April CPI Forecasts Show Inflation Improvement Slowing to a Crawl

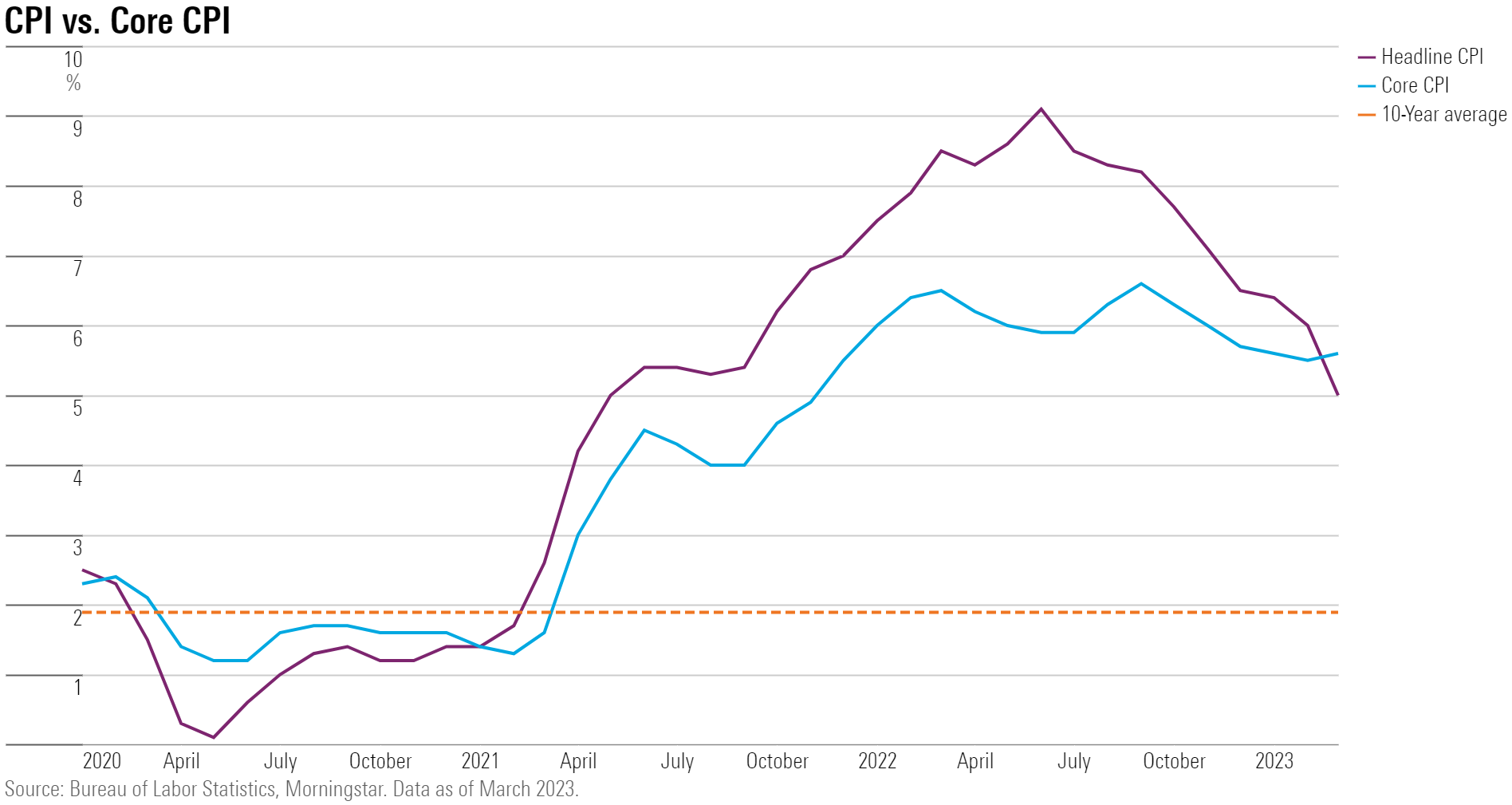

Inflation is expected to remain well above the Fed’s target.

Even as investors see the Federal Reserve hitting the pause button on interest-rate increases, forecasts for the April Consumer Price Index report suggest progress in the fight against inflation has slowed to a crawl.

The April CPI report is expected to show a 5.0% increase in inflation from a year ago, according to FactSet’s consensus forecasts.

That would be the same annual rate of inflation that was logged in March. While down substantially from the inflation rates seen in 2022, it would show upward pressure on prices continuing at a pace well above the Fed’s target levels.

“The direction of inflation is getting less bad, but pace of improvement is still frustratingly slow,” says Bill Adams, chief economist for Comerica Bank.

For the month, the CPI is forecast to rise 0.4%, while core CPI—which excludes volatile food and energy costs—is expected to rise 0.3%. In the March report, the overall CPI clocked in at an increase of 0.1%, which was the smallest increase in two years.

If the April report comes out in line with forecasts, analysts say it would reflect the challenge still facing the Fed in its battle to get inflation down closer to its 2% target as measured by the Personal Consumption Expenditures Price Index. Economists at Bank of America Securities, for example, titled their CPI preview “Moderating at a snail’s pace.”

Inflation has already fallen from the four-decade highs hit last year of a roughly 9% annual rate for the CPI to south of 6% in recent months. The question facing investors: How much further will inflation fall and at what pace?

Many economists are expecting economic growth to slow significantly in coming months owing to the combination of the Fed’s interest-rate increases and the regional banking crisis, which is expected to reduce bank lending. That slowing of economic growth—which could also lead to a recession—is seen as likely to take inflation pressures on another leg down.

April CPI Report Forecasts

Forecasts for the April CPI report show that progress toward reducing inflation is stalling, according to FactSet.

- The CPI is forecast to rise 0.4% in April after rising 0.1% in March, according to FactSet.

- Core CPI is forecast to rise 0.3% for the month versus 0.4% in March.

- The CPI, year over year, is forecast to rise 5.0% in April, the same pace as in March.

- Core CPI, year over year, is forecast to rise 5.4% versus 5.6% in March.

At Comerica, Adams’ forecast calls for a slightly more friendly reading on inflation. Adams is looking for a 0.2% increase in overall CPI, with a 0.3% increase in core CPI. On a year-over-year basis, that would amount to a 4.8% rise in the headline CPI and a 5.4% increase in core CPI.

Under the hood of the CPI report, Adams expects gasoline prices to show a decline as an increase in prices at the pump is erased by the Bureau of Labor Statistics’ seasonal adjustment factors. Food prices should show a smaller year-over-year increase than has been the case lately as costs for items such as eggs and pork have been flat to lower, Adams says.

Elsewhere in the report, Adams expects to see softness in auto prices in the wake of some car manufacturers cutting list prices. Used-car prices, which had been a significant source of inflation in 2022, are on the decline. “Used-car prices are over time going to be less inflationary than they have been in this cycle up until now,” he says.

However, shelter prices, which get recorded in the CPI with a lag when compared with costs in the economy, are expected to remain high, Adams says.

Watching ‘Supercore’ Inflation

Morningstar senior U.S. economist Preston Caldwell says he’s keeping a close eye on “supercore” inflation, which is core services excluding healthcare and housing costs.

“This category was up 7.3% year over year as of March, so still a very fast rate of inflation,” Caldwell says. “This category is heavily driven by labor costs, although the various wage measures are giving conflicting signals right now. So, this inflation category may help reveal whether wage pressures are contributing to inflation or not.”

Looking ahead, Adams thinks the trend for inflation remains lower, even if the pace at which it declines isn’t as quick as the Fed would like. He’s forecasting inflation to be in the 3%-4% range by the end of the year.

“Slowing inflation in combination with more signs of a cooler labor market will probably be enough for the Fed to decide to start reducing interest rates by the end of this year,” he says.

However, Adams cautions that the risk to his forecast is “to the upside to inflation as well as the interest rates.”

“Inflation has stayed higher for longer than then the conventional forecasting techniques would lead us to believe, and so the risk is that the persistence of inflation continues,” he says. “That’s another way of saying that once inflation has picked up, it’s hard to slow down again. And that’s where we are now.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)