, have struggled more than many of the risk-aware multistrategy vehicles. Bronze-rated

The week provided a note of vindication, at least in the short term, for one other notable bear.

With the variability of results among alternative fund managers, the key thing is to check whether the fund performed in line with its (and your) expected range of outcomes. If you expected more protection on the downside than you received, it's time to examine whether your assumptions were correct or the fund has changed the way it structures its strategy or portfolio.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)