A Mixed Bag for International Funds in 2021

Elation over economic recovery balanced unease about the future.

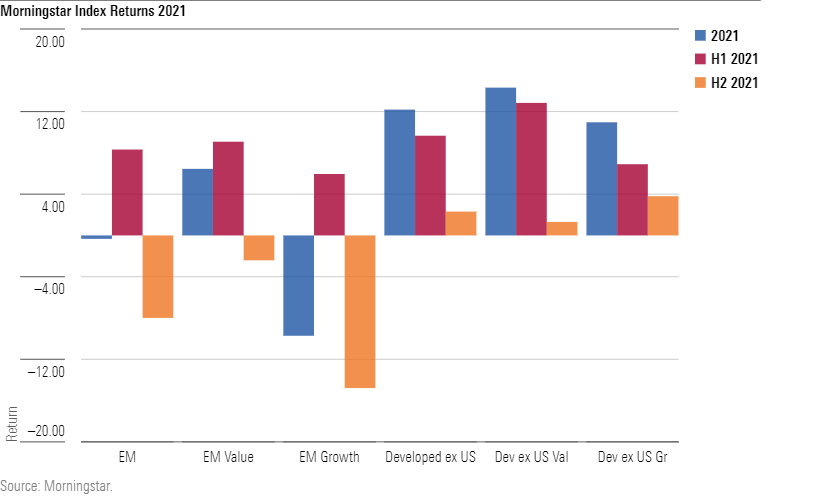

The previous year’s momentum carried into early 2021, but non-U.S. equities struggled in the year’s second half due to re-emerging pandemic concerns and rising inflation fears. The Morningstar Global Markets ex US Index rose 8.4% in 2021, though returns flatlined after a 9.3% gain through the first six months. Emerging markets struggled more than their developed counterparts--the Morningstar Emerging Markets Index dropped 0.3% over the year, while the Morningstar Developed Markets ex US Index rose 12.2% over the same period. Most developed-markets sectors did better than those in emerging markets, but healthcare and consumer discretionary stocks fared much better.

Economic reopenings and coronavirus vaccinations drove a value-leaning rally in the first half of the year. Many value companies that had been decimated by the pandemic, such as homebuilders and casinos, began to bounce back, and industrial and materials stocks had strong showings in the first half of the year. Developed-markets financials, energy, and consumer discretionary stocks also rallied as confidence in the economic recovery grew, but emerging-markets stocks didn’t keep up in those sectors.

The second half of the year was a different story, as inflationary pressures, the prospect of tightening monetary conditions, and the resurgent pandemic threw cold water on the rally, especially in emerging markets. From July 1 through year-end, the Morningstar Emerging Markets Index fell 8.0% compared with the 0.8% drop of the Morningstar Global Markets ex US Index. Emerging-markets consumer discretionary stocks performed the worst over that time, as Chinese regulatory threats and slowing growth hit e-commerce giants like Tencent and Alibaba BABA hard. Furthermore, Chinese property developer Evergrande’s failure to pay its debts sent shock waves through Chinese real estate stocks, with many trading down 70% or more from their all-time highs.

Category-Leading Funds

Artisan International Value ARTKX, which has a Morningstar Analyst Rating of Silver across all share classes, posted a strong 17% return during the year, placing it in the top decile of its foreign large-blend Morningstar Category peers. The strategy’s performance in 2021’s up-and-down market was consistent with the excellent long-term record it built by outperforming in most down markets. Lead manager David Samra looks for stocks with low valuations, financial strength, and shareholder-oriented management. The strategy owned some of the only companies to surge last year--its 3% stake in Swiss luxury-goods distributor Compagnie Financiere Richemont gained 68% through 2021, while the Morningstar Global Markets ex US Index rose just 8.4%. Strong energy and financials picks also boosted relative performance, as Imperial Oil IMO and Dutch bank ING Group ING also outpaced the index. The strategy closed to new investors in June 2021 after briefly reopening to them in March 2020.

The price discipline of Bronze-rated Lazard Emerging Markets LZEMX manager James Donald had caused the fund to struggle for much of the past decade as he avoided stellar performers such as Tencent. The fund saw stronger performance in 2021, however, as many of those high-flying stocks gave back their 2020 gains. While the strategy's 5.3% in 2021 may not be exciting, it still ranked in the top fourth of the diversified emerging-markets category and beat the Morningstar Emerging Markets Index’s 0.3% drop. In addition to avoiding the struggling Chinese giants, overweighting energy stocks, including strong picks such as Russian giant Gazprom, boosted performance.

Funds That Lagged

Silver-rated JPMorgan Emerging Markets Equity JMIEX lost 10% in 2021, placing it in the diversified emerging-markets category’s worst decile. The managers seek firms that boast quality franchises, consistent earnings, and solid returns on equity, but many such stocks fell short in 2021. A position in Chinese tutoring firm New Oriental Education & Technology hurt the most after Chinese regulators essentially eliminated the for-profit education industry in the country. The strategy also ran into some trouble in some out-of-benchmark consumer discretionary picks, such as Brazilian retailer Magazine Luiza.

Gold-rated Causeway International Value CIVIX gained 9% in 2021, placing just outside its foreign large-value category’s bottom quintile. The managers have employed the same value-driven process throughout the strategy’s history, pursuing companies facing operational, but not financial, distress. In 2021, however, poor-performing tech stock picks accounted for all the strategy’s underperformance for the year. Positions in electronics conglomerate Samsung SSNLF, semiconductor supplier SK Hynix HXSCL, travel technology firm Amadeus IT Group AMADF, and Japanese sensor-maker Murata Manufacturing MRAAF each detracted from annual performance. Meanwhile, the strategy shunned some better performers in the sector, such as Tokyo Electron TOELF.

Medalist Fund Stances

Heading into 2022, the postures of many, if not all, managers of non-U.S. equity funds might be changing by the day because of uncertainties over how the omicron variant of the COVID-19 virus will affect economies, stock markets, and businesses. Here’s a look, however, at how stock-pickers whose strategies have earned Morningstar Analyst Ratings of Gold, Silver, or Bronze shifted their portfolio allocations, on average, as similar concerns waxed and waned in 2021.

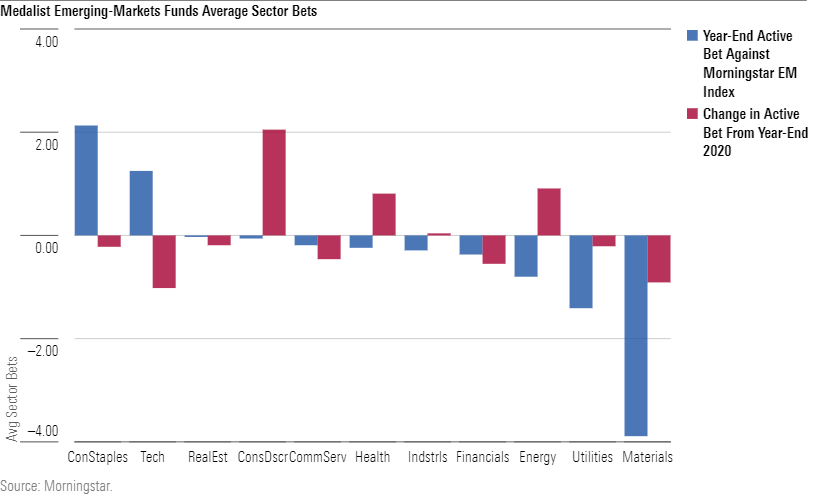

Emerging-Markets Medalists The sector bets of the typical medalist emerging-markets strategy as of the end of 2021 exhibit concern over global growth mixed with some cautious optimism.

After an eventful year for emerging-markets managers, they still on average had a large overweight in consumer staples and underweight in materials. The largest materials stocks in the Morningstar Emerging Markets Index, Brazilian miner Vale VALE and Korean chemical manufacturer LG Chem LGCLF, illustrate the importance of the sector to the global supply chain, which continues to be significantly impaired by pandemic-driven growth issues. Meanwhile, the hefty consumer staples overweight also indicates that managers may be looking to protect some capital after the explosive rally from the COVID-19 trough on March 24, 2020, through Feb. 17, 2021. (The Morningstar Emerging Markets Index rallied 95% over those 11 months.)

Medalist managers rapidly peeled away their consumer discretionary underweights, often buying attractively priced companies hit hard by the initial pandemic drawdown such as Hong Kong-based e-commerce company Meituan MPNGY. Many managers became uncomfortable with the price multiples of emerging-markets tech darlings like Tencent, leading to many pulling back on their overweights. The sector still remained a relative favorite overall, though.

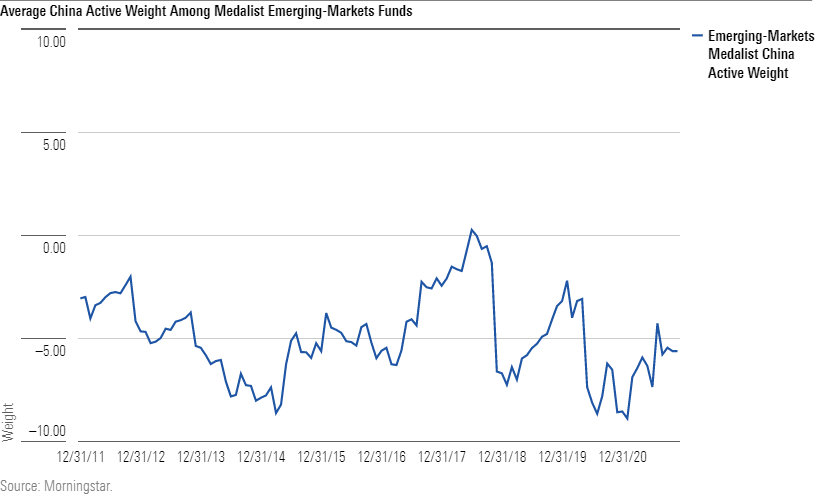

The average emerging-markets medalist increased its relative China exposure over 2021 (starting the year 8.5 percentage points underweight and ending it 5.6 percentage points underweight) as some unsettling news caused stocks in or connected to the country to struggle, especially popular growth-oriented names. China was the first major economy to move toward normalizing monetary policy in early 2021, reeling in the price multiples of some high-flying growth stocks like Tencent. Then Chinese regulators surprised investors by cracking down on the public education sector (some manager favorites like TAL Education TAL plummeted 70% in a day) and intensifying their scrutiny of e-commerce giants like Alibaba and Baidu BIDU. As of year-end, Tencent was down 41% from its all-time high in February, while Baidu and Alibaba were each down at least 55%.

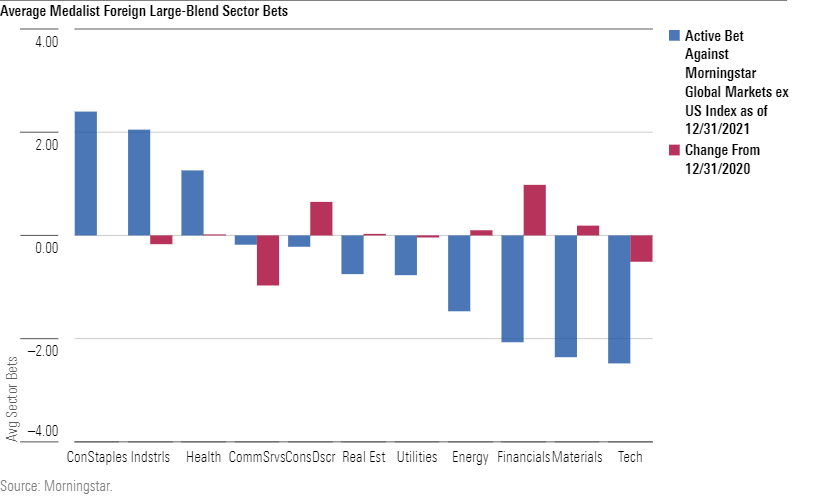

Foreign Large-Blend Medalists Allocations in medalist foreign large-blend portfolios, which often can invest in both developed- and emerging-markets equities, painted a more mixed picture, as developed-markets central banks were slower to tighten monetary conditions than many emerging markets such as China, Mexico, and Brazil (though the Bank of England did surprise investors with a late-2021 rate hike).

The foreign large-blend fund technology sector underweight got bigger in 2021 as the price multiples of popular tech stocks, such as Taiwan Semiconductor Manufacturing TSM and semiconductor equipment manufacturer ASML Holdings ASML, increased. Meanwhile, in the typical foreign large-blend strategy’s financials-sector underweight narrowed as many managers forecasted a more favorable interest-rate environment for the sector. In general, financial firms perform better when there is a wider spread between short- and long-dated rates, and central bank rate increases and less bond buying on the part of central banks--which many managers expect in 2022--would theoretically contribute to such conditions.

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)