Model Portfolios to Keep an Eye On

With new model portfolios continually hitting the market, we’ve highlighted three series on Morningstar’s radar.

The model portfolio landscape continues to grow at a rapid pace, expanding the opportunity set for advisors and their clients. Since Morningstar launched its model portfolio database in 2019, asset managers and investment strategists have flooded the space with new offerings. As of mid-December, the database included over 2,500 individual U.S. model portfolios. In 2022 alone, 44 models were launched and over 300 were activated, or added, into Morningstar’s database.

Morningstar Manager Research analysts currently apply their qualitative assessments, known as the Morningstar Analyst Rating, to nearly 500 of those portfolios. However, keeping pace with the steady growth can be a difficult feat. That said, analysts closely monitor the coverage for new and interesting offerings that model providers have released to the market.

This article highlights three model portfolio series that were launched over the last 24 months and underscores notable trends in the model portfolio space, like the increased adoption of blend constructions, the broadening of open-architecture lineups, and greater use of liquid alternatives. Though these series aren’t under the qualitative coverage of an analyst, they have interesting attributes that have garnered intrigue.

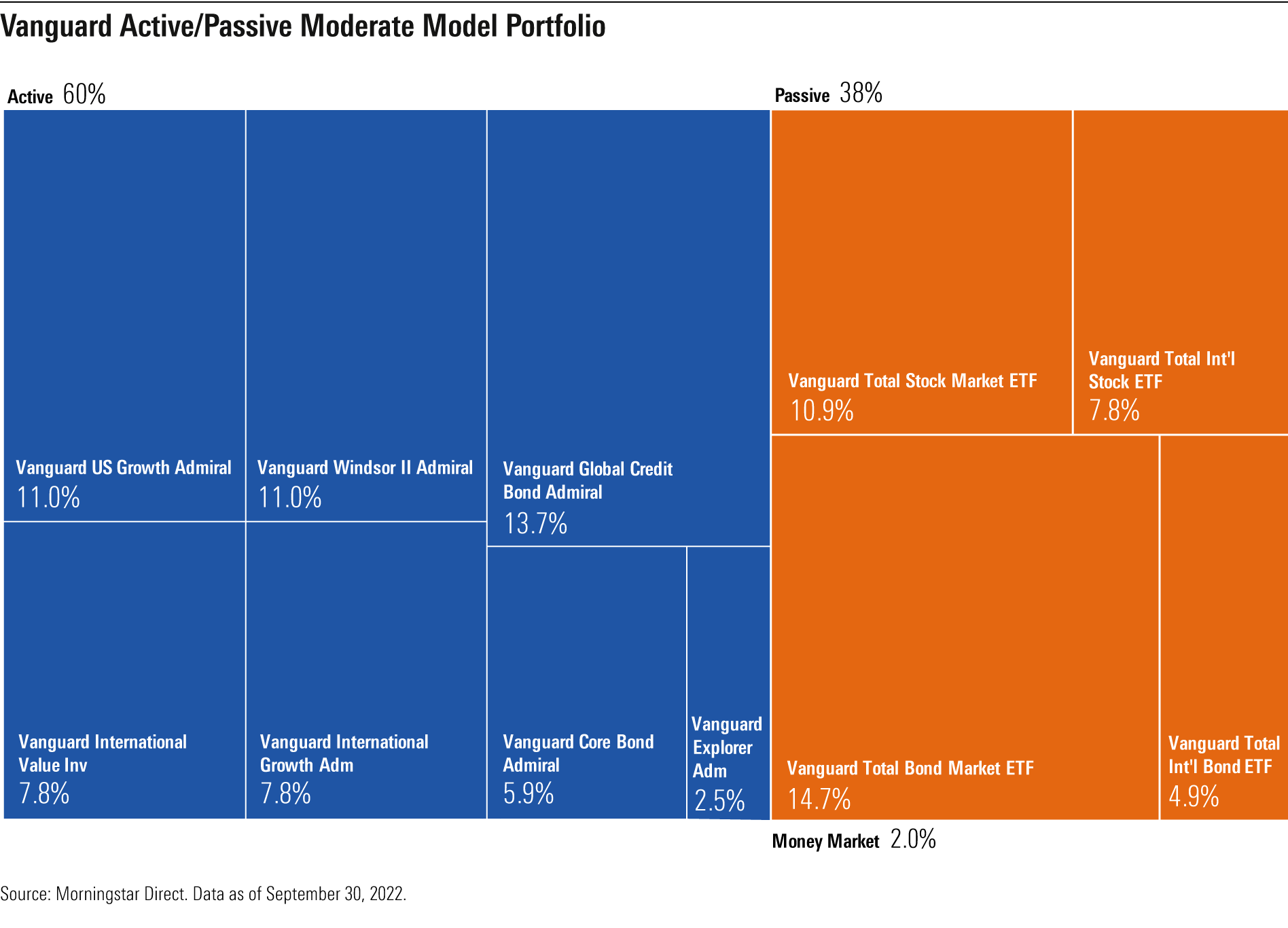

Vanguard Jumps on the “Blend” Train

Marrying both active and passively managed funds continues to gain traction across the industry. This approach typically leads to a lower fee offering but doesn’t fully forgo the alpha potential provided by active management. And model providers have shown a higher propensity to deliver such blend constructions, which has helped drive their lower costs, on average, relative to similarly allocated mutual fund equivalents.

In March 2021, Vanguard entered the mix by launching the Vanguard Active/Passive model portfolios. This was a unique launch for the firm as their other allocation model series all tapped proprietary exchange-traded funds, eschewing any active management. This series includes offerings of all equity, all fixed income, and five diversified portfolios spanning different risk profiles. Vanguard funds make up the entirety of the underlying fund lineup. Four ETFs provide passive, broad market exposure, two equity, and two fixed income, which mimic the lineup of the firm’s core model series—accounting for 38% of the moderate portfolio. Within the actively managed exposure, the team looks to capture alpha opportunities through growth- and value-oriented equity strategies while focusing primarily on corporate credits within bonds. These models remain attractively priced, with an average cost of 17 basis points, yet they stand as an intriguing option for investors with a desire for active management. Five of the seven mutual funds tapped in the moderate portfolio earn a Morningstar Analyst Rating of Silver or Bronze as of December 2022—the other two are not rated by an analyst, but they receive a medalist designation based on the Morningstar Quantitative Rating.

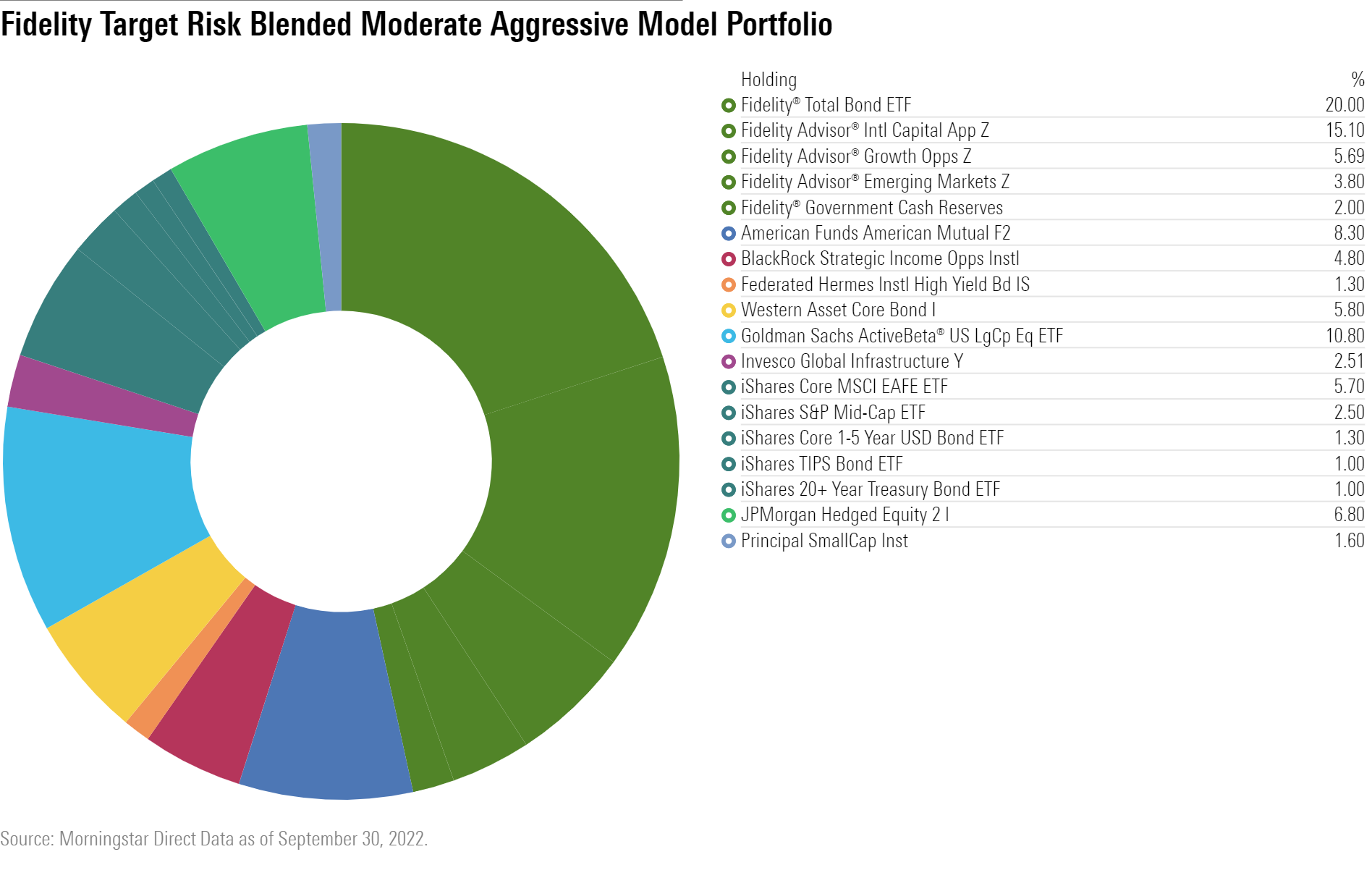

Fidelity Goes Open Architecture for Active Management

Model portfolios fitting the bill of a blend construction might not come strictly through a mix of that firm’s own proprietary products. Instead, model providers may choose to take an open-architecture approach, which combines strategies from various investment managers. This can provide diversification of thought and processes across investment teams while also introducing complementary strategies or skill sets the firm may lack. Also, we’ve heard anecdotally that model marketplaces and investment platforms may require some level of open architecture for inclusion, another driver to increased adoption.

In July 2022, Fidelity expanded their extensive lineup of model portfolios to include the Fidelity Target Risk Blended model portfolios, which sports an open-architecture construction. This isn’t new to the firm, as many of its offerings tap third-party ETFs; however, the use of outside active managers is a more novel endeavor. The four portfolios in this series span a range of risk profiles with an objective of minimizing downside risk within a targeted level. The series leverages iShares ETFs for passive exposure, while active management is spread across myriad asset managers. Within the moderate aggressive portfolio, the team taps nine firms and 13 strategies, including highly regarded mutual funds that receive Morningstar Analyst Ratings of Gold, like American Funds American Mutual AMRFX and BlackRock Strategic Income Opportunities BSIIX, indicating our highest level of conviction. Two medalist-rated active and strategic-beta ETFs, Fidelity Total Bond ETF FBND and Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC, respectively, are also included in this group. Altogether, this series delivers a sound, and seeming complementary, mix of underlying strategies that bears watching.

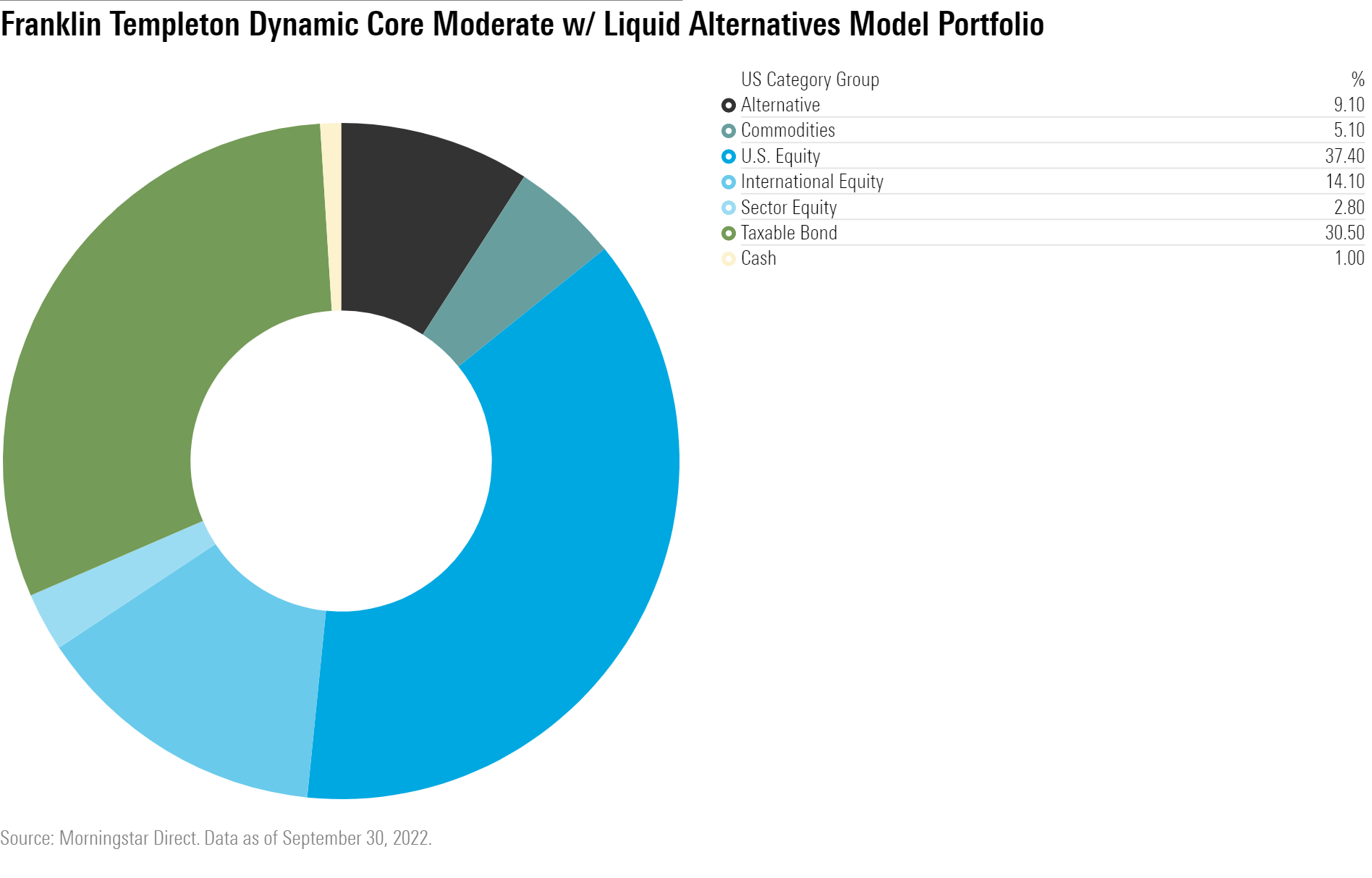

Franklin Templeton Slots in Liquid Alternatives

Model architects may look to niche asset classes like liquid alternatives for diversifying exposures. Their typically uncorrelated returns streams relative to stocks and bonds can make them a prudent allocation, especially during sideways markets like we’ve experienced in 2022. However, despite the diversifying properties of alternatives exposure, adding them in can be a difficult decision for model providers as they can be pricey, and the sector is already extremely diverse with a wide array of strategies. Some larger asset managers may have in-house expertise, while others may have to look elsewhere.

In June 2021, Franklin Templeton launched their Dynamic Core with Liquid Alternatives model portfolio series. This series of five portfolios spanning risk profiles of conservative, moderately conservative, moderate, moderately aggressive, and aggressive leverages dedicated exposures to two alternative funds. As of September 2022, the moderate portfolio held a 5.9% allocation to the Bronze-rated AlphaSimplex Managed Futures Strategy ASFYX, a systematic trend fund, and a 3.2% exposure to the Franklin K2 Alternative Strategies Fund FABZX, a multi-strategy fund. The former offering posted a 36.7% return over 2022 through November, while the latter posted a 7.9% loss; however, it still outpaced both broader equity and fixed-income markets. A measured exposure to liquid alternatives can make sense when done in a selective, well-informed, and cost-aware fashion.

For a deeper dive into the model portfolio landscape, check out our 2022 Model Portfolio Landscape.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)