Mega-Cap Stocks Are Leading the Latest Rally. What’s Ahead?

Valuations on many of the largest stocks may be less attractive.

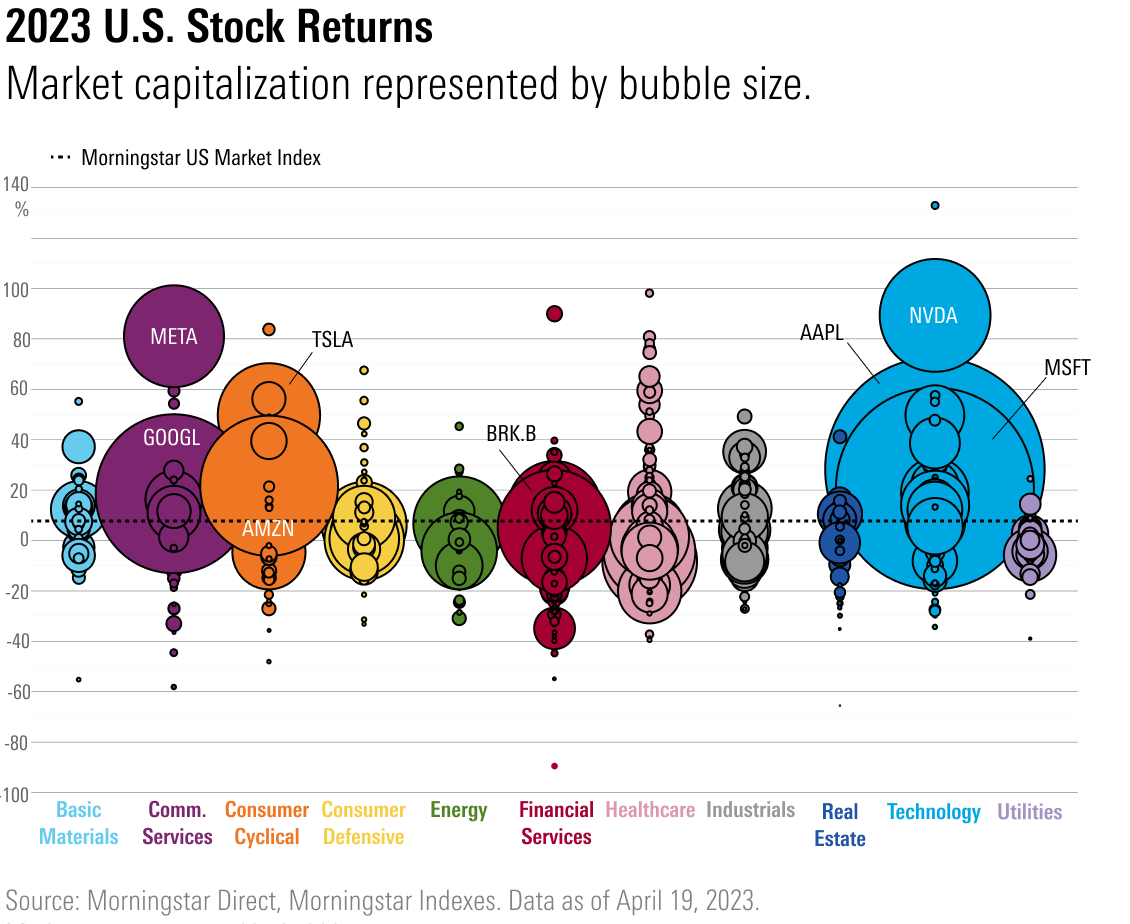

The biggest of the big among U.S. stocks have been this year’s heavy hitters, making double-digit gains and lifting up the rest of the market.

That includes names like Apple AAPL, which has a stock market value of $2.6 trillion, Microsoft MSFT, which is worth $2.2 trillion, and Google parent company Alphabet GOOGL, which has a market capitalization of $1.4 trillion.

“Mega-cap stocks have led a huge portion of the latest rally” says Gargi Chaudhuri, head of iShares Investment Strategy at BlackRock. “The largest eight or so names drove the massive outperformance we’ve seen over the past few weeks and months.”

The mega-cap gains have been especially pronounced since March, when fears around the regional banking crisis and potential economic slowdown drove investors to seek safety in these giant, well-known stocks.

“Amid a little bit of a banking tremor and overall turmoil, investors recognized that there were going to be ramifications to the very rapid rate-rising cycle that had taken place,” Chaudhuri says.

The companies that have been leading the stock market this year are mainly high-growth technology stocks and communication services sector stocks. These stocks tend to be sensitive to changes in interest rates, and the building expectations that the Federal Reserve will be cutting rates in the second half of this year have helped buoy the group.

The recent bounce in these mega-cap names marks a big reversal from 2022, when the same stocks got clobbered amid the fastest interest-rate hike cycle in decades, dragging the rest of the market into bear territory.

But what happens now is less clear, in part because for many, valuations look less attractive than they did at the bear-market lows.

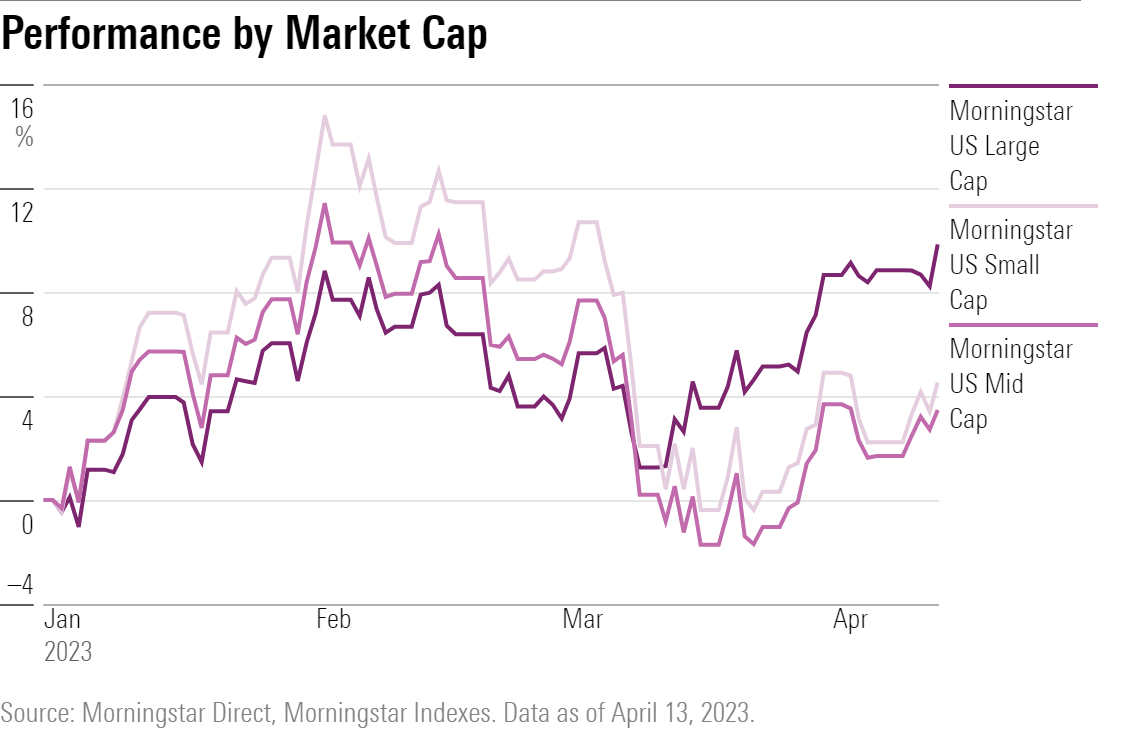

The Large-Cap Stock Surge

The Morningstar US Large Cap Index—which measures the performance of the largest 70% capitalization of U.S. large-cap stocks—gained 9.8% for the year through April 13, while the broader market gained 9.2% as measured by the Morningstar US Market Index. For the same period, small-cap stocks rose only 4.5%, as measured by the Morningstar US Small Cap Index.

Morningstar’s large-cap index is heavily concentrated with mega-sized U.S. companies, with an average market capitalization of $282.4 billion. That’s over $150 billion more than the Morningstar US Market Index, which carries an average market cap of $127.5 billion. And the S&P 500, which measures stocks of the 500 largest U.S. companies, has an average market capitalization of $188.8 billion, $100 billion smaller on average than the Morningstar US Large Cap Index.

Tech and Communication Services Drive the Mega-Cap Rally

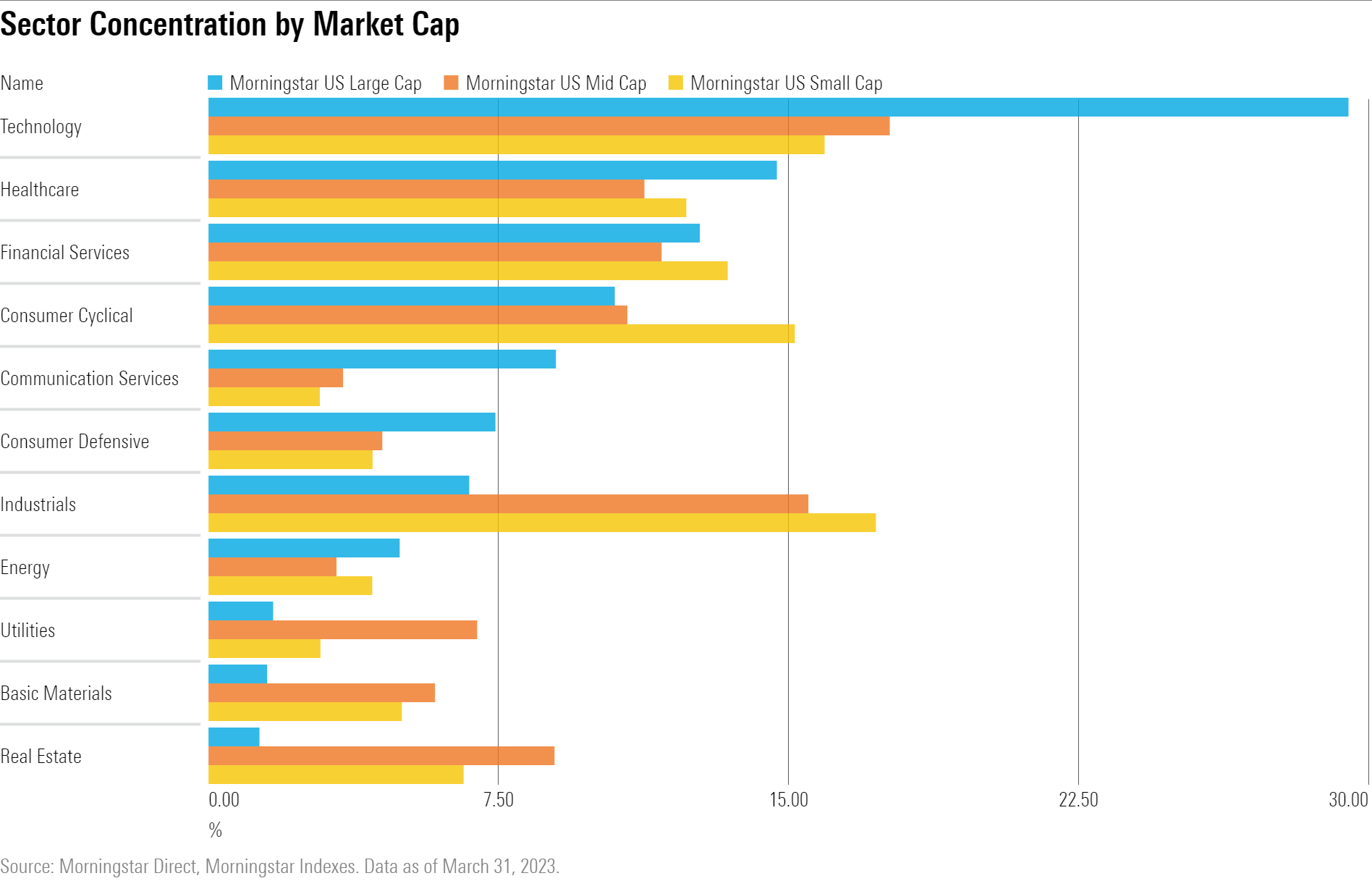

Among sectors, it has been largely technology and communication stocks leading the mega-cap stock bounce.

The Morningstar US Large Cap Index is made up of nearly 30% technology stocks, nearly double the tech-stock weightings for the mid- and small-cap indexes. As technology stocks rose 20.9% this year through April 13—more than double the gains of the broader U.S. market—the large-cap index benefited.

It’s a similar story with the communication-services sector, which includes heavyweight names Alphabet and Facebook parent company Meta Platforms META. The Morningstar Communication Services Index gained 23.1% in 2023 through April 13.

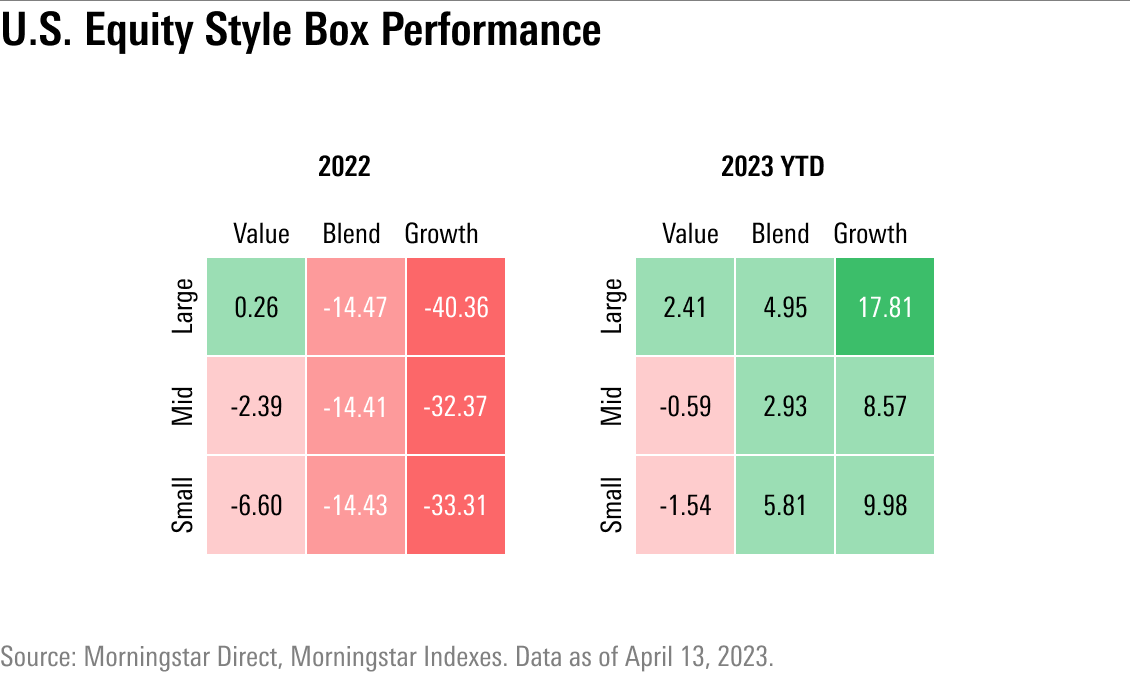

Mega-Cap Stocks’ Rally Is a Reversal From 2022

BlackRock’s Chaudhuri says, “Interest rates have been a big driver of the large-cap sector. Last year, in a world where many central banks were raising interest rates, both stocks and bonds were down in double-digit territory. Much of what was driving the tech-sector losses was the rapid repricing of interest rates.”

This year, as many investors expect the Fed to stop its interest-rate hikes in the coming months, the largest tech stocks have rallied.

The Morningstar US Large Cap Index increased 9.8% through April 13, nearly a full percentage point above the broader market, as measured by the Morningstar US Market Index. And among the largest stocks, growth names have been the leaders: The Morningstar US Large Growth Index gained 17.8% for the same period.

That’s a flip-flop from 2022, when large-cap stocks lost 20.4% as a group, dragged down by large growth, which fell 40.4% over the year as measured by the Morningstar US Large Growth Index.

Which Stocks Propel Mega-Cap Gains?

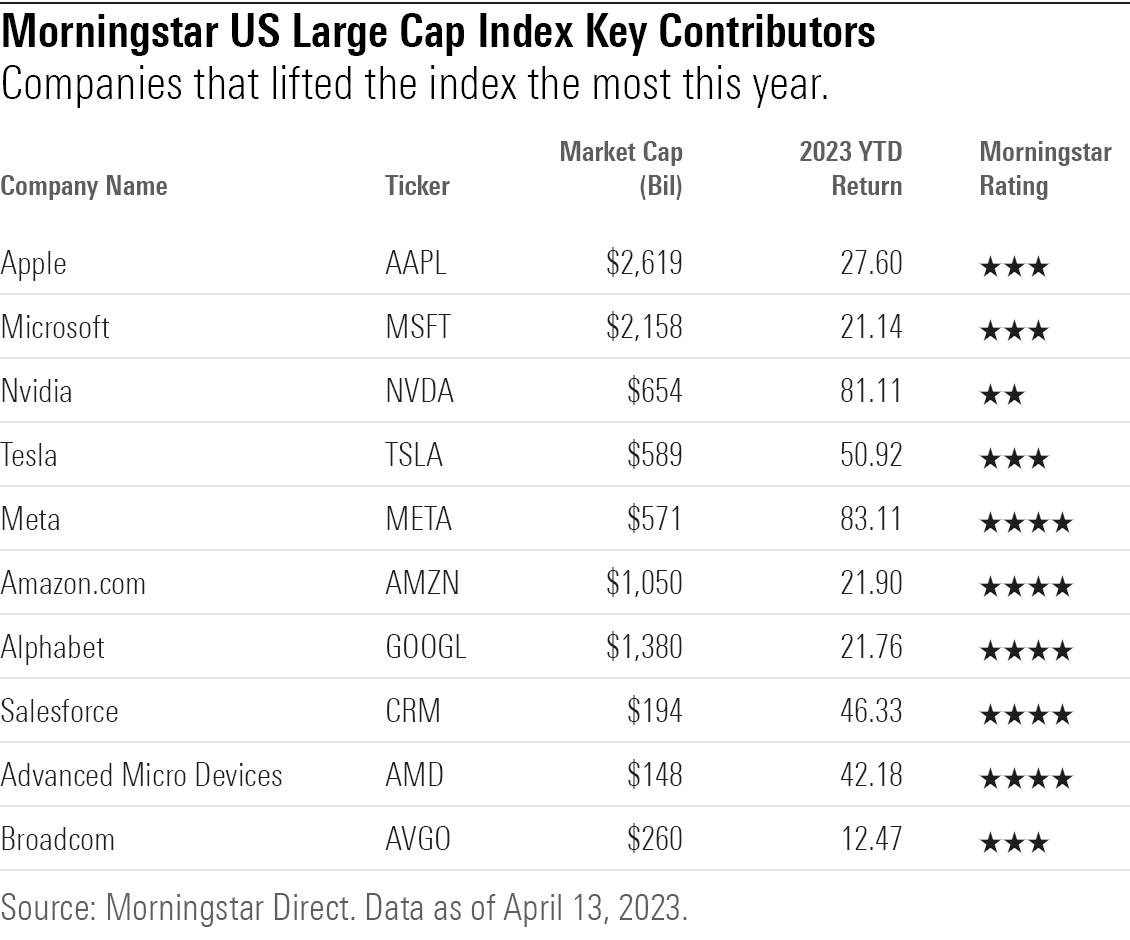

At the industry level, the biggest contributors to the Morningstar US Large Cap Index through April 13 were consumer electronics, software infrastructure, semiconductors, internet retail, and internet content and information.

The semiconductor industry, which includes companies that design and sell microchips as well as companies that supply microchip designers with parts and equipment, made the biggest contribution, with a return of 35.9% through April 13. The internet content and information industry, which is made up of interactive media companies, including social media, search engines, and networking platforms, trailed closely with a gain of 34.9% for the same period.

The companies that have lifted the large cap index the most in 2023 have been Apple, which was up 27.6% through April 13; Microsoft, which gained 21.1%; and Nvidia NVDA, which rose 81.1%.

Are Mega-Cap Stocks Undervalued?

Based on Morningstar’s fair value estimates of individual stocks, Morningstar’s U.S. market strategist David Sekera says that after the rally to start the year, technology stocks are closer to fair value, warranting a shift to a market-index weighting in a portfolio from an overweight. Stocks in the communication-services sector, however, have been the most undervalued of any sector, trading at a 30% discount to Morningstar’s fair value estimate as of the end of the first quarter.

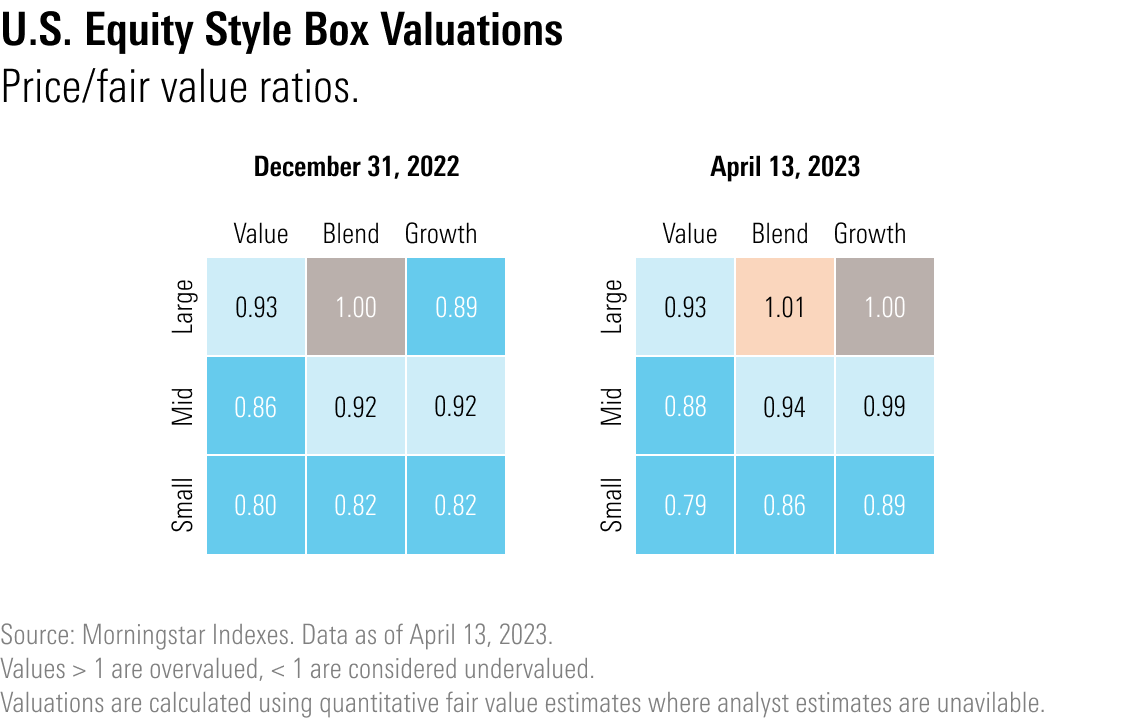

The Morningstar US Large Cap Index carried a weighted-average valuation of 0.98 as of April 13, essentially at its fair value. At the end of last year, its valuation was 0.92, or 8% below its average fair value.

Small-company stock valuations haven’t changed quite as much since the end of 2022. The Morningstar US Small Cap Index’s average valuation was 0.85 on April 13, for a 15% discount to its weighted-average fair value, down from the 18% discount to its average fair value at the end of last year.

BlackRock’s Chaudhuri says that based on forward P/Es, “very broadly, it does feel like the market is a little too optimistic.”

“We’re still in the process of learning from different companies across the airline industry, communication services, and big banks,” she adds. “If the economy does slow down, expecting to see small positive earnings growth—in a world where U.S. growth is slowing—is a bit optimistic.”

Chaudhuri recommends that investors stay cautious, especially regarding the interest-rate outlook. “Inflation is a lot higher this time around compared to the last time the Fed lowered interest rates,” she says. “It will be very difficult for the Fed to cut interest rates back to zero.”

In the current environment, Chaudhuri says, investors should look for growth companies at reasonable prices. “Growth companies can still do well in this environment, but not highly speculative growth,” she says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)