Where a Top Dividend-Fund Manager is Finding Quality Stocks

With a long-term focus, JPMorgan's Clare Hart holds stocks like UnitedHealth, Philip Morris, and Analog Devices.

When Clare Hart, lead manager of top-performing JPMorgan Equity Income Fund OIEIX, is looking at dividend-paying stocks for the portfolio, big-picture risks like the possibility of a recession or the outlook for Federal Reserve policy are always part of the equation.

But they’re not the be-all and end-all in making a buy or sell decision around income-payers for the fund to buy and hold.

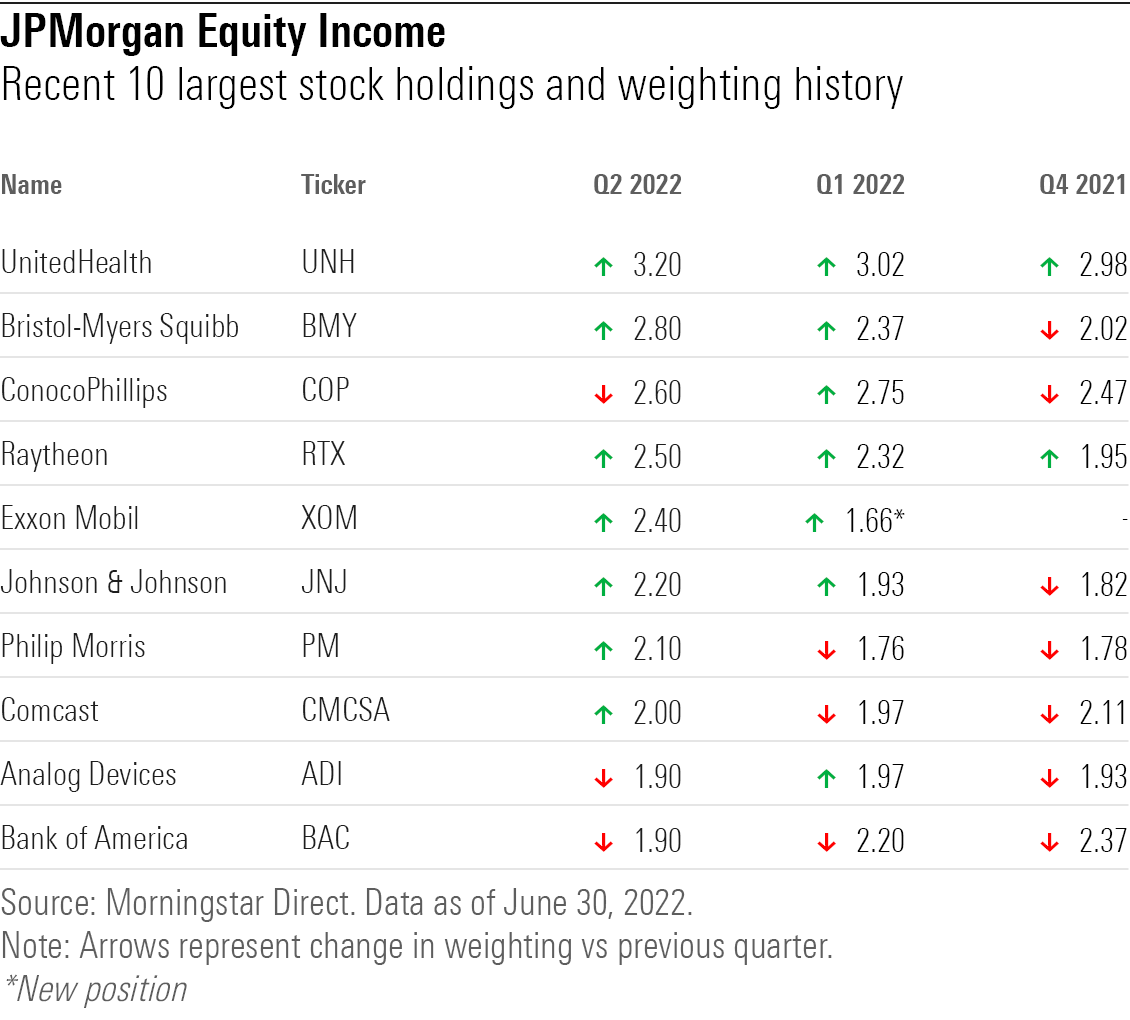

Major holdings in the fund, like Bank of America BAC, Analog Devices ADI, and Philip Morris PM, should be relatively insulated from any economic slowdown, Hart says, as are the fund’s top two positions, UnitedHealth Group UNH and Bristol-Myers Squibb BMY. But the underlying investment case around the fund’s choice of dividend-paying stocks is always built on valuations, quality of financials and management teams. And Hart and her team often hunt for new stocks among the market’s underperformers, bringing a value approach to the dividend-stock strategy.

“It’s not like we say, `a recession is coming, so how do we want to position the portfolio,’” says Hart, who has managed the fund for 18 years. “But we have to be aware of what the risks are.”

Hart points to the fund’s bank and semiconductor holdings as examples of their approach for picking stocks among dividend-paying companies.

“People have been afraid of the semiconductor names and afraid of the banks because a recession is coming, credit is going to get worse or chip manufacturing demand is going to dry up,” she says. “But if you own the right chip company or the right financial institution, yes demand might slow down or yes, you might see credit losses … but we think that these companies are fully discounting that.”

“One of the hallmarks of this strategy is that we can be patient,” she adds.

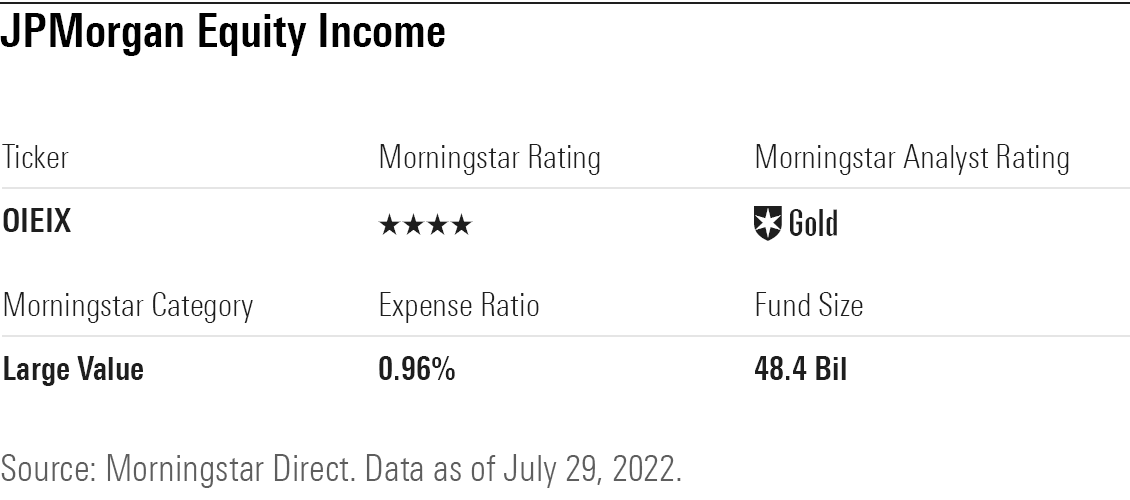

The strategy taken by Hart and the four other people on her team have led the Gold-rated fund to be a top-performer across short- and long-term time frames. JPMorgan Equity Income ranks in the top third or top quarter of large value funds for one-, five-, and 10-year returns. So far in 2022, it is down 2.2%, but that performance has the fund outperforming 74% of the funds in its category.

"Lead manager Clare Hart has masterfully steered this strategy since August 2004," writes Morningstar manager research analyst Paul Ruppe. "Hart's deft execution has offered reliable downside protection and sparkling long-term returns."

Quality Stocks First, Yield Second

The JPMorgan Equity Income portfolio tends to hold 85 to 100 stocks, focused on companies with strong competitive advantages, strong balance sheets, steady cash flows and company management that Hart and her team members identify as capable. It’s a similar strategy to the one used on Hart’s other charge, the Silver-rated JPMorgan U.S. Value Fund VGRIX.

“We spend a lot of time talking to management teams,” Hart says. “Does the management team do what they say they are going to do? That’s really important.”

The dividend screen looks for companies that have at least a 2% yield at the time of purchase, with an added layer of scrutiny leveled a company’s ability to sustain its dividend payouts. However, if a company dips below that 2% threshold – as is currently the case for Analog Devices – the fund can still hold the stock. Morningstar’s Ruppe terms Hart’s approach “quality-first, yield-second.”

Demand for dividend stocks over the last two years has ebbed and flowed. Higher-yielding stocks lagged during the stock market’s rebound from the pandemic bear market in 2020 and again in 2021, although rock-bottom interest rates in the bond market kept some investors in the hunt for yield through the stocks. This year, as the stock market fell back into a bear market, dividend strategies like JPM Equity Income outperformed.

Hart and her team, which includes co-managers Andrew Brandon and David Silberman, tend to hold stocks for the long-term. JPM Equity Income has annual portfolio turnover of 16% a year, well below the average large value fund’s turnover of 59%. But during the last year the portfolio has seen changes as the market has seen wide swings and the economic backdrop changed dramatically.

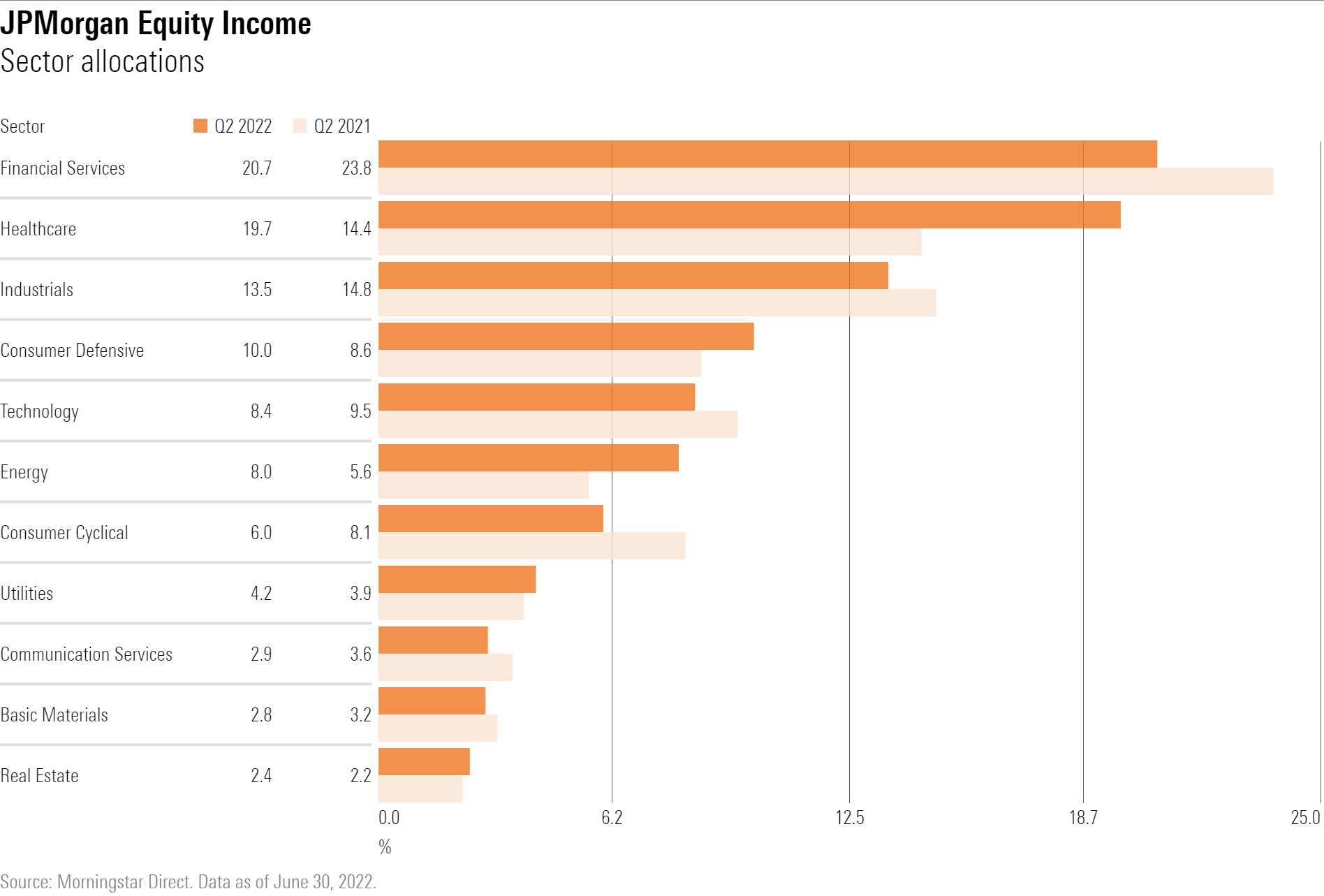

In 2021, health care stocks were underperforming, and the fund made a significant shift in that sector’s direction, lifting its weighting by roughly 3 percentage points. UnitedHealth and Bristol-Myers are now the fund’s top two holdings. Financial stocks have come down as an emphasis in the fund, in part because the stocks have lagged but also as a more strategic decision.

Zigging and Zagging With Energy Stocks

While energy stocks are now a bigger bet, Hart and the team have been doing some zigging and zagging. The fund added to its investments in energy stocks in the fourth-quarter of 2020 and rode that sector’s market-leading performance last year. But now the team is taking some profits among its energy stock positions.

Hart points to changes in the fund’s holdings of industrial stocks as reflecting their investment strategy. While the overall weighting of industrials hasn’t changed much, there was a shift in emphasis among the underlying holdings.

In 2021, the team began trimming it’s holdings of economically sensitive industrial stocks. Hart says at that point co-manager Brandon was pointing out that amid the booming economy many industrial stocks were looking expensive. The one group that looked cheap were defense stocks. There was no catalyst for that at the time, but Hart says, the thinking was “these are good opportunities, nobody wants to own them, so we rotated money out of the overpriced part of industrials and into defense stocks.’’

“As long as we could see being able to make money, he was willing to be patient,” Hart says. “Unfortunately (as a result of Russia’s attack on Ukraine) we’re in a position where the stocks have done well.”

When it came to navigating the market turmoil sparked by the Fed’s switch to an aggressive inflation fighting stance, “what it meant was from the team’s level is we’re going to be in for a roller-coaster ride,” Hart says.

The approach, she says, was “this is a dramatic turn in what the Fed is doing, and investors and companies are going to try and adjust, so let’s be ready to capitalize on dislocations.”

Watching the Consumer

Hart says a key trend she is watching is consumer behavior as the economy slows amid high inflation.

“How does the consumer change their spending in terms of staples and discretionary and how do they manage their debt obligations?” Hart asks. “Those three factors touch just about every aspect of the market.”

The good news, she says, is that unemployment is down, and that spending patterns are normalizing from the distortions caused by the pandemic and government stimulus payments, which should make it somewhat easier to anticipate where the economy goes from here.

Hart highlights a handful of stocks that reflect the team’s current thinking and the fund’s dividend-stock picking approach:

UnitedHealth

- Ticker: UNH

- Sector: Healthcare

- Forward Dividend Yield: 1.24%

Hart notes that managed care is a corner of the market that has gone in and out of favor over the years. “Right now people are happy with it,” she says.

The fund picked up its UNH stake “when the Affordable Care Act got rolled out and people thought managed care names were going to zero because the government was going to be your managed care company,” she says. “United was the name that we pounced on.”

“We think it’s a category killer in terms of not just delivering managed care, but also opt-in health,” Hart says.

Bristol-Myers Squibb

- Ticker: BMY

- Industry: Healthcare

- Forward Dividend Yield: 2.9%

Hart points to Bristol-Myers’ price/earnings ratio of 9. That’s well below the broad market p/e ratio of 16 for the Morningstar US Market index.

“Of all the drug companies, it’s not expensive on an absolute basis,” she says. At the same time, “unfortunately cancer is a large addressable market. And they have one of the two mouse traps out there that may be able to help you if you have cancer,” through its Opdivo cancer-treating drug. (The fund also holds Merck & Co. MRK, which owns the cancer drug Keytruda.)

“So, it has a big addressable market, a lot of cash flow and it has a pipeline” of future drugs to fuel future growth. “At 9 times earnings, that pipeline is basically free to me,” she says. “We love that kind of thing. It’s an example of what we are trying to do in our healthcare names.”

Philip Morris

- Ticker: PM

- Sector: Consumer Defensive

- Forward Dividend Yield: 5.03%

Hart points to Philip Morris as an example of how the team is navigating questions around consumer spending. “On the margin they will probably continue to smoke cigarettes or smokeless cigarettes.”

But the story goes deeper than that, Hart says. “Five years ago people said `why own tobacco companies?' Volumes are coming down. It’s a melting ice cube.”

But in her view, Philip Morris has had a strong strategy to adapt. “Philip Morris was thinking ‘the market is transitioning; how can we transition?’”

“They are seeing their future which is away from volumes on the combustible side, and while that is in place, moving to the non-combustible side,” she says. “They are really committed to becoming a smoke-free, non-combustible focused company.”

Analog Devices

- Ticker: ADI

- Sector: Technology

- Forward Dividend Yield: 1.74%

For Hart, an important catalyst for owning Analog Devices is the company’s strong business of manufacturing semiconductor chips for electric vehicles. “The dollar amount that ADI can get into an electric vehicle is multiples of what you can get into a combustible engine,” she says.

With a slowing economy, “I understand that people are concerned about autos and (chip) volumes within autos,” she says. “But at the end of the day, ADI is in car models, and will continue to be in models and will have more product in cars as they come out. To us that’s a big long-term driver vs. trying to guess (chip sales) this year vs. next year,” she says.

“That’s what we mean by being patient and well positioned,” Hart says.

Bank of America

- Ticker: BAC

- Sector: Financial Services

- Forward Dividend Yield: 2.45%

In an uncertain economic backdrop, “the idea is own the bank that has a good credit profile, is careful underwriting loans,” she says. “It’s not that loan losses won’t get worse; we fully expect that they will and the banks are telling us that they will.

“From our perspective, the truth is we don’t know the shape of a recession, how deep it would be, what it’s duration would be,” she says. “But if you’re a well-run institution – and we feel like BofA is – we feel that they can navigate credit issues.”

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)