4 Investment Mistakes to Avoid in 2023

How to accept uncertainty and prepare your investments for different scenarios.

If in 2022 we invested based on the lessons we learned from the history of the financial markets, we would have been left with a sour taste in our mouths. Now, we wonder what mistakes not to repeat in 2023. Keep in mind that even though lessons on how investments have behaved over the decades are valuable, they don’t always work. We must be careful not to trust “averages” too much.

One example is how correlations among different asset classes have behaved. “From 1973 to the end of 2021, the monthly correlation between global equity returns and U.S. bond returns was minus 0.02 points,’’ explains Nicolò Bragazza, senior investment analyst at Morningstar Investment Management. The correlation ranges from plus 1, when two assets move together, to minus 1, when they move in the opposite direction. A value of zero indicates that there is no correlation.

Based on this data, we can say that holding U.S. Treasuries has offered diversification over the years. Unfortunately, in 2022 that was not the case. “The five-year rolling correlation of stocks and bonds is at a 20-year high,” says Bragazza.

“Relying only on historical correlations can be risky or even misleading,” Bragazza continues, “because the correlation is an ‘average’ and does not tell us much about the behavior of asset classes during certain market phases.’’

“In times of recession, the correlation between stocks and bonds has been positive by 0.09 points,” says Bragazza. “In phases of high inflation [above 5%] it even rose to plus 0.23.’’

Which Mistakes to Avoid

We could feel upset because of this data, or we can use the data to build stronger portfolios for the future. Here are four mistakes we should avoid in our planning for 2023.

Mistake 1: Relying Only on Historical Correlations

The first mistake to avoid is relying exclusively on historical correlations. Also, keep in mind that diversification isn’t solely about how much two asset classes move in different directions. Morningstar analysts suggest looking for “diversifying fundamentals,” not just “negative correlations.”

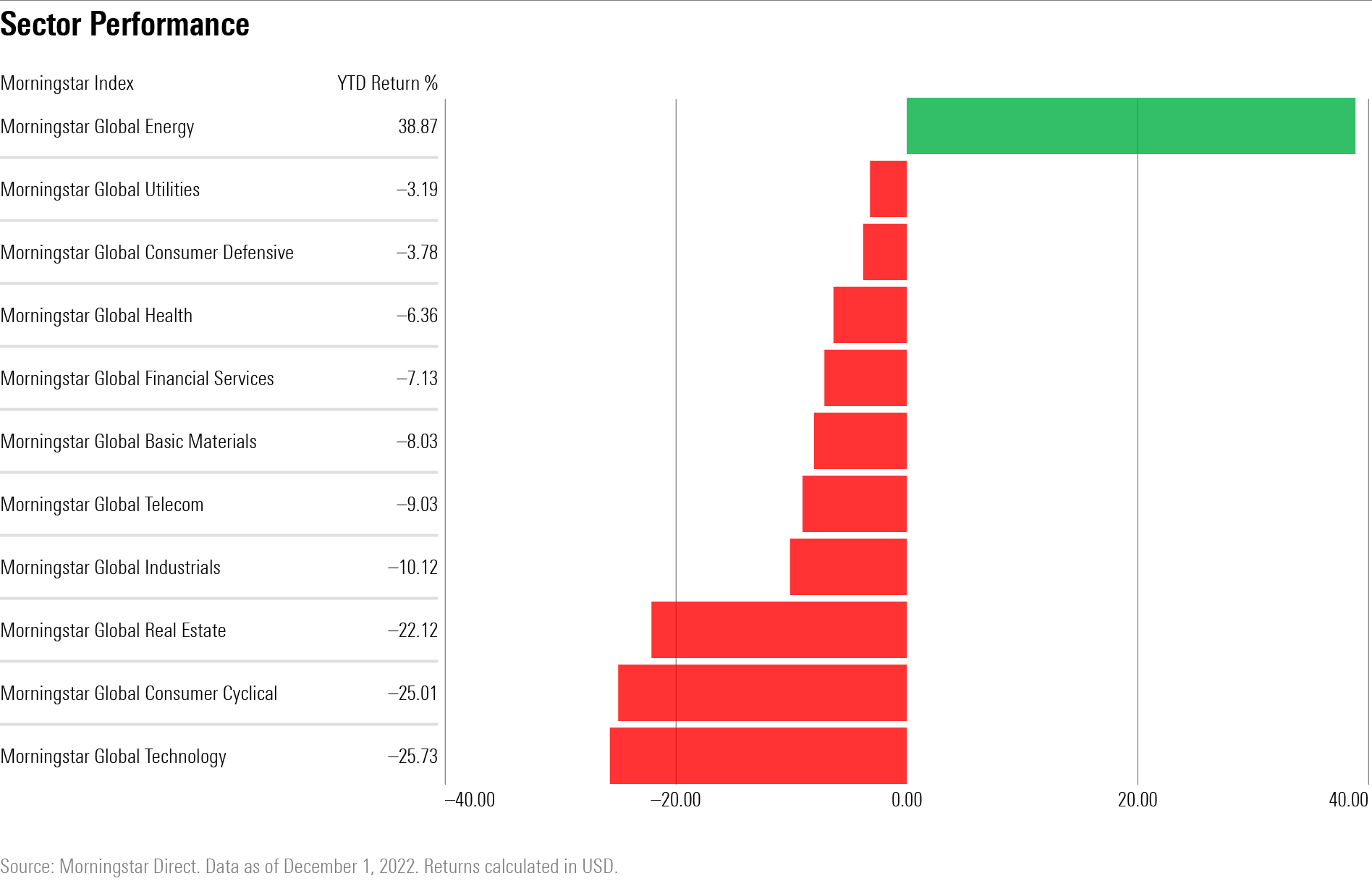

For example, the correlations between industry sectors were all positive in 2022, but the energy sector had positive returns unlike the others. Having the energy sector in your portfolio would have provided one of the best diversifications in 2022. The same applies to the U.S. dollar. It is true that Treasuries have fallen in the last year, but the U.S. dollar has appreciated greatly due to the Federal Reserve’s move to raise interest rates before other major central banks, like the European Central Bank, did.

Mistake 2: Thinking More Investment Equals More Diversification

The second mistake we must avoid in 2023 is thinking that adding more asset classes will increase the diversification of our portfolio. In 2022, there have been no ``places to hide” in fixed income as the declines have been widespread. Stock markets had one of their worst years, and having quality companies in your portfolio didn’t offer any protection either.

“Twenty twenty-two is an example of a year where more assets in the portfolio would not have offered more diversification. The only asset classes that have delivered positive returns are the energy sector, the U.S. dollar, and some `niche’ markets such as Brazilian equities,” says Bragazza.

Mistake 3: Using Market History as Your Only Guide

The third mistake is to think that history always repeats itself.

“Knowing history helps put things into perspective, but it’s not enough,” explains Bragazza, who uses the Japanese yen as an example. The Japanese currency has, generally, offered protection in times of market stress. However, in 2022 this was not the case because the surge in inflation created large differences in monetary policies.

Mistake 4: Trying to Predict the Future

The fourth mistake is trying to predict the future. Central banks have powerful systems for making economic predictions and they are often wrong. Can we do better? I don’t think so.

“It’s better to spend your time more productively building your portfolio,” says Bragazza.

Tips to Help Avoid Making Investment Mistakes

Here are some tips to help you avoid common investment mistakes:

- Think about investments in a way that is consistent with your goals.

- Take beta, the indicator of sensitivity to market fluctuations, into account. A high beta means greater volatility and therefore risk.

- Look at investment fundamentals. In the early 20th century, global indexes were composed mainly of financial stocks and rail transport stocks. Today, technology and telecommunications dominate. The fundamentals, therefore, are completely different.

- Prepare for different market scenarios and accept uncertainty. Bragazza summarizes it in one word: robustness. “It is the ability to withstand different stages without compromising long-term performance.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)