Amazon Q4 Sales Up, Earnings Drop on Lower Customer Spending

CEO Jassy: ‘Long-term trends still there, despite belt-tightening.’

E-commerce giant Amazon.com AMZN delivered sales in the fourth quarter of 2022 that beat its own guidance as well as Wall Street estimates, but net income fell far short as cloud computing service customers and online shoppers reined in their spending and the company took impairment charges related to streamlining efforts.

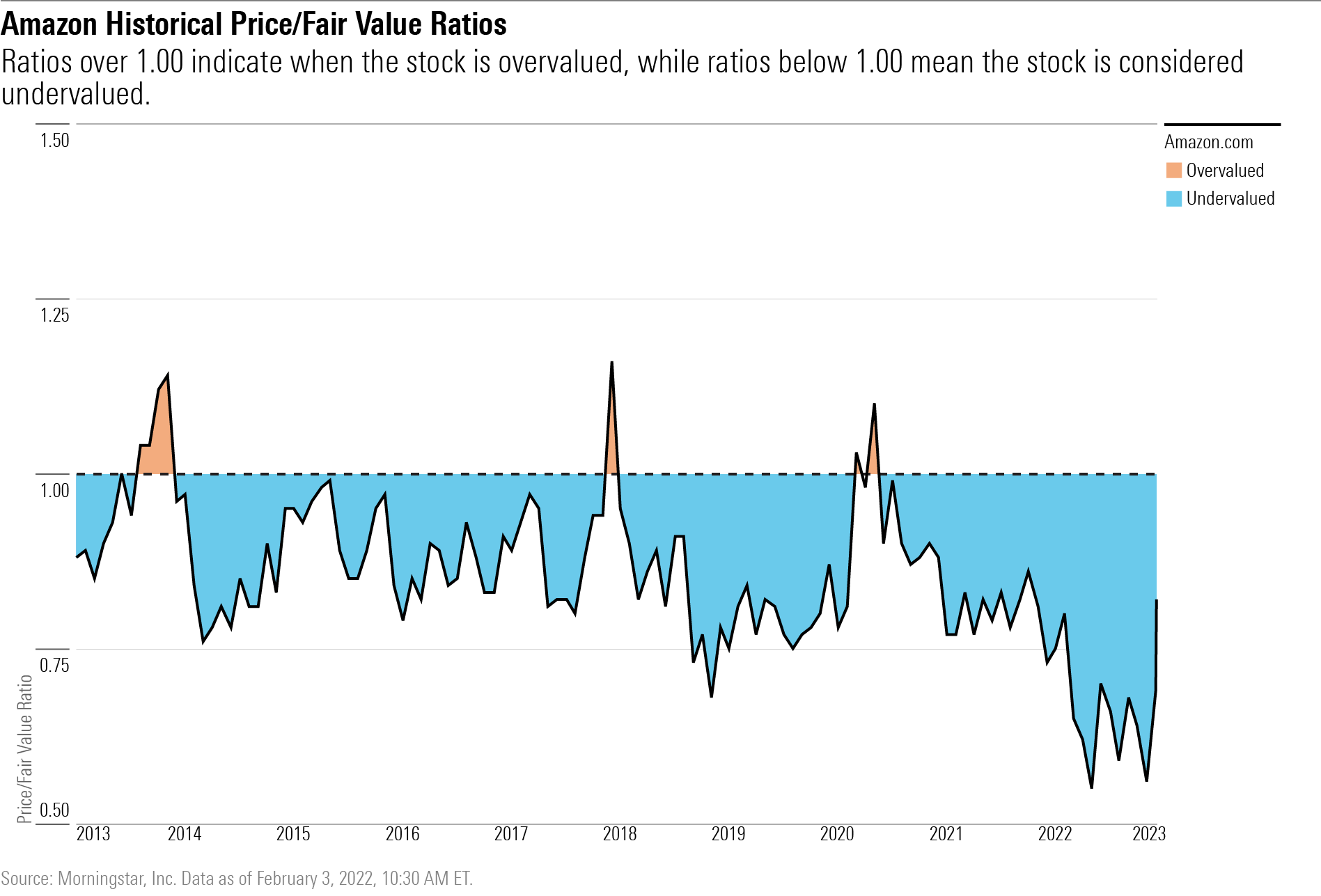

Morningstar senior equity analyst Dan Romanoff called the results solid but cut his fair value estimate for Amazon stock to $137 from $150 a share. At a recent $107 a share, Amazon stock carries a Morningstar Rating of 4 stars and trades at about a 22% discount to Romanoff’s valuation.

“We still foresee healthy long-term growth driven by e-commerce proliferation, Amazon Web Services, and advertising, but the near term remains a work-in-progress with macro issues weighing on 2023,” said Romanoff, who considers Amazon stock attractive.

Amazon posted fourth-quarter net income of $278 million, or $0.03 a share, below estimates of nearly $10 billion, or $0.17 a share, according to data provider FactSet. In the year-ago period, it posted net income of $14.3 billion, or $1.39 a share.

Amazon Q4 Earnings Takeaways

- Sales of $149.2 billion beat company projections and FactSet estimates of $145.7 billion.

- Net income of $300 million versus FactSet estimates of nearly $10 billion.

- Net sales in Amazon Web Services, its cloud computing unit, rose 20% to $21.4 billion, the fourth straight quarterly decline and down from 40% growth in the fourth quarter of 2021.

- Customer belt-tightening is expected to be a headwind to AWS growth for at least the next couple of quarters.

The world’s largest online retailer reported sales of $149.2 billion in the quarter, higher than the $145.7 billion that was estimated and ahead of its own projections for between $140 billion and $148 billion. Sales were up 9% from $137.4 billion in 2021.

For the year, the company posted a net loss of $2.7 billion on revenue of $518.98 billion. It was the worst yearly loss since going public in 1997. The loss included a pretax loss of $12.7 billion in its investment in electric vehicle maker Rivian Automotive RIVN. In 2021, Amazon recognized a pretax gain of $11.8 billion from its Rivian stake.

Amazon Stock Key Stats

- Sector: Consumer Cyclical

- Industry: Internet Retail

- Fair Value Estimate: $137

- Morningstar Rating: 4 Stars

- Economic Moat Rating: Wide

- Moat Trend: Stable

Chief executive officer Andy Jassy told investors that “in an uncertain economy where customers are very conscious of what they are spending, we’ll continue to be sharp on pricing.” He explained that Amazon Web Services is focused on building relationships and working with its customers to find cost-effective solutions.

In this environment, “we’re going to help our customers spend less money,” Jassy said, noting its pipeline of cloud-services customers is “very robust.”

“Long-term trends are still there, despite the short-term belt-tightening,” he noted. “There’s still a lot of money to be saved by shifting to the cloud.

Amazon’s Q1 Earnings Guidance

- Net sales are expected to be between $121.0 billion and $126.0 billion, up 4% and 8% compared with first-quarter 2022, including an expected negative effect from currency translation.

- Operating income is expected to be from breakeven to $4.0 billion compared with $3.7 billion in first-quarter 2022.

Morningstar’s Romanoff says, “Strong backlog growth gives us comfort that the runway for AWS remains long. We also think cloud migration is an obvious cost-cutting move for enterprise customers, which we think puts a floor under growth even if the economy formally descends into a recession. We continue to believe that the migration to the public cloud is an enormous opportunity and remains in the early stages of evolution, with AWS being the clear leader.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)