Where to Invest in Bonds in 2023

With long-term interest rates projected to be at (or near) their peak, it’s a good time to lengthen duration.

Investing in Bonds in 2023

- Begin to lengthen duration in second-half 2023.

- Monetary policy: One last rate hike will conclude this tightening cycle.

- Long-term interest rates projected to be at, or near, their peak and will decline going forward.

- Credit spreads on corporate bonds provide adequate margin of safety for downgrade and default risk.

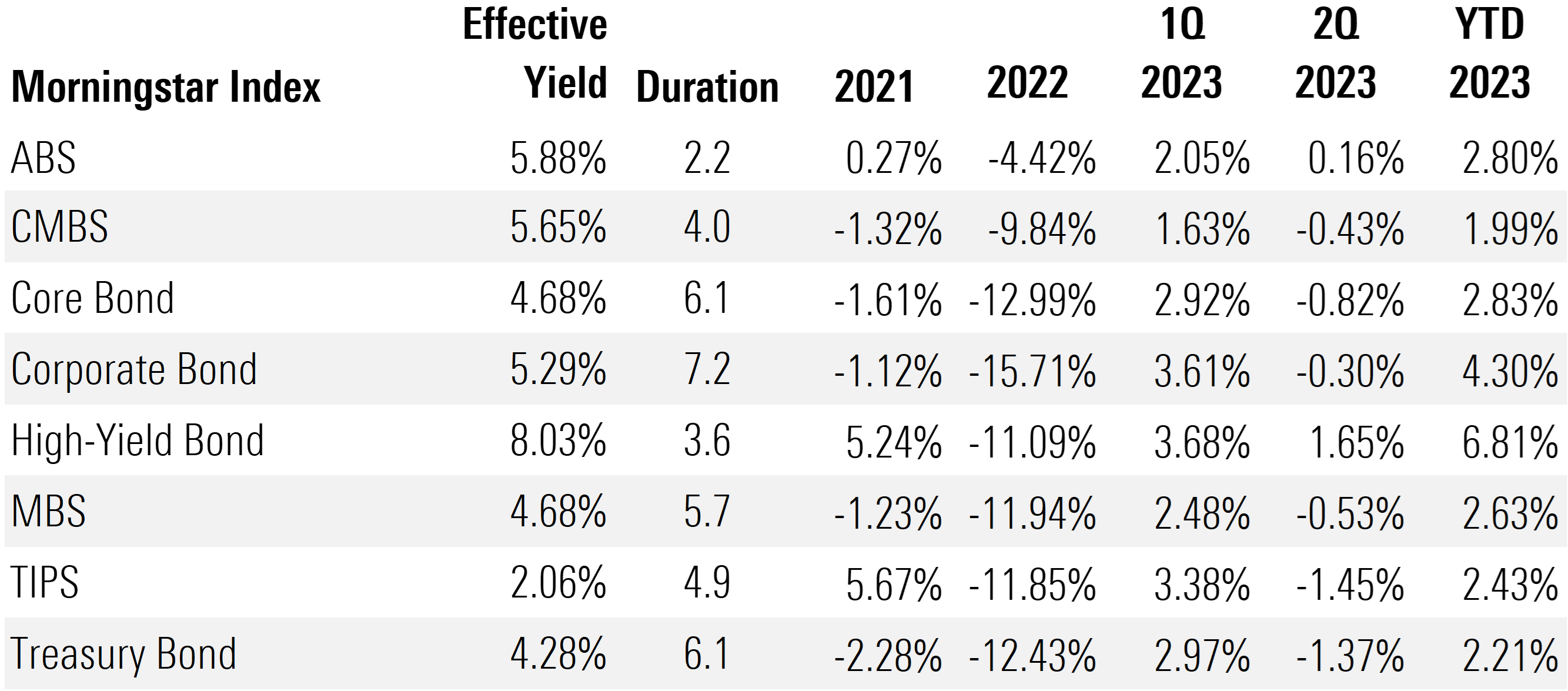

Bond Market Performance Rebounds in 2023

Following the worst bond market ever in 2022, fixed-income markets have largely normalized and rebounded in 2023. This year to date, fixed-income returns are positive, with those bonds that trade with a credit spread having performed better than U.S. Treasuries.

This year to date, the Morningstar Core Bond Index, our proxy for the overall bond market, has risen 2.83%. The return has been supported by a combination of underlying yield carry, declining long-term interest rates, and tightening credit spreads, partially offset by rising short-term interest rates.

Morningstar U.S. Fixed Income Index Returns

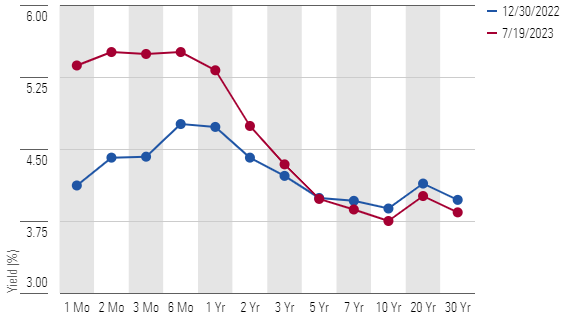

The yield curve became further inverted in the first half of 2023. Short-term interest rates rose as the Federal Reserve hiked the federal-funds rate three times and another hike is expected at the July meeting. For example, the yield on the three-month Treasury bill rose 107 basis points to 5.49% and the yield on the one-year Treasury rose 59 basis points to 5.32%.

However, on the longer end of the curve where the market dictates interest rates, as opposed to the Fed’s monetary policy, yields have declined slightly. The yield on 10-year Treasury bonds has dropped 13 basis points to 3.75%.

U.S. Treasury Interest-Rate Curve

Bonds that trade with an additional credit spread over equivalent maturity U.S. Treasury bonds performed the best thus far this year. For example, the Morningstar Corporate Bond Index (our proxy for investment-grade corporate bonds) rose 4.30% and the Morningstar High Yield Bond Index rose 6.81%. The reason for the outperformance was twofold. First, those bonds provide a higher yield to compensate investors for the risk of credit rating downgrades or defaults. Second, credit spreads tightened over the first half of the year.

In the corporate bond market, for the year to date through July 19, the average corporate credit spread of the Morningstar Corporate Bond Index has tightened 11 basis points to +119. In the high-yield market, the average corporate credit spread of the Morningstar High Yield Bond Index has tightened 90 basis points to +389.

Morningstar Corporate Bond Indexes: Average Credit Spread

Outlook for Investing in Bonds in Second-Half 2023

Now appears to be a good time for investors to begin lengthening the duration of their fixed-income investments. According to our forecasts, we think the Federal Reserve will hike the fed-funds rate one last time at its July meeting and that will be the last hike in this monetary policy tightening cycle. Further, according to our U.S. economics team, we project that longer-term interest rates are at or near their peak and will begin to decline over the next six to 18 months.

Another factor that supports extending out further on the yield curve is our expectation that the rate of economic growth will slow. While the stock market has risen from the undervalued levels we saw at the beginning of the year, stocks are now trading near our fair value. With stocks no longer undervalued and earnings under pressure from slowing economic growth, further gains in the stock market will likely be muted in the second half of this year.

At this point, corporate bonds are less undervalued than we thought at the start of 2023, but based on our economic outlook (slowing growth, but no recession), we think the current credit spreads offer an adequate margin of safety to investors to offset future downgrade and default risk.

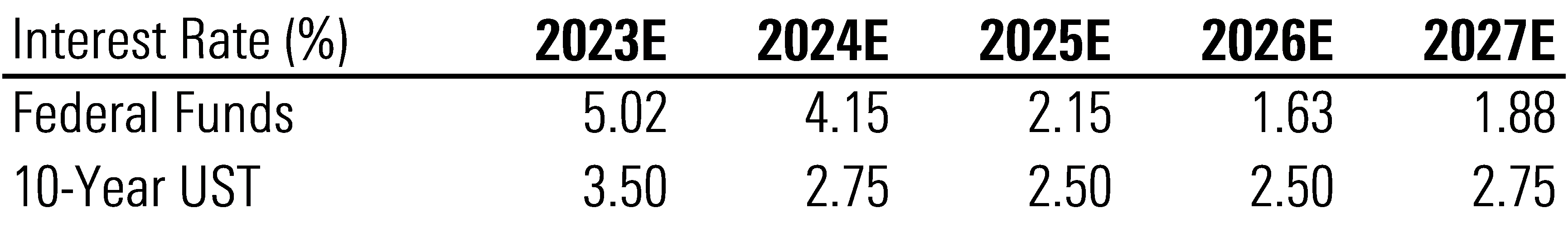

Interest-Rate Projections

Over the second half of 2023, interest rates may vacillate as economic and inflationary metrics are released, but our forecast is that the interest rate on 10-year Treasuries will generally follow a downward trend which will continue into 2024 and 2025. Falling interest rates will push up long-term bond prices and help bolster fixed-income returns over the underlying yield carry.

While short-term interest rates are currently higher than long-term interest rates due to the inverted yield curve, we think investors should begin to lengthen their duration over the next 12 months. Once the market begins to price in the Fed switching to an easing monetary policy, short-term rates will quickly begin to subside. We project the fed-funds rate will average 4.15% and 2.15% in 2024 and 2025, respectively.

Morningstar Interest Rate Forecasts

End of This Monetary Policy Tightening Cycle in Sight

The Federal Reserve paused and held the fed-funds rate steady at its June meeting. However, with inflation still running hotter than the Fed prefers and the economy more resilient than expected, we expect that the Fed will likely hike the federal-funds rate another 25 basis points at its July meeting. Yet, we also expect that will be the final interest-rate hike of this monetary policy tightening cycle. We expect that inflation will continue to moderate enough over the next few months to convince the Fed that it has raised interest rates enough to be appropriately restrictive to keep inflation on a downward path.

Not only do we expect this will be the last hike of this monetary policy tightening cycle, but we also forecast that a combination of declining inflation and a slowing rate of economic growth will provide the Fed with the basis to begin loosening monetary policy in early 2024, with a rate cut coming as early as next February.

Corporate Bond Market Outlook

Corporate bonds have performed very well over the first half of the year. Performance has been driven by a combination of tightening credit spreads and the higher yield carry offered by corporates. At this point, corporate bonds are now less attractive than we noted in our 2023 bond market outlook published last December. However, we think that current spread levels are adequate to compensate investors for potential downgrade & default risk.

According to PitchBook, defaults have risen back up to historical averages. Based on our economic outlook for the rate of economic growth to slow, we suspect there will likely be an additional increase in downgrades or defaults. However, considering we do not expect the economy to slip into a recession, the amount of downgrades and defaults will likely be constrained and remain below levels experienced in prior recessions.

The combination of higher underlying interest rates and closer-to-average credit spreads is providing investors with some of the higher all-in yields we have seen in corporate bonds over the past 10 years. The Morningstar Corporate Bond Index currently yields 5.29% and the High Yield Index yields 8.03%. The main risk to our view is if the economy slips into a deeper and/or more prolonged recession, in which case default rates could rise.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-08-2024/t_f17f0449d3314a27b966dcee5d39a6cb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)