The Market Is Undervalued But Concentrated

These four mega-cap stocks are pushing down overall valuations.

For much of the stock rally from the lows of the coronavirus pandemic, a handful of mega-cap stocks led its gains. Now, some of those same big-name stocks are depressing overall market valuations.

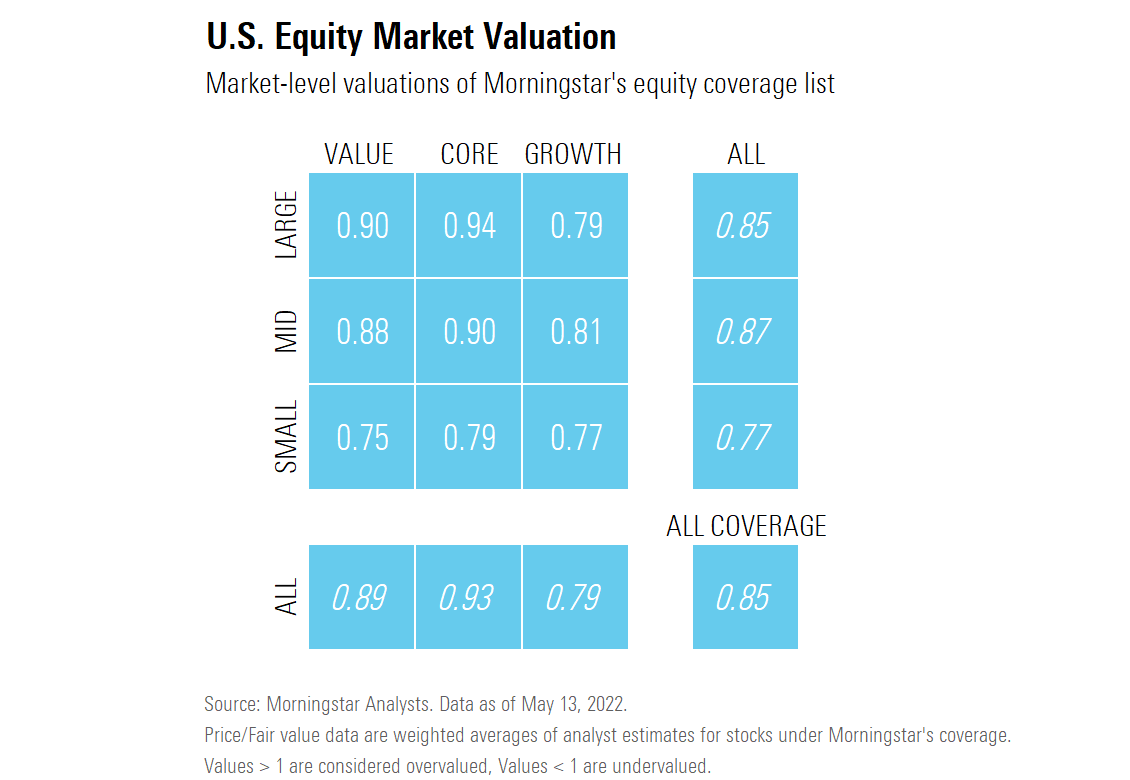

After starting the year in overvalued territory, we think the market has swung too far to the downside. According to a composite of the stocks covered by our equity research team, the broad U.S. equity market is trading at a 15% discount to our fair value. The most recent instances in which markets traded near this discount level were in December 2018, when the market suffered from a growth scare, and in March 2020, when the markets were reeling from the emergence of the coronavirus.

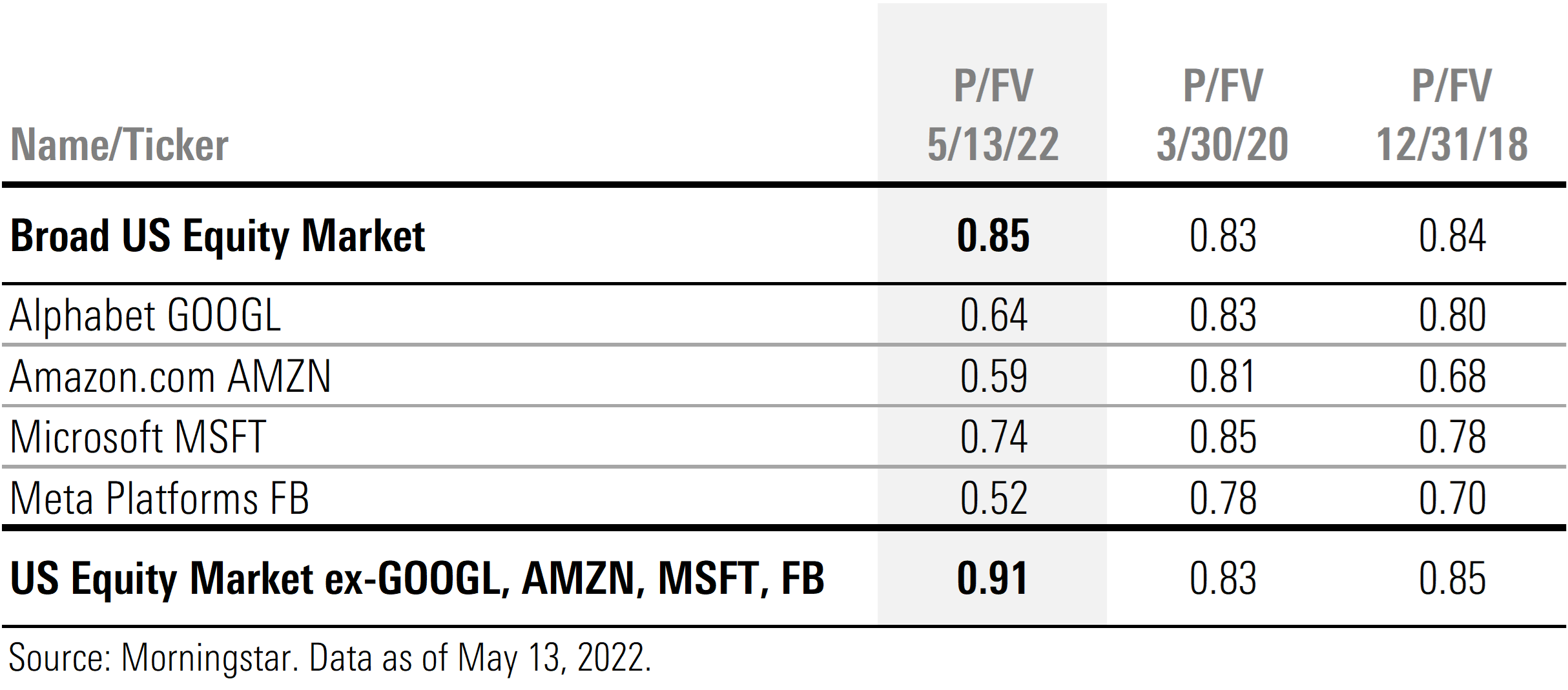

What is different this time around is how much of the undervaluation is skewed by a concentration of significantly undervalued mega-cap stocks: Alphabet GOOGL, Amazon.com AMZN, Microsoft MSFT, and Meta Platforms (formerly Facebook) FB. For the year to date, each stock's price has dropped more than the broad market average, yet we remain convinced of the intrinsic value of these companies for long-term investors.

Based on our research and valuation methodology, we think the market is providing long-term investors the opportunity to invest in these high-quality, wide-moat growth stocks at valuations that are closer to value stocks and provide a significant margin of safety from their intrinsic value.

One aspect we find interesting about the market selloff is that much of the current undervaluation has been unusually concentrated. If we remove these four undervalued mega-caps from our broad market valuation calculation, the discount to our fair value for the rest of the U.S. equity market drops to 9%. The reason the amount of undervaluation drops as much as it does is that the market cap of these four stocks represents 14% of the total market cap of the approximately 700 stocks we cover that trade on U.S. exchanges. The market-cap-weighted average discount to fair value of these four stocks is 35%.

Comparatively, if these same four stocks were removed from the calculation in March 2020 and December 2018, there would be very little difference from the broader market valuation. At those times, the market was more broadly undervalued as opposed to being skewed by these four stocks. We think this emphasizes the current opportunity long-term investors have to invest in these companies.

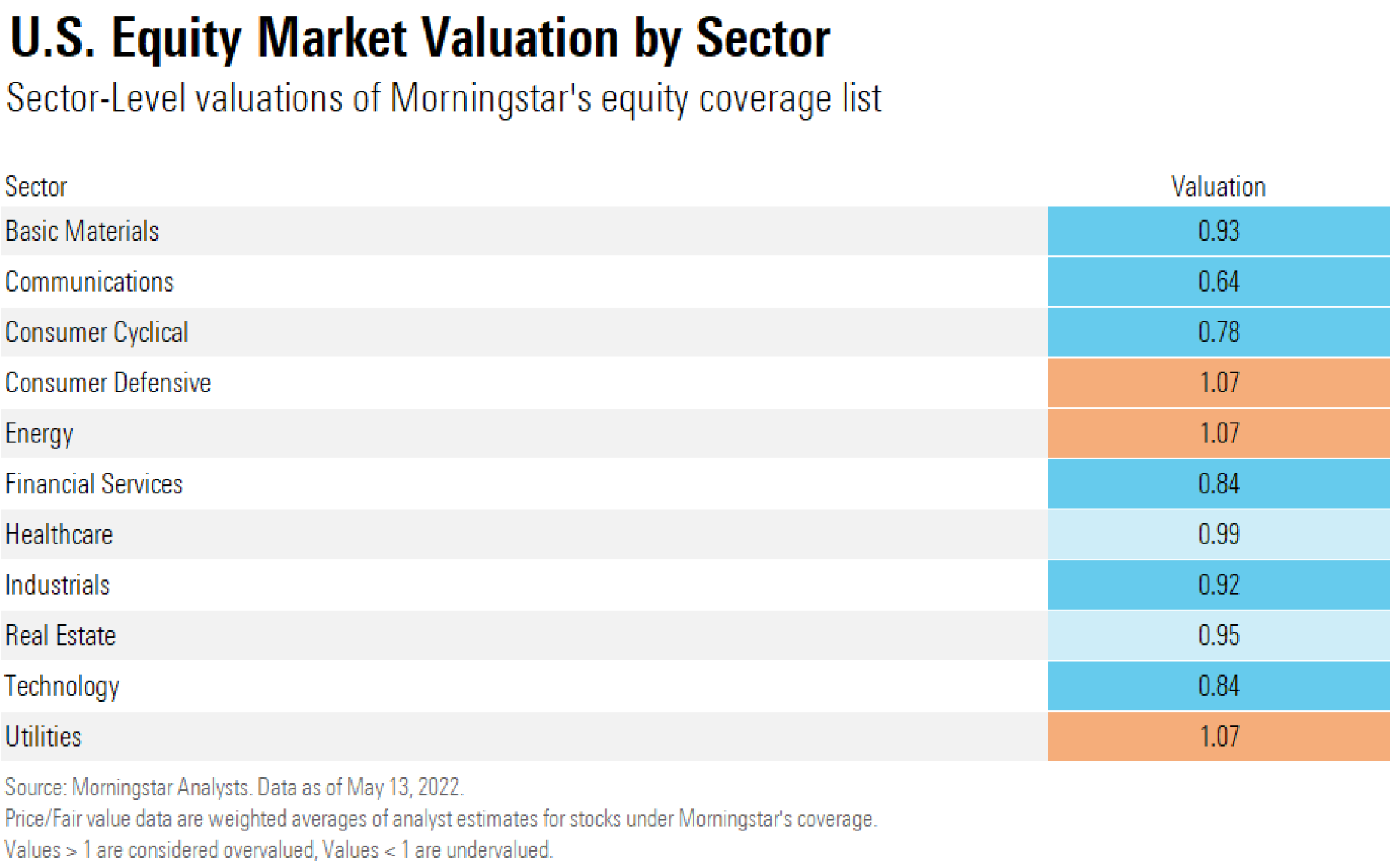

Undervalued Mega-Caps Have Less of an Impact on Sector Valuations

The sectors in which these four stocks are included are each in their own right undervalued. As such, when you exclude these stocks from the sector valuations, those sectors remain significantly undervalued.

For example, at a price/fair value of 64%, the communications sector is the most undervalued across our coverage. Even after removing both Alphabet and Meta Platforms from our calculation, the price/fair value remains at 65%. Although the market cap of these two companies comprises more than half of the sector index, this sector has a high number of deeply undervalued stocks. The median price/fair value of the stocks in the communications sector is 73%, the lowest of all the sectors.

The price/fair value of the consumer cyclical sector is 78%, the next-most-undervalued sector. Removing Amazon has a larger impact on the sector valuation, as the price/fair value would increase to 88%, but the sector would still be one of the more undervalued.

Technology has been the hardest-hit sector thus far this year and is now trading at a price/fair value of 84%. Like communications, the sector is widely undervalued, as removing Microsoft from the valuation calculation brings it up to just 87%.

What We Expect Over the Next Few Months

While we view the market as currently undervalued, looking forward we expect the current volatility will continue over the next few months. This volatility is the result of a confluence of the four main headwinds we identified at the beginning of the year that investors are now struggling with:

- Slowing rate of economic growth in the United States;

- Tightening monetary policy;

- Inflation running hotter than expected;

- Rising interest rates.

Until there is better clarity as to when these headwinds will subside, volatility will likely remain elevated for the next few months.

Investors are caught between fears that earnings and valuations will be under pressure in the short term from these headwinds, but they also realize that the equity valuations have declined to levels that have become attractive for long-term investors. As such, on days with negative news headlines, the market selloffs have been exaggerated, whereas on days with positive headlines, stocks have surged.

In these types of market environments, it is especially important for investors to have an investment plan in place that balances their long-term investment goals with their risk tolerances. This plan should also allow for periodic rebalancing to increase their equity allocations when valuations decline but also reduce exposure when valuations become overextended. Based on our view that the U.S. equity market is undervalued, we think that now is not the time to be reducing exposures, but to be adding judiciously based on your investment plan and goals.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BAG2H5VQKBERZKT5SM7JTWM6CY.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)