Q2 2022 Market Trends in 6 Charts

Selloffs across asset classes left investors with nowhere to hide last quarter.

For many investors, uncertainty over the global recovery from the coronavirus has rapidly been replaced by fears about surging inflation. Global commodities markets continue to struggle to meet the high demand brought on by the surge of global economic reopening, contributing to price increases not seen in decades.

To combat this, central banks around the world (led by the U.S. Federal Reserve) have tightened liquidity conditions, hurting risky asset prices as money becomes scarcer and more expensive. However, many safe havens have struggled to provide investors the hedge they may have expected in such rocky equity conditions: The inflation environment has made bond coupon payments less attractive, lowering prices, and gold and traditionally risk-off currencies have struggled to hold a candle to the U.S. dollar.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

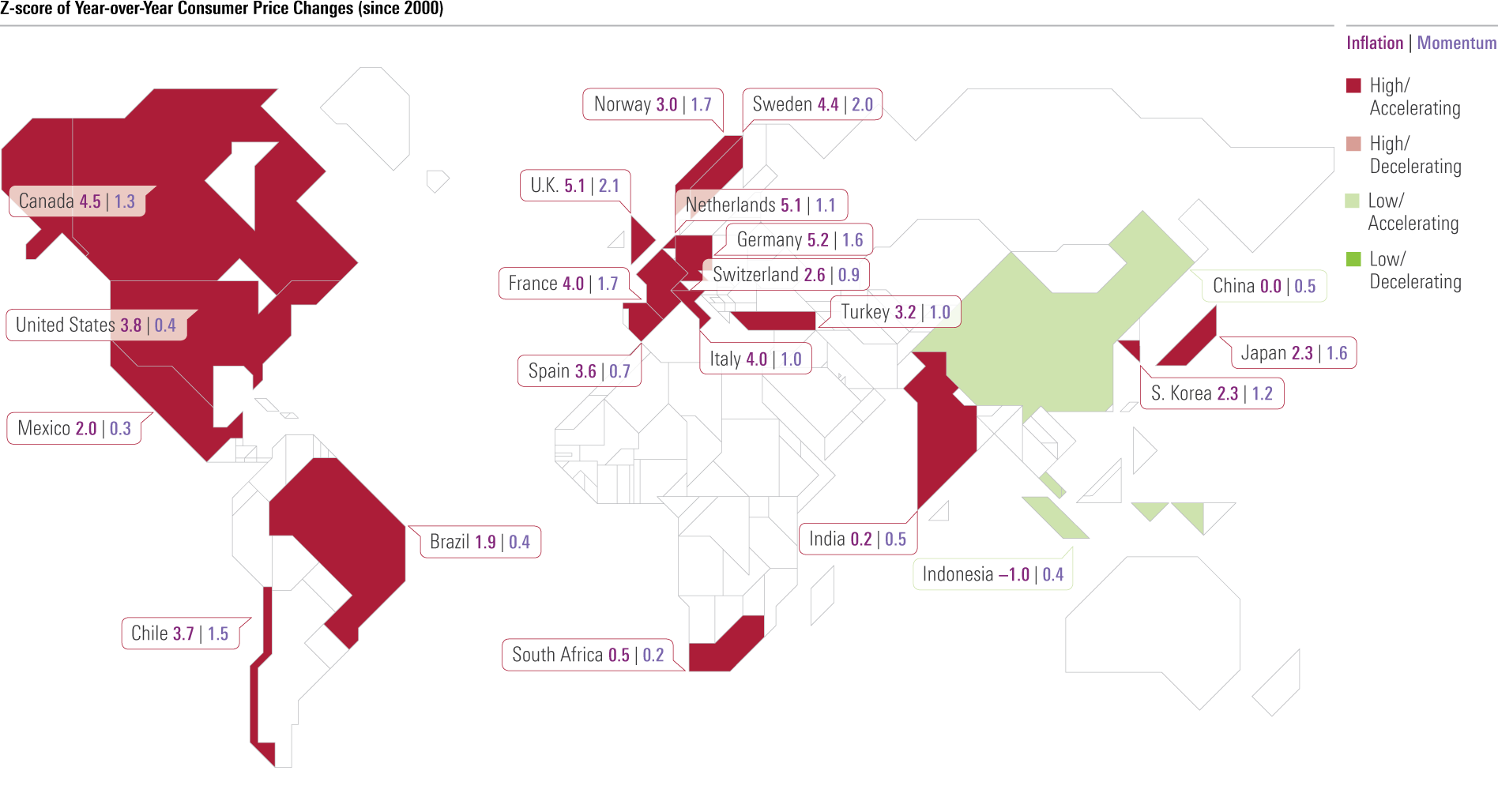

Inflation Burns Bright in Western Economies

The current bout of elevated inflation is undoubtedly global in nature, though some regions are worse off than others, at least on a relative historical basis.

The chart below shows that several European countries are experiencing inflation rates a full five standard deviations above normal since 2000, while in China, India, Indonesia, and South Africa, inflation rates are roughly in line with averages over the same period. In the United States, inflation is elevated, but momentum is significantly slower than in its European counterparts.

Source: Organization for Economic Cooperation and Development. Data as of June 30, 2022.

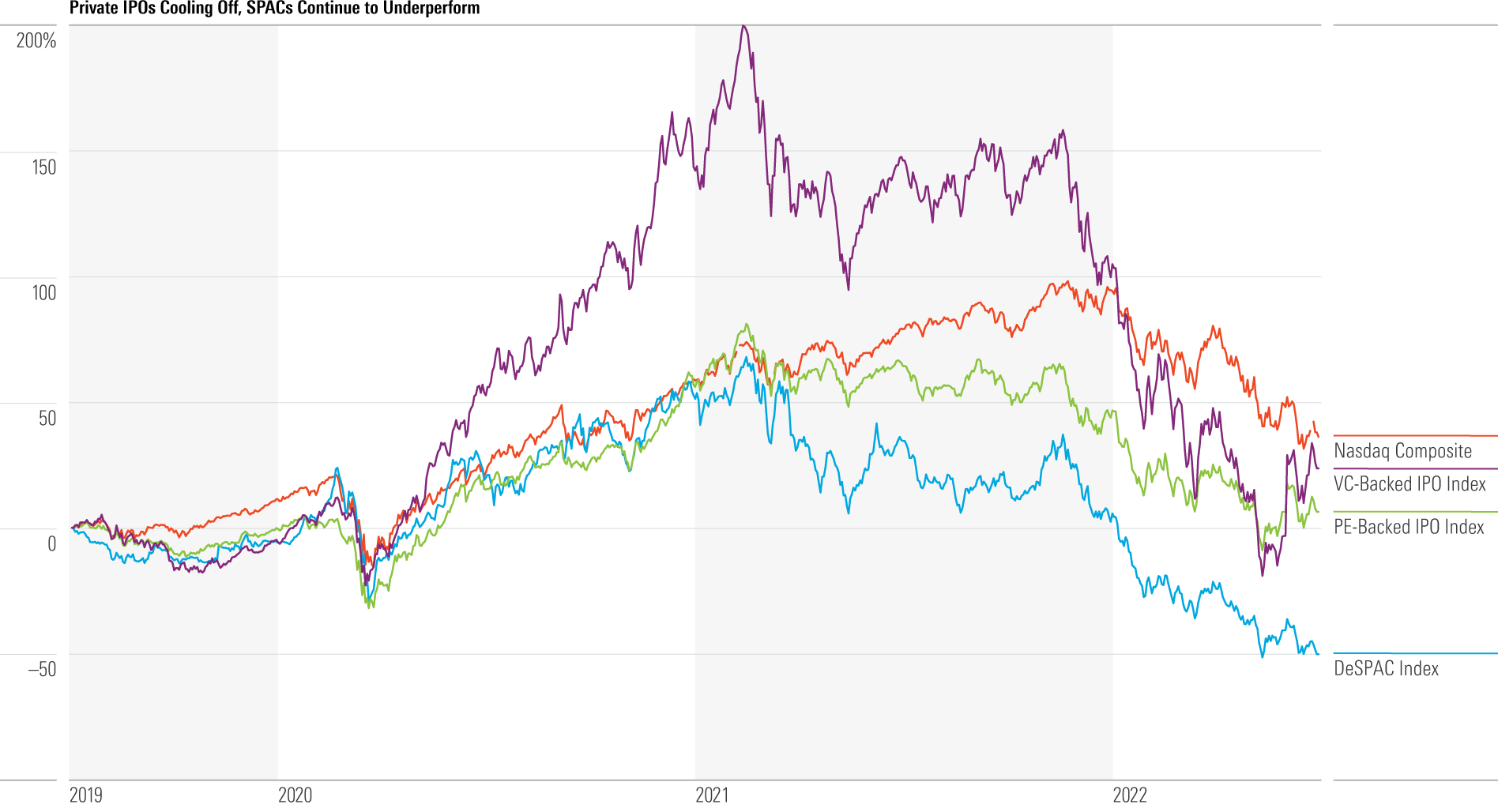

Riskiest Assets Cooling

Recent venture capital- and private equity-backed IPOs have fallen out of favor in 2022 as liquidity conditions have tightened, as shown in the chart below. As the opportunity cost of making those allocations rises, some investors have been scared away from riskier assets.

The chart also shows that special-purpose acquisition companies continue to slide, now faring far worse than other high-risk options since 2019. Still, investors have profited from patiently sticking with more-traditional risky stocks: While the Nasdaq 100's fall has certainly stung, it was still up almost 50% cumulatively over the three years through June 2022.

Source: PitchBook. Data as of June 30, 2022.

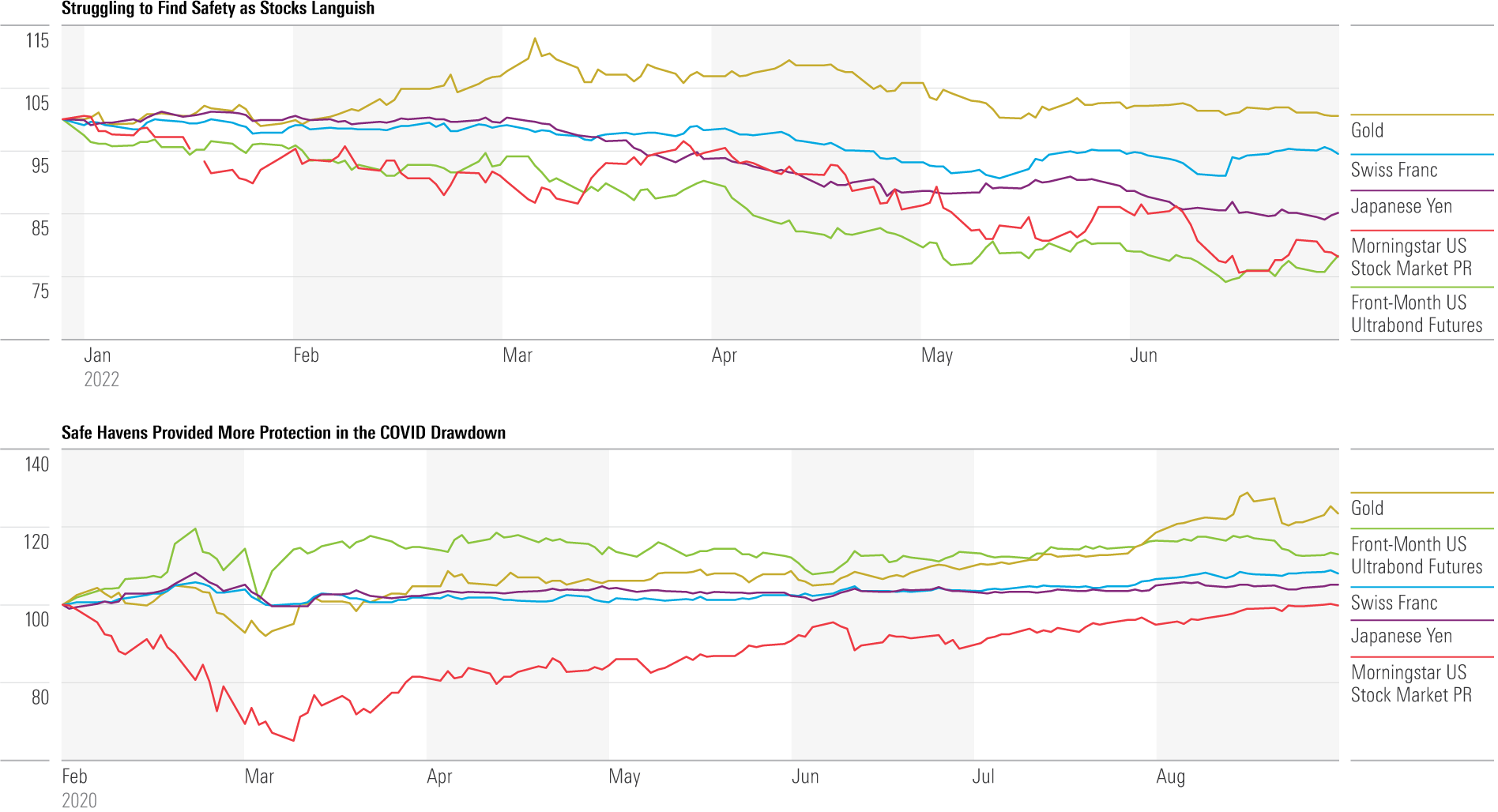

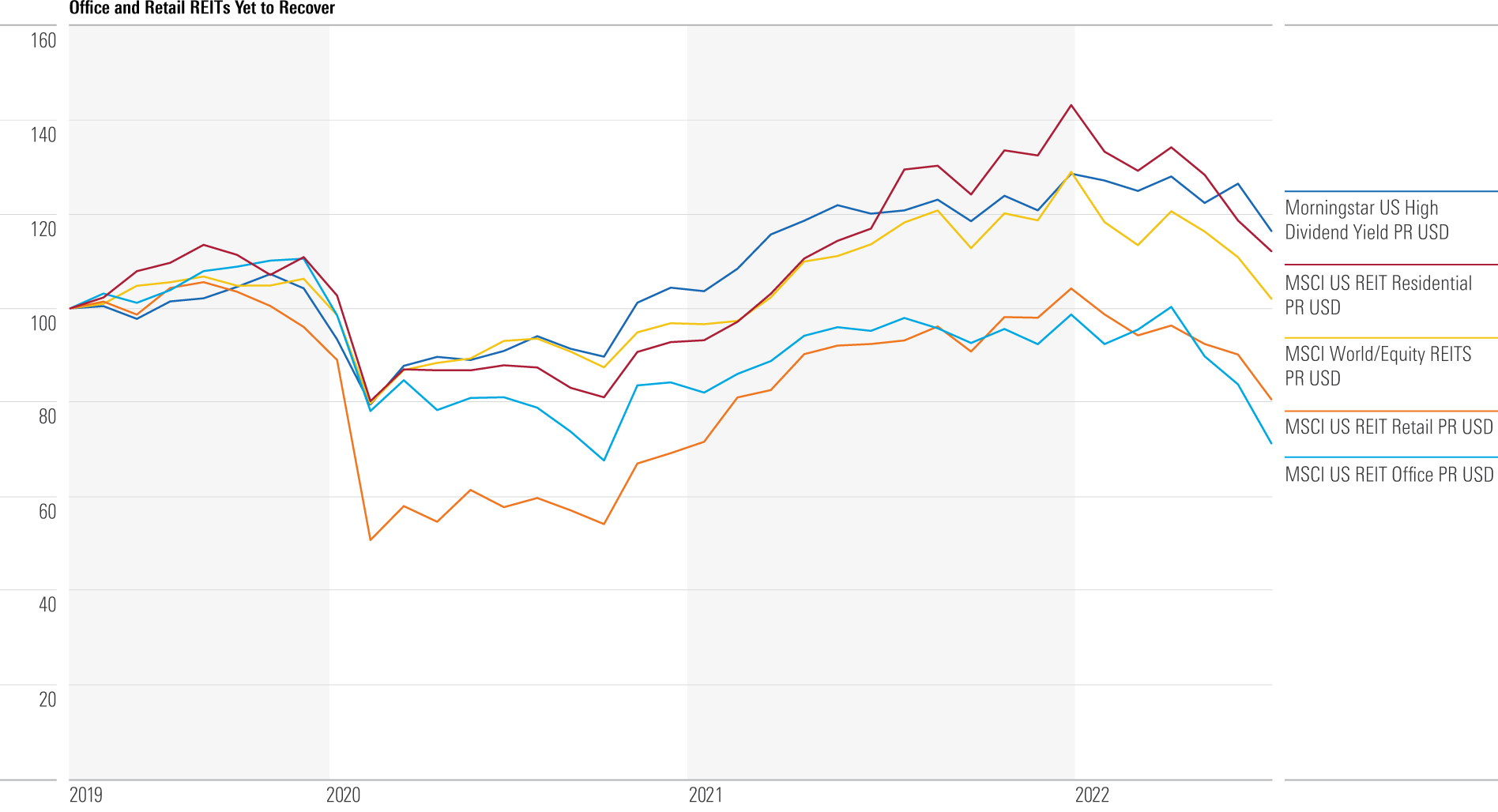

No Safe-Haven Investments This Quarter

Investors may have found heightened returns in fixed income, safe-haven currencies, or gold in previous drawdowns. But they found no such luck in the first half of 2022 as monetary tightening and rapidly accelerating inflation were the tides that lowered all boats.

The first chart below shows that Japan and Switzerland's easy monetary policies have dulled their luster as the market has come to appreciate the Fed's relative hawkishness, and gold has struggled to outperform cash amid broad strength in the U.S. dollar.

And the second chart demonstrates that many REIT investors have also struggled more than they might have expected in such an inflationary environment, as office and retail real estate have yet to surpass prices from before the lockdown; they are down about 20% over the three years through June 2022.

Source: Macrobond, Morningstar Data. Data as of June 30, 2022.

Source: Morningstar, MSCI. Data as of June 30, 2022.

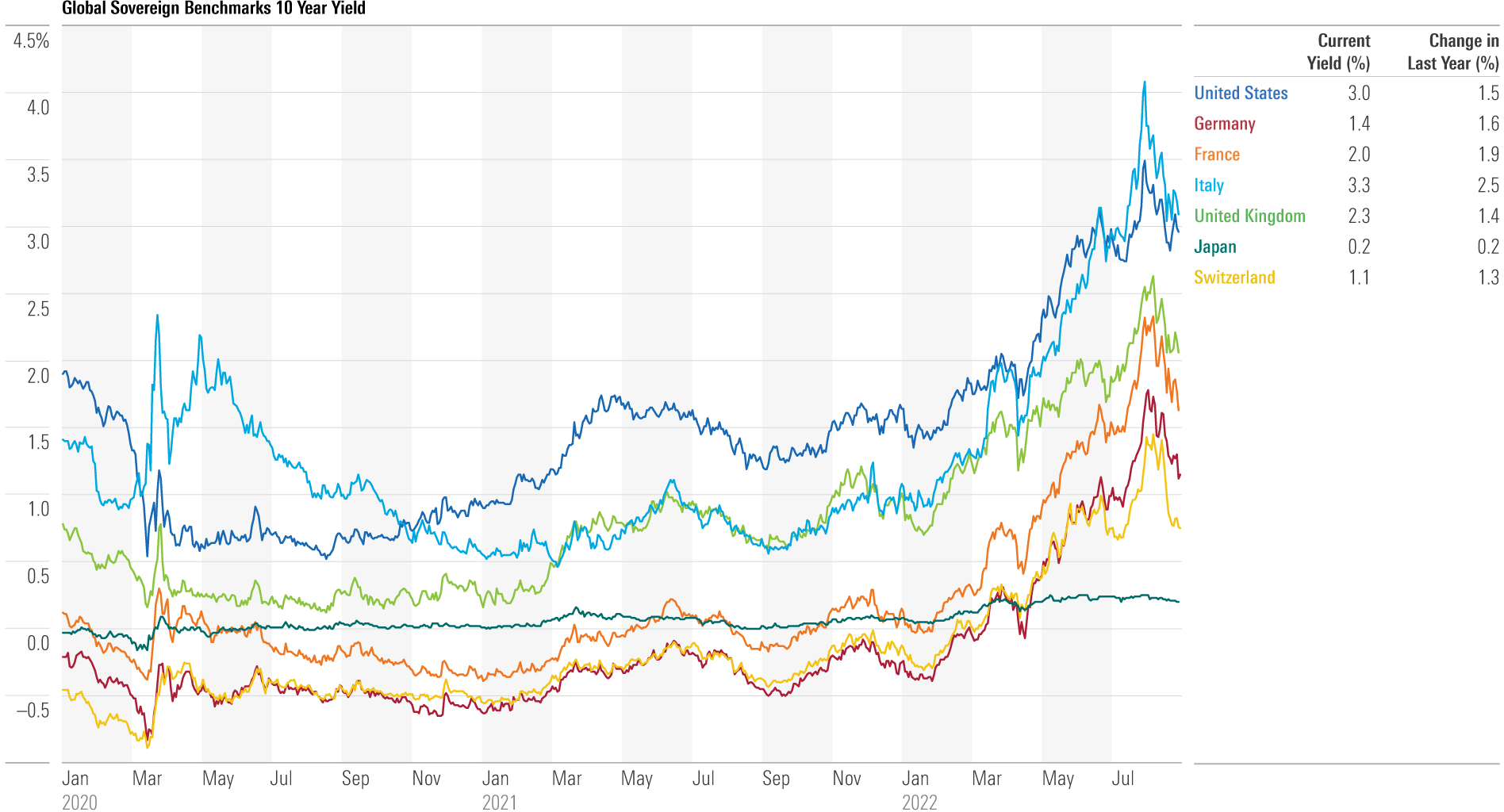

Global Yields Pause Their March Higher

Government yields across the major sovereigns rocketed from the previous quarter, except for Japan, whose central bank has spent six years controlling the yield curve in an unsuccessful effort to stimulate growth.

In the U.S., strong action by the Fed to reduce inflation increased yields across the term structure. European markets responded quickly to their uncertain political climates and potential European Central Bank tightening by sending rates higher there as well.

Global rates fell toward the end of the second quarter and into July as recessionary fears set in, as shown below, but they remain at or near multiyear highs in most developed markets.

Source: Macrobond. Data as of June 30, 2022.

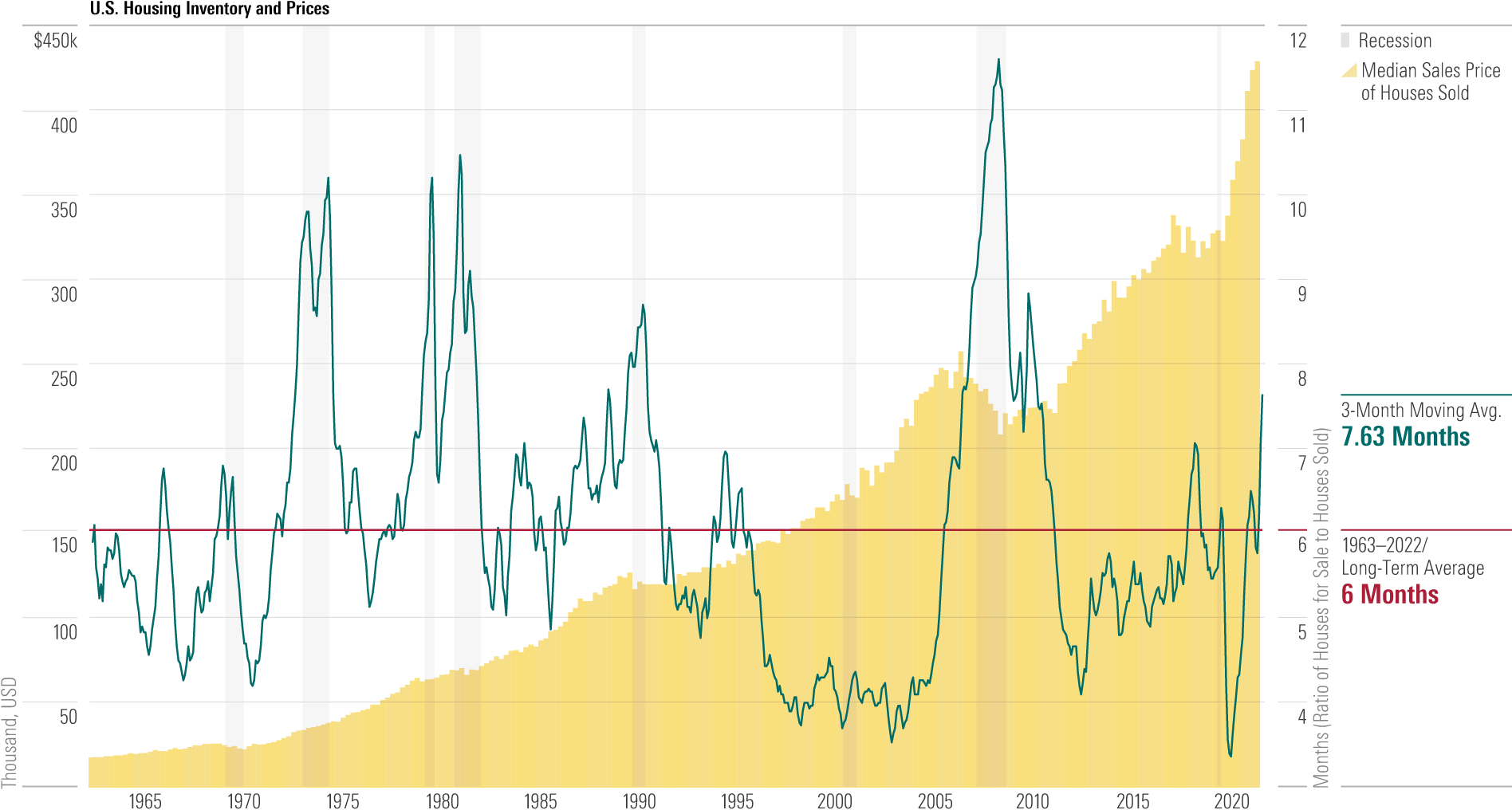

Higher Yields Have Hurt U.S. Home Sales, but Not Prices (Yet)

The ratio of new houses for sale relative to new houses sold—a measure of housing supply conditions—has climbed sharply in the past several months, reaching levels last seen in 2011.

While this is certainly good news for potential buyers, the bad news is that the median home price has nearly doubled over that same time, from around $225,000 to $430,000. While this is an increase of more than 90%, average weekly earnings (not pictured) have only increased by about 40% in that time.

Higher savings rates owing to purchasing slowdowns during lockdowns likely contributed to these higher prices, but it's unlikely that they can continue to rise in tandem with supply going forward—one or the other will have to slow down.

Source: U.S. Census Bureau. Data as of June 30, 2022.

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)